About

NSE: DIXON BSE: 540699

Current Market Price per Share (as of 8th Aug): Rs 8,005

52 weeks High / Low: Rs 8,358.00/1,560.00

Book Value per Share: Rs 467.87

Market Cap: Rs 9,311 Cr

Dividend Yield: 0.05 %

Dixon Technologies Ltd was established back in 1994 in a single office with the thought of taking the advantage of underpenetrated electronics manufacturing market in India. The company started by focusing only on one product i.e. manufacturing colour television. At present Dixon is a homegrown pioneer in contract manufacturing, providing design-focused solutions in consumer durables, home appliances, lighting, mobile phones and security devices to customers across the globe, along with repairing and refurbishment services of a wide range of products including set-top boxes, mobile phones and LED TV panels.

After 24 years of foundation, Dixon Technologies (India) Ltd went public in September 2017. The IPO price was Rs. 1,766 and was subscribed by 118 times. It listed at Rs. 2,725 i.e. 54% premium to the offer price. Dixon Technologies has been a darling for IPO investors as it is currently quoting at Rs. 7,723 delivering a gain of 337% since its IPO.

The market cap went 3x after secondary issue.

But who are the men behind building this manufacturing mammoth of India?

Guards of the Company

Mr Sunil Vachani (on left) is currently the Executive Chairman and also the promoter of the company. He holds a degree of Associate of Applied Arts in Business Administrations from the American College in London. He has held positions like chairman of the Electronics and Computer Software Export Promotion Council of India and Co-Chair of the CII ICTE Committee.

Mr Atul B Lall (on right) is the Managing Director of the company. He holds a Master’s Degree in Management Studies from the Birla Institute of Technology and Science, Pilani. He is associated with the company since inception. (Dixon Technologies Website). Both of them have been able to give competition on a global level in terms of costing and have built a reputation for the company.

The company appoints a different Chief Operating Officer (COO) for all segments to manage the product life cycle, efficiently.

Business Model

The clientele comprises of leading global and domestic brands that the company serves, original equipment manufacturer (OEM) as well as original design manufacturer (ODM) which are the two main businesses of Dixon.

- Original Equipment Manufacturer (OEM)

Dixon only deals in the B2B segment. They charge a fixed cost to their client for eg. Panasonic to convert the raw material into a finished product. The fixed cost charge is not affected by fluctuation in raw material price. Production is carried out as per the customised requirement of the clients.

- Original Design Manufacturer (ODM)

DTIL is one of the biggest ODM players in India. Under this model, the company is responsible for the complete logistics and supply chain management right from designing, planning, sourcing of raw materials & components to final product manufacturing and then shipping, including warranties concerning defects in raw materials and technical faults. The company is trying to expand its repairs business as it has good margins.

Future possibilities:

The company has a huge space for opportunities in manufacturing white goods. Given the fact that they have more than two decades of experience. DTIL can come up with its own line of products as they already know what the market wants and might as well give competition to smaller players.

So you might be thinking what does the company make for which the market is rewarding such a premium? Let’s have a look at their product segments and client base.

Dixon Technologies deals majorly six segments which are as follows,

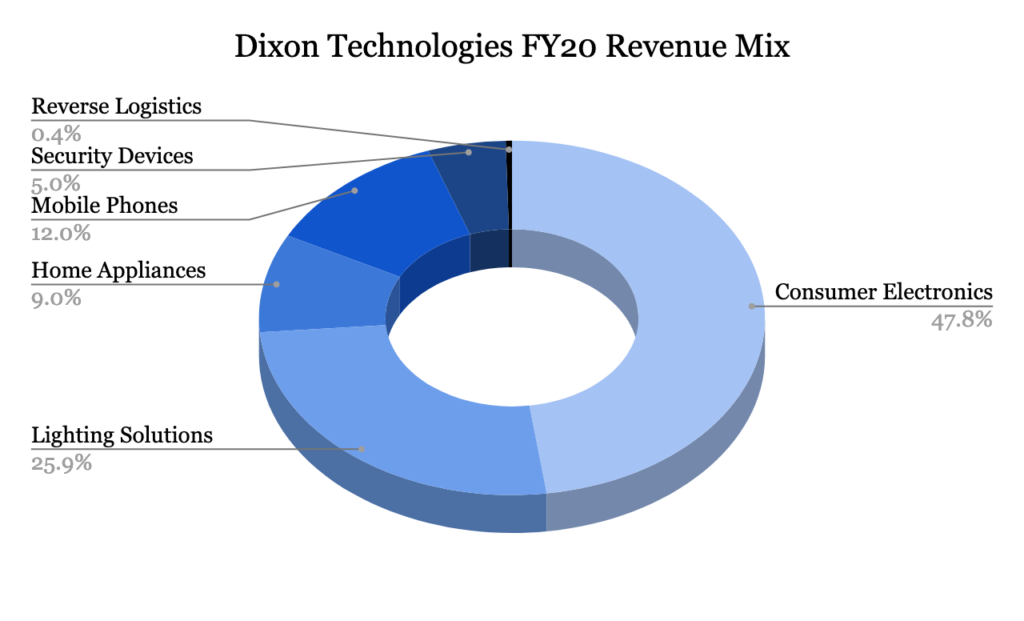

The Revenue Mix from all six segments is distributed in the following manner,

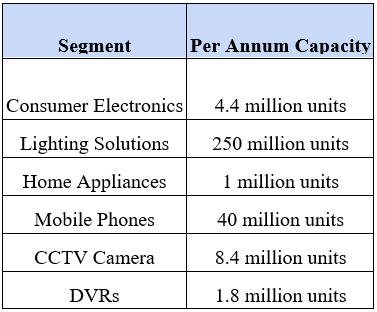

Manufacturing Capacity

To know how huge a manufacturing company is, it is very important to know the capacity and infrastructure built by the company. Capacity helps in estimating the future growth prospects if the plants run at 100% capacity subject to rise and fall in demand.

Given the fact that the company has built such a huge capacity is it able to deliver to its potential customers? The answer is Yes. The company started with manufacturing colour televisions back in 1994 and slowly expanded its wings, to various electronic segments with the aim of being a leader in manufacturing the product at the lowest possible cost.

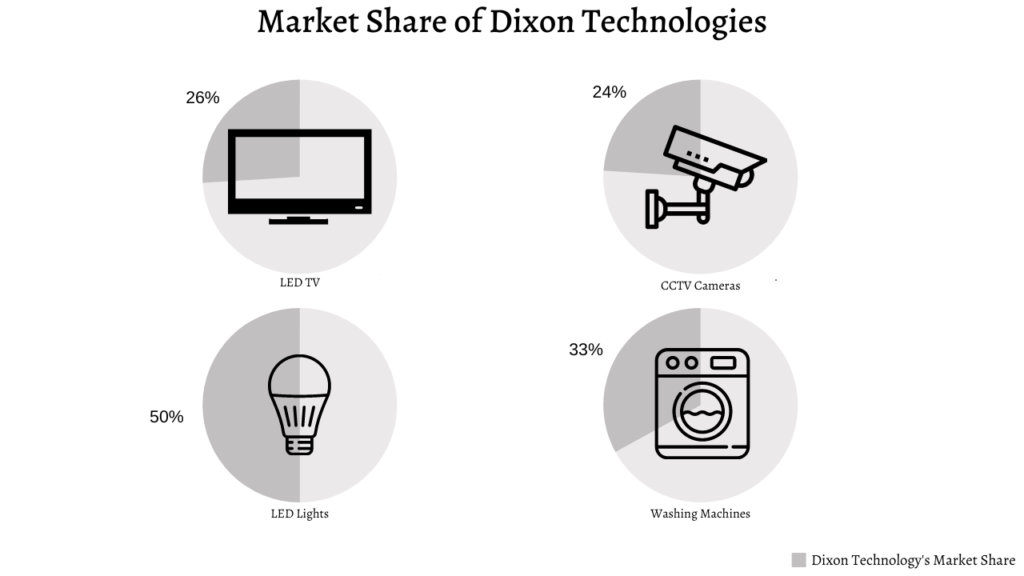

Dixon Technologies Market Share

One of the reasons why Dixon enjoys a good chunk of market share is because over the years the company has been able to build a well-diversified client base. They have been able to enter new product categories with their existing clients, aggressively ramp up capacity with minimal CAPEX and attain market leadership while maintaining a pool of clients.

Having such a huge capacity with a diversified client base means that the company would be earning huge profits? Well, let’s see.

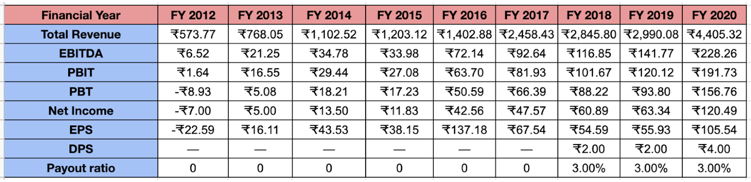

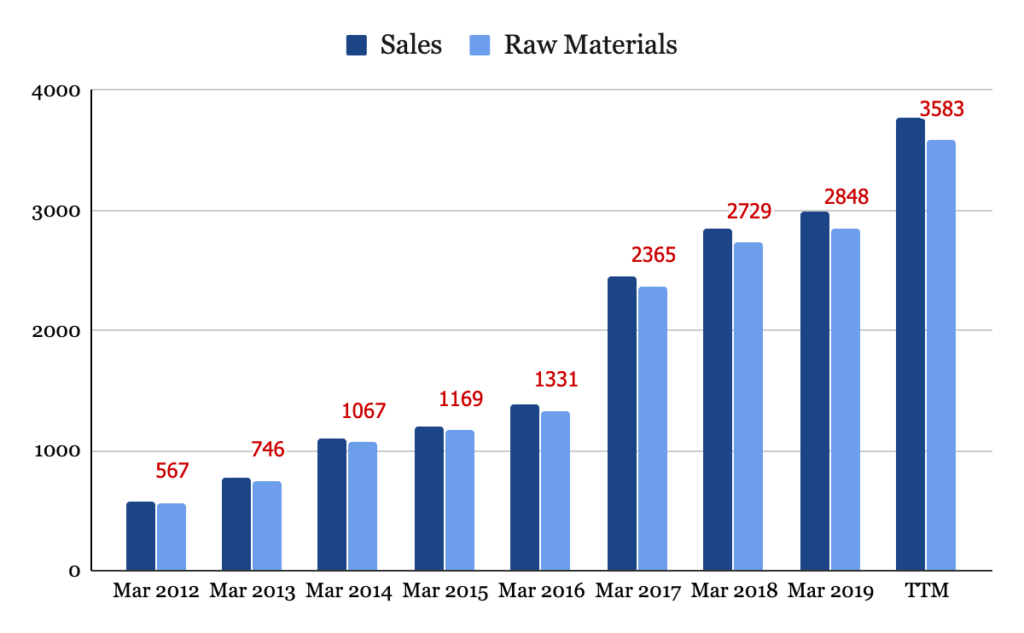

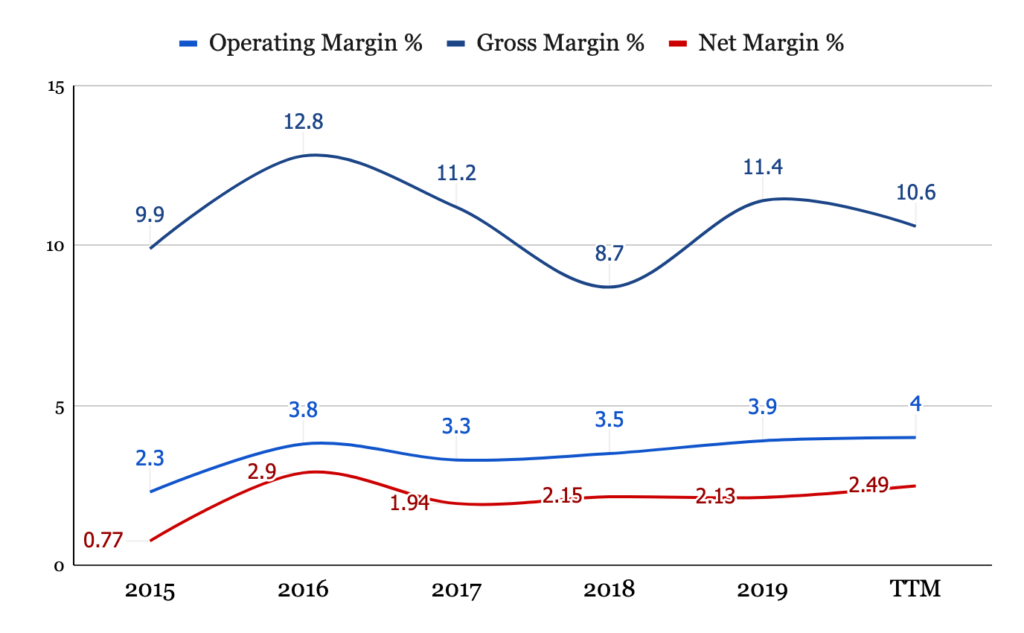

This is the revenue trendline for the last 8 years and we can observe that there has been an exponential growth for the company. But the majority of the companies are focusing on bringing down the price of gadgets to make it more accessible to a wider base and also because of competition from Chinese companies and hence this has affected the margins of Dixon Tech. The company sacrificed a lot of itsn margins to gain more market share as seen below

Taking advantage of the capacity they have built-in, it was easy for the company to get huge orders of manufacturing because economies of scale helped Dixon’s client to reduce the cost of production on a large scale.

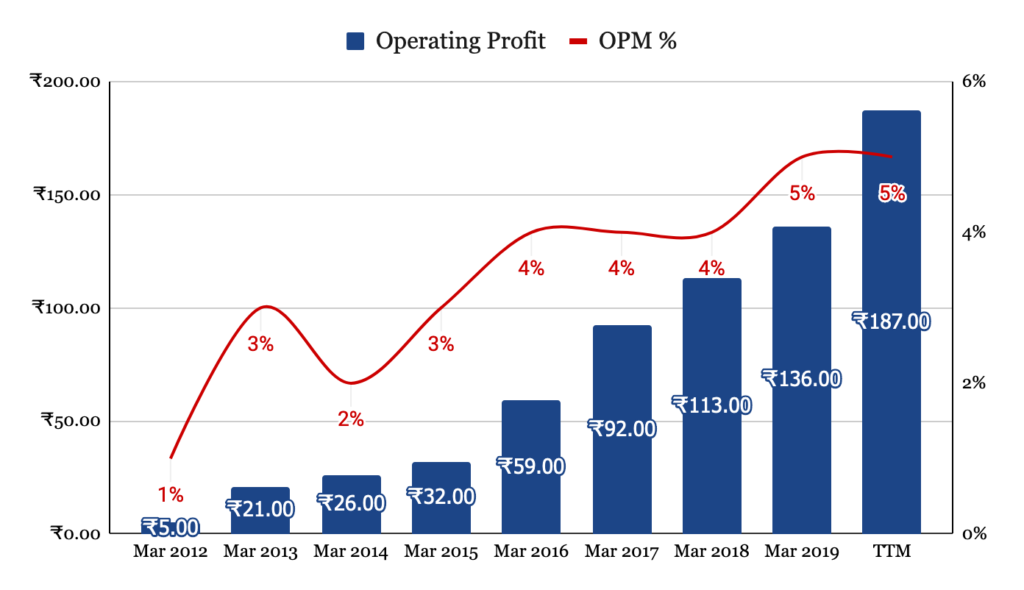

With the rise in operating profits over the years, Dixon has been able to increase its margins but have mostly been flat. It depends on the growth in the future, whether the company can go towards higher single-digit or double-digit margins? The company imports its raw materials from China. To enhance its margins the company is going for Backward Integration including sheet metal, plastic moulding and wound components. That helps the demand and lead time management, inventory management and control. However, the company in the last concall has revealed its strategy to increase its focus on reverse logistics business as it can demand better margins from clients.

Economies of Scale is quite not working well for the margins of Dixon tech as a big chunk of the cost goes into raw materials. Keeping in mind such narrow margins, the company is still able to earn considerable profits. But is the company able to create any value for the shareholders?

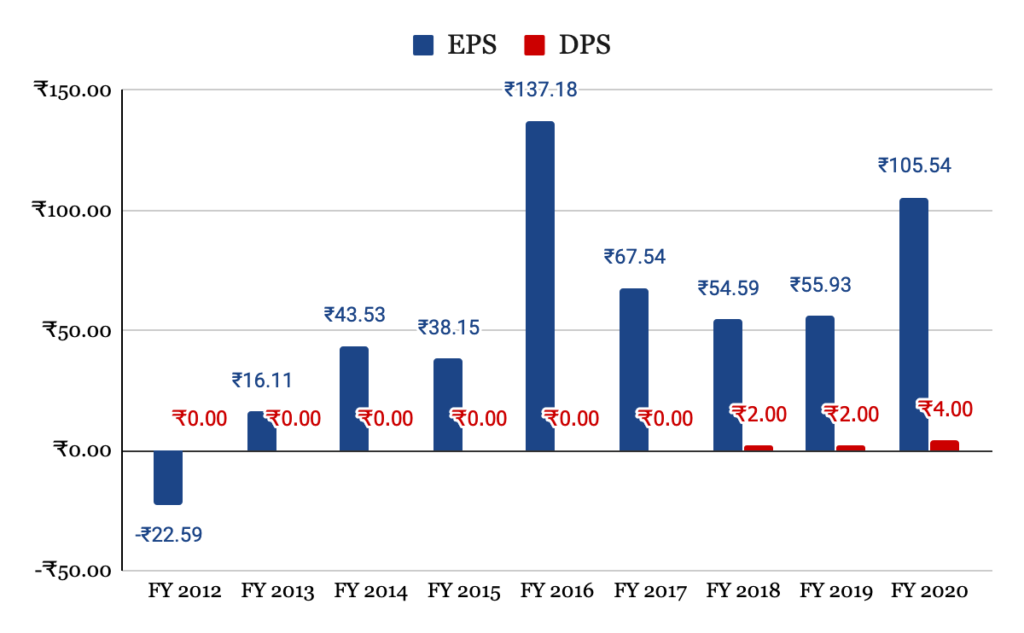

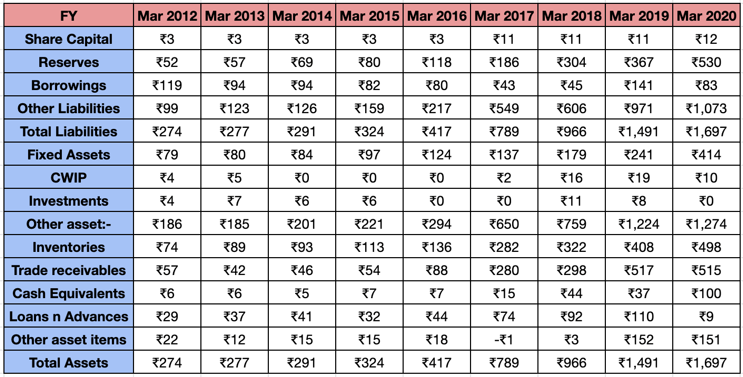

DTIL has a very good EPS but the records are not consistent. Also, the company has recently started paying a dividend which is hardly 3.58% of the net profit The reason being DTIL has been expanding its capacity and constructing new plants, the latest being at Tirupati. EPS of the company is highly correlated to the domestic demand of consumer durables. It’s important to see after multiple years of CAPEX, what is the strength of the Balance Sheet of DTIL.

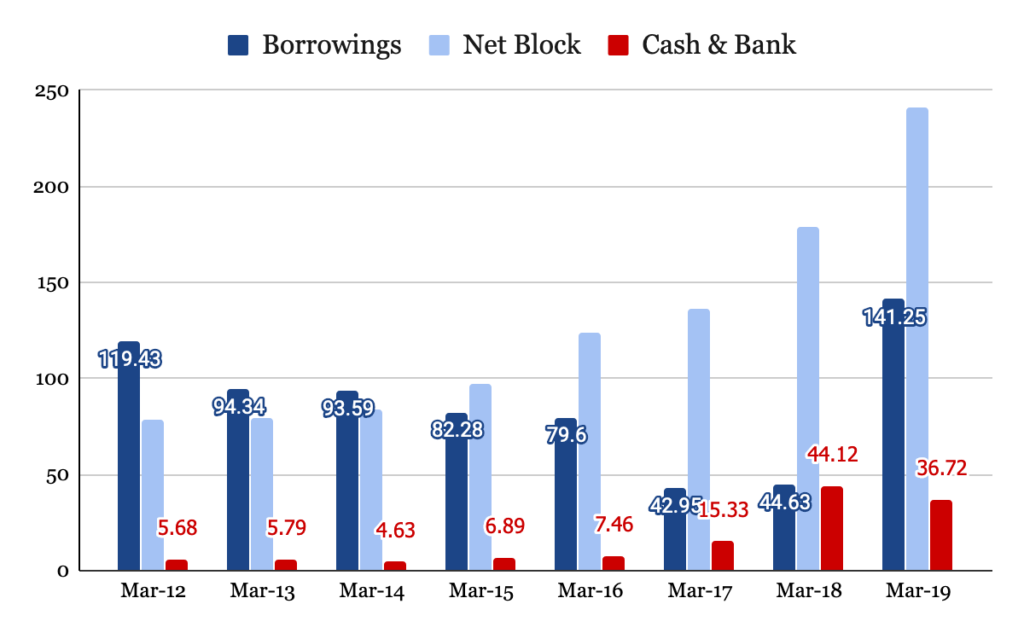

Net block is the gross block less accumulated depreciation on assets. Net block is actually what the asset is worth to the company.

Here we can see over the years how DTIL was able to manage its cash efficiently by constantly reducing their borrowings and increasing their netblock value and piling up cash at the same time. Due to this they were able to bring in new technology for the company and have grown from one single office to 11 plants all over India. But in the end, most of the money went back into the business and hence investors didn’t get any cash returns (in the form of dividends)

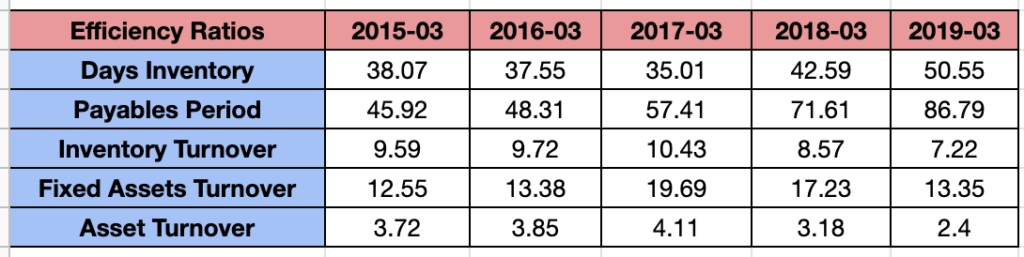

For a company to handle such a huge production scale, they need to have their logistics and supply chain at place, which involves inventory management. Moving of goods out of the warehouse depends on the demand in the market and hence we will have a look at some ratios which will help us know how DTIL manages it.

- Inventory turnover:

It shows how many times a company has sold and replaced inventory during a given period. This helps businesses make better decisions on pricing, manufacturing, marketing, and purchasing new inventory. A low turnover implies weak sales and possibly excess inventory, while a high ratio implies either strong sales or insufficient inventory (Investopedia)

DTIL’s Inventory Turnover Ratio has been coming down significantly for three years, this is possible because of increasing competition in the market as new players are entering this segment.

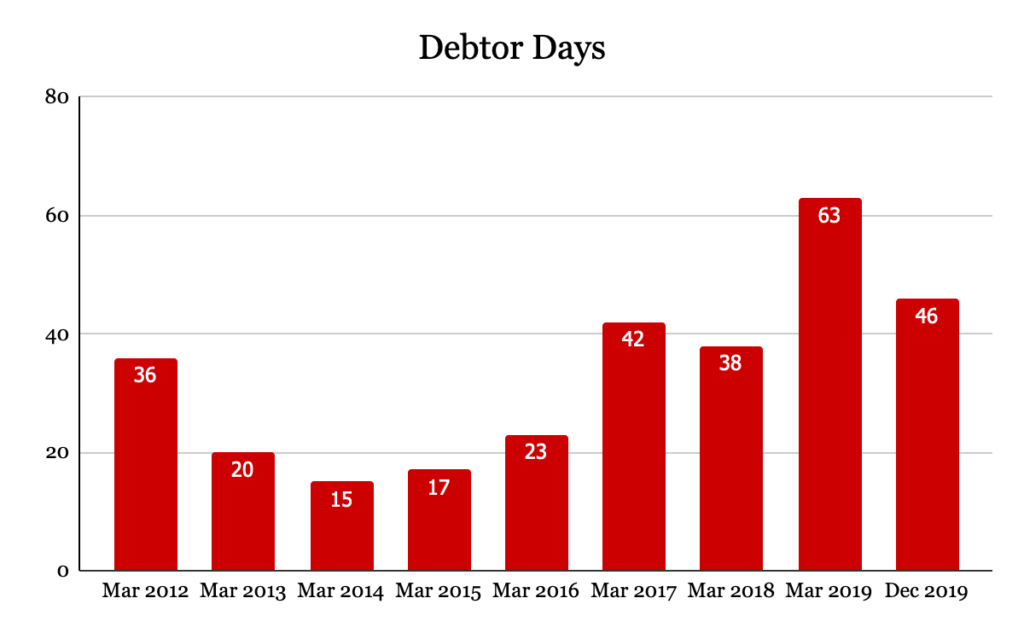

As we now know that DTIL has both domestic and international clients spread all over India and abroad and for their business to run they need to get payments from them on time for the cycle to continue.

- Debtor days:

It is a measure of how quickly a business gets paid. It’s the average number of days taken for a business to collect payment from its customers. The average time it takes for a business to get paid within a set period can reveal a lot about the state of the business; a longer number of debtor days may mean that cash is in short supply. The less cash a business has available to it, the less able they are to invest in growth opportunities, or even to pay their suppliers. (Fluidly)

Debtors used to pay DTIL very much on time. The reason for the increase in the debtor days can be because of the slow down which Indian economy was facing since September 2018, which had led to demand falling drastically resulting in lower volumes which is not good for DTIL’s business. Cash received then goes into production which eventually helps in increasing the profitability of the company. Let’s see how DTIL has been managing its cash at work and what kind of returns were they able to get on their invested capital. This can also be due to inefficient debtor policies. Also, will affect the working capital cycle.

Cash received then goes into production which eventually helps in increasing the profitability of the company. Let’s see how DTIL has been managing its cash at work and what kind of returns were they able to get on their invested capital.

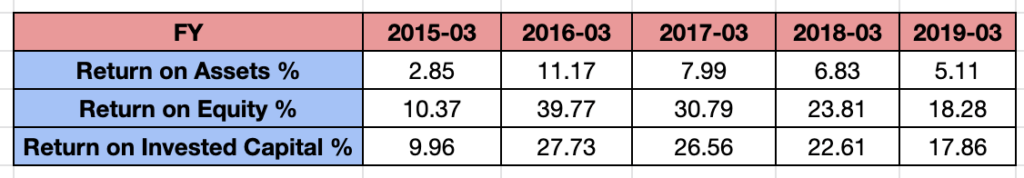

Decreasing return on invested capital is not a good sign, but the company is focusing on becoming the one-stop solution for B2B clients in electronics segments. Hence though DTIL is getting huge volumes, the margins are contracted thus leading to decreasing ROIC.

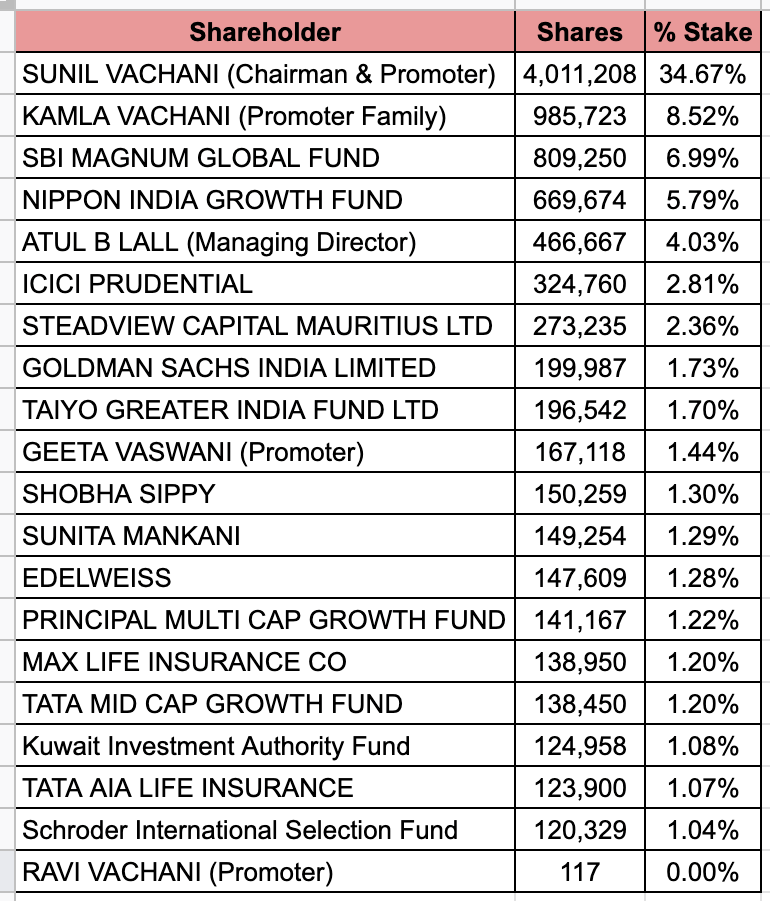

Who owns this huge Manufacturing Mammoth of India?

One of the most interesting parts is some of the early investors were, Bennett Coleman and Company Ltd who acquired a 9.68% stake in Dixon for $1.5 million (Rs 7 crore). In 2008, India Business Excellence Fund-I, a fund managed by Motilal Oswal Private Equity Advisors, invested $9.95 million (Rs 40 crore) in Dixon for a 22.86% stake which they took an exit from the company by taking it public.

These are the biggest investors who are holding chunks of DTIL. The point to worry over here is that the promoter holding is just of 36.11% which is extremely low for any company, especially for a midcap company. Usually, promoter holding > 50 % is considered to health. But for DTIL we can see that Mutual Funds have a good hold on the stock. Also, the insiders including employees have been continuously offloading the shares as DTIL has shown good momentum over the last one year. Promoters themselves have sold 2.76% stake in the last 11 quarters.

Valuation

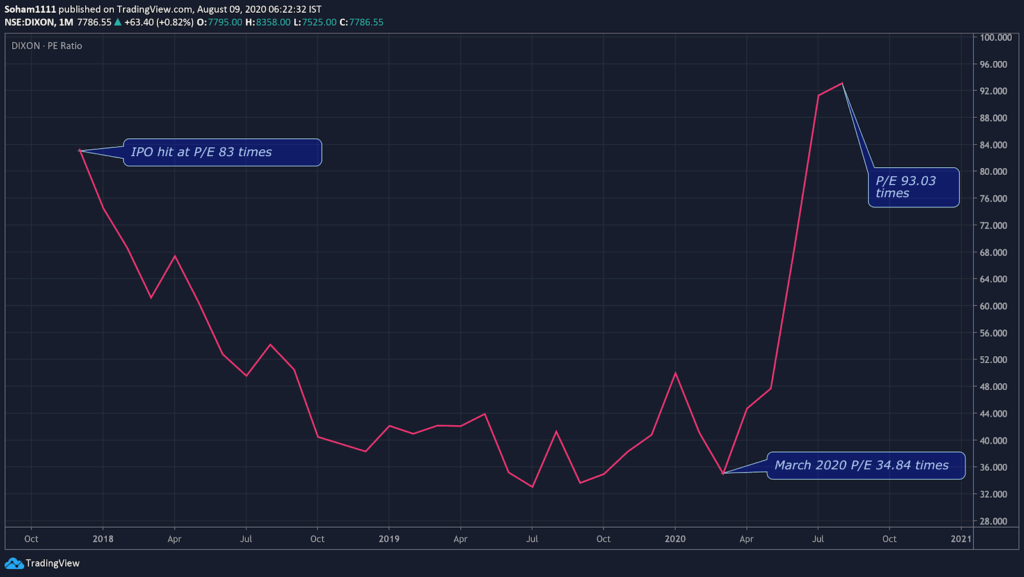

Lifetime Chart of DTIL

Historical P/E Chart

As of now, DTIL is being traded at 93.03 times of its earnings ie. the shareholder has to pay Rs. 93.03 to the company to earn Rs. 1. This is very expensive. But if we look at the historical P/E, Dixon had was ranging P/E range of 32x to 44x. Even that is quite expensive but people are betting on the story of Dixon as a huge electronics manufacturing company.

P/E Valuation

Assuming the median as P/E= 40x

Current EPS= Rs. 86.68

P/E Valuation= Median P/E x Current EPS

P/E Valuation= Rs. 3,467.2 per share

The current Market price is 124% higher to the P/E Valuation.

GRAHAM NUMBER

The square root of (22.5 x Earning Per Share x Book Value)

Therefore, Square root of (22.5 x 86.68 x 476.67) Graham Number= Rs. 964.18

The current Market Price is almost 7 times more than that of Graham Number. One cannot go for a Value play in DTIL.

Opportunity of DTIL

Global Scenario

i. The global EMS (Electronic Manufacturing services) and ODM (Original Design manufacturer) was valued at US$ 525.99 billion in 2018 and is anticipated to reach US$ 734.40 billion by 2026 growing at a CAGR of 4.26% between 2019 to 2026.

ii. Underpenetrated market potential in developing nations such as India, Taiwan, Asia-Pacific region for EMS and ODM market is anticipated to grow at a CAGR of 4.8%, remain the highest growing segment between 2019 to 2026.

iii. Growing demand in the downstream industry and more brands looking to outsource their manufacturing to ensure cost-effective pricing and reduce dependence on China.

Domestic Scenario

i. The electronics manufacturing is expected to increase at an annual rate of 30% over the next five years and clock Rs 11.5 lakh crore (US$ 163.14 billion) additional production during this period, says electronics and IT secretary, Mr Ajay Prakash Sawhney. The exports of electronic products are also estimated to grow in the range of 40-50% per cent annually over the next five years.

ii. India has seen an increase in mobile manufacturing from 6 crore handsets five years ago to 33 crores at present, and meeting over 90 per cent of the country’s mobile phone requirements through domestic production.

iii. There are around 22 domestic and international firms, including iPhone maker Apple’s contract manufacturers as well as Samsung, Lava, Dixon and so forth, that have lined up with proposals for mobile phones production worth Rs 11 lakh crore (US$ 156.05 billion) over the next five years. These proposals under the government’s Rs 41,000 crore (US4 5.82 billion) production-linked incentive (PLI) scheme for mobile phone manufacturing are expected to create around 12 lakh jobs, 3 lakh direct and 9 lakh indirect employment opportunities in the country.

iv. The television industry in India reached an estimated Rs 787 billion (US$ 11.26 billion) in 2019 and is projected to reach Rs 955 billion (US$ 13.66 billion) by 2021. Shipment of TVs in India increased by 15% annually to reach the highest-ever level of 15 million units in 2019. As of FY20, electronics, domestic appliances and air conditioner market in India were estimated to be around Rs 5,976 crore (US$ 0.86 billion), Rs 17,873 crore (US$ 1.80 billion) and Rs 12,568 crore (US$ 2.56 billion), respectively.

v. There is a lot of scope for growth from the rural market with consumption expected to grow in these areas as penetration of brands increases. Demand for durables like refrigerators and consumer electronic goods are likely to witness an increased demand in the coming years, especially in the rural areas as the Government plans to invest significantly in rural electrification. (Source: IBEF)

Conclusion

i. While Q1FY21 was hurt by the lockdown, Dixon continues to lead the government’s self-dependence measures to manufacture consumer durables. It is well placed to benefit from the PLI scheme.

ii. The next Megatrend is in vigorous policy measures which are undertaken by the government to lower imports of consumer durables, increase domestic manufacturing and ramp up exports as major OEMs are in process of lowering dependence on China and rebalancing supply chains. for which DTIL will be the biggest beneficiary.

iii. Competition from peers like Amber Enterprises can lead to a decrease in market share as favourable government policies invite more players in the market to take benefit.

iv. Some analysts say a key risk for these homegrown players may emerge should the demand drought in consumer durables prolong in the country.

One has to wait and watch how the demand game plays out once the pandemic has settled as right now there is huge shoot up in demand but no one knows how sustainable it is. Hence, the company’s plan to expand in repairs business is a very good decision because more the units sold, more will need repairs.

Disclaimer:

We, shall take no responsibility for any losses occurring out of investment/trading decisions you make based on the contents of this article.

We are not SEBI registered investment advisors. This article is meant for educational purposes only, please consult your investment advisor before acting upon any information you see here.

We may or may not have open positions, kindly assume that we are biased.

Sources: TickerTape, Screener, Moneycontrol, Companies Website, Annual Reports, Brokerage Reports.

Follow Us @

Some Unrelated Stories!