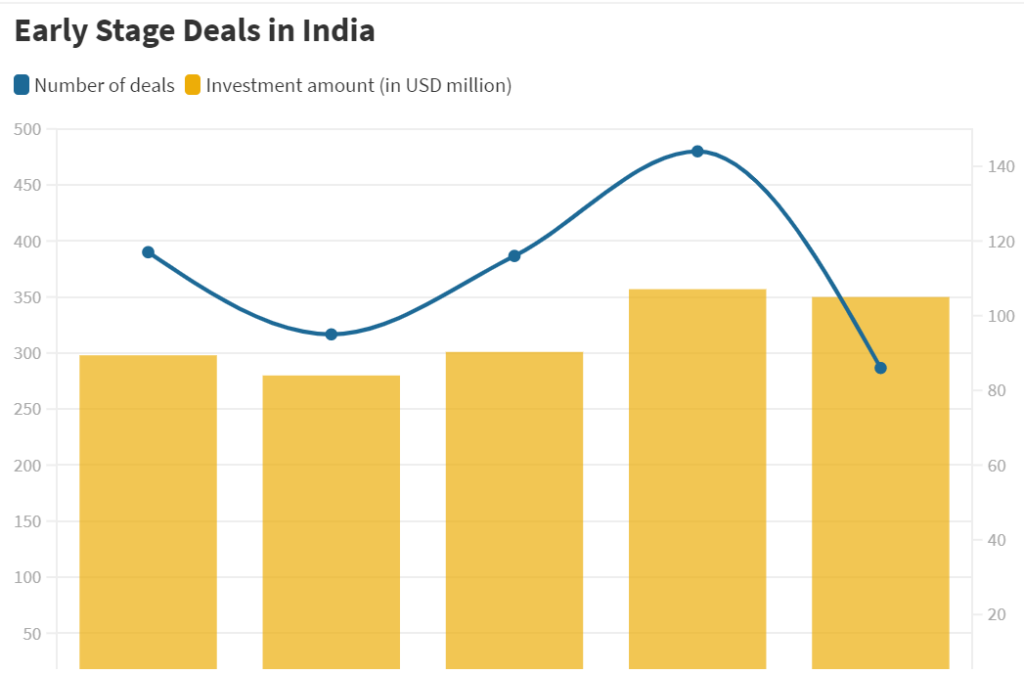

As per the 2021 report by the State of Indian Startup Ecosystem, India houses about 38,000 active startups. These stats indicate the rise of the entrepreneurial spirit in India. The Indian ecosystem is molding itself to create a hospitable environment for startups. Despite the pandemic, the startup sector has seen significant traction, catching the attention of Venture Capitalists* (VCs) and funds backed by VCs. They are trying to seize a stake in these futuristic projects. Speaking of VCs, Artha Venture is a standout in the industry with a track record of 150+ investments; 40+ exists with seven unicorns.

*A venture capitalist is an equity investor who provides funding to emerging startups with high growth potential.

Artha Venture Fund (AFV)

Artha Venture Fund(AFV) is a Micro VC Fund that aids passionate founders create a better tomorrow! Being India’s first early-stage Micro VC fund, AFV has already raised the bar for its peers. The fund was founded in 2017 by Anirudh Damani, its current Managing Partner. Previously, Anirudh led the alternative investment arm for his family office, Artha India Ventures. At Artha India Ventures, Anirudh invested in category-defining startups like OYO Rooms, Purplle, Tala, NowFloats, Coutloot, Mobilewalla, Rapido, and others.

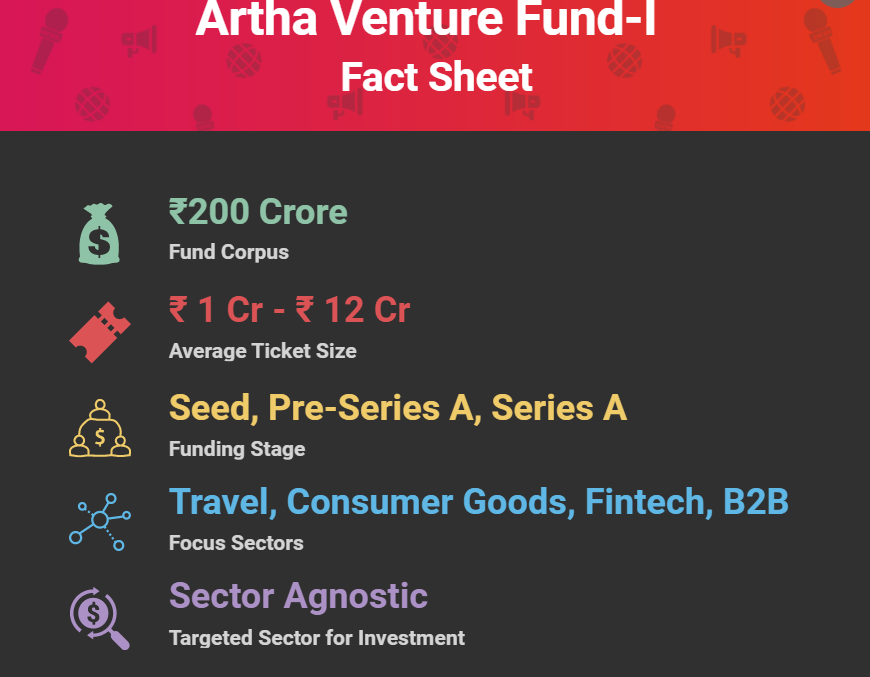

AFV is a Category I alternative investment fund (AIF) that aims to invest in startups across seed, pre-Series A, and Series-A levels of growth. The fund has allocated over 65% of its corpus for follow-on rounds and is all set to estimate 10-12 seed investments per year.SEBI’s second amendment to SEBI (Alternative Investment Funds) Regulations, 2021is primed to aid Category I AIFs, including AFV, as it broadens the range of investments by reducing the scope restrictions imposed earlier.

On 4th June 2021, AFV announced the close of its debut fund at INR 220 Crs exercising the over-allotment option. The fund was expected to raise around $ 31.5 mn, i.e., INR 200 Crs, along with a greenshoe option* of $ 15.7 mn, i.e., INR 100 Crs. The fund is a close-ended fund for seven years with a chance to extend by up to 2 years. It aims to invest across sectors and market segments.

*A greenshoe option is an over-allotment option that gives the underwriters the right to sell more shares than what was initially planned by the issuer if the issue has a higher demand.

With various NRIs, HNIs, super angels, and SIDBI partaking in a share of capital in the fund, the popularity of AFV saw an increase. The fund saw over 50 limited partners participating with a greater than majority portion from various family offices. AFV also noticed a good number of listed entities engage either directly or via promoter participation. Various other backers also have some skin in the game, namely the family office of Ashok Kumar Damani and Ramesh M Damani, Artha India Ventures, Singularity Ventures, and the family office of Madhusudan Kela (formerly served as a chief investment strategist at Reliance Capital).

The plan of action for AFVs Debut Fund states to invest in around 40 accelerator stage companies, half of which are in the deal discussion or closure stage. The firm believes in instilling a marginal amount as its first cheque and gradually increases the investment in the follow-up rounds.

Taking a deep dive

The Investments AFV has made from its debut fund goes as below:

Hob space – Provides multiple online and offline after-school co-curricular activities (B2C).

Piggyride – Tech platform providing child-focused mobility & education financing solutions (B2C).

Agnikul – Develops dedicated launch vehicles for Nano & Microsatellites at a lower cost (B2B).

Everest Fleet – A fleet manager leveraging technology to run its fleet of cars 24/7 (B2B).

Daalchini – Provides instant, affordable & healthy home-cooked meals through India’s largest network of intelligent temperature-controlled vending machines (B2C).

Jadoo – Chain of entertainment zones, consisting of cinemas & VR Cafes that showcases latest Bollywood as well as regional movies in Tier II, III & IV towns (B2B)

Hazari – Provides fresh, hygienic, standardized, and affordable tea/coffee & snack options to corporates (B2B).

London Club – India’s largest Peer-to-Peer micro-lending platform is connecting lenders with credit-worthy borrowers (P2P).

Kabaddi Adda – Data analytics & content platform for Kabaddi matches (B2B).

This post was written in collaboration with Asif Yahiya Sukri LLP. Asif Yahiya Sukri LLP provides unparalleled personalized financial services to a broad range of clients across different geographical locations. With a presence in the USA, India and the MENA region, they ensure that all of your financial decisions are made carefully and with your best interests in mind. They are innovators who understand what goes into building companies.

You can also reach out to them on info@aysasia.com

Follow Us @