We all remember how we enjoyed the practical lectures of Science on Electric current in our secondary school. A curriculum that explained the effectiveness of Alternate Current in our lives. A current power that could be generated and transformed anywhere back and forth from its source. Simply understandable, Alternative current is present today everywhere and on every electrical gadget (from mobile phones to running large-scale machineries in a factory) so, why not on Vehicles?

Hold on! I know what are you thinking? or about which company? brought this imagination into reality.

Tesla Motors, the name was inspired by great Siberian- American Inventor Nikola Tesla for his phenomenal contributions to the designing of an Alternate Current Electricity system. The company was incorporated by two electrical engineers Martin Eberhard and Marc Tarpenning on 1st of July 2003. Their vision was aspired by the General Motors EV1 experiment that was later shut down with a conclusion of being unprofitable! Anyway, the reports of its built model were proven successful from engineering standpoint. The partners desired to manufacture Cars that were Tech-based. Wait a minute, what? A car attributing digital features? Well, Yes! They planned it, so could build it.

The story of Tesla Motors is exhilarating. The tech- partners had a plan, vision, passion but lacked like most startups – “FUNDS”. So, they started hunting for people who could invest in the company through PRIVATE FINANCING. Among were Compass Technology Partners, Valor Equity Partners, Google co-founders Sergey Brin and Larry page but the highest infused funds was from PayPal co-founder Elon Musk (now the CEO). After gathering a total of $100.5 million between 2004-2006 the company embarked on a journey of evolution in auto- sector.

But, Why Electronic Cars?

Whether is it Porsche, Bentley, Jaguar, or Tata Nano these all are fitted in with an internal combustion engine. An ICE is a heat engine generated by the chemical energy of fuel and air. As per JATO H1 2019, internal combustion engines accounted for global car sales of 90%. The USA and China are the top two markets that use gasoline cars. In the USA, the reasons were clear – An increasing demand for SUVs (a vehicle that allows an occupant feeling of an off-road due to its higher ride height). To run an SUV requires an excessive consumption of gasoline fuels because of its heavyweight and faster acceleration. On the other hand, the charges in the USA for gasoline is quite cheap (average $0.66 per liter). Since the SUVs consume too much fuel, contribute most in releasing carbon emissions. Whereas, in China, during 2010 diesel fuel accounted for nearly 34% of its total oil consumption. To keep it under control, national policies were imposed on diesel but this led to the reciprocation of increased demand for gasoline. Gasoline usage accounted for nearly 24% by end of 2017.

According to the U.S. Energy Information Administration, more than 5 billion metric tons of carbon emissions were released in 2007. Increasing carbon emissions have a hazardous effect on the ecosystem.

Furthermore, the reliability and maintenance charges of gasoline cars are quite high.

Read the chart below for better understanding

|

Gasoline cars |

Electric vehicles |

||

|

Type |

luxurious SUVs |

Type |

Model 3 |

|

Gasoline Tank |

28 gallons |

Wall charge watt (installed) |

75 kWh |

|

Cost per gallon |

$3.20 |

Cost Kw per hour |

$ 0.130 |

|

Miles per gallon |

An average of 27 |

Units cost (fully charge) |

$9.75 |

|

Cost to run 300 miles (enough for a week) |

$35.5 |

Cost to run 300 miles (enough for a week) |

$9.75 |

|

Monthly cost |

$142 |

Monthly cost |

$39 |

|

Yearly cost |

$1704 |

Yearly Billing cost |

$468 |

|

Battery life (average) |

4 years |

Battery life lasting 500000 miles(waranteed) |

8 years |

|

Maintenance charges of 5 years (approx.) |

$6000 |

Maintenance charges of 5 years |

$1490 |

Source: motor1.com,thebalance.com

All these signs were pretty discernible to the Tech partners of Tesla that Electrical cars would be a game-changer. As, it effectively produced zero – emission also the inserted lithium-ion cell batteries that would accelerate in less than 4 seconds, saving time to travel.

So that raises a question, How did the company break a #glassceiling of limitations?

Let’s find out!

The company launched its first model prototype Roadster in 2006. Their design was specifically based on to attract rich people as they believed the real market mass is not volume weightage but valued – weightage. They kick off the production of Roadster in 2008 by investing $25 million and started generating revenue. The bookings were done either in person or through telephone. The boost sales led to their 2007 revenue of $73,000 to $111,943 million by 2009.

Source – Tesla 10-k 2012

The global financial crisis of 2008 hit the company hard too. It was a phase of walking dead for them. Despite, cutting down their staff by 24% they still could not cope-up with overrun expenses. Being unaware of the global crisis, the company strived to raise funds of $100 million for their next Model S. They realized it sooner the chances of surviving in this environment were less than 10%. There were Elon Musk came as a savior to the company and infused $35 million more funds from his fortune to resume the delayed production and raised $187 million by selling 147 Roadster cars. The good news came running to them when the Federal government approved an Advanced Technology Vehicle Manufacturing Program in 2008, administered by the Department of Energy (DOE). Tesla Motors was able to fetch an overall $465 million low-interest federal loans (debt financing ratio of 65%) of which $365 million was invested in building Model S sedans and $100 million in constructing a powertrain manufacturing plant in Fermont, California(secured).

Further, in May 2009 Tesla sold less than 10% equity sale to Germany’s Daimler AG, maker of Mercedes-Benz(another automotive manufacturer) for $50 million by agreeing to sell its own designed electric power train components and sales of battery packs and chargers to Daimler AG for its Smart Fortwo and A-class electric vehicles in at least five European cities.

They also entrusted Toyota Motor Corporation to produce an effective powertrain system for use in its RAV4 EV.

Well, that was a temporary work out a way to avoid Bankruptcy but losses due to the Roadster model’s unreliability was a huge debacle for the company. The company faced complaints of occupants losing driver control in the car and causing collisions because of rear not properly fitted resulting in a lower twisting force in the engine. It recalled nearly 784 cars between 2009 – 2010 and eventually halted its production completely by 2012. Thereafter, for better inventory management of the Roadster model, Company came up with an alternative idea of bringing it back on the roads by leasing it for 36 months to qualifying customers and an option to purchase it after on a pre- determining residual value

A ladder of Exponential Growth?

The company launched its IPO on NASDAQ on 29th June 2010. They raised a total of $226 million (closing price of $23.89). Well the honeymoon, did not last any longer. The stock price fell to $17 (offered price) in the next five trading days because of the quarterly results updated in July. The company reported losses of $31 million over the sales of $28 million in the 2nd quarter of 2010 which tumbled the stock price up to $4 per share over the months. The exit of venture capitalists, private equity funds also affected cash flow operations in the company. Booking losses subsequently for 10 years, Tesla reached the profitability levels in the first quarter of 2013. The company claim stabilized manufacturing process, Low expenditure in Research and development, and production efficiency (up to 80%) generated a profit of $11 million. The company revenues took a fly after the success of the Model S sedan in North America.

From 2013 to 2016, the company bought SolarCity Corporation as its subsidiary, built a factory in Lathrop (manufacturing), acquired Grohmann Engineering(German based organization specialized in automotive and bio tech), and opened its sales operation services in Beijing, China. After, the introduction of Ludricous Mode (accelerates vehicle 10% faster) in Model S sedan, they sold nearly 107000 units across the world. They also started the sale of energy storage products to residential consumers.

The company’s cumulative Equity return of 5 years touched $1100.

An intend to start Model X production and launch of Prototype Model 3 rallied its stock price from its rock bottom to return of 800% (i.e $5.774 to $45.99) in just 3 years. Hence, their market mass began to mature and consumer base bigger and wider.

Tesla all on- running Models

*Awd – is a It is an All – Wheel Drive car that has two – ultra responsive, independent electronic motors which digitally control torque to the front and rear – wheels for better handling, traction (prevention of wheel spinning) and stabilisation.

Models | Launch date | Specifications | Sale units( USA) |

Model S | June 22nd 2012 (Price – $80000) | Fully electric five door hatchback sedan with EPA of 402 miles | 158000 |

Model X | September 2016 (Price – starts from $79900) | Seven seater SUV with EPA of 371 miles | 18240 |

Model 3 | 28th July 2017 (Price – starts from $39990) | 4 seats, AWD dual motor* with EPA of 353 miles | 300000 |

Model Y | Still to be launched (price – starting from $39000) | Compact crossover utility vehicle, AWD dual motor with EPA of 326 miles. | – |

Tesla in a span of 15 years became a 18% market share holder in global EV Sales.

Hypothetically, imagine you invested $100,000 in Tesla’s stock by the year end 2016. Today, you would have fetched a total return of $1.2 million in span of 4 years.

The question is simple here?

Is it really worthy? or an over-appraisal?

What’s clearer than a mirror? Financial statements of a company!

Sales revenue is the pioneer of any company’s operations. The sales growth of a company has always been on the brighter side since 2013.However, it slackens in 2019 with a growth sales percentage of 14.52% than the previous year of 82.51%. It was due to a switch in consumer preferences.

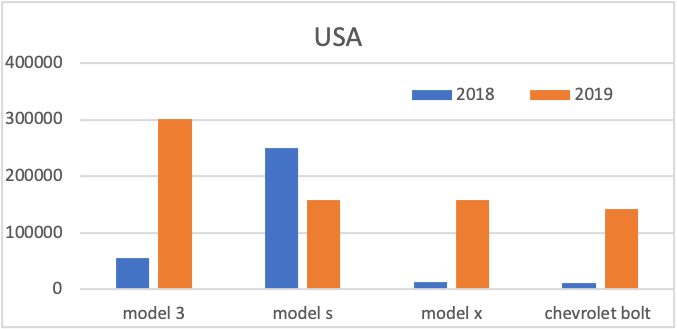

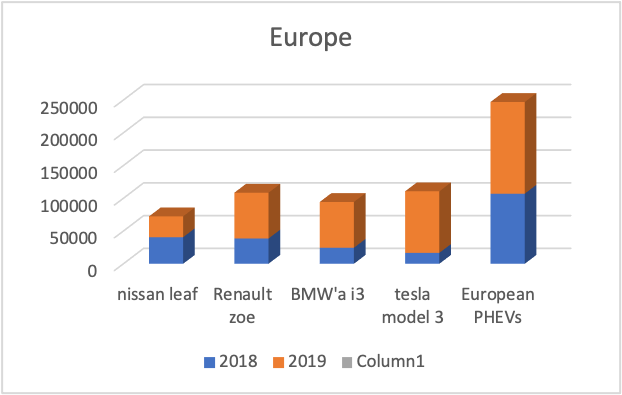

Look at the charts of other manufacturers EVs who fractured the sale numbers of Tesla, where plug- in Ev sales are highest:

- USA – Top selling EVs

2. Europe – Top selling Evs

Year 2018 (sale in units) | Year 2019 | ||

Nissan Leaf | 40609 | PHEVs | 140000 |

Renault’s Zoe | 38538 | Tesla model 3 | 94000 |

Bmw’s i3 | 24432 | Bmw’s i3 | 70000 |

Tesla model S | 16682 | Renault zoe | 39400 |

Tags : https://www.ev-volumes.com/

Is the vision of $25k car attainable?

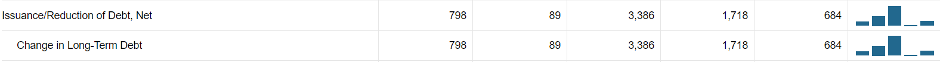

On 22nd September 2020, Elon Musk said a $25000 car with the next generation battery is in the works. It is being expected to “halve” the prices of $100 kwH. Elon Musk has suffered in the past for his over-promising tweets. as of 2019, the cost of fitting a lithium-ion- cell battery is $156 kwH. His failure to achieve the most affordable car Model 3 a price hit of $35000 was due to the company’s unavoidable production costs. Tesla’s Market capitalization as of 2019 was $75.72 billion. To fund the expansion of its cars and batteries, the company issued a debt of more than $5000 millions. Despite the positive cash flow situation, it may face a turmoil situation in the foreseeable future because it solely uses to off- run past debts. Rather than, touching masses over the world. A company needs to focus on generating more revenues. Simply understanding, the company could not even cover the interest rates from its day to day operations.

Tags : finance.yahoo.com

Interest coverage ratio (excluding Depreciation)

Years | 2019 | 2018 | 2017 |

Interest Expense | 685000 | 663071 | 471259 |

Net income before tax | 80000 | (252000) | (1632086) |

Coverage ratio | 0.116 | (0.380) | (3.46) |

Exchange Risk. Tesla also undertakes a risk of solely dependent on one Supplier. They have even reported in their filing, any consequences in supply materials would result in “production hell” and immense losses. An appreciation in Japanese Yen in 2016 caused Tesla to bought batteries and components at a higher cost (from Panasonic). To mitigate this, the company started investing in swaps to hedge its currency exposure focusing mainly in Asia –Pacific Territories.

Remarks

The company’s vision of building a $25k car might be hampered by its rising loans, aggrandizing revenue sales, competitive rivalry, supplier risk, territory limitation, and not the least – overvalued stock price(P/E – 1227). A company needs to ameliorate its risk and return factors and not just focal the point on manufacturing affordable cars.

Follow Us @

Good article that focuses on Risk as well as reward aspects of 🚗🔌🔋

Great Article. After reading this many people will come to know lot of new things about world favorite company TESLA. Thank you for sharing