Introduction

At the outset, the Warehousing business looks straightforward – buy the land, build a structure, and store goods. But it is much more complex than that; goods are continuously flowing in and out of the warehouses, there’s a need for accurate coordination among the warehouse management, transporters, manufacturers, distributors, agents, and all other stakeholders, and on the top, it one has to minimize the losses and damages while handling all these goods. As a result, the warehousing business has evolved from a storage business to an industry providing value-added services like sorting, processing, and packaging goods, using technology for data accumulation and analysis..

The Indian Boom

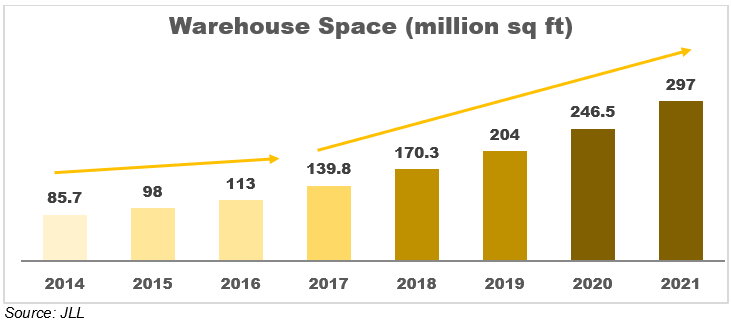

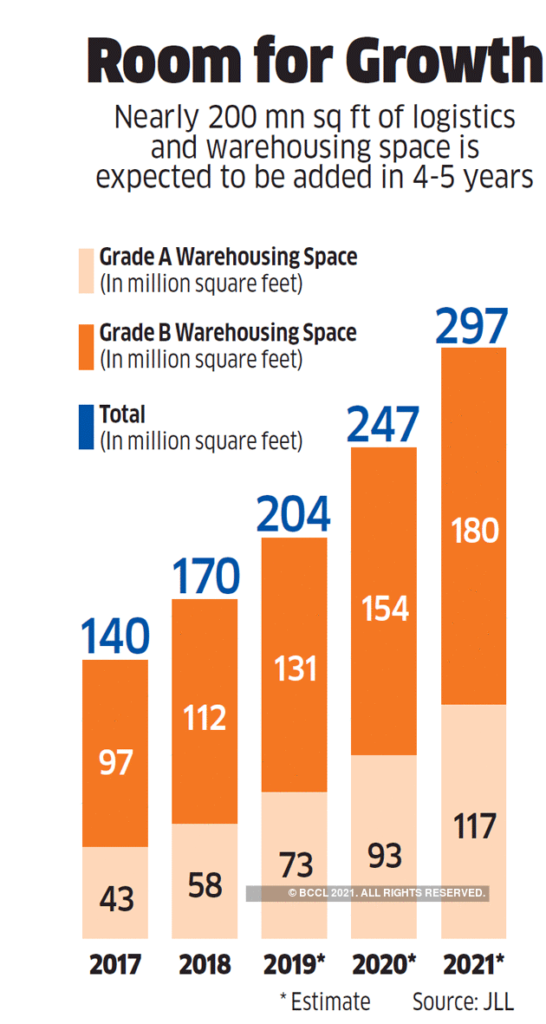

Indian Warehousing industry has seen unprecedented growth in the last few years, with the absolute absorption within the sector has increased from 13 million sq ft in 2016 to 35 million sq ft in 2020 according to JLL (Absorption in simple term means “Area Sold or Leased”). According to Research And Markets, India’s warehousing market is expected to grow from $12.2 billion to $19.5 billion by 2025.

The most significant catalyst for the Indian Warehousing sector was implementing the Goods and Services Tax Act in 2017 and the Indian Government’s grant of “Infrastructure” status to the logistics sector, which includes warehousing.

In India, Warehouses are primarily used to store agricultural and non-agricultural consumer goods like FMCG products, pharmaceuticals, and all the white goods you order on Amazon, among others. Explosive growth seen in the E-commerce segment propelled the Indian Warehousing industry; however, record foodgrain production in the last couple of years has also increased the need for warehouses to store Agri Commodities.

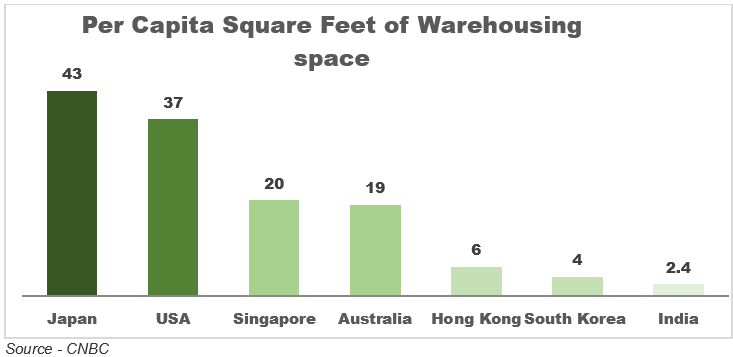

The general trend seen in the Indian Warehousing industry is that of formalization of the businesses, Consolidation of smaller warehouses, Shift from Unorganized to Organized warehousing, and increasing participation of international players with substantial capital investments in warehousing infrastructure (over US$6 Billion of commitments in 2-3 years before covid). All of this points towards the rise of a behemoth in the Indian Economy. Even after the recent upsurge, India remains behind developed economies in per capita warehousing space, which tells us that there’s more scope for growth in this industry.

Why the Boom

Before introducing the Goods and Services Tax Act (“GST”) in 2017, controls by states over some tax laws in India and companies had to build or lease at least one big warehouse in all the states to bypass these taxes resulted in high storage cost. With the uniformity of taxes in GST, the companies could build few big warehouses that could serve different states and smaller warehouses in each of the states (Hub and Spoke Model). This has led to the rationalization of the warehousing capacity in favor of well-located hubs and made the operations leaner and efficient. It has also resulted in the consolidation of smaller units.

Although the pandemic has created havoc in everyone’s life, it has helped the warehousing sector in 2 ways; first, the supply chain disruption caused by the lockdown gave a reality check to manufacturers, and in response, they started increasing their inventory levels, thereby resulting in higher demand for warehouses and secondly Covid-19 brought a change in the consumption pattern and a shift in buying behavior towards adoption of E-commerce and in turn created a growing need for more storage spaces. The cold chain logistics and warehousing business are also booming with rising demand from food grains, dairy, horticulture, poultry, and pharmaceutical businesses.

Indian Government’s focus on making India a global manufacturing hub has caused warehousing clusters to expand rapidly beyond the top cities into Tier II & III locations. Indian Government has also granted infrastructural status to the logistics sector, which meant it could benefit from various infrastructure policies of the Government. In the agricultural warehousing space, measures taken up by the Government to curb post-harvest loss are increasing the demand for modern agri-warehouses and cold storage in the country.

The demand in the industry is so high that we saw Malls, Marriage halls, Auditoriums, etc., being used to store goods during the pandemic. In February, Reliance Retail said it is building its supply chain by converting its Reliance Market stores into fulfillment centers to further the reach of its new commerce venture, JioMart, and expedite deliveries.From a Supply point of view, Warehousing in India has traditionally been unorganized and fragmented, but after the onset of GST, things have changed drastically, and there has been the increased attraction of foreign capital. On the other hand, demand for a better quality of storage space has been growing significantly alongside growth in signing long-term contracts showing commitment and stability in the Warehousing sector. According to Knightfrank, the industry has seen 3x transaction growth from 2017 to 2020 in the top 8 cities.

The demand is also coming from companies that are looking to shift their storage needs to Grade A facilities and need for larger structures with around 400,000-plus sq. ft being the average demand (‘Grade A’ and ‘Grade B’ stock are industry’s lingo for modern and well-equipped warehouses. ‘Grade C’ is a godown).

The Way Ahead

2017 would be heralded as the year when a giant Industry was rejuvenated due to historic tax reform. However, a lot needs to happen for the Warehousing sector in India to be more profitable and sustainable as it is still substantially fragmented, unorganized, and lacks technological advancement. Individual Warehouse investment is not very profitable; the business needs to become part of a larger supply chain providing end-to-end solutions, including transportation, storage, financing warehouse receipts, and other value-added services.

The Indian warehousing sector is gradually adopting modern technologies like the Internet of Things (IoT), turning our Godowns into Warehouses. Welspun One part of the well-known Welspun Group has announced their Bhiwandi facility, which has features like park management and maintenance on a tech-enabled platform, an IoT-driven traffic management system to minimize travel distance trucks with RIFD tags to predetermine directions and docking. In India, FM Logistics, which is a family-owned French logistics company active in 14 countries, has implemented drones for inventory control, fully automated packing lines, paperless operations with bar code scanning, GPS tracking at its warehouses.

Space has value, but how you utilize it determines its worth!!

For sources click here

This post was written in collaboration with Asif Yahiya Sukri LLP. Asif Yahiya Sukri LLP provides unparalleled personalized financial services to a broad range of clients across different geographical locations. With a presence in the USA, India and the MENA region, they ensure that all of your financial decisions are made carefully and with your best interests in mind. They are innovators who understand what goes into building companies.

You can also reach out to them on info@aysasia.com

Follow Us @

Sources:

https://www.careratings.com/uploads/newsfiles/13042021060144_Update_on_Warehousing_Industry_-_April_2021.pdf

https://www.vccircle.com/how-2020-set-off-indian-warehousing-s-growth-decade/