What would you do, if you were one of the few women out in a man’s world? Go out blazing all your guns, with a solid repository of your work vouching for you!

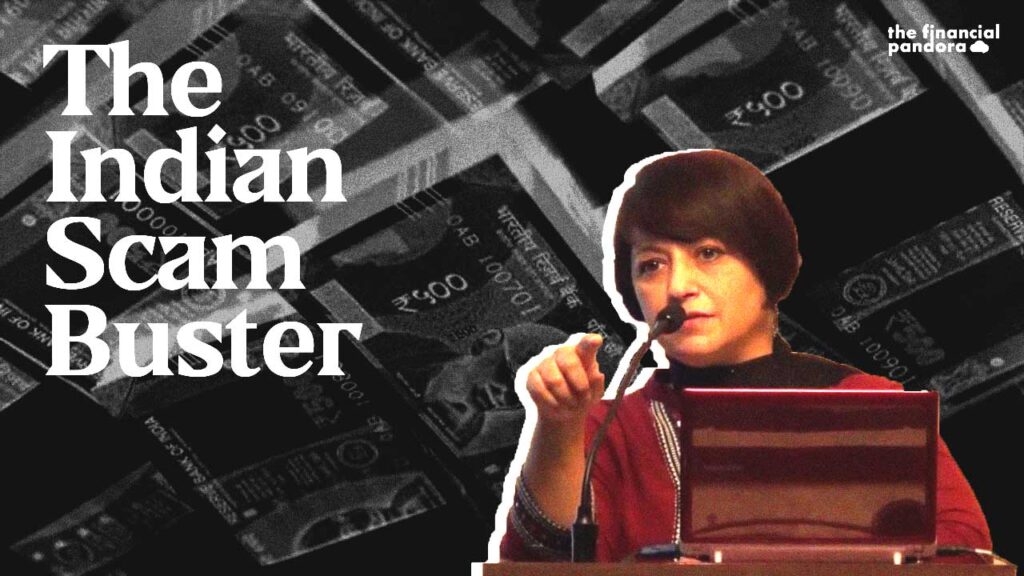

And that is precisely what Sucheta Dalal did, not once or twice, but multiple times when she unearthed financial scams the rest of the country completely overlooked. In fact, her investigative journalism in the field of finance even won her the prestigious Padma Shri Award in 2006. This was shortly after the updated release of her book “The Scam” (2005 reprint), which was a forensic audit into the Harshad Mehta scam, a book that detailed ways the regulators failed to take note of the red flag, and how they could’ve curbed it a lot earlier.

Sucheta’s investigations did not just end there. Years later, she would be the one to ring the bells on the fronts that continued to trade on behalf of Ketan Parekh, even though SEBI had banned him from entering in any sort of market activities. How did she manage to reach this conclusion, which blinded others? Simply by asking the hard questions and not giving up when she met with brick walls. Ever since Parekh’s arrest and his subsequent bail out, Sucheta Dalal had been raising questions about his source of income, or lack thereof and his ability to repay the money back to the market entities. In his bail appeal, Parekh promised to repay every penny if he was granted bail. And that was no menial amount. It compounded to the tunes of INR 100s of Crores.

Sucheta doggedly followed up on this. How can a person whose assets have been seized, and who has been thrown out of the only means of earning, make such claims, and keep up to it? In hindsight, these were obvious warning signs, so why didn’t the SEBI or other regulators pay heed to it? In her interviews, Sucheta claimed that market regulators that she spoke to all turned a blind eye, because their aim was to ensure that the money came back. It shocked her to no end that means by which the money came in, happened to be none of their concern.

Therefore, in 2006, when SEBI restrained 26 entities for trading on behalf Ketan Parekh, it came as no surprise to her. But what broke the SEBI out of it slumber that lasted five and a half years? Well, SEBI had implemented an online tracking system to alert them on securities fraud. One of these alerted them to the possibilities of synchronised trades being carried out, that was inflating the prices of a few stocks. And once the stock catches on to the public’s imagination, these companies would dump their holdings onto them. Eerily like Ketan Parekh’s modus operandi. And as the official investigations began to unravel, Parekh’s hand in it was also revealed.

But Sucheta was not done yet. In the years to come, she would go on to investigate the irregularities in ILFS. Followed by DHFL. In fact, she was one of the few who picked up the INR 20,000 Crores hole in the books of DHFL. She had even made connections between Ikbal Mirchi, Dawood Ibrahim’s gangster associate, and the Promoters, but most of it fell on deaf ears, mostly due to their ministerial links. Not one to be deterred, Sucheta pursued every angle and was able to bring to light, plethora of shady deals which reduced the promoter’s equity holdings to half, while allowing some lenders to cherry pick out assets.

Her most recent expose involved a few Covid-19 related scams. Scamsters were using the panic spread during the lockdown to attack groups that were the most vulnerable to fall for such attacks. The senior citizens, who are not that tech savvy and are being forced to go online because of the lockdown. Many of the scams also managed to target the sophisticated digital users, by spreading fake news and preying on their greed. WhatsApp links were being circulated, which typically directed you to a fake site or asked you to download an unrecognised third-party app. Once you did, the app would work in the background, stealing your financial information, thereby wiping your account clean.

Another scam she highlighted was related to the online travel and tour companies. Scamsters sent out messages to people who had booked flight tickets before the lockdown and were not getting their refunds, with baits like “click here for refund”. And once you did, you would be directed to a clone site, which would guarantee that they will refund the money to your account. Only, these were phishing sites, aimed at collecting your personal information, which was then used to drain your account of your hard-earned money.

Another very interesting scam was related to postal services, stating that Postman will deposit INR 10,000 to your account, for which you’d have to register beforehand, with your bank details, Aadhar Card, PAN Card and other such details. The funny part was that all those who were duped out of their money, did not happen to realise that postal services were shut considering the spread of the virus!

Currently Sucheta Dalal serves as the managing editor of MoneyLife.

Follow Us @