Industry: Chemical

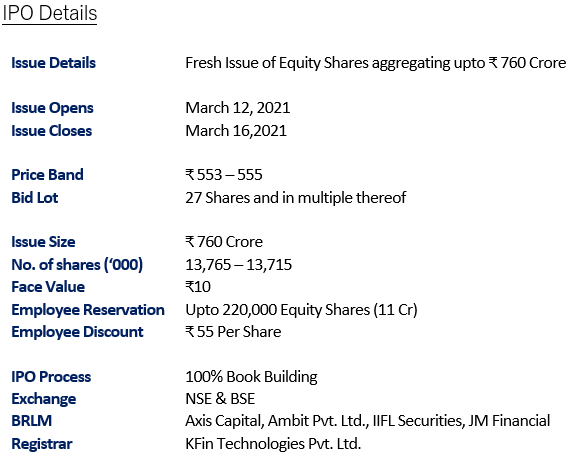

IPO Details

Objective of the Issue

i. Repayment/prepayment of certain indebtedness availed by the company (including accrued interest) of ₹ 70 Crores, and

ii. General Corporate Purposes

Business Overview

Anupam Rasayan India Ltd is one of India’s leading companies engaged in custom synthesis and manufacturing of specialty chemicals, which involves multi-step synthesis and complex technologies. The company commenced operations in 1984 as a partnership firm as a manufacture of conventional products and today has evolved into a specialty chemicals manufacturer with domestic and foreign customers. The key focus is on developing in-house innovative processes for manufacturing products requiring complex chemistries and achieving cost optimization.

Business Verticals

i. Life science related specialty chemicals comprising products related to agrochemicals, personal care, and pharmaceuticals

ii. Other specialty chemicals, comprising specialty pigment and dyes, and polymer additives

The company operates six multi-purpose manufacturing facilities in Gujarat, with four located at Sachin, Surat and two units located at Jhagadia. The facilities have a combined aggregate installed capacity of 23,396 metric tonnes, of which 6,726 metric tonnes was added in March 2020.

Anupam Rasayan has developed strong and long-term relationships with multinational corporations such as Syngenta Asia Pacific Pte. Ltd., Sumitomo Chemical Co. Ltd. and UPL Ltd. enabling the company to expand global footprint across Europe, Japan, and United States.

Financial Details

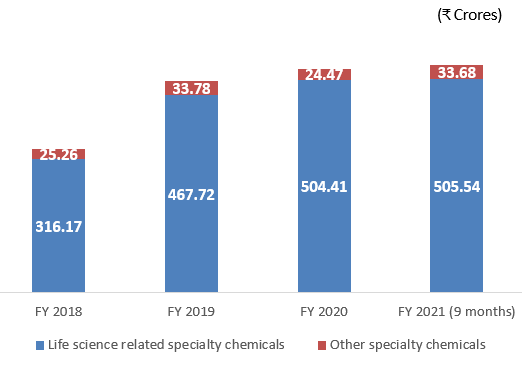

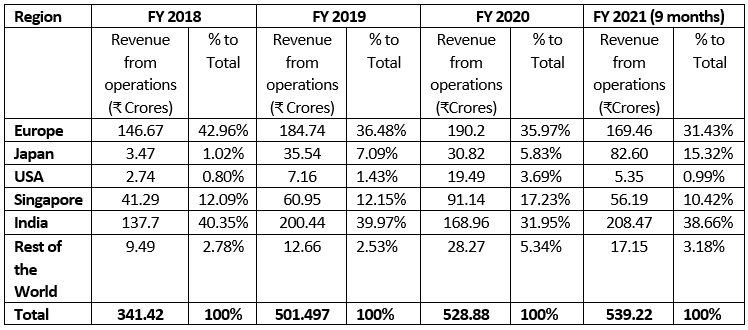

Revenue mix

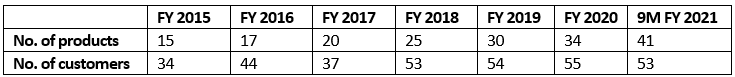

Products and Customers

Industry Overview

India’s Chemical Market is valued at approximately US $200 billion in 2019. The Indian specialty chemicals industry is expected to grow at 10%-11% over the next five years. Currently, India accounts for 1-2% of the global exportable specialty chemicals indicating a large scope of improvement and large opportunity base for India. Overall, all the sub-segments of specialty chemicals continue to show significant export growth and is likely to be the next great export pillar for India. The specialty chemical industry in India is set to rise with initiatives such as ‘Make in India’ and improvement of India’s ranking in ‘Ease of Doing Business Index’.

In 2019, the India market for custom synthesis and manufacturing was valued at $11.5 billion in 2019 for specialty chemicals accounting for 6% of the global custom synthesis and manufacturing market. Custom synthesis manufacturing is on the rise in India and contract research and manufacturing services market is expected to grow at a rate of 12% in the next 5 years due to strong growth in demand.

In addition, the ‘China plus one’ strategy and the shift in manufacturing operations and sourcing of raw materials from China on account of stricter environmental protection norms in China, increase in operating and labour costs, and geo-political shift after the outbreak of covid-19 as the world looks to reduce its dependence on China, provides an opportunity for India to capture a larger market share.

Competitive Strengths

i. Established market position in specialty chemicals with significant entry barriers

ii. Strong long-term relationships with multinational corporations across the globe

iii. Focus on research and development, value engineering and complex chemistries

iv. Diversified and customized product portfolio with a strong supply chain

v. Automated manufacturing facilities

vi. Strong focus on environment, sustainability, health, and safety measures

vii. Consistent growth in terms of revenue and profitability

viii. Experienced promoter and management team

Key Concerns

i. Concentration of manufacturing facilities in one region and the inability to operate and grow business in this particular region may have an adverse effect on its business

ii. Top 10 clients account for 84% of the revenue leading to risk of client concentration and loss of one customer can deteriorate the financial performance

iii. Higher working capital due to large amount of inventory kept offsetting price fluctuations

iv. Lack of long-term agreements with suppliers and volatility of raw material cost can have adverse effect on the business

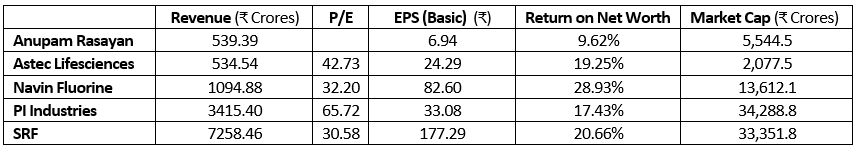

Comparison with listed industry peers

Anupam Rasayan, a company with strong financial performance operates in a growing industry. The company derives large sales from export and the Government of India has recognized the company as a 3-Star export house. The segment of specialty chemicals exports in expected to grow from a $22 billion industry in India to $44 billion in the next six to seven years. The company can gain market share in future and simultaneously improve its margins, thereby showing a growth prospect in the long-term.

Follow Us @