We all acknowledge that food and beverage industry is in crisis. While the prognosis varies and the healings for restoration differ, we believe in the quest to survive the industry has to be reinvented or re-imagined. When you manifest that your job is not to save yourself from a crisis but to reinvent – then the possibilities are endless.

At a time when there are opportunities for growth only in the tech ecosphere, customer’s wallets are shrinking and with the rising lease rentals, it is only making things rough for the food and beverage industry. But what is clear is that restaurants and cafés are essential; it is a culture in itself. It is more about the people it employs and the community it serves rather than just food and drinks.

But, will this culture still continue?

If the novel Coronavirus (COVID-19) is here to stay – for the coming months or till a vaccine is ‘truly’ found – co-working space and cloud kitchens are the only viable options for the industry to endure.

Why food & beverages industry is a key segment in the economy?

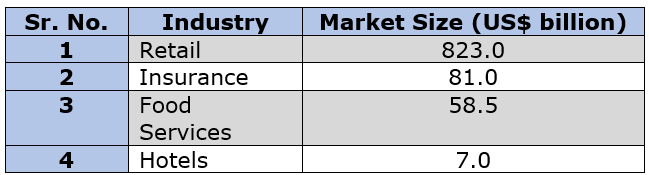

The organized market is worth US $ 21 Billion (chain and organized standalone outlets) of the total market size of US $ 58.5 Billion. This is approximately three times bigger than the hotel industry as seen:

Industry-wise Market Size in Fiscal 2019.

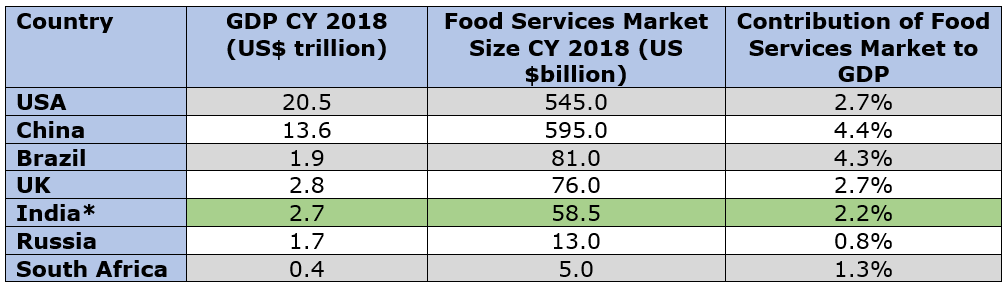

Contribution of Food Services Market to GDP Calendar Year (CY) 2018

The growth of the industry is expected to outpace its growth till now, i.e. from 8% p.a. (Fiscal 2019) to 10.5% p.a. (Fiscal 2024). The rising disposable income and rising urbanization is fueling the growth of the Indian food services market. Additionally, the increase of women in workforce has brought a paradigm shift in the patterns of household activities. This includes a downward trend in the home cooked meals and an increasing demand for “out of the home” meals.

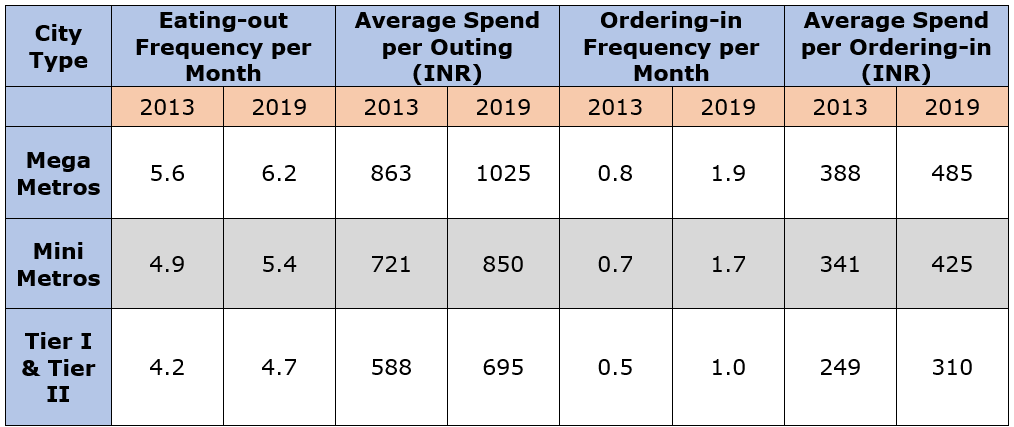

Historically, the “dine in” option was considered the only medium to reach out to the “out of the meal” segment and food delivery was essentially an unorganized market back then. But, ever since the advent of delivery based aggregators like Swiggy and Zomato, the market dynamics have transformed as shown in the table below:

With the buzz of industry’s survival, lets learn more about the two concepts and how they’re entrepreneur’s only alternatives.

Co-working Space

Given the changing dynamics, it is clamant that restaurants and cafés have to remain upbeat and on the front burner. It is time to bet big on the Co-working culture. While this may sound strange at first, it’s an incredibly business-savvy and logical initiative. Ever noticed these restaurants have surprisingly a favourable work environment? With tranquil seating, pleasant ambience, the food and beverages option which is a plus, they already have the skeleton of a great coworking space. And we’ve all seen this initiative in cafe’s, you would be likely to notice start-ups,, readers, web designers, consultants and writers working behind their laptops. To keep the business afloat, this is the formula of maximum utilization of their additional space to earn revenue and to manage their lease rentals.

They’re coworking space during the day and restaurant by night. By day, the dining rooms are evanescent offices, hosting gig workers sipping their coffee and grinding their artistic minds. By night, diners pile in to drink wine and eat food at the very same tables.

Let’s do a SWOT Analysis:-

Will it work?

Utmost people believe coworking culture will be preferred over work from home. We all know what it’s like with the Gen Z and the freelance community, they like to work in a less traditional environment and continue living their digital nomad life.

Also, with the current layoffs and work from home scenario, people have found more time to take up different projects which shows a dramatic shift in how people are making a living.

Co-working spaces in restaurants is a win-win situation; it is providing you the amenities you require instead of paying upfront for a space and restaurants are tremendously benefiting from this niche by attracting traffic.

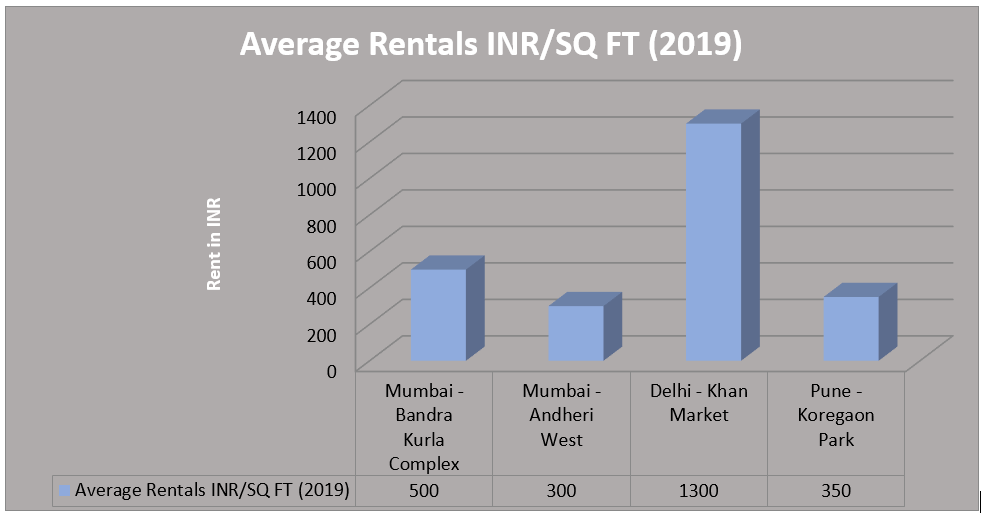

Retail Rentals across Prominent Areas:

With these rentals, there is a necessity – the mother of reinvention.

Which restaurants are a good fit?

- Dinner – only restaurants

Dinner only restaurants can make great coworking spaces, particularly in cities where rent is expensive. These restaurants have the most inviting decors, soothing lightning and the relaxed seating arena which makes it all the more attractive to the community. Instagram worthy decors is a plus to spread the word. Example – The famous brewery in Pune Effingut Brewerkz.

- Café’s

They have been a go-to choice since a really long time. They’re simply a natural fit. Café Coffee Day and Starbucks are a great example of a café-turned-co-working space. They make good co-working space since they provide healthy food and they have the already required amenities.

Will it be profitable?

There will be models according to the preferences.

- Ala carte model

Initially, to endorse themselves, they can attract attention by putting a sign board “open for coworking during the day”. In this model, customers only pay for the food and beverages they consume and do not pay for the use of the space.

Pain – Prices of the food and beverage sector will have to be optimized. Your menu, along with your restaurant’s interior design, is what communicates your restaurant’s brand to guests loud and clear. Use “eye magnets” to draw your guests’ attention to the dishes you want the customers to order instead of passing by only coffee.

Gain – This will invite a lot of customers because entrance to coworking space is so appealing.

- Membership Model

This is the crucial part. The membership plan is only for the access of space, free Wi-Fi, printing and scanning services and power outlets. The plans can vary from weekly plans to monthly plans, from daily plans to weekday plans and the dedicated desk plans. With a bit of time and experimentation, finding the right combination of membership plans for your coworking space is an iterative process.

Pain – They should be wary of the membership model because it could be detrimental to customers who would openly stop by for their all-time favourite food.

Gain – An incremental revenue will be through food and beverage spend, with little to no operational effort, on membership revenue alone.

- Hybrid Model

A mix of food and beverage with access to space. Here, members get discounted food and beverages. Plans here could vary from:

Basic Plans – Coffee plus access to internet

Morning Plans – Breakfast with a reserved space

Lunch Plans – Lunch with a reserved space

Premium Plans – Breakfast and Lunch with a reserved Space

Pain – Freelancers may pay only for coffee for a reserved space and several hours of internet access

Gain – All of these amenities are technically the essentials for a coworking space. What more would you want from the restaurant that used to be your go-to place for food is now also allowing to work?

How will the customers stick around?

Rewards! Freebies! Souvenir’s! The ultimate objective of turning your restaurant to a co-working space is to become a hub for anyone looking for the nourishing amenities whether they’re Gen Z students, freelancers or entrepreneurs.

The Pareto Principle, or the 80/ 20 rule fits right in here i.e. 80% of the results will come from just 20% effort. Using this, the top 20% customers who are maximizing the sales shall be rewarded with the loyalty programs. And these are the customer relationships restaurants need to nurture. This will in turn help you grow your revenue, attract new customers and keep the loyal ones.

Why are co-working spaces gaining popularity?

You will be surprised to know that top companies initially began at a coworking space.

Uber – Your ride to restaurants/office company, was started by Travis Kalanick and Garett Camp in a co-working space.

Instagram – The base for your photos and IGTV’s – Mike Krieger and Kevin Systrom managed to build the trending social media platform within 8 weeks in a co-working space.

Spotify – Your music and podcasts app, Spotify began in Rocket Space.

Taking everything into consideration, we see a bright future for coworking spaces. As it is a lucrative model for the existing ecosystem with simple monetization systems and affordable workstations. As quoted above, necessity is the mother of reinvention – co-working is needed now more than ever.

The contemporary model of dining in with family and friends has been a distant reality since a while and the evolution of this industry is heading towards “cloud kitchens”.

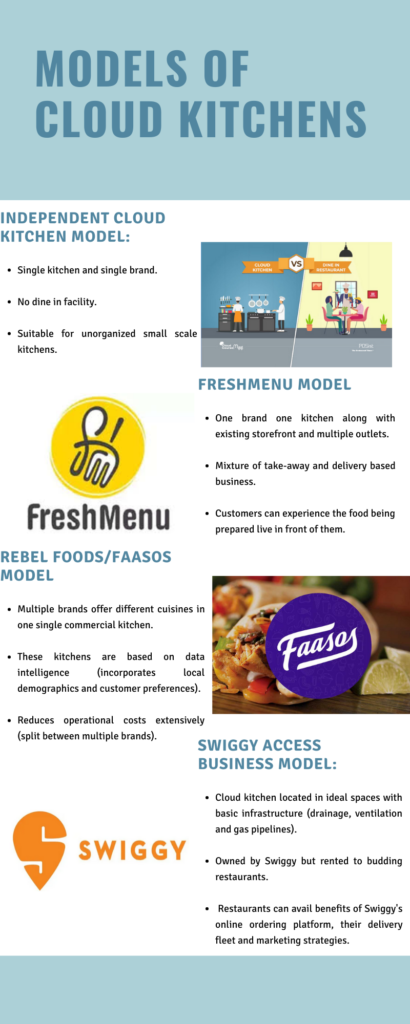

What is a cloud kitchen?

Cloud kitchens, also known as ghost, virtual, or dark kitchens, are delivery only restaurants (production unit) that lease space for its functioning. These kitchens either integrate the takeaway and delivery model or completely depend upon the latter to reach out to its customers.

The cloud kitchen industry is forecasted to exponentially grow at a CAGR of 19.1% annually (Source: Statista). The lower variable costs that the cloud kitchens have to incur add into their functioning advantage and hence makes them price their products competitively with respect to their rivals.

The Model Of Functioning:

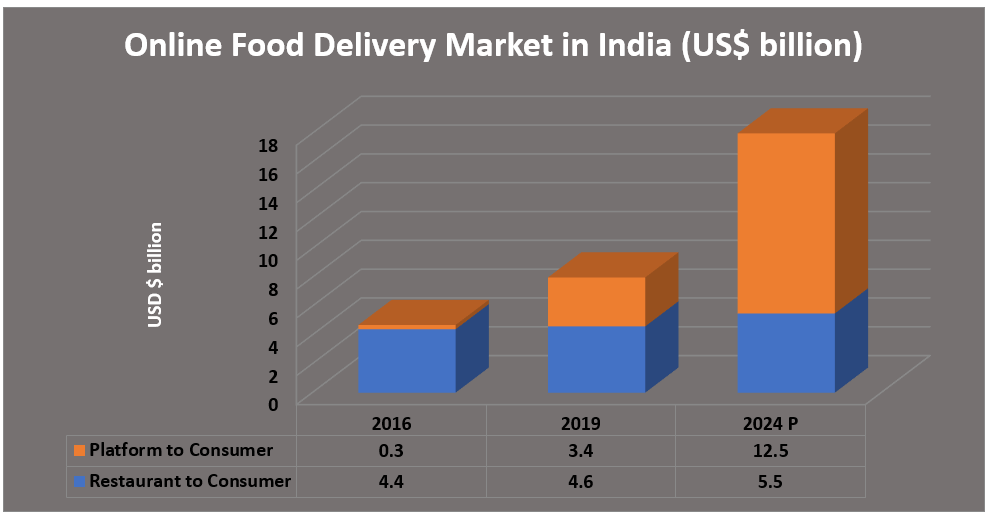

Online Food Delivery Market in India (US $ billion):

The above-mentioned table and graph explain that the frequency of ordering-in has more than doubled in six years. The percentage increase in average spending per ordering in (roughly around 24.5% – 25.5% across city types) is more than the percentage increase in average spending per dining out (roughly around 17.5% – 18.5% across city types). These “ordering in” are also transitioning from “Restaurant to Consumer” to “Platform to Consumer” model. Growing user base of smartphones in India is also allowing online delivery platforms to capture market by offering a wide range of food products. The rise in digital technology is ultimately shaping up a whole new dimension into online delivery in India which is further strengthening the restaurant’s top-line.

The Fear of the Pandemic:

There is no doubt about the fact that the Food & Beverages industry has space to accommodate every kind of model. It is unlike the content exhibitor’s business wherein if a movie is bought by OTT platforms directly, it cannot be filmed on the big screen theatres and multiplexes. With delivery only option being the most preferred, the entrepreneurs are bringing in more variety. Earlier the dishes for dine in and delivery would vary and the most exclusive dish would be excluded from the delivery option so as to attract the customer to the restaurant. Hence, this segment provides an overlapping luxury for the restaurant owners with dine in facility to operate on both the models by leveraging the technology available. The delivery model which once multiple dine in restaurants chose to avoid due to the manpower hassles associated with it, have been able to outsource the same through aggregating platforms like Swiggy and Zomato and have ultimately been able to expand their reach.

But a coin has two sides!

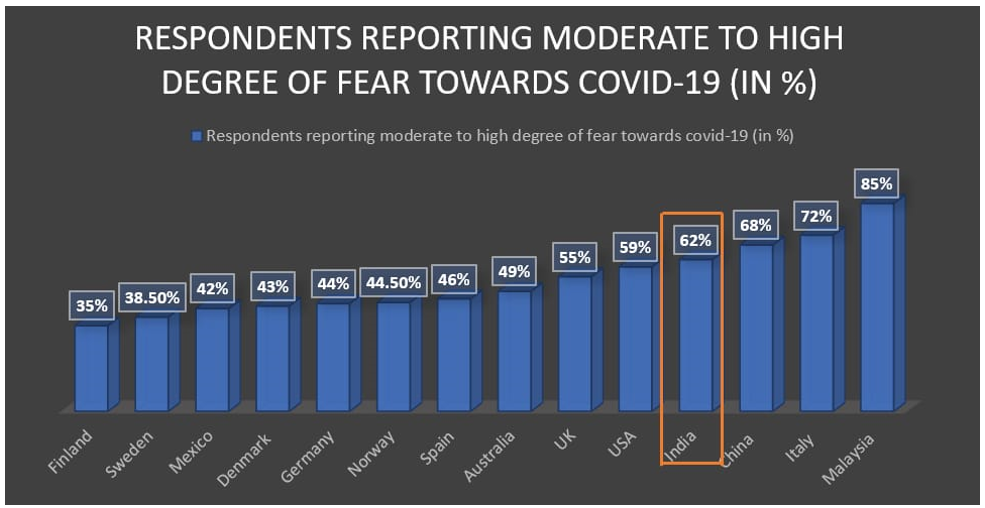

The ongoing pandemic has completely turned the tables in favor of the cloud kitchens/ virtual kitchens. Let’s have a look at the image below for further details.

The ongoing pandemic has mentally traumatized everyone and the fear of transmission still persists. The same could be reflected in the image above considering that ~ 62% of the Indians fear acquiring the virus and hence step out only for work and essential activities. While the impact of these consumption patterns over the last quarter has been a major blow for the economy (since India is consumption driven economy) and hence the ripple effect can be seen of the Food Services segment too.

Even after the government allowing the food industry to open up in certain areas of the country, the response has been far from promising. The restaurant footfalls are at an all-time low with only 10% of the projected sales taking place. According to CRISIL, the recovery of the INR 1.5 trillion-rupee (US$ 20 Billion) sector will take at least a year. Every possible food industry model has been impacted but the ones to quickly recover are the ones with an asset light model. In other words, only delivery-based channel business models have been able to weather the storm.

The dine-in restaurants have multiple overheads that need to be accounted even if there is practically no business happening (e.g. employee staff salaries, lease expenses and so on). Hence, to at least make sure that they are breaking-even, the delivery services become the need of the hour for them. Operationally, the revenue model for a dine-in restaurant and cloud kitchen will be more or else the same till the dust settles down but the overheads of the dine in facilities will act as slow poison for the former’s business model.

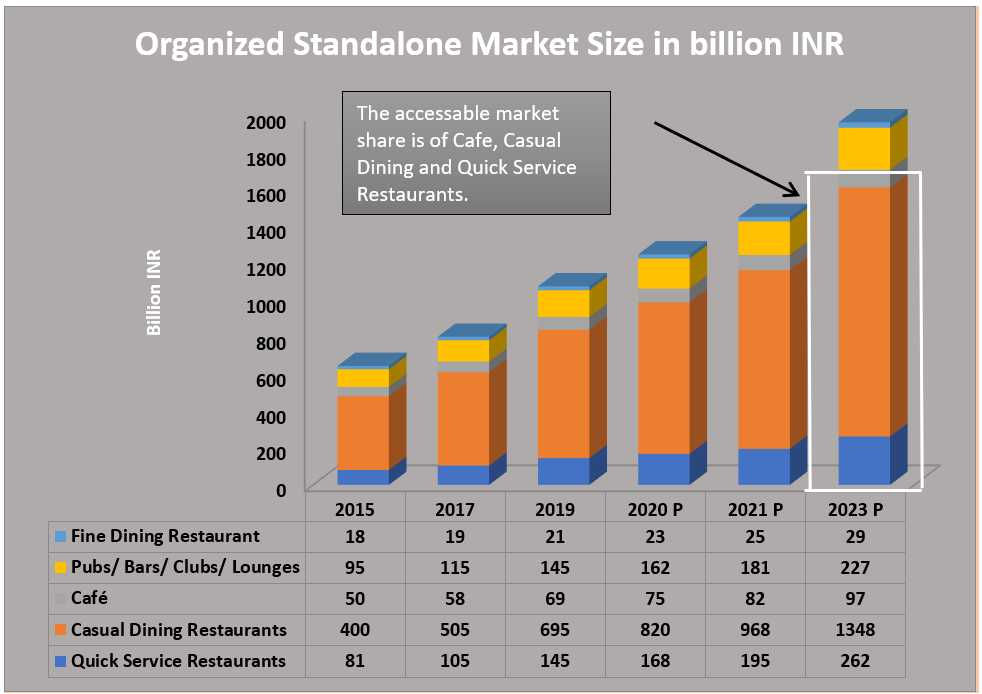

There is some potential market share that can be gained due to the structural damage the ongoing pandemic could cause, depending upon its longevity. Let’s look at the image attached below for more details:

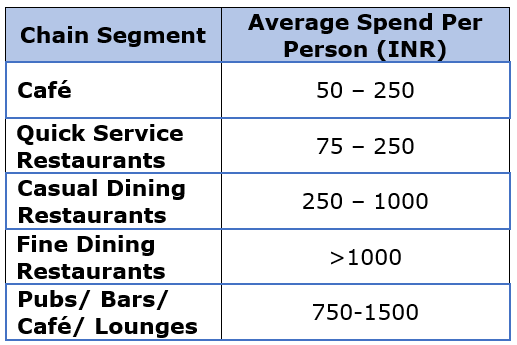

For a moment let’s recollect the data of average spending on food ordering by customers. The average range was between INR 300 – INR 500. Hence, the market share that could be grabbed by any delivery-based cloud kitchen is of customers ranging between these order values. Below is a table depicting the spending pattern of various customers at the various options mentioned above in the graph:

As we can see from the table above: cafés, quick service restaurants and casual dining restaurants fall into the average ordering price range of a customer and hence naturally, competing and winning their market share would be much easier than the fine dining restaurant’s market share.

The casual dining restaurants are the one with the highest market share but also the worst affected restaurant segment due to the ongoing pandemic. Around 16.9% of the total organized market share of the casual dining restaurants is further controlled by a particular brand of restaurants (INR 118 billion out of INR 695 billion) and hence it is easier to fight a battle for the cloud kitchens with standalone restaurants. Naturally, since the scale of operating these casual dining restaurants are greater, currently, the delivery model becomes the pulse of the business and their aim is to offset delivery gains to the operating losses faced through the overheads of dine in. This is where the cloud kitchens can go aggressive in terms of their pricings to gain market share, establish their presence and begin gaining a loyal customer base going forward.

Asset Light Model Can Fight Longer:

The financial model of any cloud kitchen/ delivery based company and a dining restaurant will be poles apart. Firstly, the space that is required to initiate a cloud kitchen can be within the cheapest properties that are available within the vicinity. It could be even a parking lot from where these kitchens could operate and hence that is why they are also known as “ghost kitchens”. The models with just an additional take away option will also require a maximum area of around 100 – 200 sq. ft. for its operations. This is around a quarter of space that any restaurant would require for its functioning of a larger space. Think of it like this. An airplane has to fly and incur the costs of even flying at 50% capacity knowing that the empty seats have not reaped them any revenue. Similarly, if the restaurant is occupied at 50% during its whole monthly operations, the rent for the remaining space that goes unoccupied has to be paid even if it was not able to generate the traction for which had been taken. A similar drawback is faced for the employee costs. Let’s look into the table below for some deeper references:

They make good coworking space since they provide healthy food and they have the already required amenities.

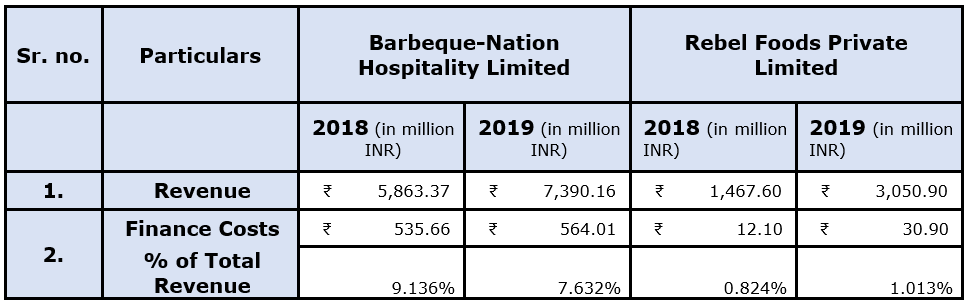

Comparative anaylsis of the Financing costs of the below mentioned companies.

In the above example, we have considered two companies, namely Barbeque-Nation Hospitality Limited and Rebel Foods Private Limited with the former being a traditional brick and motor “dine in” restaurant and the latter being an internet-based restaurant company. An asset heavy company which is leveraged by debt is always functioning on thin ice. Nearly 7.5% of its revenues account for its financing costs. These kinds of restaurants work on the lease-based model and hence have that liability to be catered to, irrespective of gaining business or not. With a lease liability of more than INR 500 Crs. each fiscal, not gaining business for a quarter becomes a major blow for any company. On the other hand, Rebel Foods has a financing cost of a mere 1% of its revenues. Since, the company is leveraging technology and primarily focusing on just delivery, these kind of financing costs could be easily covered considering that online delivery business has zoomed northwards during the gradual opening of the economy.

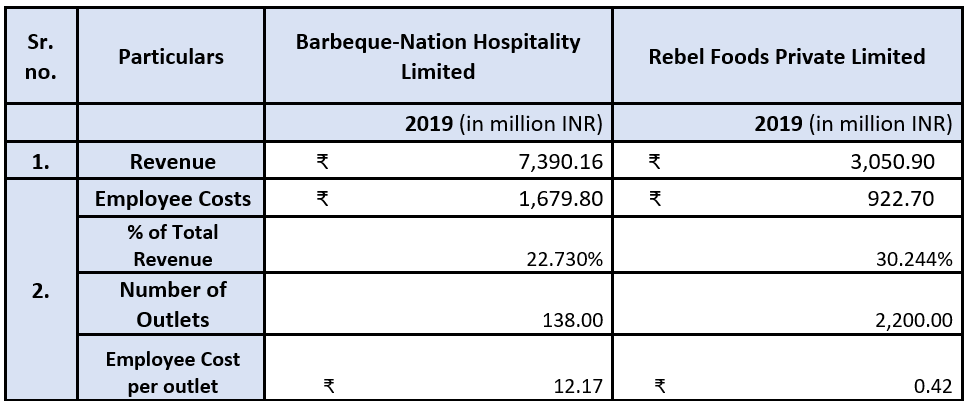

Comparative Analysis of Employee costs between the below mentioned companies:

When considering as a percentage of total revenue, the employee costs are higher for Rebel Foods than Barbeque-Nation but let’s not forget the revenue range that these companies deal into and the purpose that each of them fulfill. Hence to draw a better comparison, let’s look into the employee cost per outlet. When taken into consideration, the numbers change drastically. There is an employee cost of INR 12 Million outlets compared to only INR 0.42 Million for Rebel Foods. The cost per outlet for Rebel Foods is merely 3.5% to that Barbeque-nations’. Being an asset light model helps them to cut down on expenses and channelize their excess cash flows towards marketing and advertising expense, to build a loyal customer base for their company. The downside risk of setting up a cloud kitchen is also very meagre compared to setting up a classical dine in restaurant. Some of the expenses that an internet-based company does not need to incur is rent for space, expenditure on interiors etc.; the manpower is only restricted to chefs and packaging labor and so on. Hence, it is important for these traditional restaurants to optimally utilize their resources to make sure that the overlapping advantage is not lost from their hands.

Final Thoughts:

“Change is Inevitable”

Time and again we have witnessed transitional change in the business dynamics of an industry. History has given us many examples of industry leaders being rattled from their spot and made to bite the dust. In today’s world, there’s juxtaposition of ideas, hybrid methods, and reinventions creating entirely a new product or category. Classic references come from the mobile phone industry. The resistance of the likes of Blackberry and Nokia towards the smartphone evolution ultimately pulled them down and paved way for a new market leader in Apple!

To reinvent itself, which is rooted in its adaptability, is the only choice left for the food industry today. Delivery whose path to profitability was once questionable is now a permanent path. According to the reports of ‘Let’s Co- Work India!’ brought out by QuikrRealty in alliance with HDFC (formerly HDFC Realty), “India has one the highest office space requirements in the world.”

What do you think about the co-working collaboration and cloud kitchens? Would you consider managing a cloud kitchen or a co-working space or working in one?

Follow Us @