Hello Folks!

A lot has been already spoken about how mindful one should be while investing in the Fixed Income Markets in India, particularly in various unprecedented scenarios like the current COVID – 19 & economic stagnation.

If we observe, actually there are a lot more risks in Equity Markets, then why is fixed income discussed so largely?

The answer to this question could be – Expectation vs Reality! This gap may turn out to be much wider if such investment decisions are not handled with care.

The term “Fixed Income Markets” provides an assurance to the investors that this avenue will give them a safe return over time. But then, on the contrary – big names like that of Franklin Templeton shut their 6 debt fund schemes abruptly! This makes the investors bewildered and wonder – is my investment really that safe as I thought it would be?

Of course, such an ambivalent thought is absolutely natural for someone looking to get safe heaven while expecting to take a ride to their dreams.

However, this leads us to discover that, apparently there’s an elephant in the room and no one wants to talk about it! So by this, let’s understand where these investors go wrong.

In India, retail investors – invest in the debt markets largely through Mutual Funds. Almost all Big Fund houses have an array of categories of schemes in the Debt Segment itself. (Don’t worry, we’ll not get into these array of categories in detail) Now, each scheme has its own objective & cater to different types of investors. Most importantly, think about this one thing whenever you are investing in any Fixed Income avenue – Safety First, Return Later!

The reason as to why I advocate this idea is – even though a lot of people are not cautious about this fact but every investor bears on some risk even if they’re investing in a Fixed Income Instrument!

One of the simplest to comprehend but yet a daunting risk is Credit Risk! In simple words, credit risk is the risk that the Lender (fund) of the money will not get repaid either partially/fully. The Credit Rating Agencies analyse the instruments and state their opinion as far as only credit risk is concerned. Generally, Corporate Bonds are categorized and classified by their likelihood of performance and is rated each as AAA, AA, A, BBB, BB etc.

But when we talk about undertaking credit risk, it probably suggests that one is buying a corporate bond with a lower credit rating. But nowadays we are witnessing the bonds of companies even with an AAA & AA credit rating like IL&FS, Dewan Housing defaulting. How? And what to do about it?

First things first, a retail investor should understand and have at least an iota of an idea of why is he investing in a Fixed Income avenue? Just to shield oneself from volatility the equity funds have, right? That is you don’t want to take on a lot of risks on this corpus. That is, you are risk-averse. This is where investors get it wrong the most. They are expecting to have a ‘Fixed Income Investment’ but in reality, they’re actually undertaking on a lot of credit risk, which could really implode in unexpected times. Agreed that the more risk an investor bears, the more superior returns he can expect – But let me assure you, it’s not really worth it!

So, JUST SAY NO TO CREDIT RISK. FIXED INCOME INVESTING IS NOT SO SEXY, REALLY.

Instead, one could go for many stable alternatives in the same domain, probably for a fund which has less risk, like – Government Bonds, T-Bills, PSU Bonds, etc. These bonds too have credit risk but is relatively, very low.

Let’s keep credit risk funds only for institutions, shall we?

Another thing a lot of people get puzzled about is the Interest Rate Risk – Agreed, but how does it relate?

Well, what this suggests is every fund maintains a portfolio of securities and the value of this portfolio changes as a reaction to changes in the general interest rates. (Overnight Funds rate changes by RBI – REPO)

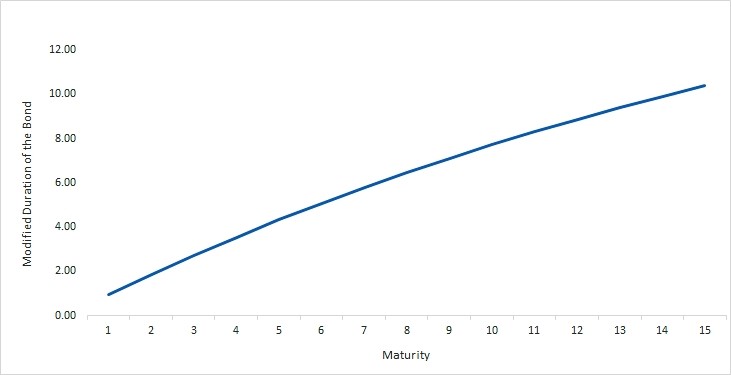

Now how much does a fund get impacted for a 1% change in the overnight fund’s rate is called as the Duration of the fund (Modified Duration). The Duration measures the Interest Rate Risk the fund brings with itself.

The above graph shows the effect of % change in expected prices (Modified Duration) of the bond across maturities for a % change in interest rates. The Bond used as an example has a face value of Rs 100 & Coupon Rate @ 10% p.a payable annually. You can observe that the % Change of price of the bond is high for a bond with longer maturity. Please note – as interest rates fall price rises & vice versa.

To counter this risk, investors should decide the term of their corpus to sit in till maturity. We call this as an “Investment Horizon” Then they should find a fund having a Duration equal to (or almost equal to) their own Investment Horizon. That’s it!

Some people would continue to suggest during these times to invest in the fund having a duration greater than an individual’s investment horizon. This sounds like a good idea, but again this means that you’re taking on a huge risk for a “potentially” handsome reward!

As Babu Bhaiyya suggests in here, Be like Babu Bhaiyaa.

Also, now there are some investors who’re listening to the “Local Gyan” are investing in a Gilt fund. A Gilt fund is a fund investing in Long term government instruments. Now, these funds have credit risks under check but ‘Long term’ is the key term here. What I mean by this is they have a very long duration. That is, if the RBI increases the rates even slightly, these funds will be hit the most!

Nonetheless, even during these times, RBI has been taking so many measures to ensure adequate liquidity in the system, one of them is lowering interest rates.

By the way, these funds’ value increases dramatically as the RBI cuts REPO rates as they have a high duration!

This is what tempted a lot of people for entering these schemes in the past couple of weeks. As a rate cut again would prove to be very profitable for them. But to everyone’s surprise, The Honorable Prime Minister of India – Shri Narendra Modi, appeared on the night of May 12, 2020, at 8:00 PM (IST) and announced a HISTORIC STIMULUS PACKAGE reckoning to be around 20 lakh crores ($266 billion) on the national television.

That’s Impressive! But how is this connected to Gilt funds?

Let me get this clear.

A huge stimulus package means a high fiscal deficit, and a high fiscal deficit means high borrowing done by the government. A high borrowing means the supply in the debt market for government bonds increases. This, in turn, means YTM (Yield to Maturity) will go up which means the price will plummet and go down.

Also to recall, the Duration of these Gilt funds are high, so they will be the most impacted ones of all!

Of course, this is a theory, but it still holds potential, it can be accompanied by a lot of RBI regulations & policies. The point I’m trying to make is – Don’t invest in gilt funds unless you have an investment horizon equal to the Duration of these funds (which is usually 8-10 years).

Also, one more blunder people resort to, is – Going for a short/ultra-short term duration fund (as this matches their investment horizon) but taking on a substantial amount of Credit Risk. This means investing in a fund that invests for a short term, risky bonds.

After all these, the fund manager has to make a judgement whether the borrower will be able to raise the amount repayable to the fund by leveraging it from some another lender – because it is highly unlikely that the borrower will be potent enough to repay the entire debt amount from his own funds.

Again, this is a risk that the Fund Manager has to bear – the risk of change in perception of the market towards lending to the borrowers. If the borrower fails to raise money, then what? We all know, the answer is – He’d Default!! And these funds are still classified as short/ultra-short-term funds as their durations are short.

This is the reason why there were some shorter duration schemes’ names too, along with the credit risk funds in the list of schemes shut by Franklin Templeton.

A Mutual Fund Investor needs to be on top off the portfolio, these schemes are managing.

This can be done by analysing factsheets updated by these funds on their websites. This is what a Financial Advisor is an expert at. These things have to be observed, analysed and evaluated before investing. Even by this, sometimes this analysis can get tricky. Please don’t hesitate to take professional help.

Mutual Funds Sahi Hai. Simple Nahi.

Follow Us @

Some Unrelated Stories!