UTI AMC is the largest asset management company (‘AMC’) in India in terms of Total Assets Under Management (‘AUM’) and the seventh-largest AMC in India in terms of mutual fund Quarterly Average AUM (‘QAAUM’) as of September 30, 2019, according to CRISIL. The company caters to a diverse group of individual and institutional investors through a wide variety of funds and services. The company has been active in the asset management industry for the last fifty-five years and is the first established mutual fund in India.

Now, the basic functioning of UTI AMC or for that matter any other AMC is to manage money. These companies act as an aggregator and invest the pooled funds from clients/ investors into a variety of securities and assets. AMCs range from personal money managers, handling high-net-worth individual accounts, to large investment companies sponsoring mutual funds. Their major source of income is the compensation in the form of fees, usually a percentage of AUM.

Now, let’s dive into the industry and the company analysis to understand better:

Industry Analysis:

“Compound Interest is the eighth wonder of the world. He who understands it, earns; he who doesn’t pays it.” – Albert Einstein

8th November 2016 was the day when Prime Minister Narendra Modi announced demonetization, banning high-currency notes, to curb the black money transactions happening in the country. Amidst all the chaos that was created within the economy, there was one interesting feature that also happened within multiple households. Multiple cash reserves that were saved in different parts, maybe, some in the kitchen, some in the closet, some in the bedroom, all of it suddenly re-appeared leaving multiple family members in a state of mixed emotions.

While all of those savings created added problems for any household, there was one silver lining that might have been missed. The power of savings in every Indian household. India has historically been and is expected to continue to be, a high savings economy but these savings are of no use if they are not channelized in the right direction.

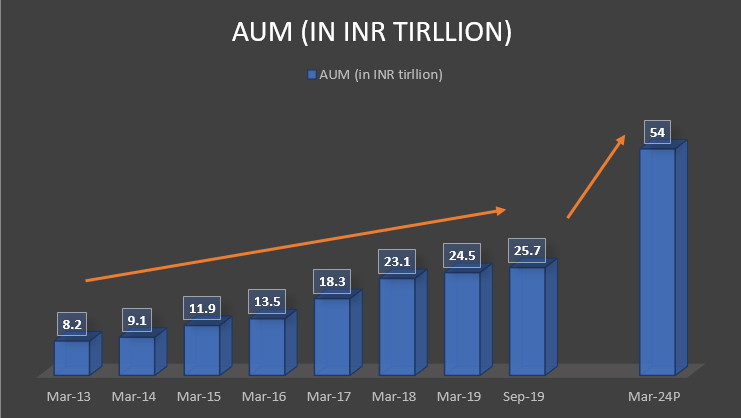

The AUM have been growing at a CAGR of 19% from March 31, 2013, to September 30, 2019, as per the data mentioned below and is further expected to grow at a pace of 17-19% and increase two folds in the next five years. Below is the data with respect to the same.

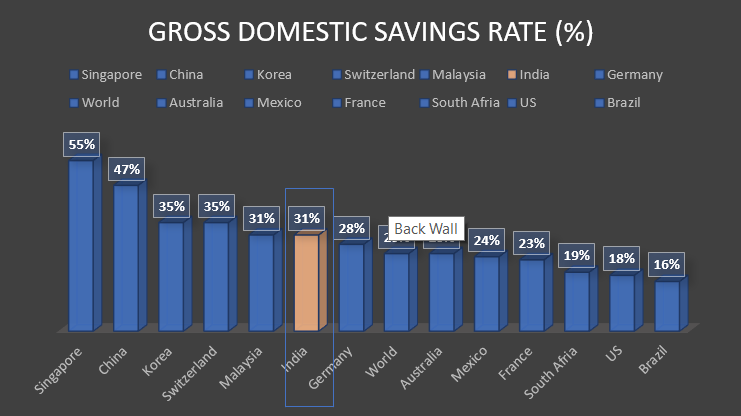

There has been a rapid increase in the AUM within the Indian economy but when compared to the savings rate within the economy, the above numbers could have potentially been much higher. Let’s compare the Gross Domestic Savings Rate (%) to the other developed and developing nations across the globe:

Just as expenditure spurs the consumption within any economy, it is also really important that all the savings that happen within an economy are routed back into the financial system. These high savings can be used to finance investments, which can further reduce the strain on the supply-side constraints in the economy and give a push to the long-term economic growth of any nation. Erstwhile, the savings pattern caused hindrances and created a big void in the financial system of the economy. India has primarily been a consumption-based economy but if the segments of the economy start to save more, then the pivotal factor fueling the growth is paused. Also, the savings not being channelized in the form of investment activities causes it to become a double blow for any economy.

The potential opportunity to channelize these savings into rightful investment opportunities and making these savings available to the economy (and thereby increasing liquidity) is one of the biggest reasons why the AMCs can see exponential growth in the years to come.

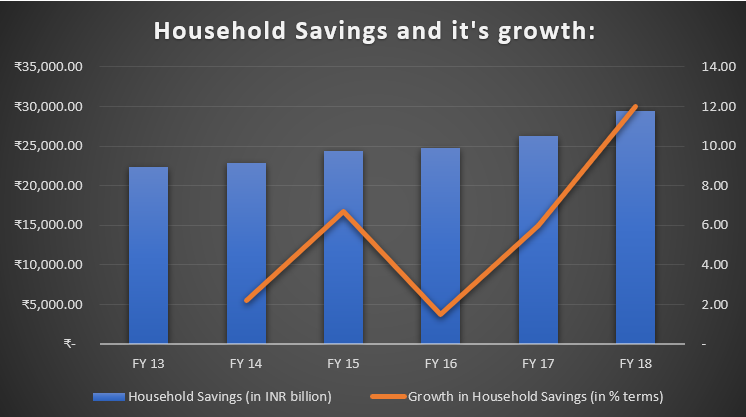

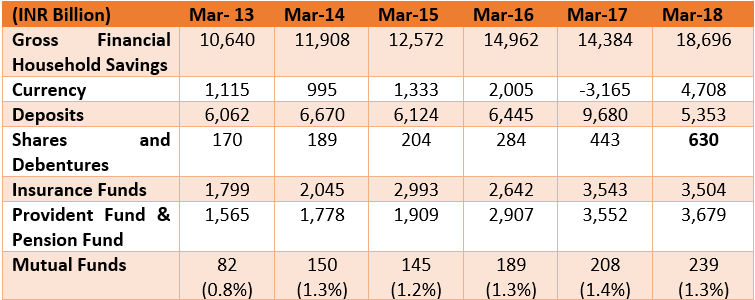

Household Savings and Investments in Mutual Funds:

When we look into the above-mentioned table, we can identify that while the gross financial household savings are increasing, there has not been an exponential increasing in investments within the AMC. An absolute change in the savings pattern is seen but when compared with the total gross financial household savings, the numbers remain stagnant since the last five fiscals.

Mutual funds have seen a robust growth within the country, especially in recent years, driven by a growing investor base across geographies, strong growth of the capital markets, technological progress, and regulatory efforts aimed at making fund products more transparent and investor-friendly.

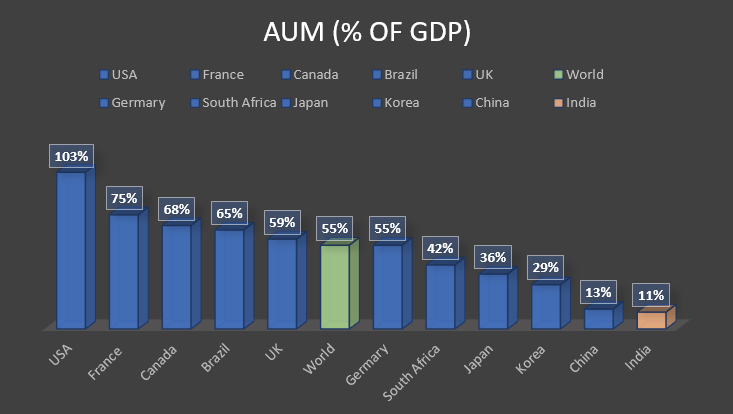

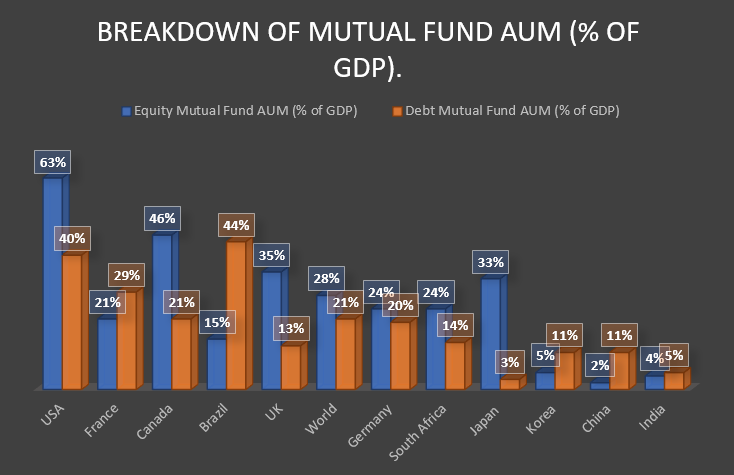

In the last eighteen years, the Mutual Fund AUM as a percentage of GDP has grown from 4.3% as of Fiscal 2002 to ~11% as of Fiscal 2019. Even as we see a rampant increase in the user base, the penetration level within the economy remains low. This can be highlighted with the help of the graph below:

Hence, when we look into all of the above-mentioned graphs and tables, it is evident that the asset management segment within the Indian economy is still in a nascent stage and could witness exponential growth in the years to come. India’s AUM as percentage of GDP (11%) is just one-fifth of the world average (55%) and meagerly over 10% than what is prevailing in the US (103%) and hence the room for expansion is immense.

The most important factor that could dictate the growth in the asset management business is financial literacy. It is all about managing your money and making sure that an individual takes informed decisions related to money. A survey conducted by Standard and Poor found out that three-fourth of Indians are not financially literate and have the lowest knowledge when it comes to risk diversification. India has the lowest rate of financial literacy amongst the BRICS nations (Brazil, Russian Federation, India, China, South Africa) and has a lot of ground to cover when to comes to the world average.

The key is constant financial learning and making the knowledge work for you. Once every household understands the importance of channelizing the savings into correct form of investments, it could in turn benefit them individually (keeping the purchasing power at par with the inflation) as well as the economy (would prevent savings going out of the financial system).

The Competitive Landscape:

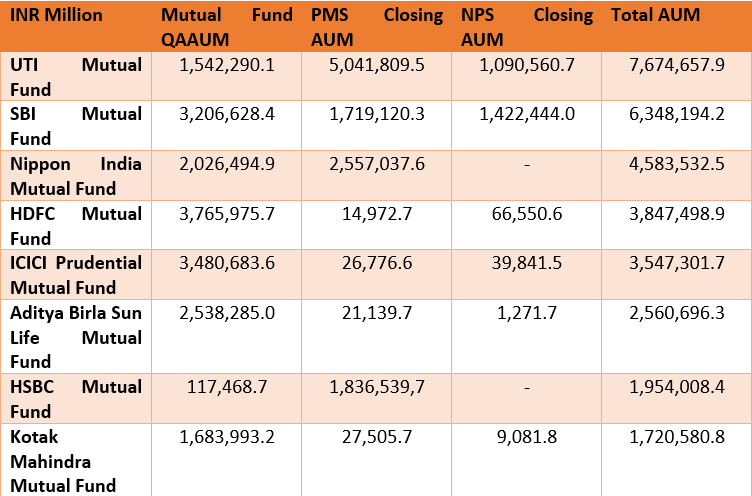

UTI AMC and its subsidiaries are nicely poised as the market leaders within the Asset Management Industry and have the largest total AUM considering mutual funds, portfolio management services and NPS assets.

The below data shows the Top 8 Mutual funds in India and their breakdown of the assets managed by them:

When we look into the above-mentioned table, it can be noted that UTI AMC is the seventh largest AMC in terms of Mutual Fund QAAUM but is the largest (and by a very long margin) in terms of the Portfolio Management Service (PMS) AUM. SBI Mutual Fund has the second largest AUM in terms of the PMS AUM but is still only roughly around 34% of the fund size of what UTI AMC manages. Hence it is evident that UTI AMC has a really strong market share in terms of HNIs and Institutional clients. However, the company has immense room for expansion within the Mutual Fund QUAAM segment.

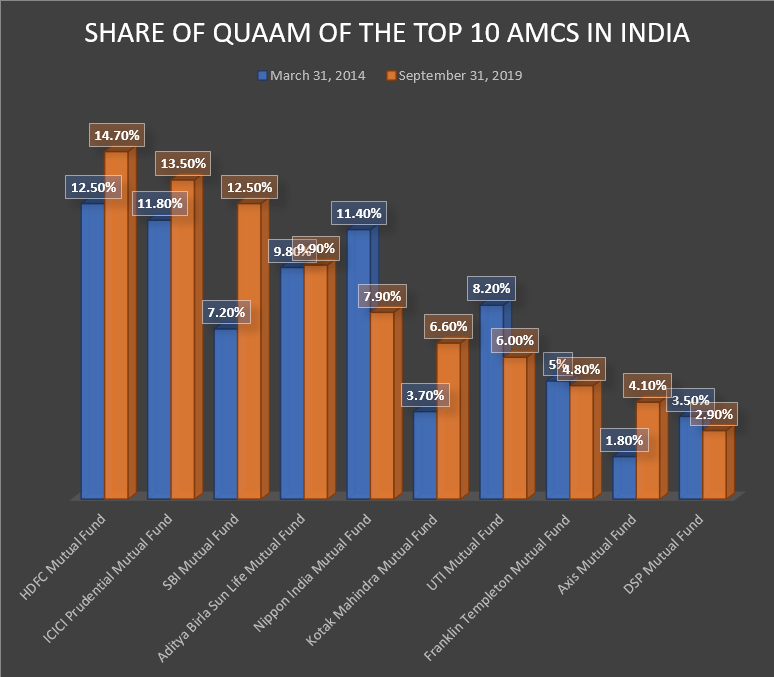

Declining Market Share:

Another cause of concern for the company could be the decline in market share over the last five years as mentioned in the graph below:

The top 10 AMCs have about 82.7% QUAAM market share as on September 2019 and has seen an increase of 7.7% in the last five years. However, as we can see that the market share of UTI AMC as dropped nearly by 25% from 8.2% in March 2014, to 6% in September 2019. This shows the fierce competition that this space faces. We do see immense potential within the industry but the company has to take steps to make sure that as the potential market within the industry grows, the company is not losing ground with respect to the same. The loss of market share could be a cause of concern for some investors as nearly 0.5% market share was last in H1 of 2019 according to the draft red herring prospectus that is filed by UTI AMC.

Extremely well positioned in B30 markets, High Customer Satisfaction and other allied strengths:

The company, however, has performed well with respect to the B30 markets and the customer satisfaction segment.

The B30 markets refer to the locations beyond the top 30 geographical locations in India. According to the statistics, in August 2020, 25% (or approximately 27%) of the assets held by individual investors is from the B30 locations. UTI has the highest concentration in the B30 markets among the top 10 AMCs. Apart from UTI AMC, SBI AMC is the only player with a concentration of over 20% in B30 markets. This is an interesting point of disparity (POD) for UTI AMC because a higher presence of AMCs in the B30 regions should allow AMCs to leverage their established position and the potential infrastructural capabilities in which they have already invested in these markets.

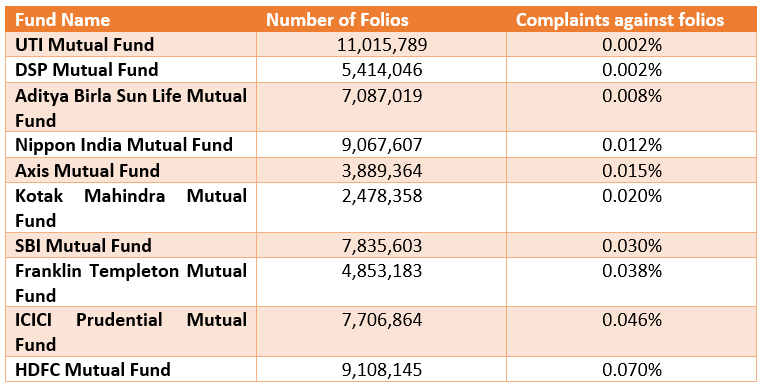

In terms of customer satisfaction, UTIC AMC and DSP AMC have the lowest complaints against folios, followed by Aditya Birla Sun Life as mentioned in the table below:

The company is delivering a high customer satisfaction rate when compared to all of its peers. The brand value of the company also validates the above-mentioned data and hence the company does not want to leave any stone unturned to maintain the brand value within the industry. Since, the company is proven in terms of performance and track record, the company can leverage the same and invest a lot into product innovation and diverse product schemes. The innovation is also backed by experience management and investment teams supported by strong governance structures and product mix. However, there are some pieces of the puzzle still missing and that can be interpreted from the financial data given below:

The Financial Dilemma:

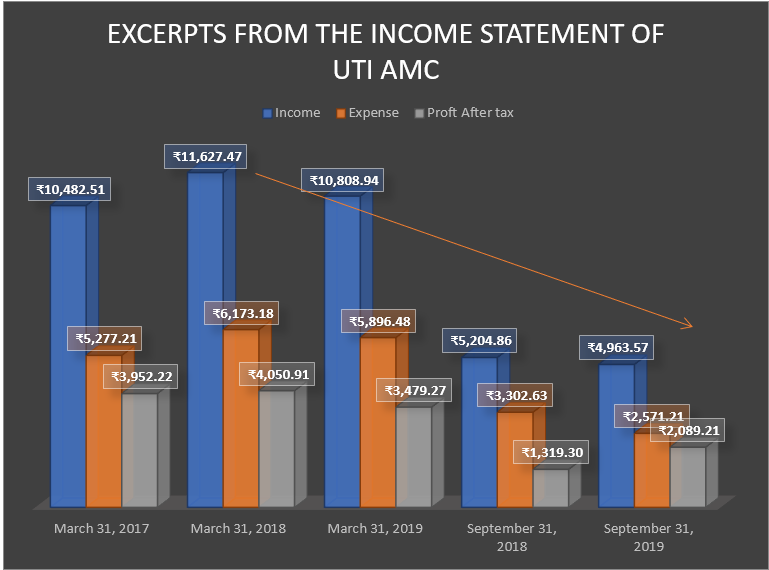

Note: Total Income is attribute to Income; Total Expenses is attributed to Expense; Profit for the year after deduction of tax is attributed to Profit.

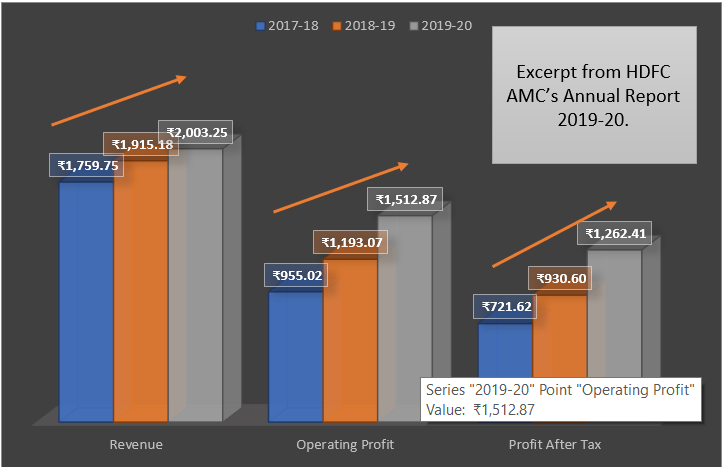

The most important factor to judge any company is the growth in revenue that the company can generate. However, with respect to the UTI AMC, this is a major cause of concern as we can see in the graph above. The revenues have nearly gone down by more than 50%. A similar pattern can be witnessed in the profitability numbers too. Before we shed more light onto the above mentioned numbers, let us look into the financials of one of UTI AMC’s already listed counterpart, HDFC AMC.

We can identify that the Revenue from Operations has grown by a 5-year CAGR of 14.40% and the Profit After Tax has grown by a 5-year CAGR of 24.89%. These numbers are enough to state that the industry has grown in the last five years but UTI AMC’s revenue and profitability numbers were all out of place when you compare it with another listed counterpart.

Summing it up:

The Asset Management Industry is an industry standing at an inflection point and is nicely poised to witness an exponential growth with respect to the same, provided the fact that there is increased focus kept on increasing the financial literacy of the country and making sure that the savings are channelized into meaningful investments that can be productive on an individual as well as on macro-economic level.

In an industry with exponential growth prospects, the immediate beneficiary should have been the market leader, i.e., UTI AMC, but the company’s performance over the last five years has not been one that is depicted by the market leader. The company is under immense pressure to perform and regain its lost ground in terms of revenue and market share. The positioning in the B30 segment and the PMS AUM segment could really beneficial to the company provided no more ground is lost on that aspect by the company.

The potential of the company is immense but from an investor’s perspective, the company could be kept on the watchlist for a couple of years given the fact that there it’s biggest competition, HDFC AMC, is also a listed company and could give the company a run for their money in the years to come.

Disclaimer:

The authors shall take no responsibility for any losses occurring out of investment/trading decisions you make based on the contents of this article.

We are not SEBI registered investment advisors. This article is meant for educational purposes only, please consult your investment advisor before acting upon any information you see here.

We may or may not have open positions, kindly assume that we are biased.

Follow Us @