The foundation for the rapid development of the now-famous blockchain technology was laid by none other than Bitcoin. The base for cryptocurrencies is said to be set by the whitepaper “Bitcoin: An Electronic Cash System,” which Satoshi Nakamoto shared on a cryptography forum as a response to the system’s shortcomings, which led to the 2008 financial crisis. The whitepaper initiated a new asset class and created a mystery or enigma because Satoshi Nakamoto is a pseudonym. Even 12+ years after the paper was published, no one has been identified as the individual or individuals behind the movement.

This article is certain to unravel a mystery, not about the identity of Satoshi but behind the roller coaster ride of Bitcoin.

Despite cryptocurrency’s lack of mainstream traction, its popularity is growing as a store of value and hedge against inflation.

Since being founded in 2009, Bitcoin has seen various changes and shifts in value, just like any other asset available on the market. But what is so astounding behind the volatility is the speed and magnitude of the rise or fall.

As the value of a single Bitcoin jumped from $ 0.0008 to $ 0.08 in 2010, the first price increase was recorded for the cryptocurrency. An unknown person in Florida successfully traded 10,000 bitcoins for two pizzas on May 22, 2010. This was the first bitcoin payment ever known was made when bitcoin was worth $41. In 2011, its price jumped from $ 1 in April to $ 32 in June of that year, gaining 3200% in just three months. Post the attention-catching ascent, it saw a decline in value to $ 2 in November 2011 as the global recession continued. Till August of 2012, there was a marginal increase in value to $ 13.20.

2013 played a pivotal role in molding the future of bitcoin as the currency began trading at $ 13.40 and underwent two price bubbles in the same year. The first bubble occurred when the price shot up to $220 by the beginning of April 2013. However, the rapid increase quickly saw an equally rapid deceleration in its price as the trades were concluded at $ 70 in mid-April.

That’s not all.

The year saw yet another rally in early October when Bitcoin was traded at $ 120. By the end of the year, the price spiked to $ 1156.10. Yes, you read it right. Then, however, Bitcoin, following its typical volatile nature, crashed to $ 760 in just three days.

In the event of the failure of the leading bitcoin exchange called Mt. Gox, followed by the news of its bankruptcy, slowly led to the start of a multi-year slump in Bitcoin’s price. Finally, in early 2015, the price reached a low of $ 315.

The following price bubble was seen in 2017 when the price was floating around the $1000 range, which then shot up to $20,000 in December of that year. Some researchers have speculated why this massive rise is a coordinated price manipulation using another cryptocurrency called Tether.

In the wake of this rally, Bitcoin gained notoriety, and governments across the globe began taking it seriously. As a result, they began developing other competing currencies for Bitcoin.

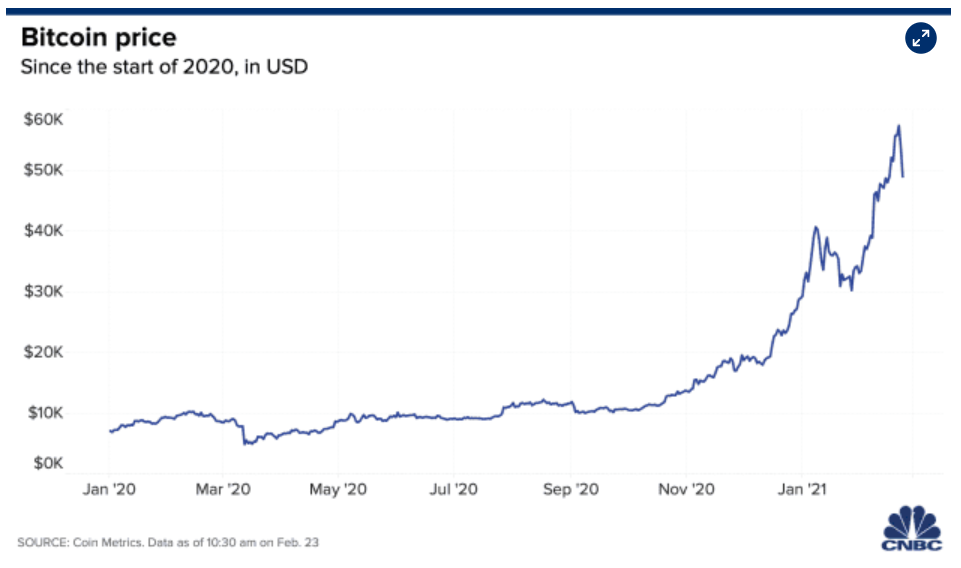

Post that, Bitcoin’s price saw a few fluctuations here and there. But it was not until 2020 that Bitcoin’s price burst into activity once again when the economy shut down due to the pandemic. The cryptocurrency started the year at $7,200. Investors’ fears over the global economy were exacerbated by the government shutdown and subsequent policy decisions. The closing price of Bitcoin on November 23 was $18,353.

So, do you wish to play in crypto and become a millionaire overnight?

Brace yourself for more days like Monday (May 13) when Bitcoin prices reached a three-week high of $40,000 post the viral tweet of Tesla Founder Elon Musk stating that the company would resume transactions in cryptocurrency once the mining process becomes greener, resolving the company’s previously raised ESG concerns.

Why is the value of Bitcoin so volatile?

1. Global Currency Acceptance/Adoption-related news

News events that scare Bitcoin users include geopolitical events, formal/informal communications by the companies on the adoption of Bitcoin, and statements by governments that Bitcoin is likely to be regulated. Headline-making bitcoin news like the bankruptcy of Mt. Gox in early 2014 and, more recently, that of the South Korean exchange YapianYoubit, etc.

All these incidents caused panic amongst the public, which further drives down the value of bitcoin rapidly. On the other hand, investors with a positive view of bitcoin viewed the news events as signs that the market was maturing. The value of bitcoin versus the dollar surged as a result in the short period following the news.

2. Changes in the Perceived Value

There may be fluctuations in Bitcoin’s value against fiat currencies due to the perceived store of value. However, Bitcoin is similar to gold in terms of its properties. The number of bitcoins produced is fixed at 21 million BTC due to a design decision by its core technology developers.

This is in stark contrast to fiat currency, which governments dynamically manage in order to maintain low inflation, high employment, and satisfactory economic growth. As a result, the strength or weakness of economies built with fiat currencies may affect the allocation of assets to bitcoin.

3. Future Uncertainty

Variations in Bitcoin volatility are also primarily caused by varying perceptions of the cryptocurrency’s value as a store of value. In the future, an asset can be helpful to with a degree of predictability if it is a store of value. For example, a store of value can be saved and exchanged for some good or service in the future.

A method of value transfer is any object or concept used to transmit property in the form of assets from one party to another. Bitcoin’s volatility at present makes it a somewhat unclear store of value, but it promises nearly frictionless value transfer. As a result, we see that bitcoin’s value can swing based on news events, much as we observe with fiat currencies.

Is there a measure of Bitcoin’s volatility?

Bitcoin spot rate fluctuates due to multiple factors on cryptocurrency exchanges. The Volatility Index, also known as the CBOE Volatility Index (VIX), measures volatility. More recently, a volatility index for bitcoin has also become available. The Bitcoin Volatility Index, also referred to as the. BVOL24H Index. Using measurements of the Bitcoin spot price taken every minute, this index is calculated logarithmically.

To conclude, let me assure you that cryptocurrencies are here to stay. As for the question ‘When will they replace fiat currencies? ‘ only time will tell.

For sources click here.

This post was written in collaboration with Asif Yahiya Sukri LLP. Asif Yahiya Sukri LLP provides unparalleled personalized financial services to a broad range of clients across different geographical locations. With a presence in the USA, India and the MENA region, they ensure that all of your financial decisions are made carefully and with your best interests in mind. They are innovators who understand what goes into building companies.

You can also reach out to them on info@aysasia.com

Follow Us @

References:

https://www.investopedia.com/articles/investing/052014/why-bitcoins-value-so-volatile.asp

https://www.investopedia.com/articles/forex/121815/bitcoins-price-history.asp