Background:

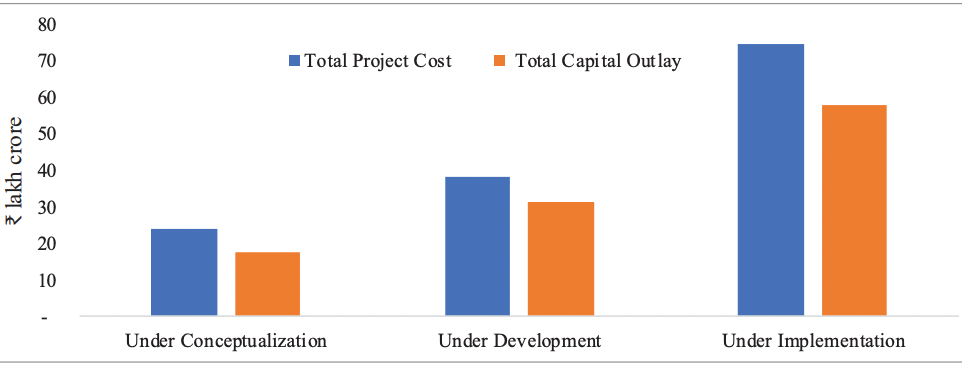

The 2023 budget, being the last full budget before the 2024 elections, has set its sights on boosting consumption-led growth in the Indian economy to achieve ambitious GDP targets. The government, having introduced the National Infrastructure Pipeline with a starting allocation of Rs 111 lakh crores for FY19-25, has consistently recognized infrastructure spending as the key driver of growth.

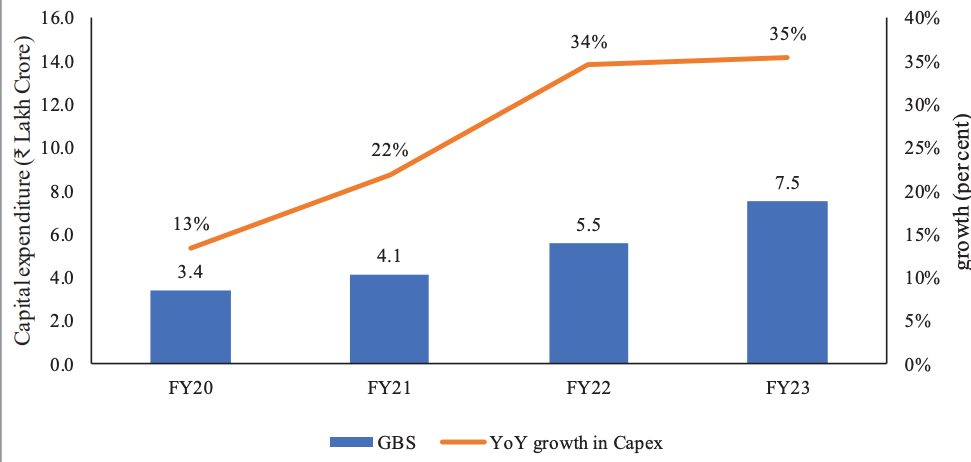

Despite the pandemic’s unplanned expenses, the Modi government managed to successfully deliver on infrastructure projects and has now ramped up capex spending by 33% to Rs 10 lakh crores (from Rs.7.5 Lakh crores in 2022), which accounts for 3.3% of the GDP.

India is a consumption-led emerging economy and has demonstrated that public capital expenditure has a significant impact on the economy, leading to a positive cycle of job creation and investment. The infrastructure-focused budget aims to drive organic growth, attract private investments, and protect against global risks.

Key Challenges and Expenditure:

The government has increased direct capital investment by the Centre, which is supported by grants-in-aid to the states. The Centre’s Effective Capital Expenditure is budgeted at Rs.13.7 lakh crore, which is 4.5% of GDP.

The major challenge faced to attract private investment in infrastructure projects is the complex regulatory landscape across states, long gestation period, lower returns, and more attractive investment opportunities in other countries. To overcome these challenges, the government has extended the 50-year interest-free loan to state governments for one year, to stimulate infrastructure investment and encourage complementary policy actions, with an increased allocation of Rs 1.3 lakh crore.

The role of the Infrastructure Finance Secretariat, set up to attract private investments in infrastructure, has been confirmed to play a key role in attracting investments in sectors such as railways, roads, urban infrastructure, and power.

The harmonized Master List of Infrastructure will be reviewed by an expert committee to decide the appropriate classification and financing framework. In the past, highways and expressways have absorbed most of the budget allocation, but the focus has now shifted towards the railway capex, with a capital outlay of Rs. 2.40 lakh crore, the highest ever allocation and approximately nine times the allocation made in 2013-14.

Infrastructure spending has a multiplying effect on the economy, directly impacting sectors such as steel, automobiles, cement, and construction materials. Further creating jobs, reducing logistics costs, and improving competitiveness.

To address the high logistics costs faced by Indian industries compared to their global peers, 100 critical transport infrastructure projects have been identified for last-mile and first-mile connectivity for the ports, coal, steel, fertilizer, and food grains sectors, and will be prioritized with an investment of Rs. 75,000 crores, including Rs. 15,000 crores from private sources, which will significantly reduce the logistics gap.

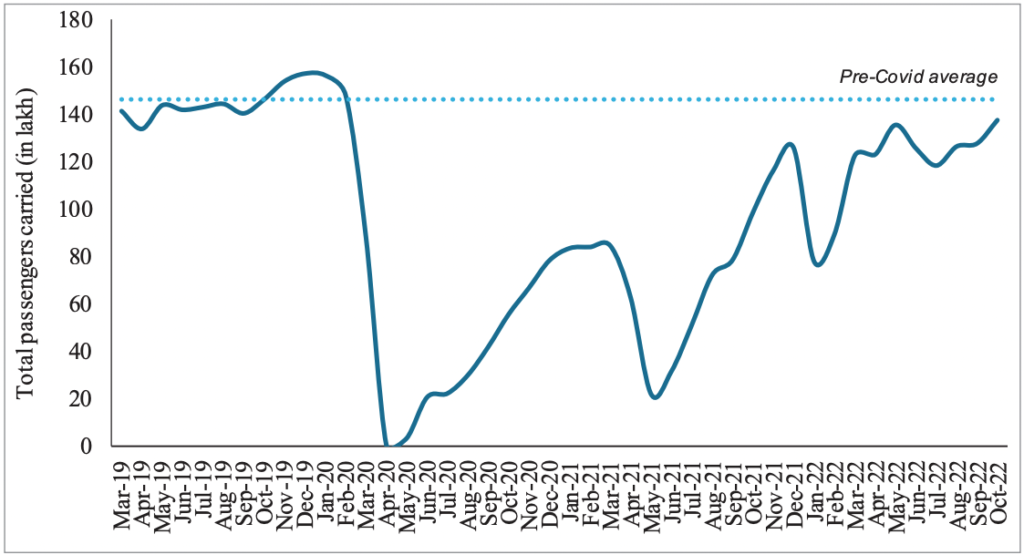

The budget proposes the revival of 50 more airports, heliports, water aerodromes, and advanced landing grounds. The regional connectivity scheme of the Ministry of Civil Aviation has seen a doubling of allocation from 600 crore to Rs.1,244 crore, despite the 70% reduction in the Ministry’s total budgetary allocation due to the privatization of Air India.

To transform cities into sustainable cities of tomorrow, the government will encourage urban planning reforms and actions for efficient use of land resources, adequate resources for urban infrastructure, transit-oriented development, and enhanced availability and affordability of urban land.

An Urban Infrastructure Development Fund (UIDF) will be established through priority sector lending shortfall, managed by the National Housing Bank, and used by public agencies for urban infrastructure development in Tier 2 and Tier 3 cities. The government plans to make available Rs.10,000 crore per annum for this purpose and states are encouraged to leverage resources from the grants of the 15th Finance Commission and existing schemes.

Limitations

The pre-budget data in India reveals limitations in the current state of the economy. While corporate India is performing well, the overall development of the economy relies on the growth of MSMEs, which need support from policymakers.

The allocation of INR 10 lakh crore for capex raises questions about its effectiveness as an absolute figure, with 8.3% of it being for BSNL and BPCL, which may be just budgetary support rather than infrastructure capex.

The combined expenditure of government (driving infrastructure) and PSU capex (driving production) remains at 3.9% of GDP, unchanged from FY-2020, raising concerns about the accuracy of growth in numbers.

The government’s focus on infrastructural growth over production stimulation raises questions about the potential micro-level cannibalization of production vs infrastructure.

Conclusion:

In conclusion, the 2023 budget aims to boost consumption-led growth in the economy by ramping up capex, attracting private investments, and transforming cities into sustainable cities of tomorrow. The government has prioritized infrastructure spending and is taking steps to tackle the challenges faced in attracting private investments. The budget will have a positive impact on various sectors, create jobs, reduce logistics costs, and stimulate organic growth in the economy.

For references click here

Appendix:

Fig 1 – Centre increasing infra outlay per year

Fig 2 – NIP Project status

Fig 3 – National Highways and Road construction increasing

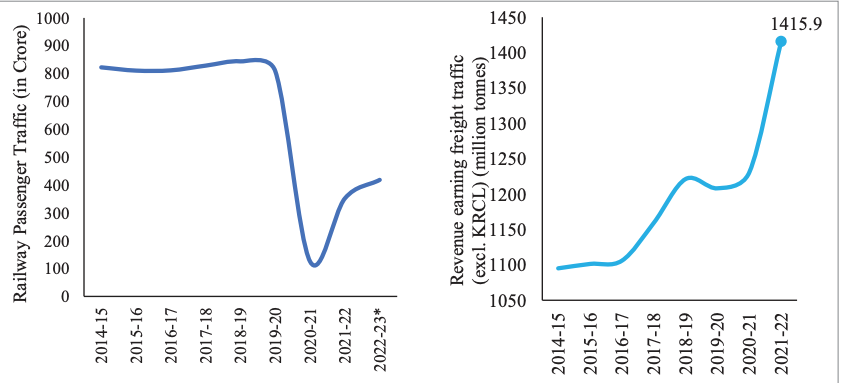

Fig.4. Railways as well as freight traffic chowing strong growth post-pandemic

Fig.5 : Performance of Indian aviation sector

Follow Us @

References :

- Indian Economic Survey 2023 – Physical and Digital Infrastructure: Lifting Potential Growth

- Budget 2023 – Ministry of Finance