Company Overview

During the end of the last decade, Borosil sensed the exponential the demand of solar energy equipment and commissioned a facility at Bharuch, Gujrat in 2010 which was later named as Borosil Renewables (BRL from now on). It is the only solar PV (Photovoltaic) glass manufacturer in India.

In 2018, the all the companies in the Borosil group went under restructuring to form Borosil Renewables and Borosil limited respectively.

Potential of Solar Energy in the times to come

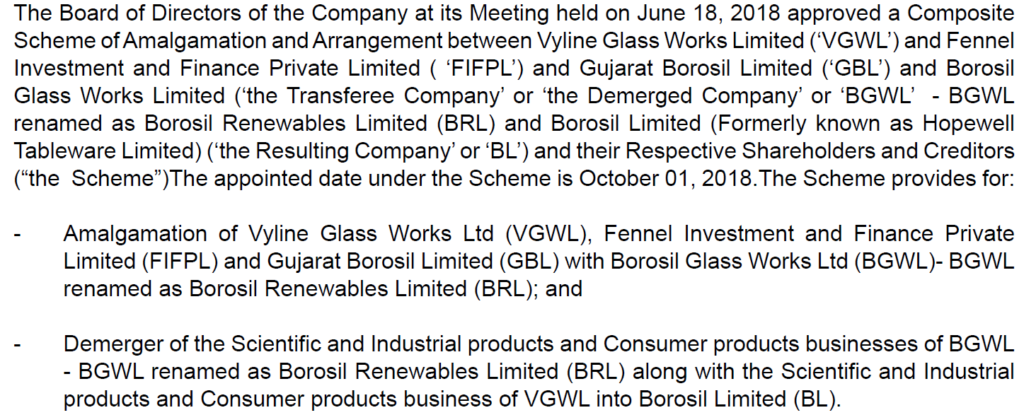

There has been a huge evolution in solar energy productions since the past decade. Back in 2010, the market was very small and it was heavily dependent on the subsidies provided by the countries. But, in the past decade, due to technological advancements, the cost of produci ng solar energy has fallen dramatically. It is anticipated that by 2030, solar energy could be one of the most important source of electricity production for the world. New technologies have increased the efficiency and reduced the costs of production further.

According to a report by International Renewable Energy Agency (IRENA), “At a country level, the average total installed cost of utility-scale solar PV projects has declined by between 66% and 84% in major markets during the period 2010–18. Germany and France witnessed a reduction of 71%, while others have experienced reductions closer to 80%, such as China and Italy (77% and 78% respectively). India was estimated to have the greatest reduction, estimated at 80%”

IRENA: The Future of Solar Photovoltaic

India is the second most populated country in the world and it the carbon emissions in the country is only less than China and the United States. India, by 2030, has committed to a goal of having 60% of its electricity from renewable sources. According to an article published in Nature Communications, the researchers have found that solar and wind energy would be able to meet 80% of the electricity demand of India by 2040. If it happens that way, then it could make a huge impact towards the carbon neutrality goals of India by 2050/60.

Solar Industry Overview

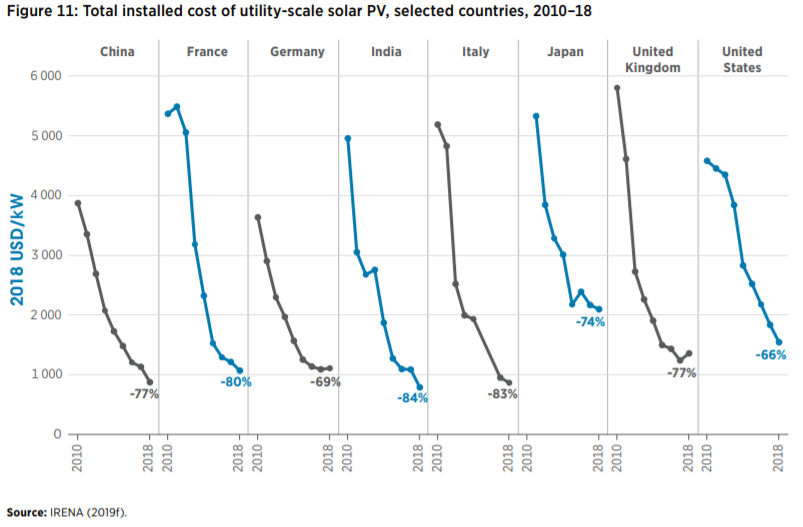

Solar energy has become one of the fastest growing sectors in the world owing to the adoption by the countries in the world. This has created some giants in the solar PV equipment manufacturing business.

The Solar power sector is dominated by China and they have started to manufacture as well as export from Malaysia and Vietnam to overcome the international trade restrictions.

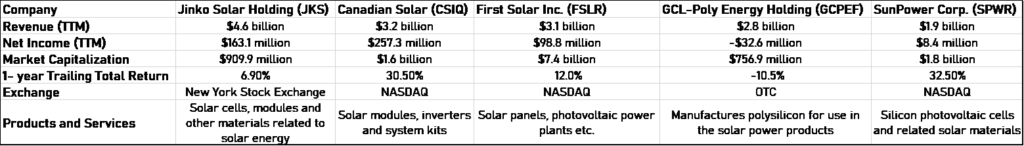

Five biggest solar companies in the world

Note: All the companies except GCPEF are listed in US. GCPEF is listed in Hong Kong Stock Exchange.

India

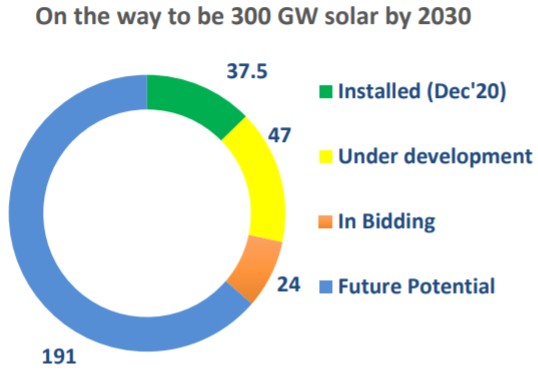

India has a total power generation capacity of 375 Gigawatts (GW) (as of December 2020) out of which around 91 GW (24%) comes from renewable sources. Solar energy contribution to the renewable energy is 37.5 GW (40%). Government of India has set a target to install 175 GW of renewable energy by 2022 of which 100 GW is supposed to come from Solar. Also, the target for solar installations is kept at 300 GW by 2030 under the National Solar Mission.

Some of the growth drivers for the Solar Industry in India include the following:

- Kusum Program for farmers (30.8 GW by 2022)

- Central Public Sector Undertaking (CPSU) program for domestic manufacturing (12 GW, 2019-23)

- Renewable Purchase Obligation (RPO) for growth of solar energy generation

- Railways – Rooftop generation capacity of 500 MW and installations of 20 GW till 2030

- The net zero emission goals set by various countries according to the Paris Treaty

- The Production Linked Incentive (PLI) scheme to boost domestic manufacturing and exports

Though the domestic manufacturing capacity is estimated to be around 11 GW, due to tough competition from outside, the actual domestic manufacturing of 4-5 GW happens.

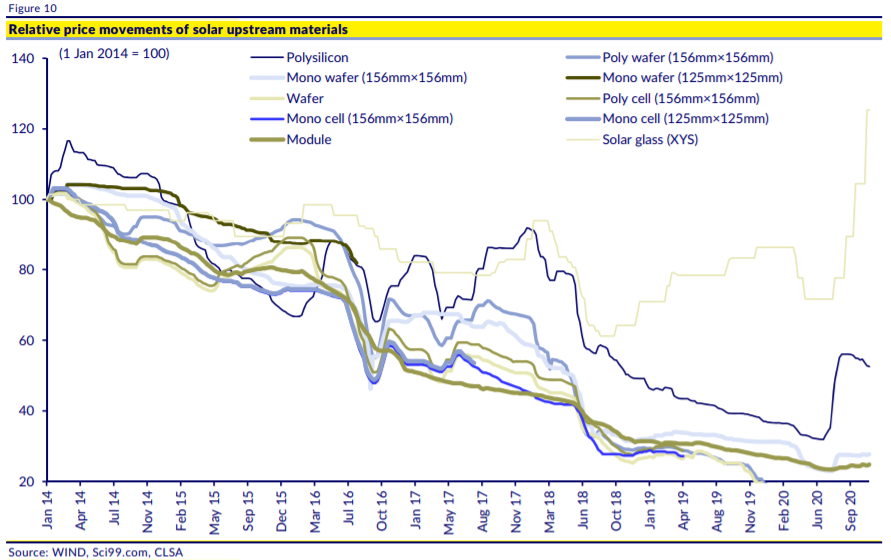

Solar Glass

Solar glass is an important component of a solar module. The Solar Glass sector is dominated by China. According to a Solar Energy Outlook report by CLSA, the price of Solar glass has remained stable or increased overtime for the last five years. We can expect similar behaviour to unfold in the near future (for the next 5 years) unless some disruptive technology comes in and the prices decrease.

Companies in this sector are expected to gain as the solar industry grows. Since, Borosil Renewables is the only domestic player involved in making solar glass, it has a big opportunity to grow its business and compete with international players.

Current drivers for the Solar glass manufacturing in India include:

- Shift towards bi-facial modules globally due to better power generation capabilities

- Anti-Dumping Duty (ADD) on the products imported from China to boost domestic manufacturing

- Countervailing duty of 9.71% levied on the solar glass imports from Malaysia on the recommendation of Directorate General of Trade remedies (DGTR)

Borosil Renewables (BRL)

Growth Drivers

The company has a strong focus on R&D and innovation. BRL has developed the world’s first fully tempered 2 mm thick glass with lowest iron content which gives the highest efficiency. It is also the first company to have been able to remove the most hazardous substance from its PV glass, Antimony.

The company has launched new products namely Selene and Shakti. Selene is a anti-glare solar glass which is suitable for the installations near to airports and Shakti is a matt finish solar glass which increases efficiency of energy production.

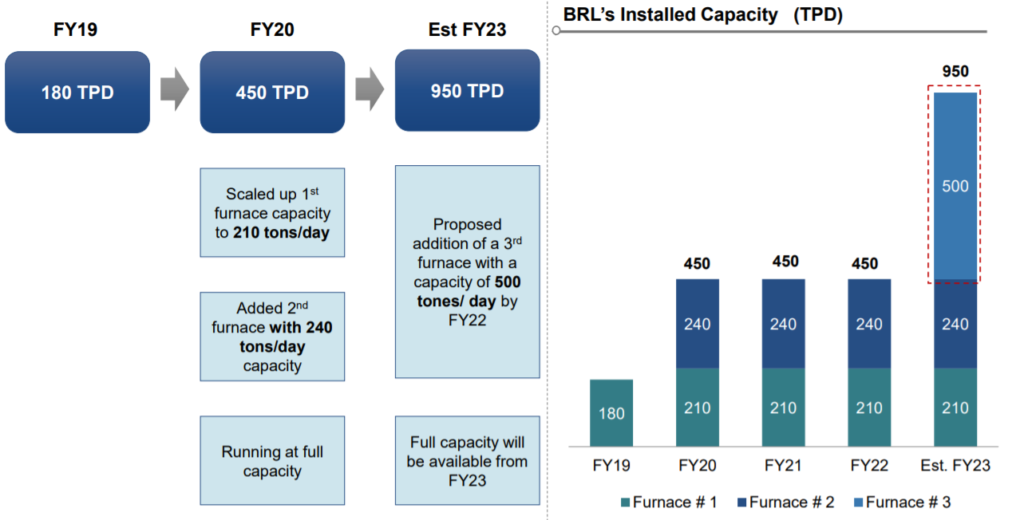

Over the last few years, there has been a constant growth in the solar energy production and installations. To address the demand, BRL has recently doubled its existing capacity. Earlier, the company had a furnace to produce 210 Metric Tonne (MT)/day. BRL has added another furnace of capacity 240 MT/day. With the current capacity, both the plants can produce glass to 2.5 GW per annum.

European market is the major customer base for BRL, where it has successfully started its supply of its products (2 mm and 2.5 mm glass). The additional capacity will help BRL to increase exports and tap customers in Europe as well as the Americas. The company has grown at a CAGR of 33% in the last three financial years.

The company is planning to increase the production capacity and add another 500 MT after assessing the demand of India and the world. For this, the company has decided to take shareholder approval for raising the borrowing limit from the present 100 crores to 500 crores.

Financials

- Revenue – 77% of revenue is derived from India and 23% from exports. Exports have grown at 33% CAGR in the last three years

- For the last five years, the EBITDA margin has been 18.41% versus an industry average of -5.26%

- For the last five years, the net profit margin has been 7.54% versus an industry average of -16.83%

Opportunities

- Sole producer of solar glass in the country

- Company invests in R&D and innovates better products. Products also have a widespread acceptance

- Government initiatives such as not signing of Regional Comprehensive Economic Partnership (RCEP) and Atmanirbhar Bharat will boost domestic manufacturing

- Company’s products (2mm and 2.5 mm) are niche products and are beneficial for glass-glass modules

Risks

- Due to COVID-19, the world going through economical disruptions and manufacturing companies have been severely affected

- China is the world’s largest PV glass producer and accounts for over 90% of solar glass capacity. Prices are mostly controlled by them and if they decide to decrease prices, it can affect BRL’s top line and in turn the bottom line

- Major companies in China are adding production which will allow them to decrease prices (economies of scale)

Follow Us @