Hello avid readers,

What if you were asked to choose between your Ethics towards society and your multi-bagger returns expectation from your portfolio? You must wonder how they even correlate; both are perceived as essentials and can be accomplished separately!

But that is where most of us get defeated unknowingly. You investing in stocks after analyzing the business, technicals, and fundamentals and thinking your research to be apt to make a wise investment decision makes your stock picks attract additional unfortunate and unpredictable risks to your assumed-to-be-hedged portfolio!!

So, not trying to loop it up more unnecessarily, what our main focus for this write-up will be is understanding what ESG Investing is and how you can ensure that you make your research exhaustive about considering the crucial “ESG” factor and make your investment society-friendly as what’s good for the society is also suitable for your portfolio!

Basics Of ESG Investing Decoded:

ESG stands for environmental, social, and governance. We must look for ESG compliant companies, and it satisfies all the conditions of ecological, social, and corporate benchmarks.

As by the names,

ENVIRONMENTAL factors urge companies to adopt greener or environment-friendly practices while operating,

SOCIAL stands for how the company manages its relationships with employees, suppliers, customers, and communities.

GOVERNANCE or Corporate Governance seeks to ensure that the company is transparent in its actions and treats all its shareholders respectfully and fairly.

According to a Morgan Stanley survey conducted in 2019, 85% of retail investors are interested in sustainable ESG investing!

Working of ESG Mechanism:

Just like the Nifty 50 Index, we have this creative and much desired Nifty ESG Index to invest our hard-earned money in.

The Nifty ESG Index had given a five-year return of 14.91% compounded annually, while the Nifty 50 Index has given a 5-year return of 13.6% compounded annually.

Currently, in India, we have ten funds available with us to invest in the ESG corpus.

Now, how’s this gigantic thing of deciding on parameters, evaluating, etc., done?

“Sustainalytics,” a Morningstar company, does this enormous task of analyzing companies thoroughly from the ESG angle.

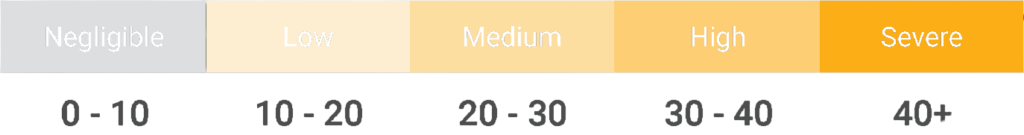

The firm gives an ESG risk score. A lower score indicates that the company is less affected by the ESG, which is good and vice versa.

The different parameters they consider while calculating this score are:-

1)Exposure of a company towards various ESG issues.

2)Management efficiency of dealing with the ESG issues in the past.

3)Controversies to which the company has been exposed in the past.

The very recent top 5 companies and the bottom five ones as released by CRISIL in consideration with the data provided by third-party providers are Infosys, Mindtree, TCS, Wipro, and Kotak Mahindra Bank, which have emerged as the top five entities in terms of environmental, social and governance (ESG) scores assigned by Crisil Ltd. for 225 Indian companies across 18 sectors. The scores are based solely on Crisil’s proprietary framework and are set on a scale of 1-100, with 100 denoting best-in-class ESG performance and 1 representing the worst. Infosys, Mindtree, TCS, Wipro, and Kotak Mahindra Bank scored 79,77, 75,75, and 74 respectively out of 100, which is comparatively reasonable. The lowest scorers among the lot include India Cements (37), Vodafone India (40), Star Cements(41), Godfrey Phillips (41), Coal India (43) & JSPL (43).

While conducting your research on these companies, you must look at the exposure, how the management is dealing with the company, the top 4-5 problems that shall affect the company, and the current controversies that shall affect the company. You can use “Sustainalytics.com” to conduct your comprehensive research to measure ESG parameters, ideally adding a pinch of eco-friendly and sustainability factors to your portfolio!

Unlike the ratings released by CRISIL, the algorithm on this platform describes the companies with low ESG scores as ideal ones and vice versa. The platform is user-friendly, and you will be able to diagnose things with ease.

Extras:

One last say, before ending this blog. And it is something for the Finance enthusiasts out there.

The renowned CFA Institute, which earlier had three exam levels for CFA aspirants, introduced one more level catering to ESG Investing.

The Certification typically represents the first global qualification in the environmental, social, and governance investing zone. When it’s by CFA itself, what better than it! As per the CFA Institute survey,76% of institutional investors and 69% of retail investors are interested in enrolling for some Certification in ESG Investing.

This Certification is designed in such a way that will help to meet the needs of practitioners in investment roles who want to learn how to integrate ESG factors into their daily investment and trading practices. A good opportunity for those willing to improve their understanding of ESG concepts in sales, wealth management, product development, financial advice, consulting, risk, etc.

So, this was all just one small subject topic in the vast universe of stock market investing. I hope you may gain something out of the entire context. Towards the last crucial line, All the stocks mentioned above are not buying recommendations; these were just presented to tell which all companies are at the top while computing the ESG score.

Conclusion:

So, I hope you got a glimpse of the implementation of ESG with a particular focus on Indian companies. We need to understand how every company works in concert with the environment, the social causes, and how they govern their entire company.

Any problem here that can create a controversy for the company will lead to a decline in the stock prices. That too with 5-inch tall red Marubozu candles as soon as the piece of information reaches the ears of the active, influential investors out there! Also, ESG Investing holds key value in transforming the investment management industry and redefining corporate India’s approach towards managing risk, and ensure sustainable value creation for all its stakeholders.

Follow Us @