With the rising fuel prices and the lowering economy, a consumer might think that inflation is on cards but how much of that is really in the books? As the measure of inflation is based on weighted average assignments to certain components forming a part of CPI*, petrol and diesel doesn’t form part of CPI but that of WPI^, so rise in these prices aren’t an indication that inflation is knocking on the door.

*CPI – Consumer price Index – The Consumer Price Index (CPI) is a measure of the aggregate price level in an economy. … The market basket used to compute the Consumer Price Index is representative of the consumption expenditure within the economy and is the weighted average of the prices of goods and services.

^WPI – Wholesale price index – The Wholesale Price Index is the price of a representative basket of wholesale goods. Some countries use WPI changes as a central measure of inflation. But now India has adopted new CPI to measure inflation.

To know more let us first understand what exactly inflation is

What is inflation?

Inflation is a state of economy where the purchasing power of a consumer is declined. Supposedly we could buy 1 kg rice at Rs. 10/kg in 1998 now the same costs around Rs. 60 in 2021. This upward rise in pricing vis-à-vis income of a consumer being the same is known as inflation.

The ideal inflation rate in India is 4% + 2% and the current rate of inflation is 4.06% which at present is well in the bracket.

In technical terms, inflation rate is derived from the change in price level of consumer goods & services used by households, this change is termed as the consumer price index.

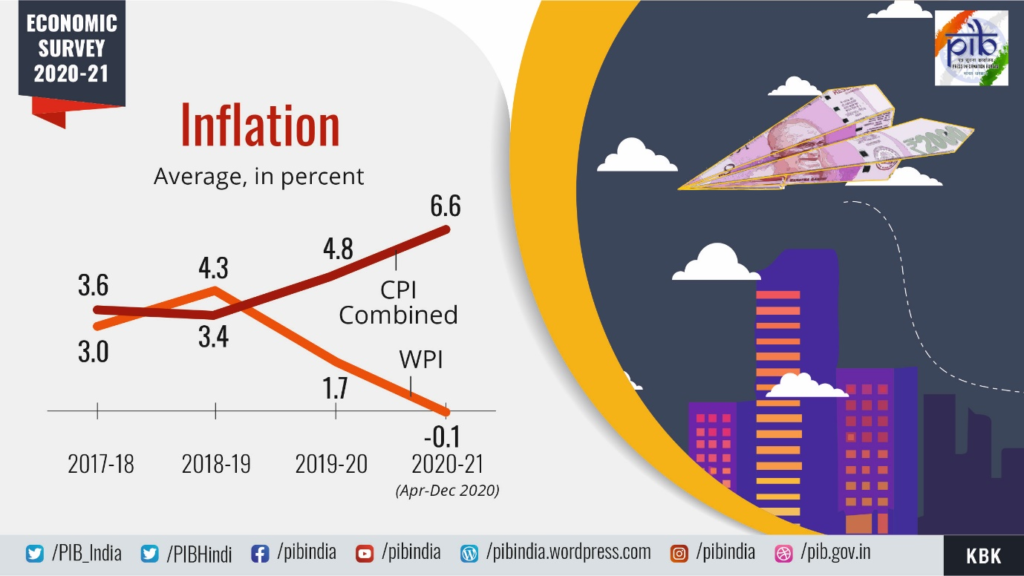

According to the economic survey 2020-21, CPI combined was 6.6% and the WPI dipped by 0.1%. The pandemic caused the demand supply equation to disrupt causing the inflation rate to shoot up as high as upto 7.61% in the year 2020 but as things are regaining their power and businesses are coming back in game the demand supply curve is taken care of and this has stabilized the rate of inflation since 2 months now.

There can be increase in the same if any of the below factors are disturbed, let’s get a general understanding of:

Causes and types of inflation

Inflation is caused due to multiple factors, to list a few

1. Increase in purchasing power – As the salaries are hiked every year consumers tend to buy more, so are the prices of the commodities, this is termed as wage push inflation.

2. The Demand supply equilibrium – The tendency to buy more increases demand for the product, it’s not new to us that higher the demand higher the prices which is caused due to demand-pull inflation.

3. Time value of money – A Rs. 100 today v/s 10 years back does not buy the same amount of goods, the time value of money which keeps on deteriorating have an inverse relationship with that of inflation.

4. Money printing – To ease liquidity in the economy, govt pumps in money by printing notes, this situation may lead to Hyperinflation if appropriate barometers are not in place like the one happened in Zimbabwe.

5. Currency depreciation – Day by day due to economic downturn and policy decisions the value of Indian rupee is depreciating to that of dollar and therefore, we need to pay more in international trade arrangements giving rise to increase in cost of the product and there you go, inflation has shown up again.

Well, enough with the reasons, there definitely must be some overseeing body to keep the track of the above.

How is inflation regulated?

First and foremost, RBI is the body who controls the level of shocks and pressures in the market.

It is well established now that increase in purchasing power gives rise to inflation. So, to control it, RBI hits the purchasing power of the people i.e if people have lesser free flow of money, they will spend less which will lower the demand which in return will control the prices. And in order to control the flow of money, RBI increases its repo rate# which in turn leads bank to increase their lending rate to the mass and the money flow is controlled, as nobody wants to pay a higher rate of interest which demoralizes the buying spur.

#Repo rate – Repo rate is the rate at which the central bank of a country (Reserve Bank of India in case of India) lends money to commercial banks in the event of any shortfall of funds. Repo rate is used by monetary authorities to control inflation.

RBI regularly keeps track of such information and same can be retained from its bi-monthly monetary policy report. Also, RBI is conducting a survey in 18 cities to seek qualitative and quantitative responses from households on price changes to predict the behavioural pattern in future period2. According to that report, nearly 83% of the survey population thinks the prices will increase in the coming 3 months period and an increase of 88% in a one-year time frame can be expected.

India also has the flexible inflation targeting (FIT) framework, which keeps an eye over this bubble bursting scenarios.

Relationship between global inflation with Indian economy

As per Forbes, Inflation might be knocking our door in the next two years.

Researchers say, even if global inflation increases their benchmark it would be cyclical and won’t stay up for long. Although as per the US Federal policy makers it may vary from 3.5% to as low as 0.5%, the uncertainty is way too much and if inflation rises on global level it is definitely going to hit India.

https://www.moneyandbanking.com/commentary/2021/2/14/is-inflation-coming

Since covid demanded many people all over the globe to change their occupation in entirety, unemployment increased and it cannot be balanced with excess monetary and fiscal stimulus because the imbalance may create inflation, says an economist from Schroders.

Another view as per the RBI report says the global inflation rate didn’t spread out much and with the vaccine rollout in the market the chances are good that economy recovers soon. But it may go in contradiction as due to the 2nd wave of covid 19 live in many countries the lockdown has been imposed once again resulting in a situation like 2020 to repeat itself.

https://rbidocs.rbi.org.in/rdocs/PressRelease/PDFs/PR1134DA80612FFABF41D89A6444D4FD641174.PDF

What should you expect?

Currently Indian economy is into technical recession! so the chances of inflation are slim as inflation lowers down while in recession due to the inverse relationship.

! Technical recession – A technical recession is when a country faces a back-to-back decline (for two consecutive quarters) in the GDP. 2. It covers a wide range of decline in economic activity, covering several economic aspects such as employment, household, corporate incomes and so forth

But Inflation as a phenomenon is very tricky, 1000 things have to come together in order to get a clear picture of this ever-fluctuating graph. With dynamic climatic changes and the covid 19 blanket, there are predictions that prices may rise again and kick the appetite of the poor.

Also, a swift rise in prices may call out for cutting down of cost and the first sector to feel an impact of this is manpower, cutting off employees has been one of the traditional ways for a company to brace themselves against rising costs, so inflation and unemployment goes hand in hand.

Not just that, even after the economy revives, businesses run smoothly and the one’s earnings will be taxed and not just the actual profit earned after deducting the inflation effect but tax will be levied on the whole amount earned.

The article “Inflation has not shown up yet, but it’s coming”, published by Forbes makes a fair point that, if prices rise 10%, and the investment goes up 13%, then the actual rise in purchasing power is only 3%. The tax will be paid on entire 13% profit, leaving a person with less purchasing power than they started with.

How to brace yourself now

Investment in indexes might prove to be a fruitful option, at any point of time there would always be top 50 companies in the nifty basket who irrespective of how the economy is, would perform well. The permutation might keep on changing but in any case, there will be rise whenever inflation hits, so analyst’s advice to buy nifty as it will earn great returns in inflation.

Gold is a never dying asset because this ship is never drowning. Invest in gold now and it will reap good returns when inflation is hit, as gold prices in August was Rs. 55400 with an inflation rate of 6.69% v/s today’s rate standing at 46165.

Also, in order to save the cost of security of the gold, one can always invest in sovereign gold bonds issued by the government wherein the bonds can be a perfect investment in gold which will be redeemable after 8 years to be held in demat form, saving up the cost to secure the asset.

Conclusion

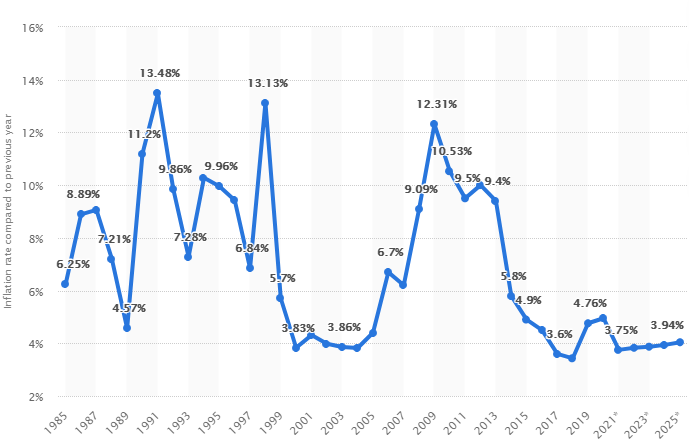

Statistics show that the rate of inflation might dip down in the coming 3-year period i.e by 2025 it can be 3.94% but all these predictions are based on historic data and sometimes economists fail to consider the current economic conditions to measure these parameters. Barring this, the lockdown has affected the spending pattern of the people and only when the activities are back to normal one can give better predictions. The consumer-price calculations state that consumption of services is lowered in comparison to goods which offsets the rising prices of goods with falling consumption of services and may lead to misleading data to calculate inflation.

To conclude, even though there are mixed views over the rise of inflation as Indian economists predict it won’t be there, the global economic changes can turn the picture so one has to wait for it and in the mean time fasten your seatbelts and keep moving.

For sources, click here

Follow Us @

Explained in very well manner. Useful Content. Thanks Ainika Jyoti.