Within the startup culture, we are enveloped in, private equity funding is not a new concept. Both Ancient Greece and Rome had relatively well developed financial systems, one of these was the influx of money by the wealthy into the risky maritime trade to increase wealth exponentially.

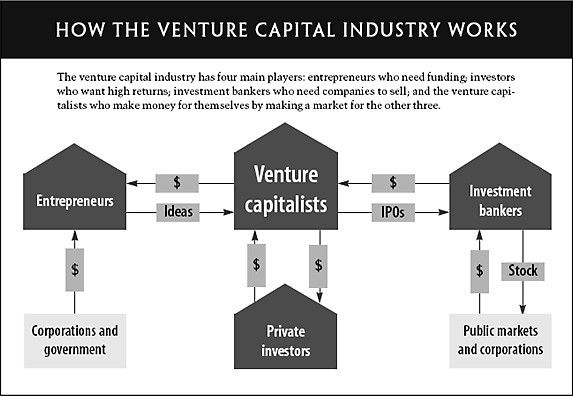

In the modern context, private equity funding can take numerous forms, one such is that of venture capital. Venture capital can be thought of as a medium to fund promising entrepreneurs and startups such that it creates wealth for investors. In reality, however, it is more complex than that. Investors often invest for the short term and “exit ” these startups when they see fit. In a venture capital route, a startup can have numerous rounds of funding.

Due to the high risk of failure in startups, the firms have to appropriately account for these risks in their portfolio. Thus, accurate predictions of the market and that of the macro-economy play a significant role in a good return. This also means that the valuation of these emerging companies becomes extremely important. They determine, if and when startups are infused with cash. These valuations, when they exceed 1bn dollars, form the basis for “unicorn” classifications that SpaceX, Flipkart and Uber among others have received.

Valuations basically help ascertain how much and when capital should be infused into the company. It also, however, means these startups have to work with the demands of these investors, these VC firms may have a member on the board of directors, some may ask for the power to directly veto or even replace the management in situations that they believe are unfavourable for the startup. This is not a bad thing, it ensures the safety of the startup. So far, the success stories of VC firms include the likes of Instagram, Spotify and Uber.

Like every investment, each VC firm strives to get their timing “just right”, so that they can maximize their return. They want to enter and exit at the ideal time. But, as an article highlights, nothing is stopping the management of the emerging company to position themselves with the sole purpose of being attractive for the next round of funding. There is a growing fear that the funding and PR that certain companies get, throw them into “startup superstardom”, and may lead to value inflation and thus cause it to be unsustainable in the long term.

2 months after its IPO Zomato recently saw a founder leave the company, and it shuttered its grocery pilot venture and shut its businesses in the UK and Singapore, and Spotify has not made an annual profit since it went public in 2018.

Continuous and consistent inflation in many company valuations across a significant time period can create a bubble, where a system of inflated values keep increasing due to raw speculation, rather than the company’s actual ability with respect to the market.

As Forbes puts it “A bubble begins to form when there’s a gathering acceleration in price for an asset that far outstrips the asset’s intrinsic value. That means people are willing to pay more and more for a security or another asset, above and beyond what’s expected based on things like demand, earnings, revenue or growth potential.” And it is in these, cases, that this overvalued asset eventually bursts, that is, it experiences a correction in value to reach its correct valuation.

There is no doubt that to a certain extent, hype adds value to the startups and that certain startups do receive funding based on associations. But discerning whether it is the increased supply of capital or the greater incentive to form startups that are ageing the sector is difficult. Moreover, it is incredibly hard to understand whether one of these aspects is taking precedence over the other, or if all of these combined are contributing to a bubble.

Additionally in an environment where extremely high risks are the norm, and in an area where more companies fail than succeed, can numerous failed companies be seen as an accurate depiction of inflated valuation, or should they just be treated as a time period that is a statistical outlier?

Moreover, there is a greater pressure to find more unicorns. VC’s are under pressure and in competition, to both; negate the volatility of the shaky startups in their portfolios as well as to find a unicorn and invest in it to maximize return, this inclination is clear to the entrepreneurs, who strive to exploit it. Could this be leading to a system of inflated values for a bracket of companies that are being pushed into a valuation stream they do not belong to?

We know that due to the high return associated with this stream, more and more VC firms are popping up. More funding statistically implies more failed startups. So, there is an inherent risk that if not planned properly the VC’s portfolio may be unable to absorb the losses. If there exists a bubble, we have an inkling of what might contribute to its burst. But, as Forbes points out, companies are growing more rapidly today, and require more capital to achieve their goals, and the time period between subsequent rounds of funding is reducing. This means that companies don’t just require bigger checks, they require bigger checks faster.

Certain companies may fail to achieve what they promise consistently, but their valuation could continue to just be inflated by their capital and associations. But it is the risk of loss in these cases that may essentially push the investors to inflate the value further just to have a safe exit.

Furthermore, venture capitalists have been observed to be quick to infuse certain startups with funds, just because a major investor has backed the startup. In his interview, John Carreyrou, a Wall Street Journal Investigative Journalist, once stated that it was easier for many to trust someone who has a sterling reputation who has already invested in a company and assume that they have done their homework than to do their research on it. These biases may have bigger repercussions than we might have imagined, how many investments have been made due to herding bias or information cascade?

There are inherent vulnerabilities in this system that have been exploited by entrepreneurs such as Elizabeth Holmes, who was once touted as the founder of a 10 Billion dollar company; the reality of which turned out to be nothing close to it. So how did a company selling faulty blood tests get funding of more than 1 billion, with no audited financial statements to even back its legitimacy?

Juicero, a company meant for pressing fresh juice, was juiced out when the investors realized that the packets that were meant to be put in the juicer, could be worked efficiently with hands and that the main product was nothing more than an over-engineered box.

Companies like Theranos and Juicero however, also stand as proof of something different, value inflation is a part of the startup culture, it is used to woo investors. Promises of what doesn’t yet exist are exactly how startup legends like Steve Jobs were disruptive. So, how do we differentiate this much needed “Fake till you make it” surplus value that has existed for a long time, from the kind of value inflation that leads to a bubble?

It could be that the value of this “ Fake it till you make it” is simply increasing across the market due to the increased growth rate. Maybe social media and its trends are just creating more hype. Perhaps the additional value of this ‘fake it till you make it’ attitude is more in industries like tech than say pharmaceuticals. Maybe it is this exact additional value that will eventually to a bubble.

As HBR states, “Asset price bubbles are obvious in hindsight…But although these disconnects seem so clear in retrospect, they are hard to predict in advance. For every asset bubble that burst, there are several alleged asset bubbles that never blew up”

Thus these questions possibly cannot be answered now. It may be wiser to answer these retrospectively, but that shouldn’t stop us from asking questions, because so far; the more we ponder, the more we know.

For sources click here

Follow Us @

Sources

- https://www.forbes.com/sites/allisonbaumgates/2021/07/05/are-we-in-a-venture-capital-bubble/

- https://www.protocol.com/vc-bubble-overheated-investment

- https://www.ramanan.com/personal-blog/on-bubbles-in-venture-capital

- https://www.cnbc.com/2021/07/13/startup-funding-vc-dotcom-bubble.html

- https://fortune.com/2021/07/16/venture-capital-funding-breaks-records-bubble-concerns/

- https://www.atlantafed.org/-/media/Documents/news/conferences/2002/02-financial-markets/papers/ventu

- recapitalandinternetbubblehellmannthomaspurimanju2002mar.pdf

- https://mlsiliconvalley.com/will-venture-capital-bubble-burst

- https://www.forbes.com/advisor/investing/stock-market-bubble/

- https://www.wsj.com/articles/SB10001424052970204468004577166850222785654

- https://hbr.org/1998/11/how-venture-capital-works

- https://www.cbinsights.com/research/report/what-is-venture-capital/

- https://www.cbinsights.com/research-unicorn-companies

- https://www.cbinsights.com/research/european-unicorns-list/

- https://www.cbinsights.com/research/best-venture-capital-investments/

- https://hbr.org/2010/06/how-to-survive-a-bubble.html