Imagine that you are a kid, ecstatically watching a balloon seller pump air into the balloon of your favorite colour! As the balloon grows larger, so does your eagerness to get a hold of it! The balloon seller ties up the balloon and hands it over to you. While you are marveling at your bundle of joy…. POP!

A naughty kid pricked your balloon!

Disheartened, you see the balloon shrinking away, leaving you with fleeting moments of joy. All this, while you cannot help but be agitated with the naughty kid! Okay, so now let’s get back to reality! Well, if you could relate to the resentment of the kid, you may be able to fathom the discontent amongst the shareholders of GMM Pfaudler Ltd. (hereinafter referred to as “GMM”), who saw their balloons being pricked, when the promoters of GMM made an unanticipated announcement on 21st September, 2020 to make an Offer for Sale (OFS) with a floor price of INR 3,500 versus the Sept. 21 closing price of INR 5,241, a steep 33% discount.

After witnessing their shares rising by about 180% since the beginning of the Calendar Year on the bourses, this announcement which led to the share price spiral down by ~28% since Sept 21, 2020, has surely not gone down well with the investor community. Many of whom, have taken to social media to lament the OFS discount as well as questioned the long term prospects of the company and the intentions of the management.

While investors holding the share, have seen a notional loss in value after the correction, the promoters who sold their shares at the steep discount to the market price experienced a real loss.

So, what was the rationale behind the infamous OFS and the steep discount?

An OFS is a method by which promoters in public companies can sell their shares and reduce their holdings in a transparent manner through the bidding platform for the Exchange. Non-promoters of eligible companies holding at least 10% of the share capital of the company are also entitled to make an OFS.

You may ask, how is it different from an IPO or an FPO? The primary difference is that in the case of an OFS, the no. of shares outstanding remains the same. The shares that are sold in an OFS only exchange hands as opposed to an IPO or FPO where the no. of shares outstanding increases. In an OFS, the existing shareholders do not see a dilution of their stake in the Company and the Earnings Per Share (EPS) remains intact, too.

But, what is the price at which the sellers are permitted to sell their shares in an OFS? Can they sell the shares at any percentage of discount or premium?

The floor price is the price at and above which investors can place their orders (floor price is decided by the company). In order to get the shares allotted, investors need to bid at a price higher that then floor price. Indicative price is the volume weighted average price of all the valid/confirmed bids. The indicative price will be separately displayed for Retail and Non Retail Category.

OFS shares are generally allocated in two ways:

- Single clearing price – All investors are allocated share at the same price.

- Multiple clearing price (GMM allocated through this route) – Shares are allocated to investors on a price priority basis (i.e. The highest bidder will be allotted first).

Luckily for investors, there is another option available: the cut-off price option. A cut-off price is the lowest price at which an investor is allocated shares during an OFS. This price will be separately displayed for Retail and Non Retail Category.

This way, the investor can simply apply for shares at the cut-off price without worrying about price discovery (price at which there seems to be the highest demand) at the time of bidding.

The OFS made by the promoters of GMM

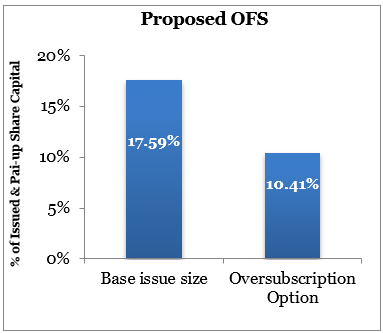

Now that we have some understanding of what an OFS is, let’s go to the OFS in question, the one announced by the promoters of GMM. In their letter to SEBI dated 21.09.2020, promoters of GMM proposed their intention to sell up to an aggregate of 25,71,429 shares, i.e. ~17.59% of the total issued and paid-up equity share capital of the company with an “option” to additionally sell up to 15,21,671 equity shares i.e. ~10.41% total issued and paid-up equity share capital.

The OFS was open for Non- Retail investors on 22 September, 2020 and for retail investors on 23rd September, 2020.

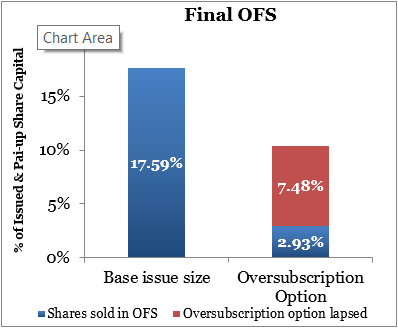

The OFS of GMM was oversubscribed by non-retail investors, following which the promoters decided to exercise the oversubscription option for the OFS issue to the extent of 4,28,571 equity shares (~2.93%) of the company, in addition to the base issue of 25,71,429 equity shares (~17.59%). Accordingly, the final share sale via OFS came upto 30 lakh shares (about 20.52% of the paid-up equity share capital of the company).

So far, we know that promoters have sold 30 lakh shares adding up to about 20.52% of the paid-up equity share capital of the company.

But, which promoters have sold shares in the OFS and what was their objective in doing so?

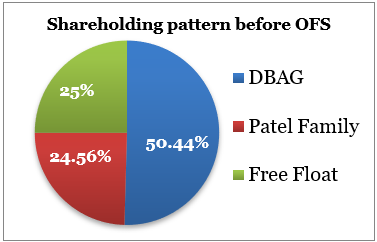

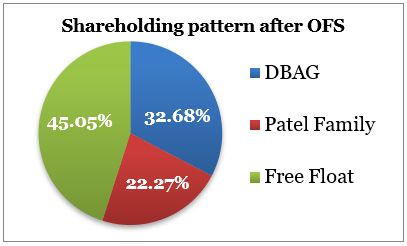

Promoters, Deutsche Beteiligungs AG (DBAG) that owned shares in GMM through Pfaudler Inc., sold 17.76% stake in the company and Patel Family sold 2.29% in GMM in the OFS.

DBAG was a private equity firm (PE firm) that completed six years in Pfaudler Inc. Private Equity firms usually invest with a horizon of 5-7 years; hence after committing 6 years to the company it decided to liquidate part of its stake.

It is worth noting that post this OFS, both DBAG and Patel Family have been locked-in for the next 3 years. So, there will be no further dilution of shares i.e. no liquidity event. Though, Patel Family is vocal about reminding the shareholders, that DBAG is a PE firm and they will look to monetize their stake after the 3-year period. Having said that, the Patel Family has firmly indicated their interest in increasing their stake close to 30% after this aforementioned 3-year period – showing their commitment towards this business.

Okay then, back to our OFS discussion.

While DBAG’s objective in liquidating part of its stake seems understandable, why did the Patel Family that is also responsible for the management of the Company, do so?

Well, the management did so in order to fund the purchase of a stake in the global business of its parent Pfaudler Group. The Patel family is to acquire 26%, while GMM is to acquire a majority stake of 54% in the parent which has an equity value of $50.8 million (More on this later). Post the acquisition, GMM will become the ultimate holding company with the entire business of Pfaudler Inc. being subsumed into itself. This transaction is expected to bring synergies across multiple levels, the combined business would be able to leverage GMM’s highly successful lean-production model and low cost to improve both revenue and profitability. Thus the amount that the Patel Family received from the OFS was in fact, re-invested in the business itself!

Now that we know about ‘Who’ the sellers were, ‘Why’ they wanted to sell and ‘How much’ they wanted to sell, we come to the more pressing issue i.e. as to why sell at a massive discount of 33%?

Before we move on to that question, it’s important to re-iterate that the share price of GMM had rallied 180% since the beginning of the calendar year on the back of positive Q4 FY 2020 and Q1 FY 2021 results, coupled with the announcement of value accretive acquisitions (discussed later in this article). Also, the low float and trading volumes magnified the impact on the price. In fact, the clamour for owning GMM was so loud that at a point of time in early August, the stock traded at valuations of 139X FY20 earnings!

Against the given backdrop, when the promoters had to come out with the price band of the OFS, they had to keep their objective in mind. As discussed previously, the first objective was to raise funds for the acquisition and secondly, they wanted to increase the free float by bringing in quality investors and ensure that investors enjoyed better visibility going forward. Hence, the management had to make a trade-off between, setting the floor price at a lesser discount or run this risk of the OFS not attracting quality investors or being inadequately subscribed. Well, pricing the OFS at a steep discount of 33% was the price the management was ready to pay in order to secure the benefits for the shareholders over the longer run.

While the pricing did not go down well with the investor community, it is important to understand that even at INR 3,500 per share, where the demand for the OFS has come in from the institutional end (oversubscribed), the stock trades at 72x FY20 earnings and such large investors do not commit money to an OFS just because of a huge discount! They are in the game to make money.

This resonates with Charlie Munger’s investing philosophy,

“A great business at a fair price is superior to a fair business at a great price.”

Adding fuel to the fire caused by the OFS pricing, were allegations of insider trading

If sources are to be believed, positions were taken in the stock lending and borrowing mechanism, or SLBM segment around the time of the announcement. The SLB data suggests that few who were privy to the information, rigged the share prices.

The Managing Director, Mr. Tarak Patel, has pleaded a clear conscience saying “From a logical standpoint when we have done the biggest transaction that we could do as a company when we bought out a global parent, when we are bringing in high-quality investors, it doesn’t make logical sense for anybody to take a risk on short term benefits which in the long-term will have more reward for people like us.” He has also offered help to any agency that wished to check or needed information on the matter from the Company.

This goes on to show that the Patel Family echoes Charlie Munger’s thoughts,

“Remember that reputation and integrity are your most valuable assets – and can be lost in a heartbeat.”

However, bad news is what dominates the headlines and influences one’s judgment profoundly. Investors who were still trying to gulp down the shock from the OFS announcement, now had begun to have concerns around corporate governance and quality of the management as well.

However, today, contradictory to the general sentiment, we try to discuss whether the resentment around the announcement is warranted or is the market “Crying Foul” as a consequence of being dispirited by the recent developments and losing sight of the larger picture.

About GMM

GMM Pfaudler Ltd. is a company with over five decades of manufacturing experience in glass-lined equipments, heavy engineering and proprietary products. Over the years, GMM Pfaudler has diversified its product portfolio to include Mixing Systems, Filtration & Drying Equipment, Engineered Systems and Tailor Made Process Equipment. GMM Pfaudler’s products are used primarily in the chemical, pharmaceutical, and allied industries.

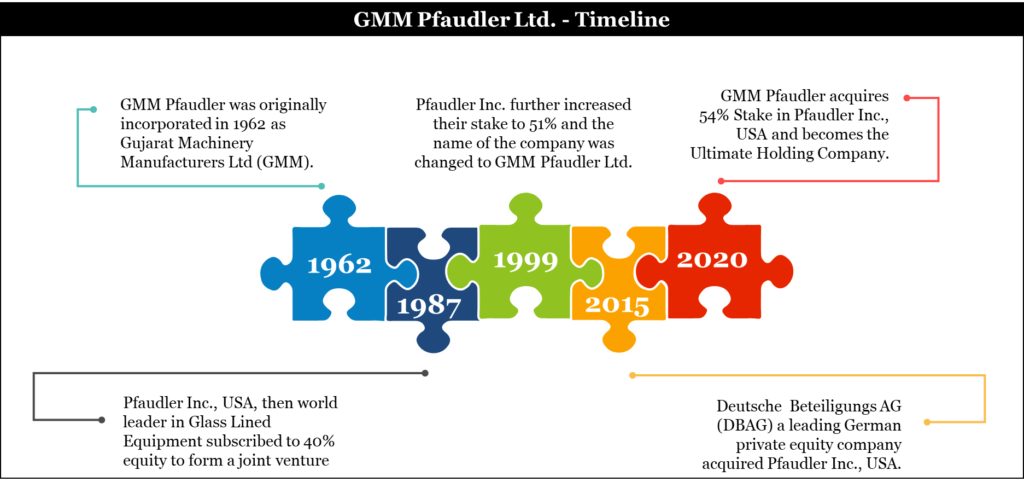

The company has been under the able management of Mr. Tarak Patel, the Managing Director of the Company since June 2015. However, GMM has had a dynamic ownership structure, which can be understood through the following illustration.

This helps us understand, GMM’s long standing relationship with Pfaudler Inc. It is the global leader for corrosion resistant technologies catering to the specific needs of customers in the chemical and pharmaceutical industries. The management of the two entities have worked in close coordination over the years.

GMM has surely come a long way from being a subsidiary to Pfaudler Inc., to now being its Ultimate Holding Co. However, let’s try to evaluate whether GMM has delivered on the expectations of its long term shareholders.

Does GMM pass Buffett’s $1 test?

In the 1980s, Warren Buffett came up with a simple yet effective method to determine if the company/ management were decent capital allocators.

It is renowned as the $1 test:

“We feel noble intentions should be checked periodically against results. We test the wisdom of retaining earnings by assessing whether retention, over time, delivers shareholders at least $1 of market value for each $1 retained.

Unrestricted earnings should be retained only where there is a reasonable prospect – backed preferably by historical evidence or, when appropriate by a thoughtful analysis of the future – that for every dollar retained by the corporation, at least one dollar of market value will be created for owners. This will happen only if the capital retained produces incremental earnings equal to, or above, those generally available to investors.”

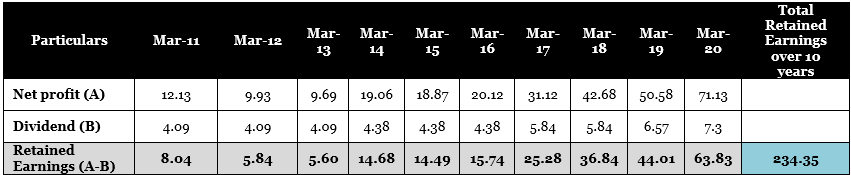

Retained earnings is the amount of net income left over for the business after it has paid out dividends to its shareholders. This remainder of profits is generally re-invested back into the company for growth. Since, this amount essentially belongs to the shareholders, but is being retained by the company and hence analyzing the value it has created for shareholders helps us to understand whether their capital is being used effectively.

So, has GMM passed Warren Buffet’s $1 test?

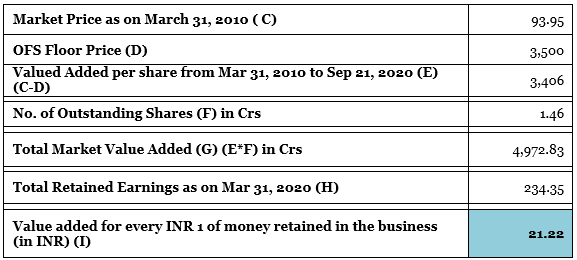

As seen in the working, GMM has accumulated retained earnings of ~INR 234 Crs. over a period of 10 years. Taking the floor price of INR 3,500 to calculate the current Market Capitalisation, it has added ~INR 4,978 Crs. to its market capitalization over the same period! Hence, for every INR of shareholder money retained in the business, GMM has created INR 21.22 value for its shareholders over a period of 10 years.

That is some massive wealth creation!

GMM has certainly aced Buffett’s $1 test.

This reminds me of a famous quote by the legendary investor Phil Fisher,

“I believe that the greatest long-range investment profits are never obtained by investing in marginal companies.”

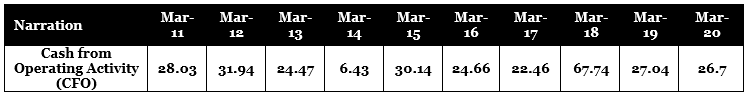

Now, let’s have a look at how smoothly is the blood running through the veins of GMM! Cash Flows, here we come!

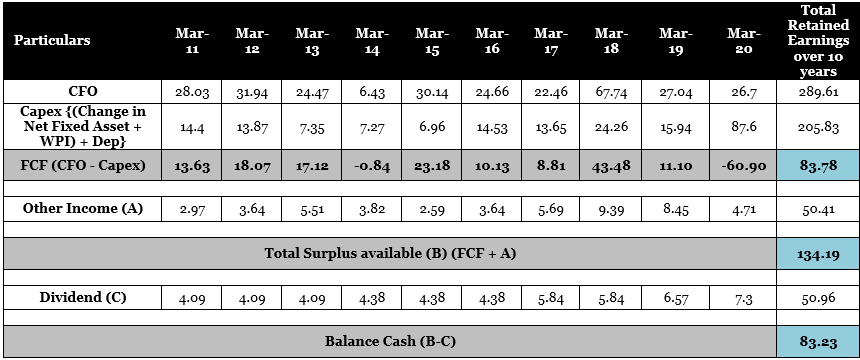

GMM has managed to generate a positive Cash Flow from Operations (CFO) with an average Operating Profit to CFO ratio of 86% over the past decade (FY 2011-2020). Hence, the profits of the business have been translated into cash flows over the period. This provides enough comfort that the profits generated by the company aren’t just book profits.

But, you’d ask, what has the company done with all the cash it has generated!

During this period, the company has generated a cumulative Cash Flow from Operations of close to INR 290 Crs. It has also made capital expenditures to the tune of ~INR 206 Crs during the same period. As a result, the company has generated Free Cash Flow to the Firm (FCF) of ~INR 84 Crs. The Company has also generated other income to the tune of ~INR 50 Crs. Hence GMM has a total surplus fund of ~INR 134 Crs. Out of the Surplus, the Company has distributed ~INR 50 Crs as dividend over the last 10 years and the balance have been retained by the company and invested in Financial instruments and for future deployment in the business.

Wow! Unlike the recent fad of having cash burning business models, GMM has a model that does quite the opposite and has generated quite an impressive FCF over the years and has also put it to good use.

As Richard Branson advises,

“Never take the eyes off the cash flow, because it’s the life blood of business.”

Now it’s time to evaluate GMM’s growth!

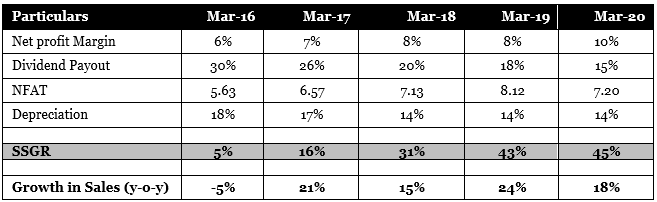

GMM has recorded a revenue CAGR of 19%, 14% and 12% over 3, 5 and 10 years respectively. However, is the growth in revenue a sustainable one?

Self-Sustainable Growth Rate (SSGR) is the rate of growth, which a company can achieve from its profits without relying on additional sources like debt or equity dilution. A company with high SSGR can continue to show high growth rates without impairing its capital structure, i.e. without raising high debt. This extremely useful ratio was ideated by Dr. Vijay Malik.

With the SSGR, we shall be able to derive whether the company has been able to generate sales, made profit from these sales, paid dividend from these profits, invested the undistributed profits in the company’s assets effectively to generate incremental sales/ profits in the future.

SSGR = NFAT*NPM*(1-DPR) – Dep

Where,

SSGR = Self Sustainable Growth Rate in %

NFAT = Net fixed asset turnover (Sales/average net fixed assets over the year)

NPM = Net profit margin as % of sales

DPR = Dividend paid as % of net profit after tax

Dep = Depreciation rate as a % of net fixed assets

If SSGR is more than the sales growth of the company, it indicates that the company has the ability to generate cash in excess of the requirement to sustain its current growth rate. Such companies usually keep on accumulating cash, can afford to give high dividends without impacting prospects of future growth or can increase their growth rate in the future without straining their capital structure.

Note: All the input ratios like NPM, Depreciation, Dividend Payout, Fixed Asset Turnover keep on changing year after year and huge variation in any one year can significantly alter the SSGR output. The formula assumes that profits reinvested in any year get converted in to fixed assets in the same year and start generating sales from next year. However, in reality any capital expenditure (Capex) done by a company would take a few months or years to become operational in form of increased production capacity. Hence, for a more realistic figure, the calculation is based on average figures over 5 years.

As can be seen, the SSGR of GMM has been consistently greater than sales growth indicating that the company can fuel future growth with its cash flows which implies that it can avoid falling into debt traps.

The same has been re-affirmed by CRISIL in its rating letter: “GMM Pfaudler has adequate liquidity. The company has not had any long-term debt since fiscal 2003 while its networth has risen steadily supported by steady accretion to reserves. Furthermore, bank limit utilisation has been low in the past 5 years. Modest albeit improving cash accruals and minimal capital spending in the recent past led to build-up in GMM Pfaudler’s cash surplus, enhancing liquidity.”

Debt-free companies have the leeway of reducing prices, dividend payouts and even suffer losses for a longer period than debt-laden companies. Therefore, debt free companies have higher a probability of coming out successful from economic downturns and provide avenues of long-term growth to investors at a lower risk.

Charlie Munger often says,

“We’ve really made the money out of high quality businesses. In some cases, we bought the whole business. And in some cases, we just bought a big block of stock. But when you analyze what happened, the big money’s been made in the high quality businesses. And most of the other people who’ve made a lot of money have done so in high quality businesses.”

Thus, the pessimism around the stock price up-move, the subsequent downtick, the borrowing of the shares in the SLB mechanism, and the OFS following should not overshadow the fundamentals of GMM Pfaudler at all!

Other Moats

If creation of massive wealth for long term shareholders, a business model that generates positive cash flows consistently and enjoys a sustainable sales growth with no long term debt cannot reaffirm your faith in the Company, we have some more:

- Market leader in an attractive industry:

GMM is the largest glass-lined equipment maker in India with a market share of 51% giving it a wide margin over the second largest player which has a 23% market share. The dominant market share leads to substantial scale benefits, which translates into better profitability. The company now has more than twice the revenues of the second-largest player. GMM’s EBITDA margins are nearly double of its nearest competitor and so is its RoCE. The significance of the scale advantages GMM has built is reflected in its dominance of the profit share of the industry – over the period FY16-19, GMM earned 80% of the industry’s EBITDA.

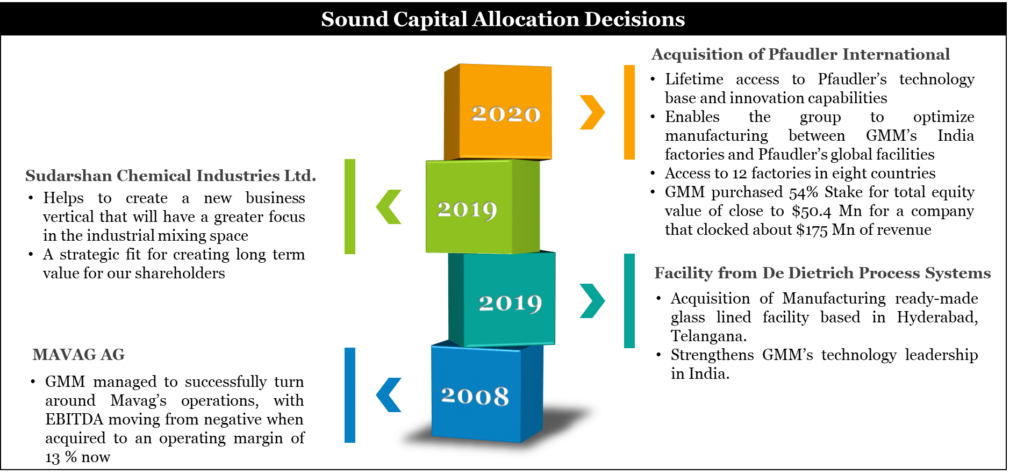

- Sound Capital Allocation Decisions:

The management of the company has laid a strong foundation for the company with its recent acquisitions. They either point towards providing better value added services to its customers, forging strong leadership in the Glass-lined equipment category and creating a global footprint.

- Loyal Customer Base:

GMM has been operating in India for close to five decades and has been a credible supplier to most of the large Indian companies in the pharmaceuticals, chemicals, and petrochemicals sectors. As per Marcellus, “GMM accounts for over 90% of the installed equipment base of these companies.” The recent three key acquisitions shall enable GMM to further its product offerings and get a higher share of the customer’s Capex spend.

- A management that has its skin in the game:

The Managing Director, Mr. Tarak Patel reassured investors that there would not be any liquidity event from either DBAG or the Patel family over the next 3 years. To the contrary, the Patel Family shall look at increasing its stake in the business from the current 22% to 30% after 3 years.

“From our standpoint also I want to make it clear to everybody that we as a family are a long term investor in the business, we have been part of GMM Pfaudler for the last 60 years and continue to be and will be a part of this company going forward. As we will also look to increase our stake, we do want to emerge as the dominant promoter. After a 3-year period we would like to increase our stake close to 30%.”

Reassuring investors about his commitment to the business, he said, “We will put in the blood, sweat and tears and at the right time we will definitely reward shareholders either through a bonus or some kind of mechanism which is going to be EPS accretive for all shareholders.”

Closing remarks

Over all, the management, in the year 2020 so far, has laid some down some great eggs with the recent acquisitions that shall enable GMM to transform into a global leader in the attractive Glass Line industry and leverage synergies of cost and technology. While the acquisition may depress ROCEs in the near-to-medium term, it would be in the best interest of investors to wait for these eggs to hatch!

As for the worries around the recent correction, unlike some permanent price damage events, this could be a temporary setback to the price.

Niraj Shah wrote on bloombergquint.com

“If the management delivers the guided numbers of Rs 2,800 crore revenue at 16% EBIDTA for FY24, then it would be trading at 23x FY24PE at the OFS price of Rs 3,500. That may not look bizarrely-priced, for a company which is the market as well as global leader in its segment.”

I would like to end with a quote from Warren Buffett which rationalizes our thoughts as well:

“Generally speaking, I think if you’re sure enough about a business being wonderful, it’s more important to be certain about the business being a wonderful business than it is to be certain that the price is not 10% too high or 5% too high or something of the sort.”

So, are you still lamenting over your pricked balloon or were you “Crying Foul”?

Disclaimer:

The authors shall take no responsibility for any losses occurring out of investment/trading decisions you make based on the contents of this article.

We are not SEBI registered investment advisors. This article is meant for educational purposes only, please consult your investment advisor before acting upon any information you see here.

We may or may not have open positions, kindly assume that we are biased.

Follow Us @