If you have read recent any financial newspaper, one article that really gets your attention is Falcon Edge’s hyperactive deal making strategy.

So, let’s find out how falcon gets the edge.

Falcon Edge was co-founded by Rick Gerson, who is based in New York, and Mumbai-born Navroz Udwadia, by backing a mix of public and private market companies in 2012. Most of us will be unaware of its very first public investment which was JM Financial.

Falcon Edge offers a variety of investment products including public equity, venture capital, distressed, private equity, and activist strategies. It manages more than $4 billion in assets globally.

In mid-April this year, the fund participated in a round of food delivery platform Swiggy.

In October, it picked up a stake in insurance-tech aggregator Policybazaar ahead of the company’s plan to go public in 2021-22.

In August, Falcon Edge invested in Avail Finance, a digital lender that seeks to provide instant collateral-free personal loans. Last year in April, it co-led a Series A round in fintech startup Setu.

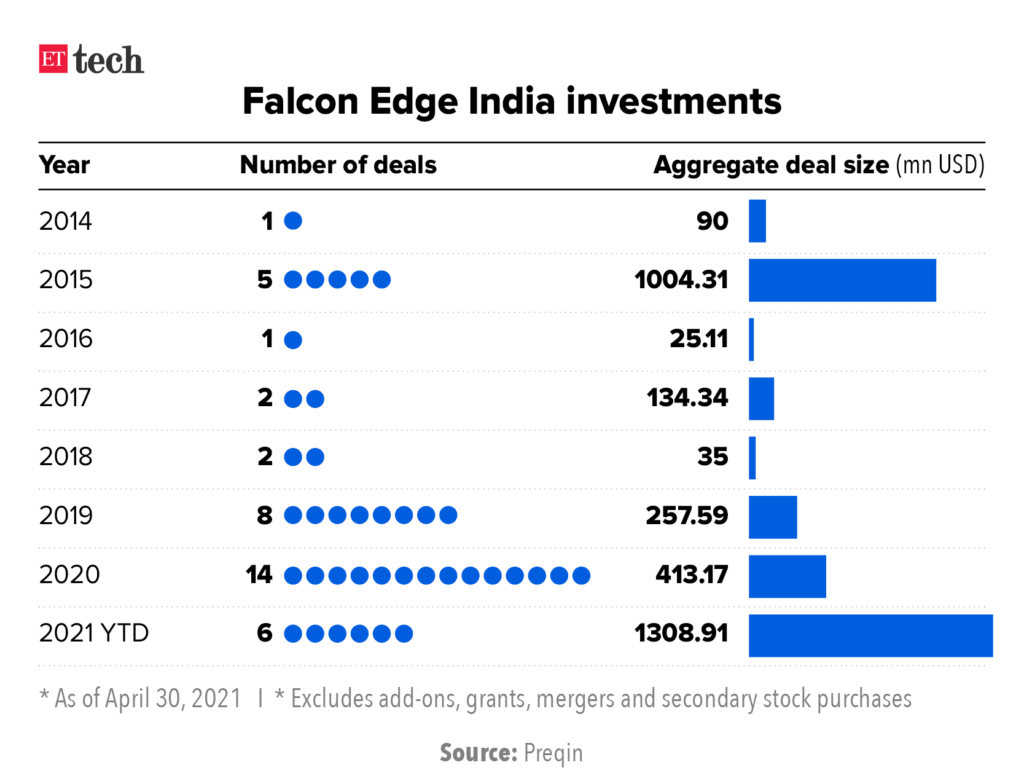

When looked at Falcon Edge’s investment over the years it surely seems eye-catching.

The Strategy

Falcon Edge Capital conducts its research internally, utilizing a long short equity strategy to make its investment decisions. The company invests in the public equity markets on a global scale, allocating its assets across a range of assets with a focus on global emerging markets. Falcon Edge Capital invests most heavily in the consumer discretionary sector, which alone makes up over a third of the firm’s total asset allocations, and also invests in the health care, information technology, industrials, and energy sectors, among other sectors to a lesser degree, in order of decreasing allocation. The company holds its allocations for 2.9 quarters on average and holds its top 10 allocations, which makes up approximately three quarters of its total allocations, for 3.5 quarters on average. Falcon Edge Capital’s top holdings include Liberty Interactive Corp., Allergan PLC, Cheniere Energy Inc., and Spirit AeroSystems Holdings, in order of decreasing allocation. In the most recent quarter, Falcon Edge Capital had a turnover rate of approximately 23.8%.

What is it that has been working in their favor?

Across several conversations, founders, investors and others who have worked with Falcon Edge said the big change has been the Middle East capital that they’ve been able to snag. Across Alpha Wave Incubation (AWI), which focuses on early-stage deals and the big money from Abu Dhabi’s ADQ, for growth equity investments, the fund has gained exponentially in India. While Falcon Edge doesn’t disclose its fund size, AWI has $400 million to invest but the huge corpus of ADQ is the real differentiator.

Moreover, the company has now changed its outlook towards making bigger bets across various segments in the digital economy after sniffing the opportunity to do so about 18 months ago. In April last year, India stepped up scrutiny of investments from companies based in neighboring countries, in what is widely seen as a move to stave off takeovers by Chinese firms during the coronavirus outbreak and introduced the new FDI rules. This move by the Indian government of restricting Chinese investment in startups has sweetened the success of Falcon edge.

Even Tiger Global, its commonly referred competitor, was not in its usual fierce deal making mode around the time Covid-19 first engulfed the world. Falcon, on the other hand, made 14 investments in 2020. This was further amplified in the first four months of this year as my story captures.

Way forward

The big challenge for Falcon going forward will be to manage a large portfolio with a lean team. Unlike Tiger, they are more the VC type. They want to take board seats, engage with the founders regularly and share inputs. How will this happen if their portfolio grows this way? When confronted Udwadia says they aren’t aggressively deploying capital and have in fact said no to many deals.

This post was written in collaboration with Asif Yahiya Sukri LLP. Asif Yahiya Sukri LLP provides unparalleled personalized financial services to a broad range of clients across different geographical locations. With a presence in the USA, India and the MENA region, they ensure that all of your financial decisions are made carefully and with your best interests in mind. They are innovators who understand what goes into building companies.

You can also reach out to them on info@aysasia.com

Follow Us @