I have always been in awe of LIC, simply because when I was living in Mumbai, I used to visit South Bombay and used to see the assets and the overall reach the company had. I strongly believe that LIC is the only company which can give a tough ‘market-cap’ competition to RIL, provided some things change and it becomes a public listed company. I have tried my best to include most of the information that will help the reader understand and get a good judgement about the business. Also, I will be talking about LIC as ‘the company’ in a lot of areas.

Insurance Industry

Insurance, as many have a notion, is not an investment product for the policyholder. Insurance is a savings product. The insurance industry is one of the most highly regulated industries that you can find in the world over. It is also one of the most important industries simply because policyholder trust insurance companies with their ‘savings’ monthly (or whatever be the case) and later if they face any calamity, health issues or the death of the policyholder, get the claim amount.

The insurance industry is one of the toughest industries to do business in. This is because of the simple fact that it is difficult to make people realize the importance of any type of insurance. Governments all over the world, have made some type of insurance compulsory which is positive for the industry like motor or health.

But and this is a big but, that the industry also suffers from a lot of risks (will be talked about later in the report), that can even make a particular insurance company insolvent!

Now some of the data, we will be talking about maybe old, like from 2018-19 because since the time we started writing this report, most of the credible sources from where the relevant data can be taken from have not published the latest numbers. Apologies for the same

To understand this industry better, we have to understand that the industry is quite influenced by the economic/macro fundamentals.

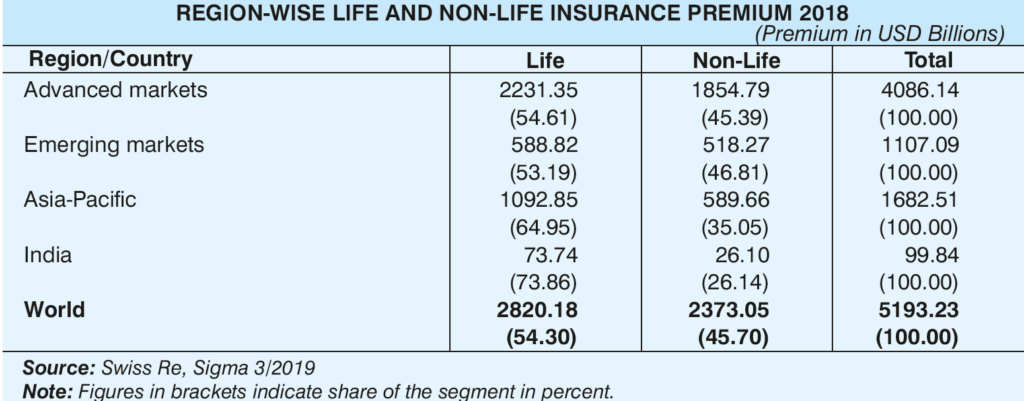

India’s share in the total global insurance market is ~1.9% according to the IRDAI 2018-19. The total insurance premium that increased y-o-y was close to 9.3%. The Indian Insurance market has been predominately dominated by life insurance due to the huge share of the company that we will be talking about soon. To give you a number, out of a total pool of 100%, life insurance has a market share of ~ 74% and the rest occupied by non-life insurance, which may include accidental, health, motor etc.

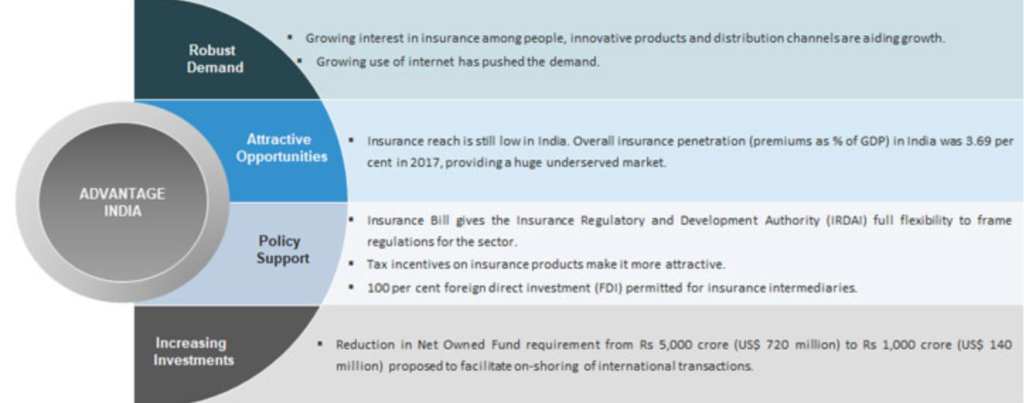

Now, the total share of insurance to GDP is ~ 4% whereas world average ~6.3% and the life insurance industry is expected to grow by 11-12%, general insurance by 18% and health insurance by 35%, according to the Union Budget 2020. The penetration of the insurance products has been quite low which leaves a big market for the innovation and clever solution to tap this huge business.

Startups are focusing to build scalable businesses in the insurance sector, models like microinsurance and insure-tech. The former is providing very specific insurance solution to a low-income customer for a definite period. This drastically brings down the cost of insurance (the premiums paid by the policyholder) which is one of the major constraints of low penetration. The latter talks about using emerging technologies like Big Data and Data Analytics to make use of customer data, to provide them with customized insurance policies. These can help in better risk management and low operating cost for the insurance providers and vis-à-vis for the policyholders.

The main impediments for these solutions to work are awareness and increased money in the hands of the common man which is one of the most difficult problems facing the almost all the life insurance and non-life insurance companies operating in India.

The above table again reiterates our finding as stated earlier. The table also tells us one important point, that there is an increased scope of non-life insurance products in India.

The correct equilibrium, if you may, points to app 50% share for both types of insurance products.

Insurance Penetration and Density in India

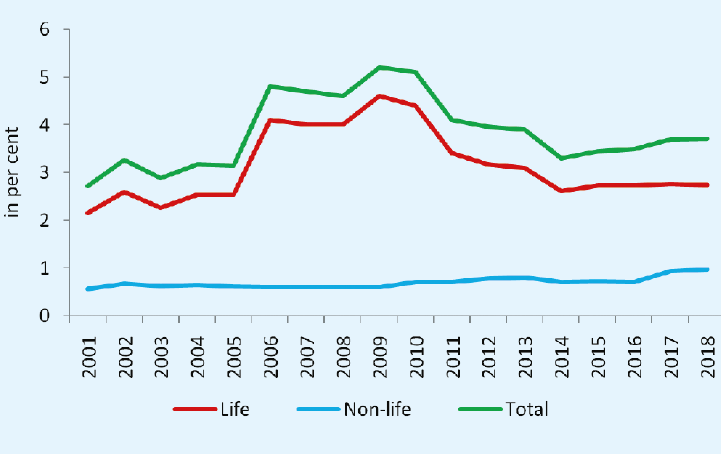

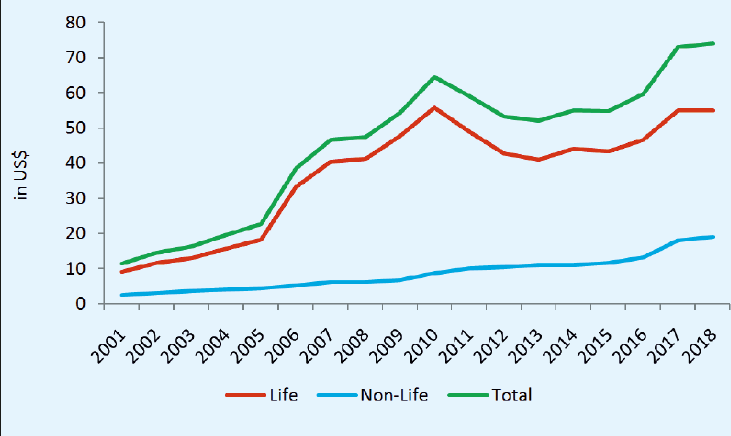

The penetration mainly points out the development degree of the insurance industry. It is measured as % of insurance premium to GDP whereas density is measured as per capita premium (on average).

Interestingly, the penetration reached ~ 5.2% in 2009 from ~ 2.7% in 2001. Since then it has been decreasing till 2015, from where it started increasing again to 2018, reaching ~ 3.7%. This can be attributed to the aftermath of the GFC as well as not so-stable Central Government, no talk to giving more income/cash in the hands of poor, no awareness etc. Since 2015, there have been some meaningful economic schemes introduced by the GoI which have directly and indirectly provided meaningful employment opportunities as well increase in GDP and per capita income growth.

Due to the current pandemic, it is expected that the share of the insurance industry will increase due to increased awareness about the importance of the insurance and general fear in the minds of the public as well as the introduction of COVID related insurance products by the companies.

Life Insurance

The density has also followed a similar trend going up from USD 9.1 in 2001 to USD 55.7 in 2009. Since then it started showing a decelerating trend till 2013. In 2018, the density is USD 55. The penetration the life insurance also showed a similar trend declining from 2009 till 2014 and in 2018 it is currently close to 3.74%

Non-Life Insurance

The penetration has gone up from 0.56% in 2001 to 0.97% in 2018. The density has also followed a similar path, rising from USD 2.4 to USD 19 in 2018.

Indian Insurance Market

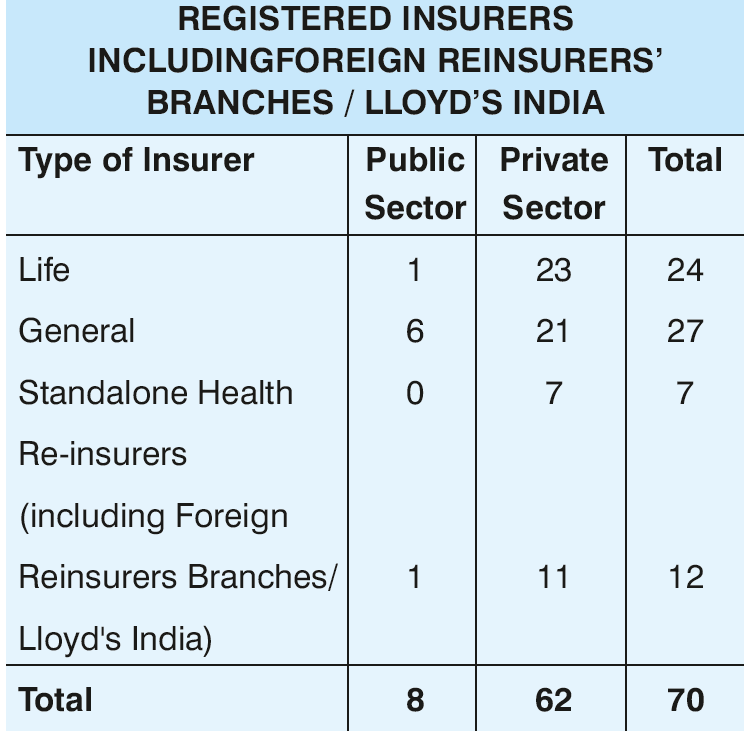

According to the IRDAI report 2018-2019, there are close to 70 insurance companies operating in India, out of which 24 are life insurers, 27 are general insurers, 7 stand-alone health insurers and 12 are re-insurers including foreign players operating in India. Out of 70, 8 are in the public sector, and remaining 62 in the private sector.

To give you a simplified glance:

Life Insurance Business

The life insurance companies mainly derive their income from two sources- premiums, which forms the bulk of the company’s revenue as well as investment income, this is primarily the income earned from the investing the premium earned in various financial instruments.

To understand the life insurance business deeply we need to look at certain factors;

- Revenue: As already stated, they earn revenue from the premium paid by policyholders over a period of time, depending on what type of insurance product it is and investment income- depends on a lot of factors like interest rates, yield environment in the markets, equity markets and how good is the capital allocation policies of the investment manager or the CIO and also the regulatory landscape of the specific country

- Factors and Assumptions: The earnings of the company depend on how prudent the company is managing its risk, actuarial assumptions, operations. The company might also face the risk of huge claim payouts. The duration risk of assets, as well as liabilities, can also be altered easily with changing interest rate environment. Companies also fix the premium of policyholders using mortality tables

- Investment Portfolio: Compared to non-life insurers, Life insurers have generally a long term ‘float’ period and hence investment returns become a key to gauge the profitability of the company. What is important, is the companies generally invest in long term government debt. One of the biggest concerns is the duration mismatch, which should be analyzed taking into consideration the investment portfolio as well as the duration of the assets.

- Debt component: Generally, as far as we have studied, the insurance business doesn’t require external long-term debt. The biggest obligation is the ‘life fund’ or in other words the long-term obligations to the policyholders, which have to be paid out later in the future which gives a long term to the company to generate returns

- Liquidity: Generally, life insurance companies are not concerned about liquidity as their obligation come due late in the future. Still, there can be possibilities of a large share of people surrendering their policies, which call for certain estimates of assets that can be converted into cash within a short period. This may decrease the return overall but at the same time, it calls is essential for the viability of the company.

- Ratios: Companies have to maintain certain capitalization and liquidity ratios to abide by regulations set up by the governments. These are important and generally related to solvency and liquidity profile of the company in question which also influences the ratings of the company

Non-Life Insurance/General Insurance Business

The most important part of the non-life insurance business is that derives most of its revenue from premium. This is because the liabilities or payouts may come due any time so the company needs to analyze its investment portfolio as well as liabilities.

Moreover, the premium is quite unstable due to the nature of the obligations. The key to profitability for a general insurance company is a good track record of underwriting skills, diversification of risk and prudent pricing risks.

Business Nature

We have to understand that insurance is a commodity business, so to gain business the companies will generally have to resort to price cuts, generally low premiums charged to policyholders.

Now, an insurance company can only succeed in this business if it has a good track record, excellent capital allocation policies, well-qualified actuaries and investment staff, as well as well reached out distribution channels that are well diversified in nature. The company also has to bring in trust that the claims will be paid out which can only come when it has a history.

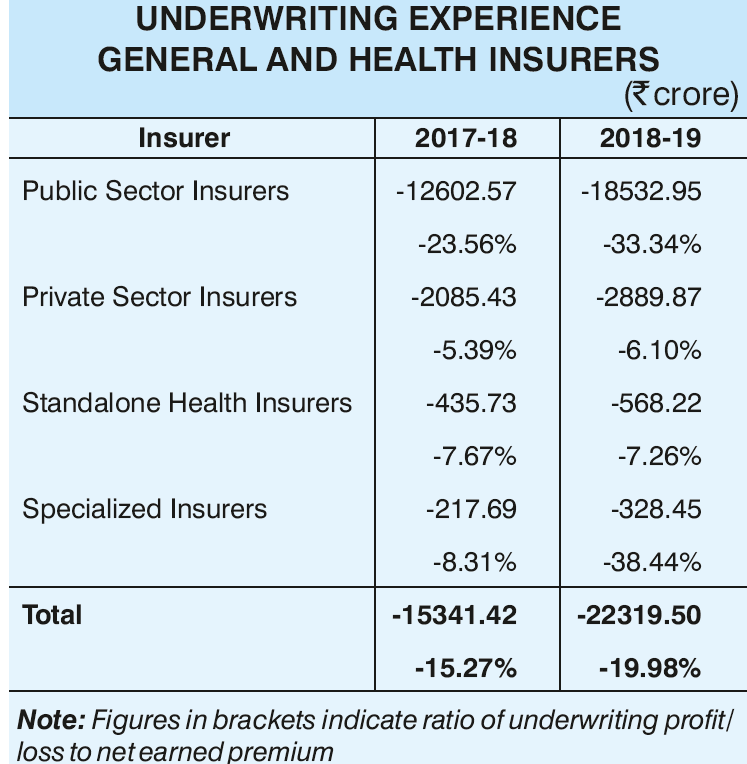

Also, to make you understand how difficult it is to attain profitability, the Indian insurance industry has suffered an underwriting loss overall

Underlying profit/loss= Premium Earned (Net)-Claim Incurred (Net)-Commission-Operating Expenses related to Insurance Business-Premium Deficiency

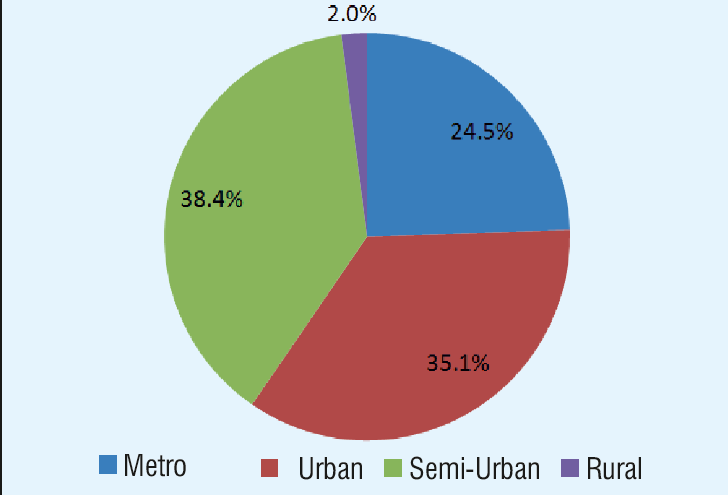

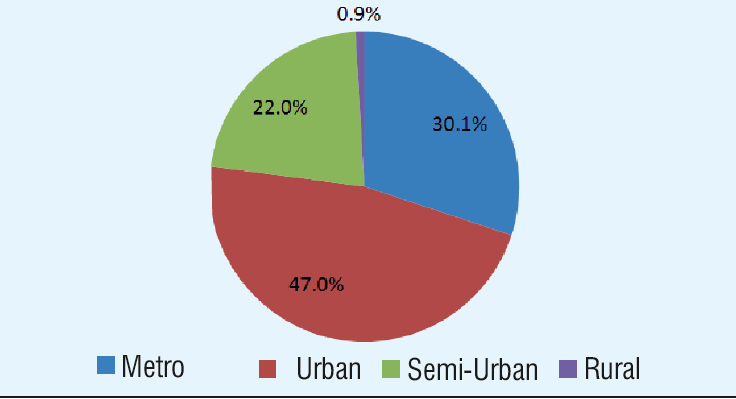

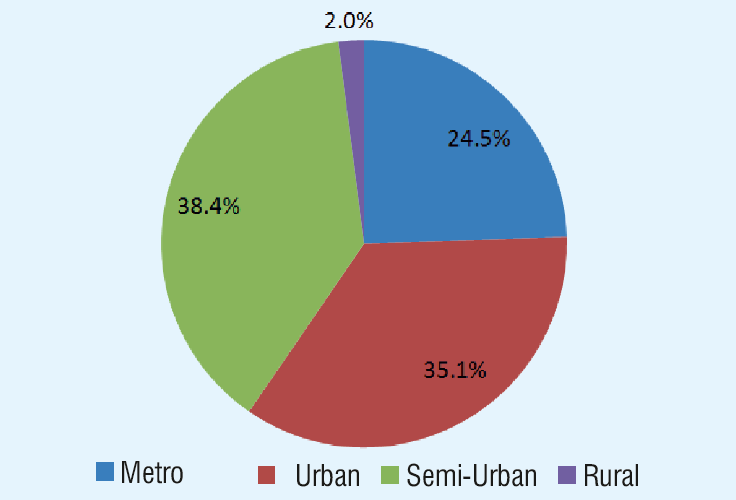

If one observes, there is a more or less equal distribution of life insurer offices with acutely low penetration in rural areas which is a big opportunity for life insurers. This equitable distribution also translates to close to 4% penetration of life insurance in India with the world average of 6.3%.

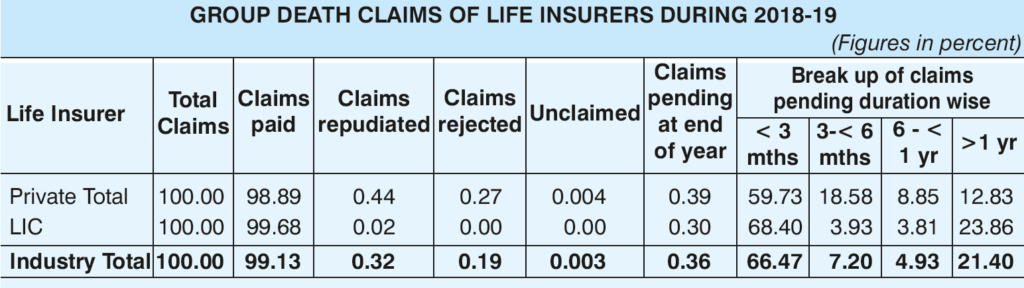

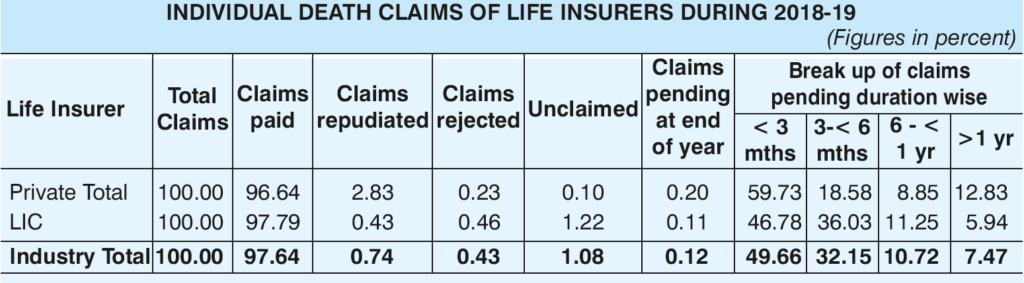

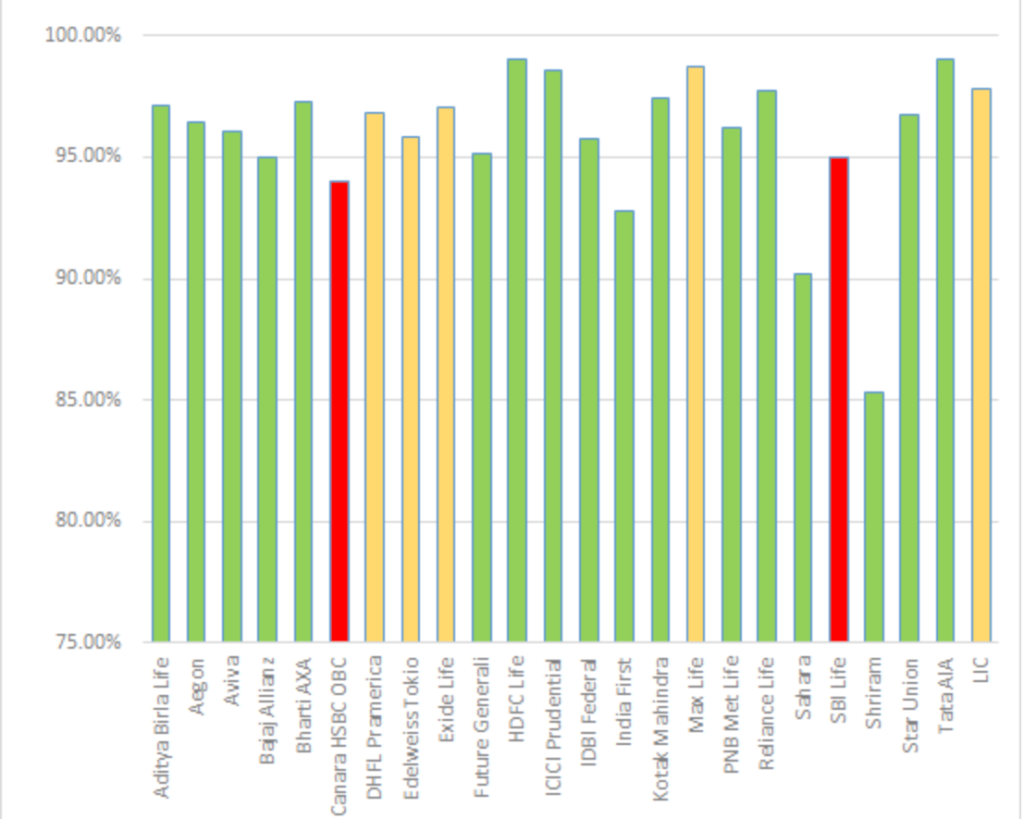

The private sector has done well in terms of claims paid % but has rejected around 0.27% of claims vs 0 for the LIC (government)

In terms of individual death claims, we see that the private sector has done better than the government in terms of claims rejected but worse in terms of claims paid.

If you look a little deeper in the above tables, you will see the short-term obligations, that have become a short term this year. These policies may have been written a long time back but are due in the above-mentioned timelines. – Just to clarify in case of any dispute or confusion

Now, to also give a basic definition:

Individual life insurance is for an individual who is to be insured by the company. The group is generally taken up by a company for its employees or a family taking- for a group of people.

The above pie diagram also clearly shows the minuscule distribution in the rural areas which again gives a big scope to private insurers. Moreover, the metro part can also be increased which generally will help in better revenue mix and stable premium payments due to relatively higher income groups present.

The most prudent way to increase your insurance business is to widen your distribution channels

Intermediaries in the Insurance Business

- Insurance Marketing Firms: They were introduced in India in 2015. They, in simple words, are a one-stop solution for the financial needs of an individual at various points in one’s life

- Surveyors and Loan Assessors: They play a very important role in the process of evaluation and settlement of claims pertaining to general insurance policies

- Insurance Brokers: They help in selling insurance products to individual, wherein they charge a commission on the insurance sold. They are having some capital requirements according to the IRDAI regulations. Brokers do-not represent one single company, so one must have to be careful as a broker in his interest might try to sell the policy which will generate the highest commission

- Web Aggregators: One of the emerging players in the insurance industry, they aggregate all the financial products from different companies and show and compare them on various parameters on their web portal

- Common Service Centers- SPV: They are established under GoI’s Digital India program. They help in the marketing of various insurance-related services of companies which agree with the CSC-SPV. It was basically incorporated to help in delivery of government, private and social services to citizen through CSC network.

- Point of Sale Persons- Life, General and Health: They are trained insurance agents who try to sell insurance related products. They can only sell individual and non-linking insurance policies.

Non-Linked plans are not dependent an underlying market instrument price. You pay a fixed premium on a fixed sum assured.

- Motor Insurance Service Provider: In simple words, they provide motor insurance. Most probably, they will be sponsored by an insurer or an insurance intermediary. They facilitate in distribution and selling of motor insurance

Now, we will be talking about the regulator of the Insurance Industry in India and some of the important regulations that govern this sector

IRDAI

Insurance Regulatory and Development Authority of India is a statutory body established under the IRDAI Act 1999 for the overall supervision as well as development of the insurance industry.

Entities that are regulated by IRDAI include life insurance companies, general insurance companies, reinsurance companies, agency channels and intermediaries.

IRDAI’s main duties as well as responsibilities:

- Supervisor of the insurance industry as a whole

- Reporting requirements of the entities

- Solvency requirements: One of the most important roles, insurers having max 150% solvency ratio

- Asset liability mismatch of the insures; stress testing and scenario analysis

- Reinsurance; Global Insurance Corporation of India is the sole national reinsurer in the country

- Corporate Governance standards in the insurers

As already spoken, this industry is one of the most regulated industries after banks. IRDAI is an independent regulator that has consistently performed these duties/responsibilities well.

Solvency Ratio is calculated as the amount of Available Solvency Margin (ASM) in relation to amount of Required Solvency Margin (RSM).

ASM- value of co. assets to liabilities

RSM- based on net premiums and defined by IRDAI

Risks

Insurance industry faces a lot of risk arising out of its operations as well as market as a whole. A catastrophe like the current pandemic, an event like 9/11 or some flood can cause huge losses for an insurance company. One has to keep a tab on such risks and look at the insurance co’s investment portfolio as a whole to gauge the diversification as well as liquidity to fulfill such obligations when the situation arises

- Liquidity Risk: The business of settling claims arising have to be paid after due diligently by the insurer. Liquidity is basically defined as the ease with which a financial instrument is converted into cash. Therefore, it is really important for a company to keep a tab on its liquid assets

- Actuarial Risk: The actuaries play an important role in calculations regarding probabilities as well as mortality tables which forms the base of the insurance business. Thus, errors arising due to these actuarial calculations can be a big blow to an insurance company

- Longevity Risk: This risk of people living long due to better healthcare facilities. This will impact the profitability of insurers providing annuity products, as annuity payments have to be paid out longer by the company but again this will be bringing in better profitability for a life insurer as the company will get a longer period to invest the premium

- Mortality Risk: The risk of people dying early, in simple words. People not living as long expected. This can arise due to situations like pandemics, wars etc. and can be a big drag on the profitability of the insurer due to less time available to invest the premiums as well as less premium payments. Again, this will be a better for an annuity insurer because there can be instances that annuity payments will not be paid out or less payments might have been paid.

More or less longevity and mortality risk offset the risk for a life and an annuity insurer. One must check the overall premium pool divided into life and annuity while checking an insurance company.

- Moral Hazard: a very important risk which is less talked about, is a psychological thing wherein the policy holder might behave differently than he/she would without taking the insurance. This will increase the claim payouts and underwriting loss for an insurance company

- Adverse Selection: The risk for an insurer being not prudent enough while choosing to insure risk. Insurance companies basically try to mitigate this risk by diversifying across geographies, age groups and demographics.This is also called underwriting risk; the insurance company’s underwriting process might be not robust enough and hence may suffer extreme losses if this is not done correct

Recent Developments in the Insurance Industry

In the year 2019, the GoI has launched the world’s largest healthcare plan called Ayushman bharat to provide medical treatment to ~ 50 crore people in India.

Two insurance schemes by the GoI Pradhan Mantri Jeevan Jyoti Bima Yojana and Pradhan Mantri Surakhsha Bima Yojana are helping in awareness as well as insuring the uninsured.

The overall insurance industry is expected to reach $280 Billion business opportunity by 2020. The life insurance industry is expected to grow by 10-15% p.a. in the next 3-5 years according to LIC’s annual report 2018-19. This is expected to increase further in late teens and early twenties thanks to the COVID situation.

Let’s talk about the some of the important points of the business that can help us understand the business better

Economies of Scale: The economies of scale is generally decreasing cost with more production. Insurance is a commodity as already stated. Doing a business on scale is generally regarded better and, in this industry, too it is considered a good strategy. An insurance companies having a large market share in terms of no of policies it insures, will help mitigate the underwriting risk, provided the management uses diversification well. Through economies of scale, you can also diversify across geographies as well as demographics.

Moreover, given the nature of the product that is being talked about here, companies can decrease their cost as well as benefit from the learning curve as they get large no of ‘instances’, that can help in the operational experience.

Switching Cost: The switching cost in dealing with the insurance company or an insurance agent. Now, the switching cost in the industry is low but prospective policyholders keep a close look on the claim settlement ratio. Higher the better. So, companies whose distribution channels are on wide scale and more robust with a better claim settlement ratio will retain as well as attract more no of policyholders.

Claim Settlement Ratio indicates % of claims an insurer has paid out during a financial year

Companies with => 95% of CSR have consistently done well in terms of customer retention as well as driving new business.

Government’s role: Government plays a really important role in the industry. The industry is mainly governed by two laws- Insurance Act 1938 and IRDAI Act 1999. Government can exercise its regulatory powers at any time which may expose the industry both favorably or unfavorably.

FDI in insurance companies is currently permitted up to 49 percent with a rider that insurance companies should be Indian owned and controlled, i.e. more than 50 percent shall be beneficially owned by resident Indian citizens and control of the insurance company shall be in the hands of resident Indian citizens.

But, 100% FDI is allowed in the insurance intermediaries which will being increased competition but at the same time, bring in global practices, learning curve with respect to new products as well as new ways of selling.

COVID-19 and aftermath

The current pandemic has affected most of the companies in almost all the countries. Same, happened with insurance companies. What started as a health crises has also spilled itself into a financial one, albeit a major one.

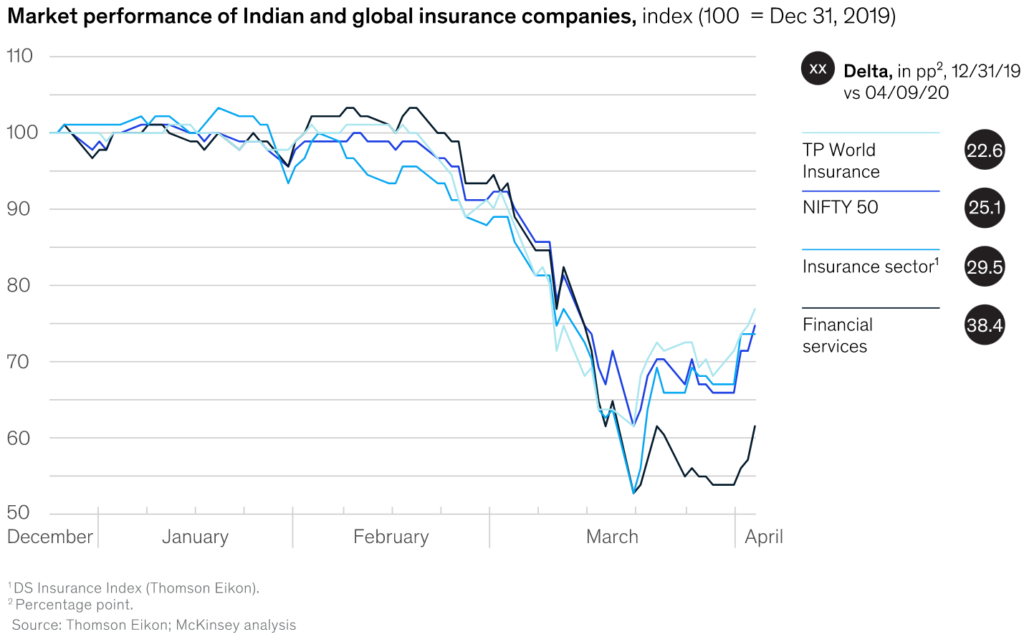

Financial industries stocks particularly both globally as well as in India have faltered

According to McKinsey’s analysis, the insurance companies have been hit hard.

According to me, this can be due to government through regulations, coaxing insurance companies to launch COVID related health care products, where currently the claim pay-outs would be obviously high. Also, the interest rates are at all time low, which drastically reduces the investment options in the bonds asset allocation of portfolio.

COVID induced market volatility and low/negative real yields will most likely affect ULIP related products because of their nature of investments in the market.

Also, the pandemic affected the motor insurance industry too with fewer motor being sold with the most of the economy being locked.

The insurance companies can wither through the pandemic by pursuing innovation in launching their products, embracing technology as well as making use of government’s digital push in bringing the distribution online as well as using web aggregators. There is also the need to diversify the portfolio as well as offerings in terms of product categories.

Focusing on LIC

History

Life Insurance was brought to India by the British in 1818, establishing the first insurance company in Calcutta (present day Kolkata, West Bengal) by the name of Oriental life Insurance Company.

All the insurance companies that were established during the time, were only used to insure the lives of Europeans and not the Indian natives. But with the efforts of Babu Muttylal Seal, the insurance companies started insuring the local lives but the Indian lives were considered sub-standard and were charged exorbitant premium rates.

Bombay Mutual Life Assurance Society was the first Indian Insurance company to be established that insured Indian lives at normal rates. Thus, started a trend; insurance companies started coming up with patriotic motives to insure Indian lives at normal rates.

Bharat Insurance Company was one such company that opened for business in 1896.

With the Swadeshi movement of 1905-1906, more insurance companies like United India in Madras, National India and National Insurance in Calcutta and the Co-operative Assurance of Lahore started coming with a nationalistic flavour.

The Life Insurance Act of 1912 was also brought in which basically stated that premium calculations and valuations need to be done by a verified actuary. The act also discriminated against Indian insurance companies, putting them at a dis-advantage against European entities.

The first two decades of the twentieth century brought in lot of insurance companies and was generally considered a boom for the insurance industry. From 44 companies with total business of ~Rs.22 crores to 176 companies with a business of Rs.298 crore in 1938.

During this period, lot of unsound business practices also were being conducted by the companies. The Insurance Act of 1938 brough both life and general insurance under its ambit. There were also talks of nationalization of the insurance industry, which gained momentum in 1944.

Life Insurance Corporation Act of 1956, was introduced in the Parliament and the Life Insurance Corporation of India was established on 1ST September 1956. The objective of the company was to spread life insurance and in particular to rural areas with a view to reach all insurance persons, providing them adequate financial cover at a reasonable cost.

Business

LIC as already spoken is a state owned insurance and an investment company. In 2006, LIC was contributing 7% to the country’s GDP. It has an investment portfolio of ~ 31 lac crores. The company was formed after merger of close to 245 insurance companies in 1956.

LIC has been the country’s most powerful monopoly and is notorious for important company/banks’ ‘last saviour’. As it is owned by the GoI, LIC due to its large life fund has invested in companies which doesn’t make a financial/business sense. It is the only insurance company in India which owns a bank. Again, reiterating my point, the bank was about to go belly up and LIC literally saved it by infusing capital. (IDBI Bank)

LIC’s main business is providing insurance products to its ~250 million policy holders and counting.

LIC provides endowment plans, whole life plans, money back plans, term assurance policies, ULIP plans, pension plans, health plans as well as riders.

Marketing Activities

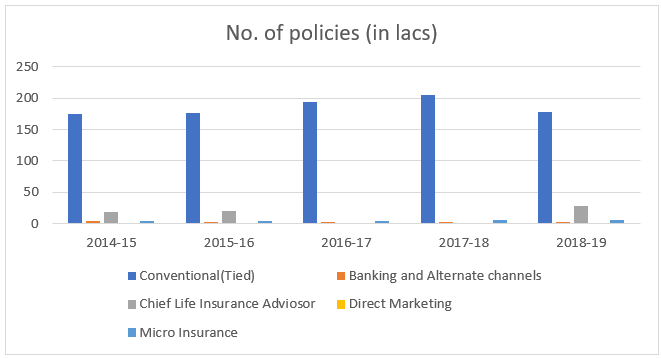

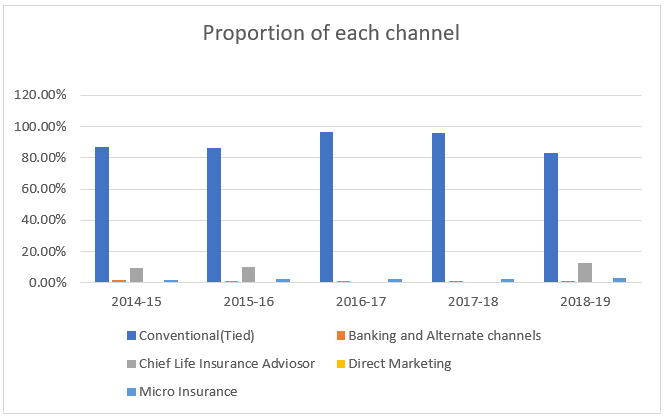

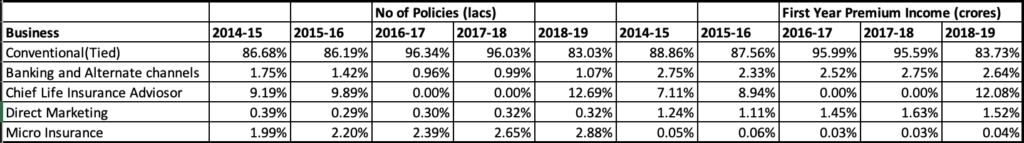

The max policies that the company sell is through the traditional route of tied up with agents. In the latest year, the conventional route has gone down. Here is a risk for the company.

LIC should work towards more diversification of its distribution channels and move toward more into digital pay model or tying up with web aggregators.

Over the years, the proportion of the conventional channel has increased but in the latest year the proportion declined from ~ 96% to ~ 83%.

As far as Bancassurance sector goes, the company has tied up with 12 public sector banks, 6 private sector banks, 18 rural regional banks, 41 cooperative banks and 1 foreign bank. The company also appointed 64 corporate agents and 83 insurance marketing firms. During FY18-19, the company added 7 new banks, 12 other corporate agents and 20 insurance marketing firms.

The conventional as expected is giving a linear return in terms of first year premium income, which shows the maturity achieved in this channel.

Bancassurance channel is delivering close to 2x premium income, and on the other hand micro insurance is quite not working for the company.

Micro insurance is important for the achievement of one of the objectives of the company of providing life insurance to most underprivileged sections of the society, which is also the objective of the Government. This is a drag for the company, in a financial sense.

The agents on the company’s roll is 11,79,229.

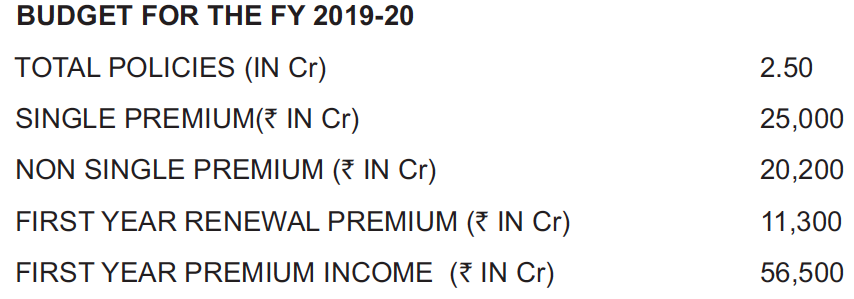

The business budget for the company for FY19-20.

Foreign Companies and JVs

LIC directly operates through branches in Mauritius (Port Luis), Fiji (Suva and Lautoka) and United Kingdom (Wembley). The company sold 14,284 policies with a premium income ~ Rs.370 crores.

LIC is one of the largest insurers both in terms of premium income as well as policies it underwrites. It has some joint ventures globally which gives it a wide reach which other insurance companies might not be able to enjoy. This is important for a company due to the underwriting risk present in the operations.

- Life Insurance Corporation (International) B.S.C. (c), Bahrain: The company provides insurance products to local population of the gulf, operating in 5 GCC countries of Bahrain, Kuwait, UAE, Qatar and Oman. It earned ~ Rs.1930 crore of premium income

- Life Insurance Corporation (Nepal) Ltd: It is a listed company on the Nepal Stock Exchange, earned ~ Rs.654 crore of premium income.

- Life Insurance Corporation (Lanka) Ltd: It is a joint venture between LIC of India and M/S Bartleet Transcapital Ltd, that earned ~ Rs.20 crore of premium income

- Kenindia Assurance Company Ltd: It is a joint venture between LIC, General Insurance Company and others established in Kenya, with ~ Rs.478 crore of net total premium income

- Saudi India Company for Co-operative Insurance: The JV between LIC, New India Assurance Company, LIC (International) B.S.C. (c), Bahrain, Kingdom of Saudi Arabia and others. It offers both life and non-life products

- Life Insurance Corporation (LIC) of Bangladesh Ltd: A JV between LIC, Strategic Equity Management Ltd and Mutual Trust Bank Ltd. The company earned ~ Rs.7 crore as premium income

Foreign Subsidiary-

- Life Insurance Corporation (Singapore) Pte Ltd: The company earned ~ Rs.68 crore as total premium income

Personal observation

Insurance is a state subject all over the world and it is tough for a company to generate sustainable underwriting standards. While growing through the annual reports, the author found some information which shows how important it is for a company to take care of its underwriting standards

LIC has a department called New Business and Reinsurance whose aim is to focus on underwriting standards within the regulatory framework.

The focus is to maintain equity by providing an accurate/fair measure of risk in selecting and pooling of risks and at the same time by charging premiums commensurate with the risk taken by the company.

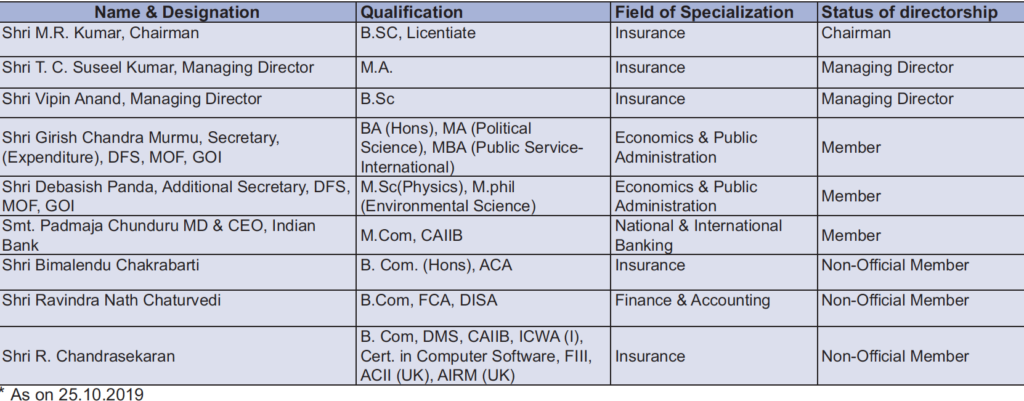

Corporate Governance

LIC as we all are aware is not a public listed company. So, we won’t be able to cover this aspect of the business comprehensively because of lack of detailed information that is required for such analysis. However, we will be delving as deep as possible.

The practice of corporate governance in LIC has been effectively governed by its owner i.e. Government of India, LIC Board as well as committees.

LIC is governed by a board with the members which are listed below

Shri M.R. Kumar is the chairman of the board of LIC. He took charge of LIC’s board since 14th March 2019 and joined LIC in 1983 as a Direct Recruit Officer. Spanning three and a half decades as the country’s biggest insurance company, he led three zones in India i.e. Southern, North Central and Northern Zones.

Some Important Points by M.R. Kumar ~ Taken from interviews (Latest first hand data as on 31st Jan 2020)

- LIC’s business is divided into two verticals- Group and Individual policies

- In a 10-month period, up till 31st Jan 2020, the company had completed 1,95,85,635 policies

- First year premium income amounting to Rs.45,199 crores

- The company has shown an impressive growth of 17.48% in individual first year premium income

- of policies, growth rate of 29.42%. In the last 14 years, this is the highest growth achieved by LIC in no. of policies

- Achieved 78.43% of policy budged in 10 months, as the budget for current year was 2.5 crore policies

- In first year premium income, the company achieved 80% of the target

- In group business, in 10-month time the company has completed 24,664 schemes under which policies of 1,84,05,292 lives

- The premium for the above amounted to ~ Rs.1,05,566 crore- first vertical to cross 1 lac crore of First Year Premium

- The individual composite NOP market share as on 31st Jan 2020, is ~ 77% (composite NOP- both types of insurance no of policies), increased from 74%

- First Year Premium income of individual business as on 31st Jan 2020, is ~ 70% from ~ 66%

- The growth of LIC has been better than all the private players put together- LIC showed 29.38% growth y-o-y, whereas competitors showed growth rate of 3.71% in terms of composite NOP. In terms of composite FYP income, LIC showed growth of 42.85% whereas competitors showed growth of ~ 20%

- LIC has 4 online products currently- 1st September 2019 online vertical launched (LIC Tech Term), 15,780 policies have been completed online- Term insurance product

- 520.66 crore of FYP income from online vertical

- 45 (for a 30-year male non-smoker) and Rs.43 (for a 30-year female non-smoker) per day premium for the tech term plan- due to better mortality seen and hence the company has passed on the benefit to people

- Health plans- 2,42,328 policies- premium amounting to Rs.78.71 crore

- Paid Rs.11,776 crore claim amount for health plans

LIC is owned by the central government. Readers should be quite comfortable with regards to the regulatory compliances as well as stringent corporate governance standards due to the relative importance of the sector and the company. Moreover, LIC is the largest financial institution investor in the country as stated before.

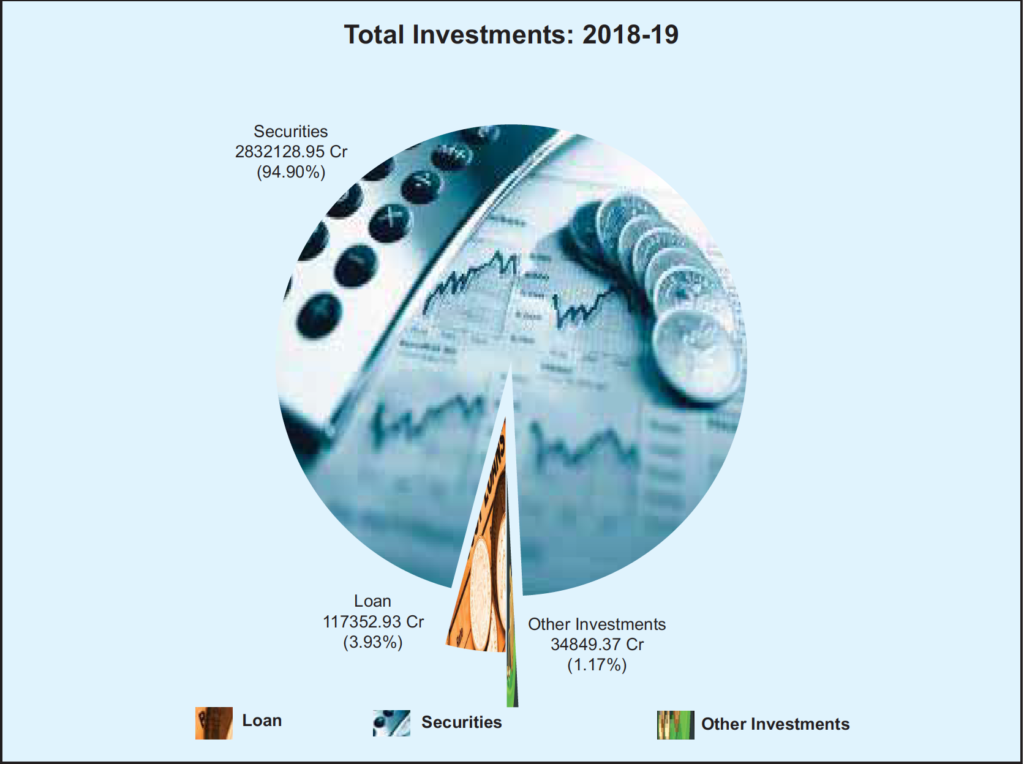

Investment Portfolio

This is the crown jewel for the company. The company’s cumulative investment portfolio is to the tune of ~ Rs.31 lac crore.

The above infographic only shows LIC’s investment in Nifty 50 stocks. The company had also invested in lot of penny stocks as well as mid and small cap stocks. The portfolio is generally seen as long term in nature due to the nature of the liabilities as well as the strategic role it plays in the companies.

LIC registered an equity gain of Rs.23,621 crore in 2019. The growth in LIC’s equity portfolio registered a growth of 8.61% y-o-y in FY19.

As a prudent institution is expected, the company has invested majority of its fund into securities, followed up by loans which include policy loans and other loans given to mutual funds and other financial institutions.

Risky Investments

LIC has always come forward to invest in short and long-term government bonds ~ Rs.18 lac crore. It also funded infrastructure projects to the tune of Rs.3.76 lac crore as on March 2018.

The company had also come forward as the savior (as stated before) and had invested close to Rs.10.7 lac crore in risky PSUs just to directly capitalize them or indirectly ‘save’ them.

One of the biggest risks, arising out of these bond as well as equity investments, is the NPA level of the portfolio. Like many PSBs, LIC is also bound to suffer from NPAs as reflected in 2018-19 level of ~ 6.15%.

Also, LIC had to trim its stake in LIC Housing Finance as well as IDBI Bank as due to the SEBI guidelines, a financial company cannot hold more than 10% stake in banks or some financial institutions according to some regulatory guidelines.

Diversified Business Activities

The company’s primary business is selling insurance but it also has some diversified business interests which the company is pursuing through its subsidiaries (substantial equity stake)

- LIC Housing Finance: The company is listed on the Indian bourses, which is one of the largest housing finance mortgage loan companies in India. LIC holds ~ 40.31% stake in the company. It has 9 regional offices, 23 back offices, 273 marketing firms and 1 customer service point. It also has representative offices in Dubai and Kuwait.

- LIC HFL Care Homes Ltd: The company was established as a wholly owned subsidiary of LIC on 11th September 2001, with a purpose to establish and operate assisted community living centers for senior citizens. The company purchases lands and build centers, with projects in Bangalore, Bhubaneshwar, Jaipur, Aluva. The company earned PBT ~ Rs.86 lac and PAT ~ Rs.63 lac

- LIC Mutual Fund Asset Management Company Ltd: The company manages 25 schemes and has AUM to the tune of Rs.4,58,666 crores. The shareholders are LIC, LIC Housing Finance, GIC Housing Finance and Corporation Bank. It ranks 18 in terms of Average Assets Under Management (AAUM). The AUM of the company for the last quarter of 2018-19 for the company was Rs.15,240 crores. One of the unique products that are offered by LIC MF only was AAPS (Auto Premium Payment System) wherein investors can invest in liquid or short-term schemes and their LIC premium is paid from the MF account.

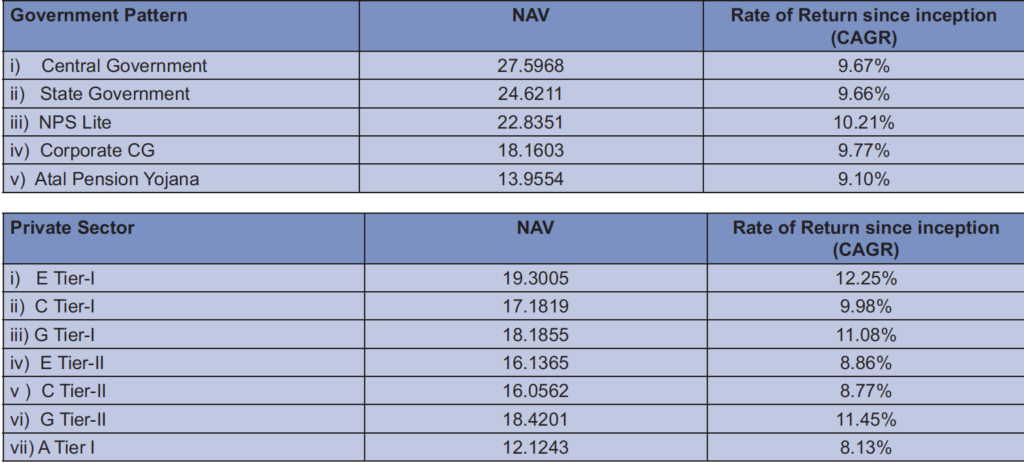

- LIC Pension Fund Ltd: This has been promoted by LIC for a specific purpose of managing pension funds under NPS regulated by Pension Fund Regulatory and Development Authority (PFRDA). LIC Pension Fund Ltd is a pension fund management company, managing schemes both for the government as well as private sector. The Assets under management of the company is ~ Rs.97,000 crore as on 31st March 2019, with close to Rs.91,000 crore under government schemes and ~ Rs.6,000 crore under private schemes.

Due to increased awareness about the NPS by the government and allowing government employees of choosing fund managers as well as investment patterns will drive the competition in the industry.

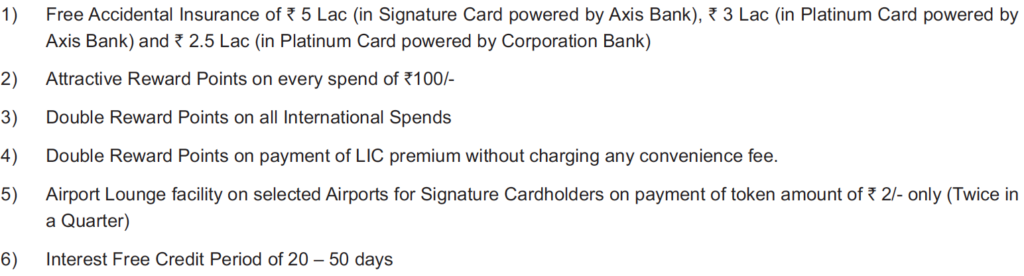

5. LIC Cards Services Ltd: The company was incorporated on 11th November 2008, with a basic purpose of selling credit card services to LIC employees, club member agents and policy holders. The company has tie ups with Axis bank and Corporation bank.

Some competitive features:

The company’s total card portfolio also increased to 2,55,271 from 2,06,681 in 2018-19. The company issued 48,590 cards in 2018-19 highest ever in a single year since inception. The company in 2018-19 achieved an overall growth of 123.06% and a net profit growth of 130.35%.

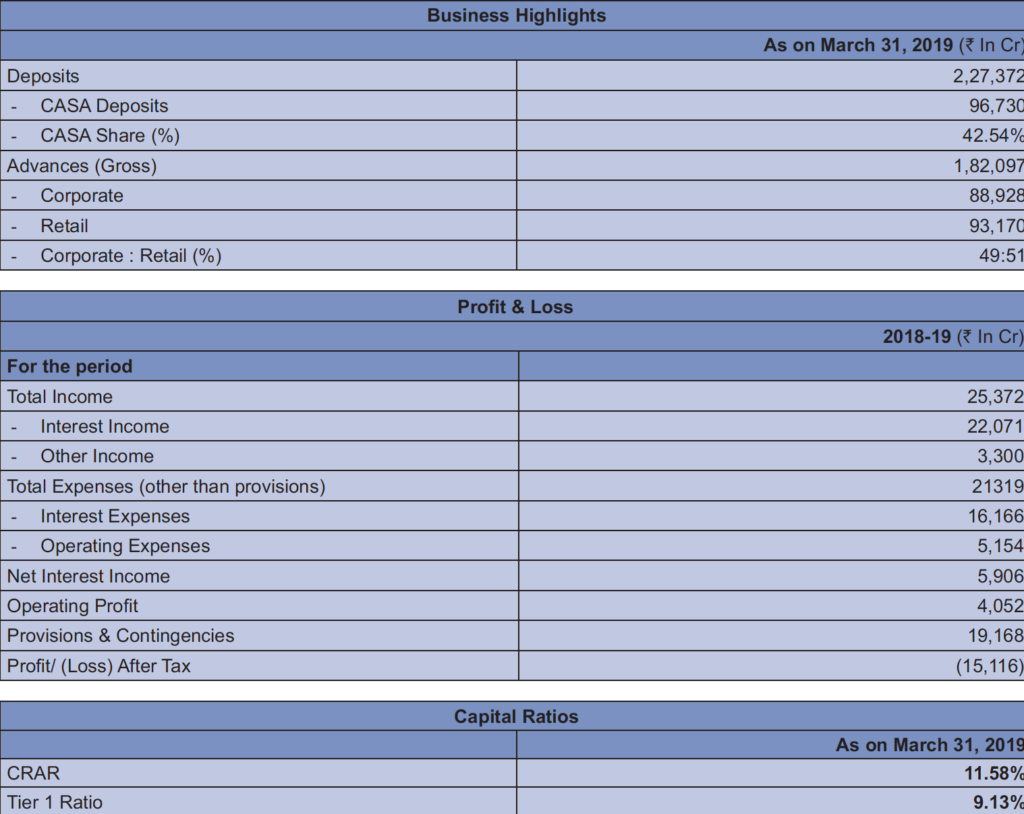

6. IDBI Bank: As the name suggest, LIC is the only company holding majority stake in a bank. This was a risky investment the company did to effectively ‘save’ the bank.

The bank provides financial services to both corporate as well as retail clients. The bank provides retail banking products as well as financial assistance to MSME as well as Agri clients. The bank issues debit as well as credit cards.

The bank also has some joint venture and subsidiaries, like IDBI Capital Markets & Securities Ltd- a broking and distribution company, IDBI Intech Limited- an IT company, IDBI Asset Management- the investment manager of schemes launched by IDBI mutual funds, IDBI MF Trustee Company Ltd- trustee of IDBI MF, the company also has life insurance JVs with Federal Bank and Ageas Insurance International.

As on 31st March 2019, the balance sheet size is Rs.3,20,284 crore and has a total business of Rs.37,416.2 crore

Financials

We will be talking about some basic numbers and move towards some important metrics.

INDIVIDUAL BUSINESS

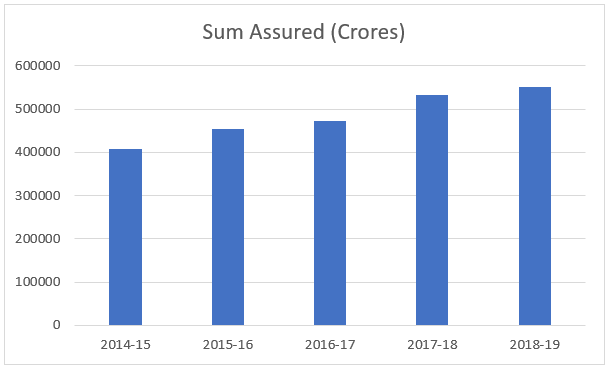

Sum Assured- In simple words, the total amount of which an insurance is taken by a policy holder. We will be looking at the growth of the sum assured under life assurance policy as it forms the bulk or in other words, the main business, and over a 5-year time period.

The sum assured has shown a growth rate of ~ 6% CAGR over a 5-year time period. This should not be read in too much, due to a simple fact as it doesn’t reflect much in terms of the operations, but for a fact that the absolute amounts are humongous and although, the large size the company has been consistently out performing its competitors.

No of Policies

Assurances:

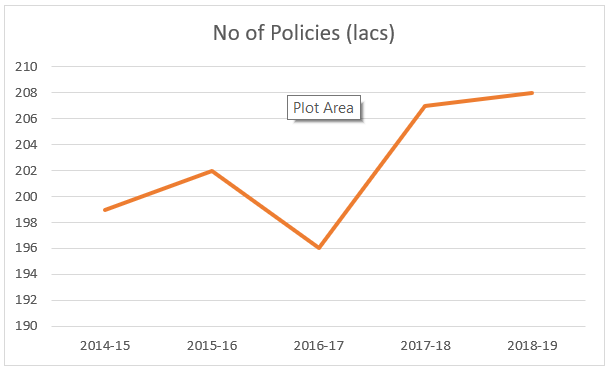

The company has reached a coveted status of selling 2 crore policies in a single year. In 2018-19 it achieved 2.07 crore policies. In 2019-20, the target as written before was 2.5 crore, and ~ 80% of the target was achieved in 10 months. The company has shown a growth rate of ~ 0.8% CAGR.

However, this is a mature business and moreover, being a government run entity the company sets budgets but historically has been falling short of the same.

Annuities:

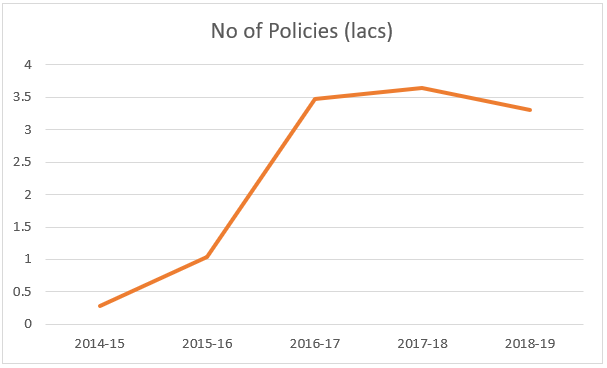

The reader can observe a steep growth of the annuity policies that were sold by the company. This is a growing area that we believe can be a new frontier for the company. Moreover, due to increasing life expectancy and awareness of the annuity product, the company is expected to do well in this business.

The growth rate that the company has achieved is impressive ~ 63% CAGR. Now, the business has fared some down years but if we take a 5-year time horizon the growth looks incredible.

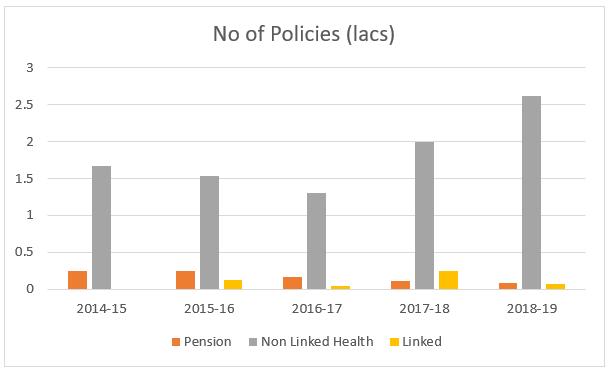

Other Business:

These businesses mentioned above form a very meagre portion of the business. The growth rates of these businesses have been in high single digits but to impact the cash flows and the earnings, these businesses have to substantially grow.

These businesses are attractive though, no doubt, and better placed than the competitors even though they must be ahead. This is simply because of the deep distribution of the existing network as well as trust factor which plays the dominant role.

However, the big question is that whether the company will focus on these emerging businesses or focus on its legacy business of life assurance.

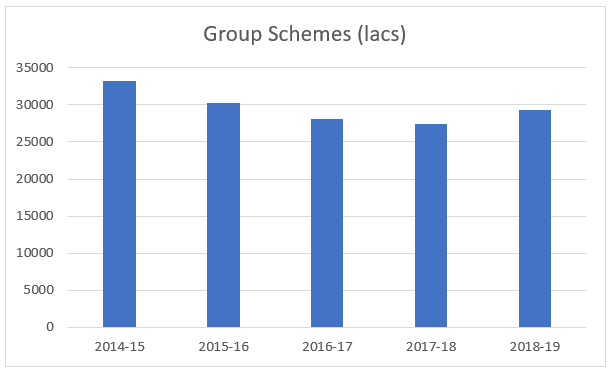

GROUP BUSINESS

The Group Schemes here cover three type of policies namely the group insurance, social security group schemes and group superannuation. We have combined it for easy interpretation, but the majority of the business is formed by Group Insurance, followed up by Group Superannuation and social security group schemes.

The last insurance type, the company runs under different schemes launched by the Government. Some are compulsory schemes, but we believe that running these schemes doesn’t affect the bottom line that much. Moreover, we are also not that concerned about these simply because it doesn’t hold that much ‘value’ to the company as a whole.

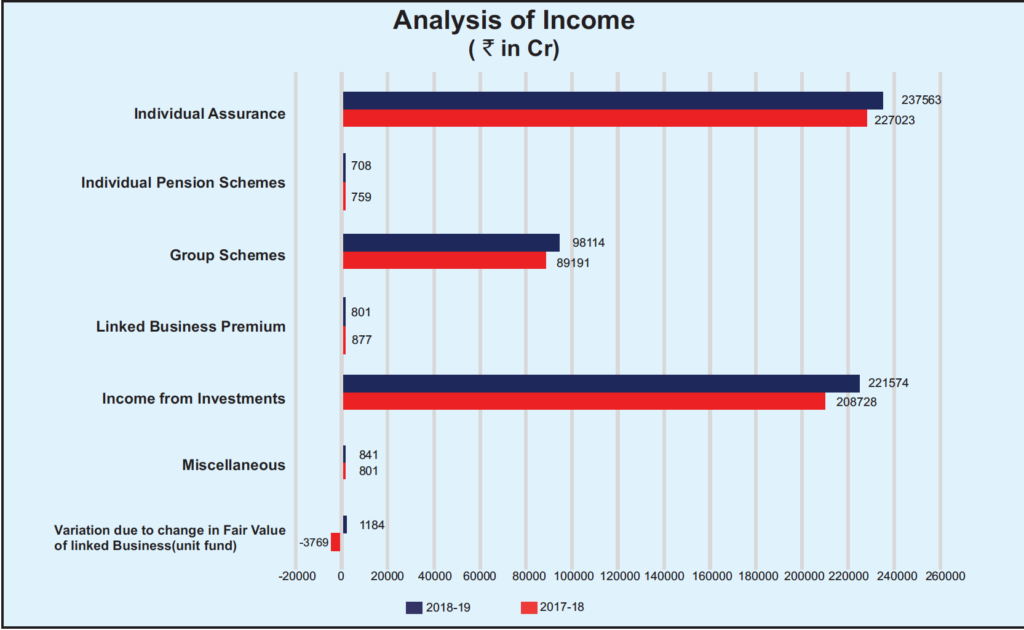

Analysis of the Income

The company generates its bottom line proportionately via different businesses. In the latest available report, we find (also over the years) that the majority of the premium income that the company generates has been through the Individual Insurance business.

Individual Insurance business in terms of premium income is followed by Income from Investments. This is due to the nature of the business the company is in. Life Insurance as discussed before, has a long gestation period (if you will) and the company can earn on its ‘float’. If one observes deeply, though it is not 100% correct to compare, but the company earned ~ Rs.2.4 lac crore as premium income and earned ~ Rs.2.2 lac crore. The company has virtually ‘earned’ 100% on its premium.

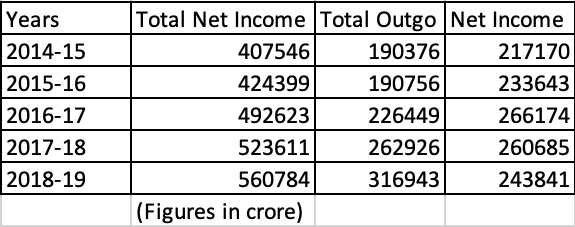

Better analysis will be to compare this net total income with the total payments the company makes in a year.

This total outgo consists of all the claim payouts, management fees as well as the employee expenses.

This outgo also consistent of a dividend that has to be given to the government. This is 5% of the valuation surplus that is payable every year to the government. This is an important mind because if LIC is divested and new strategic, financial or retail customers are brought in then this “5%” dividend amount will have to be increased and the balance have to be maintained between non-government and government investors, with increased focus on better quality earnings as well as better corporate governance standards. As well as increased focus on earnings rather than public welfare.

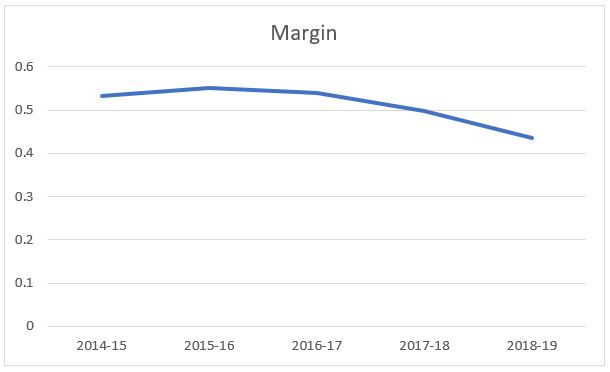

Margins

This is a troubling point for the company as the net margin has been consistently falling which shows the efficiency on the total company level is decreasing. This is simply because the surplus (net profit) has been affected by increased claim payouts as well as increase in salary as well as benefits to employees.

In the overall expense ratio, the ratio of employee expenses as well as other expenses payable to management has increased, with the latter being volatile in nature.

However, again one has to keep the point in mind that 85-90% of the business of LIC is into life insurance which is showing signs of maturity. The claims have risen with increase in expenses but the growth of premium income hasn’t kept pace.

The company has nil debt on its balance sheet.

The company’s solvency margin has also been consistently >1, which shows basically the ability of the insurer to meets its obligations.

Numbers Talk

We also looked at the company’s balance sheet and checked some numbers with which will give us more clarity with regards to some aspects.

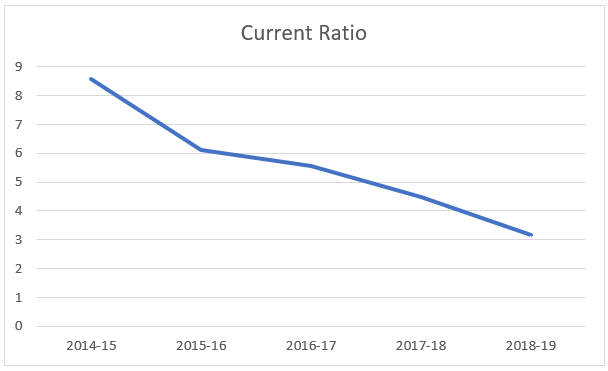

1. Liquidity

We will check the current ratio of the company and see how the company has performed over the years.

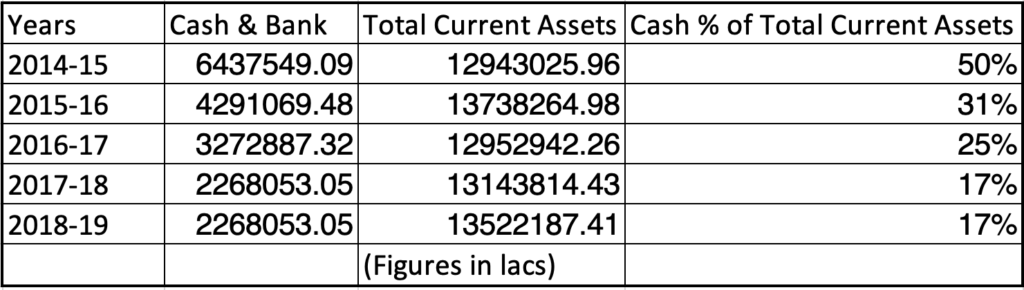

This is a cause of concern for the business as the current ratio has been declining over the years. The company still has a strong current ratio of ~ 3 times, which though declined from over 8+ times.

This is a cause if worry for the investors as well as the company, as the cash proportion in % of total current assets. The proportion of money at call and short notice seems to be rising, which is also quite liquid. So, one should not read too much in the above table.

2. Fixed Assets

This is an indirect surprising element of the company’s operations. Fixed assets include land and buildings which we believe has not been properly accounted for. As these are on the books on gross cost less depreciation, we believe they have been undervalued, and not been properly accounted for.

Valuation

The company generates strong profits. Also, the company is into insurance business so there isn’t any substantial ‘receivables’ or much of non-cash components. We will be using a simple discounted income valuation method and getting an approximate value of the whole business.

We will be assuming a growth rate of 2% and also a discount rate of 30%. The discount rate has been taken by considering 10-year Government Bonds and an appropriate risk premium, as this is owned by Government so we have considered the risk of ‘bureaucratic’ management, focus on legacy business and not focusing on earnings. These are truly conservative measures, better say pessimistic estimates.

The valuation comes out to be ~ Rs.15,13,157 crores, by taking +/- 15% band. Here, we haven’t included any premium commonly associated with such high-quality companies.

Conclusion

Though, not the most beneficial products in the market, still with a ~ 98% claim payout ratio, the company has been able to achieve the trust among policy holders. This is the ONLY factor people buy LIC insurance cover. LIC has become a synonym of insurance in India as Google has become synonym of Search globally.

Future, truly holds good for LIC due to increased awareness, disposable income as well as increasing aspirations of the young India. If the government include LIC, its most prized possession, in its dis-investment target of 2020-21, it has the possibility of becoming the biggest IPO of the history of India’s capital markets.

The company should focus more in digital services as well as annuity products which are both growing sub areas in the larger scheme of things.

~ One important note here: LIC has not compared with any particular competitors in India as it is incomparable franchise in terms of scale and dominance. Until and unless, the company becomes a public listed enterprise, we don’t believe it is justifiable to do any sort of any comparison. Industry wide comparison has been done where ever deemed fit.

Disclaimer:

The author has written this report for educational purposes and not to be taken as any form of investment advice. Also, the information and data used, is best to the knowledge of the author. Author as well as the website is not responsible in any way.

For Sources, click here

Follow Us @

Sources:

https://investeek.com/lic-portfolio-in-indian-stock-markets/

https://www.licindia.in/Top-Links/About-Us/Operations

https://www.affluentcpa.com/common-risks-faced-insurance-companies/

Risk Management and Financial Institutions by John C Hull- Book

CFA L-2 Equity and FRA and Corporate Finance – Books

https://www.mckinsey.com/industries/financial-services/our-insights/how-indian-insurance-companies-can-respond-to-coronavirus#

http://liclanka.com/index.php/10-board-of-directors/30-shri-m-r-kumar-chairman-lic-of-india