Note: The author has recorded these observations from the ‘Inc42Plus Indian Tech Startup Funding Report H1 2021’ (link at the end of the article). The data for H1 2021 is from Jan 2021 to 26 June 2021.

We are well into the second half of 2021. As Shashi Tharoor puts it, “we have to realize that sometimes the best crystal ball is a rear-view mirror,” time for a quick look into the funding of Indian tech startups in the first half of 2021.

With $10.8 bn raised in H1 2021, the 614 funding deals and 59 M&As brought a 2.1x surge in total funding compared to H1 2020. While the average ticket size of funding in H1 2021 was $22.2 m, there were 31 mega funding rounds ($100 mn+ raised in a single round). Fintech is the darling of investors, and the Silicon Valley of India – Bengaluru – recorded the highest number of funding deals and capital. Based on the current funding rate, it is expected that $22.6 bn will be raised by Indian startups by the end of 2021.

H1 2021 marks a historic peak in terms of deal count and funding amount with a growth of 14.98% in deal count and 71.43% in funding amount compared to H2 2020. One may argue about base effects; however, it is essential to note that the last historic peak in deal count stood at 578 in H1 2016 (~94% of the current rise), and the previous historic rise in funding amount stood at $7 bn (~65% of the recent peak) in H2 2019.

The average ticket size of $22.2 mn is the third-highest since H1 2014, trailing close behind $23.3 mn of H2 2018 and not so far from $25 mn of H2 2014. However, it must be noted that the deal counts in those halves were ~63% and ~33% of the deal count in H1 2021, respectively.

The pandemic had undoubtedly slowed down funding in 2020 such that 94% of the total capital inflows in 2020 and 66% of its total deal count have already been achieved by H1 2021 alone.

Fintech, Enterprise Tech, E-commerce, and EdTech comprised around 56.1% of the deal count. While Fintech has continued to remain the darling of investors H1-o-H1 comprising 18.1% of the deal count in H1 2021, Healthtech has slipped from 4th position to 5th position while Enterprise Tech has jumped up three spots to bag the 2nd position. Ecommerce too jumped up three spots to 3rd position while Edtech is down by two places to the 4th position. It is important to note that Deeptech is gaining traction in funding and comprised 6% of the deal count in H1 2021.

As for the funding amount, here too, Fintech (20.9%) remains the darling of investors, followed by Edtech (16.5%), Media and Entertainment (12.4%), Enterprise Tech (11.7%), and Ecommerce (10.7%) in that order. It must be noted that Fintech comprised 7 of the 31 mega-funding rounds of H1 2021.

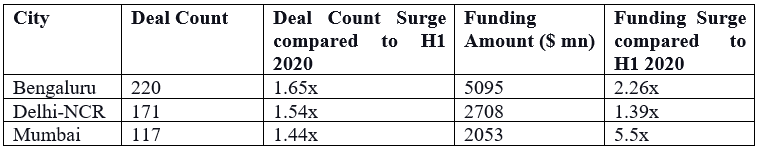

Bengaluru, Delhi-NCR, and Mumbai are at the forefront of the Indian startup revolution. These three cities alone comprised ~83% of the deal count and ~91.3% of the funding amount in H1 2021. Moreover, Chennai overtook Hyderabad for the 5th spot both in deal count and funding amount while Pune retained its 4th spot.

Be its seed stage, growth stage, or late-stage, both deal count and funding amount increased compared to H2 2020. Bridge stage deal count saw a decline of 1.11%, while funding amount saw a drop of 24% compared to H2 2020.

As per multiple secondary media sources, the following Indian startups are planning for an IPO soon:

- BYJU’S

- DELHIVERY

- Flipkart (listing market- the US)

- GROFERS

- MobiKwik

- NYKAA

- OLA

- PharmEasy

- PhonePe

- policybazaar.com

There has been a 1.25x surge in M&A deals compared to H2 2020, and Fintech is the leader in the deal count with 18.6% of the 59 M&As.

Based on the data recorded by DataLabs internal database and investors’ participation in India’s Most Active Investors Ranking, H1 2021, Alteria Capital, Sequoia, Innoven Capital, Tiger Global, and IvyCap Ventures are the top investors (in that order) of H1 2021 in Indian Startups considering only the growth sage (Series A&B) and late-stage (Series C and above) funding.

The investor sentiment is comparatively bullish in H1 2021. It is forecasted that $22.6 bn will be raised across 1,212 deals by the end of 2021. Fintech, enterprise tech, and edtech comprised 15 out of the 31 mega-funding deals of H1 2021. These are expected to continue attracting mega-funding even in H2 2021.

We are clearly amidst the Indian startup revolution. The future looks bright.

For sources click here

Follow Us @