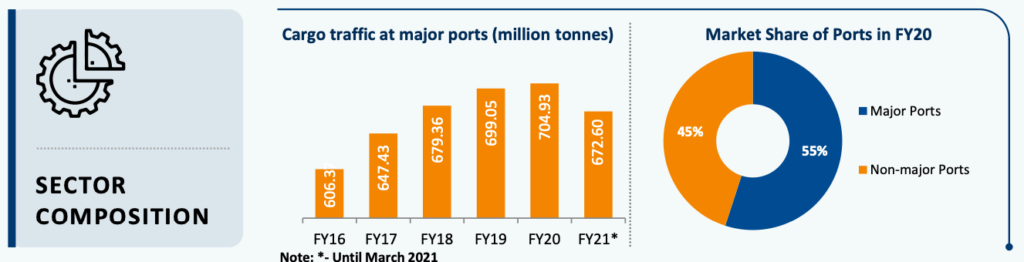

A business has several forces which drive its operations and final delivery to the customers. Over the years, this delivery has evolved and taken the shape of agile systems and complex programs that result in the seamless supply of goods and services to the expectant. Today cumulatively, these services come under logistics and supply chain. On a broader level, this would include the air, road, and water (one could also argue digital supply, but for now, let’s stick to the traditional means). The Ministry of Port, Shipping, and Waterways believes that around 95% of India’s trading (by volume) is done through maritime transport. This trade makes up approximately 70% of the trade value. In FY20, essential ports in India handled 704.82 million tonnes of cargo traffic, implying a CAGR of 2.74% during FY16-20.

India today has around 200 ports. These include both major and non-major ports. The ownership of these ports, like any other entity in India, is either public or private. Among all the port operators in India, Adani Ports and Special Economic Zone Ltd. is the largest commercial port operator, accounting for nearly one-fourth of the cargo movement in the country. The company started operations 33 years ago and currently does business out of 12 domestic ports, each with relevant strategic importance. It operates from Gujarat’s Mundra Port, the largest commercial port in India, and overall had more than 15% share in India’s cargo in FY20. Previously known as Mundra Port and SEZ, the company, while expanding from port operations, officially took up the name of Adani Ports and Special Economic Zone Limited in 2012. This port also forms a part of the infamous Maritime Silk Road that runs from the Chinese coast to the Mediterranean and via the Upper Adriatic region (near the Italian Peninsula) to Central Europe and the North Sea. The rest of the 11 ports are in Gujarat, Maharashtra, Goa, Kerala, Andhra Pradesh, Tamil Nadu, and Odisha, representing a well-rounded national footprint.

As of today, APSEZ is involved in the business of port operating & development, logistics, and Special Economic Zones. In addition to the ports mentioned previously, the company owns three logistic parks (in Haryana, Punjab & Rajasthan). As an expansion to the port business, it has established an SEZ in Mundra, the Mundra Economic Hub. The hub is a modern-day multi-product SEZ, Free Trade and Warehousing Zone (FTWZ), and Domestic Industrial Zone, spanning over 8000 hectares. In India, it competes with companies like APM Terminals (Pipavav) and Kamarajar Port Limited (Erstwhile & Ennore Port Limited).

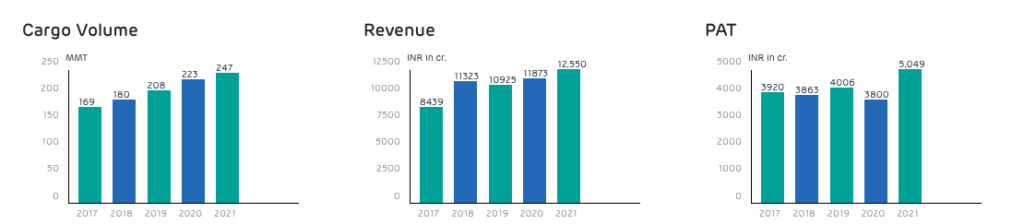

Now, translating the above to actual business figures, the main port (Mundra) handled 144.4 million tonnes (1,44,40,00,00,000 kgs) of cargo. The cargo includes bulk, break bulk, liquid cargo, container cargo, LPG/LNG cargo, crude. In FY21, the cargo mainly consisted of coal, containers & crude. The CAGR of total load for APSEZ comes up to ~25%, multiple times the industry average of 5%. This kind of development and series of strategically essential decisions have translated well in the company’s revenue figures. The total revenue for FY20 summed up to Rs. 11,873 Crores and a total of Rs. 12,550 Crore in FY21. These resulted even with India’s 12 major ports witnessing a 4.59% fall in cargo handling due to the pandemic. With this, APSEZ’s market share came up to 25% in cargo volume and 41% in the container segment. The net profit for the entity in this financial year stood at Rs. 5,049 Crores after a dip in 2020.

The current trends in the company’s operations combined with aggressive growth plans draw out a promising future for the entity. Customer-centric services, strategic partnership, geographical and cargo diversification have allowed an increased revenue consistently. The company has a target to handle throughput volumes of 400 million tonnes by 2024-2025. One can call it unrealistic, but APEZ has already started to build on it with the three significant acquisitions at a combined value of Rs 18,000 crore (between 2020-2021) to expand its market share to 30% on a pan-India basis. The focus on covering hinterlands and introducing modern technology like AI and Big Data has transformed and increased operational efficiency and is expected to continue. It is a known fact the company enjoys favorable attention from the government and has plans ready which are aimed at making APSEZ one of the top 10 port companies in the world.

However, certain challenges do lie ahead concerning the very recent negative news on investor accounts being frozen, but it is believed this will not affect the company’s business prospects. The pandemic was a massive hurdle, but APSEZ seems to have dodged the bullet without any significant damage financially.

Founders & Management

Adani Port and SEZ was founded by Mr. Gautam Adani (along with the Adani Group), currently serving as the Chairman and Managing Director. His son, Mr. Karan Adani is the Chief Executive Officer of APSEZ. He is spearheading the transformation at APSEZ to form an integrated logistics company.

For sources click here

Follow Us @

Sources:

- Adani Ports and SEZ Limited

- Explained | How Adani Ports Is Getting Ready To Become India’s Largest Private OperatorAdani Ports at BBB-: Fitch Ratings

- Adani Ports Q4 results: Net profit jumps 285% YoY to Rs 1,288 cr; operating revenue rises 24%

- Gautam-Adani

- Karan Adani | CEO | Adani Ports & SEZ Ltd

- India’s Largest Integrated Ports and Logistics company

- The Port King- Business News

- Is Now The Time To Look At Buying Adani Ports and Special Economic Zone Limited (NSE:ADANIPORTS)?

- India to privatise seven major ports in 2021

- Ports in India: Market Size, Investments, Economic Development, Govt Initiatives