Mellon Bank- Where the idea took shape:

Mellon Bank, was the 15th-largest bank in the USA by the early 1980s, with a rich history. It posted its first quarterly loss ever in the first quarter of 1987, mainly due to its overexposure in the international markets. The bank reported a $65 million loss, made a $175 million provision for future loan losses, and cut its dividend to shareholders in half. The future of the bank looked bleak at that time. Frank V. Cahouet was brought in as the new CEO to captain the already sinking ship.

Frank Cahouet, who had prior experience turning around a distressed bank, quickly realized that stabilization and cost reduction strategies were not enough for the Mellon bank. They had to find a way to recapitalize the bank and strengthen its balance sheet. However, the problem with Mellon Bank was that before the bank could raise capital, its balance sheet needed a cleanup, which contained a mix of good assets and bad (risky) assets. The existence of these bad assets in the balance sheet hurt the bank’s ability to raise capital and carry out its normal banking activities of borrowing and lending. To fund its turnaround strategy, the bank had to segregate its bad assets from good assets.

Understanding Bad Banks:

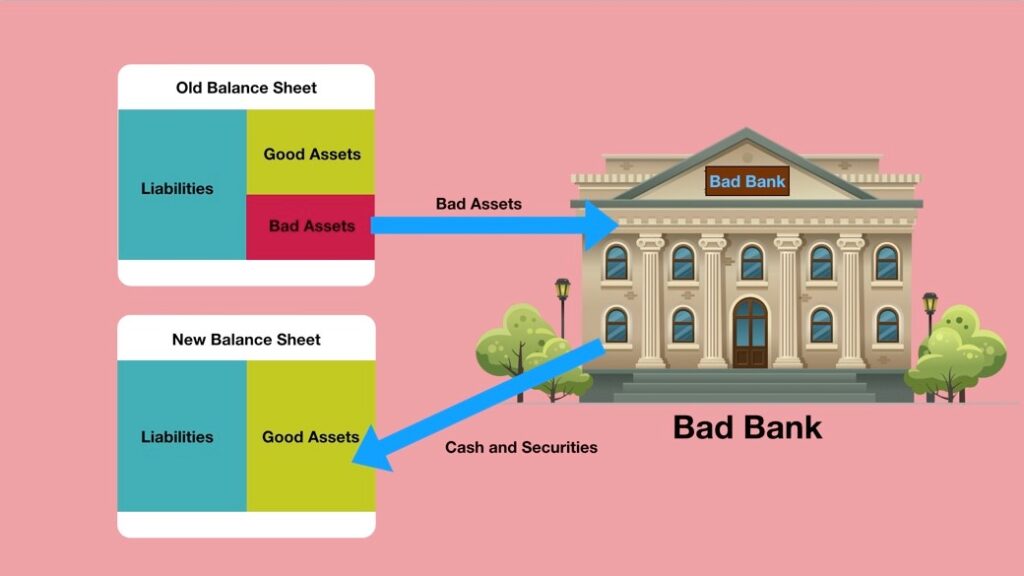

A bad bank is an entity set up to acquire, hold and liquidate Non-performing Assets (NPAs) and other bad assets which a bank or a financial institution previously had. This allows the bank to segregate its good assets and bad assets and dump all of its bad assets into this separate entity, thus cleaning up its balance sheet. The investments are typically sold to the bad bank at market values or, in the case of operations assisted with government funds, at higher valuations (possibly book value). In return for the acquired bad assets, the bad bank usually pays in cash or collateralized securities.

Let’s visualize the concept:

The bad bank acquires bad assets off the balance sheet and, in return, transfers consideration in the form of cash and collateralized securities. This cleans up the balance sheet of the bank. The bad bank now holds all of the NPAs, and the distressed bank is now left with only good assets. This is the most simplistic model of a bad bank. In reality, there are many things to consider, and it requires collective efforts of investment bankers, lawyers and accounting firms to structure a bad bank entity and its transactions.

Though called a “bad bank,” it is not a bank and does not conduct any banking business. Instead, it is established only as a temporary entity for recovering and liquidating NPAs and is wound up once the assets are liquidated. Therefore, a bad bank can more accurately be called an asset reconstruction company.

Bad banks have the following advantages:

i. Cleaning up the bank’s books increases investors’ confidence and clarity.

ii. A bad bank structure permits specialized management to deal with the problem of bad debts.

iii. The bank can focus on its core business.

iv. In cases where two or more banks set up a bad bank, the collaborative approach helps speed up the recovery process.

The bank may establish a bad bank, or a government could set it up for a group of banks. In most jurisdictions, bad banks are government-led and usually are set up on an ad hoc basis. Whether the official administrator (the banking authorities, or the state) sets up the “bad bank,”, it should adhere to the principles of good governance, transparency, and sound management.

Note that bank’s NPAs may be transferred with or without recourse. Suppose the bank’s assets are transferred with recourse. In that case, the NPAs are separated from the bank only to ensure more effective handling and asset recovery in the hands of specialists and permitting the bank’s management to concentrate on the banking business. However, the bank is still fully liable for the NPAs. This is ensured by employing full or partial recourse or indemnification arrangements in combination with contractual incentives to the bad bank for its collection efforts. Hence, in this case, the bad bank acts merely as a recovery agent. On the other hand, if the NPAs are transferred without recourse, the NPAs are completely isolated from the bank, thus achieving a clean break with the past and a fresh start. In this case, the bad bank does not act merely as a recovery agent but as the full owner of the transferred NPAs.

Returning to Mellon Bank:

Continuing with Mellon Bank, it created its separate entity, named Grant Street National Bank (GSNB), to enter into a purchase-and-assumption transaction, i.e., to hold all of its bad assets with a book value of roughly USD 1 Billion. This ‘bad bank’ did not conduct normal banking operations and was created solely to resolve and liquidate the bad assets and recover as much money as possible. This improved to asset quality of Mellon bank and allowed its management to focus on its core business and return to profitability. The bad bank eventually repaid all its bondholders in three years. It was ultimately liquidated in 1995 after successfully realizing the bad assets and paying all of its obligations.

This restructuring method by setting up a ‘bad bank’ to hold and manage all the bad assets was later implemented in other countries. Though the Grant Street National Bank was a private restructuring effort, in most other cases, the bad banks have been created by their respective governments in countries like Sweden, United Kingdom, France, and Finland. During the South East Asia crisis in the late 1990s, Governments of various countries established bad banks such as Danaharta in Malaysia, Korean Asset Management Company in South Korea, and the Indonesian Bank Restructuring Agency in Indonesia.

Bad Bank in India:

The idea of a bad bank is not new in India. After the Securitization and Reconstruction of Financial Assets and Enforcement of Security Interest Act (SARFAESI Act, 2002) was passed, many Asset Reconstruction Companies were set up for NPA resolution in India. Asset Reconstruction Company India Limited (ARCIL), sponsored by SBI, IDBI Bank, ICICI Bank, and PNB, in 2002, was the first ARC set up in India and began its operations in 2003. After that, private players like JM Financial, Edelweiss, Indiabulls, and Aditya Birla Group also entered the field.

However, before the year 2021, the concept of having a nationalized bad bank was not materialized yet by the Indian Government. The idea of setting up a government-funded bad bank for managing NPAs of all the banks in the country was first introduced in the year 2018 as one of the recommendations in Project Sashakt, a report of the 5-year strategy proposed by a panel led by PNB chairman Sunil Mehta. Under Project Sashakt, it was suggested that for bank loans above Rs. 500 Crore, an Independent Asset Management Company, would be set up to consolidate and manage NPAs. Based on these recommendations, the Indian Banks’ Association, on May 12, 2020, proposed to the finance ministry and the Reserve Bank of India to set up an entity to isolate and hold risky assets in the banks’ balance sheets.

Considering these recommendations and the need to clean up the balance sheets of banks in India, the Finance Minister, in the Budget 2021, proposed setting up an Asset Reconstruction Company to consolidate and take over stressed debt, to be called National Asset Reconstruction Company Limited (NARCL). This entity will be created in collaboration with public and private sector banks. The Articles of Association have been finalized and it is expected to be operational by the end of this month (June 2021). Public sector banks have already shortlisted loan accounts to be transferred to NARCL.

Key Points to Know about NARCL:

Funding:

The Funding structure of the bad banks is different from the structure recommended by the Indian Bank’s Association. Earlier, it was proposed that the Government would fund the proposed bad bank. However, NARCL will be funded by banks themselves. Canara Bank has declared that it will be the lead sponsor of NARCL with a 12% stake in the entity.

Swiss Challenge:

Though the fine print of asset transfer rules has not been issued yet, Sunil Mehta, CEO of the Indian Banks’ Association, has confirmed that the lead bank will go for a ‘Swiss challenge’. This means that bids from other asset reconstruction companies shall be invited to better the offer and find a higher valuation of an NPA on sale.

Consideration:

15% of the agreed value of loans acquired will be paid for in cash, and the issue of government-guaranteed security receipts will pay the remaining 85%.

Government Guarantee:

The Central Government will guarantee the security receipts issued by NARCL against acquisition of bad loans. However, the guarantee is limited to Rs. 35,000 crore, which is considered sufficient by lenders as higher recoveries are expected.

Consolidated ARC:

The most important aspect of NARCL that will make it different from the other already existing Asset Reconstruction Companies is that NARCL will consolidate NPAs from multiple lenders, which have different compulsions to resolve them. This entity is created as a collaboration among various private and public sector banks, the resolutions efforts of which will be coordinated by the Indian Banks’ Association.

Waiting for the fine print:

There is no straightforward procedure to determine at what price and which loans should be transferred to the bad bank. The exit strategy is also proposed for unresolved bad assets at the end of 5 years. However, the same is not finalized. The details are yet to be issued and all we can do is rely on the views and statements of eminent people in the know.

Arguments against a bad bank:

Though hailed as a good movie, the proposal of setting up NARCL is not free from criticism. Former RBI Governor Raghuram Rajan had opposed the idea of setting up a bad bank and wrote in his book ‘I Do What I Do’, “I just saw this as shifting loans from one government pocket (the public sector banks) to another (the bad bank) and did not see how it would improve matters. Indeed, if the bad bank were in the public sector, the reluctance to act would merely be shifted to the bad bank”. Without fundamental reforms to solve the NPA problem, the bad bank is likely to become a warehouse for bad loans without any recovery.

Dr Rajan also believes that setting a bad bank may enable the banks to continue with their reckless banking practices and create a moral hazard. There are many instances around the globe where resolution agencies or ARCs set up as banks that originate or guarantee lending have turned into reckless lenders. Many also point to India’s neighbor China, as the Indian Government needs to learn from China’s experience with Huarong Asset Management Company, a Chinese bad bank set up 20 years ago which now seems poised on an abyss.

Concluding thoughts:

The concept of a bad bank has been around for a while, and seeing its success in many countries; the Finance Minister has declared in the Union Budget 2021-22 the setting up of NARCL for cleanup of NPAs in the banking industry. Though there are many clarifications and operational guidelines awaited, this new move is hailed by many, as a step in the right direction. However, a bad bank cannot be the sole response to cure the twin balance sheet problem of the Indian economy. The banking sector in India requires holistic reforms and structural changes focusing on more excellent governance, improvement in the lending process, risk management, and stringent monitoring of loans.

Follow Us @