A guide to why Bitcoin doesn’t seem to be leaving us alone.

Do you see the words Bitcoin and Crypto popping up again in your Zoom circles again after a not-so-brief hiatus? Let me try to explain why.

Bubbles 101

To understand the future we only need to look at history. It tells us that we’re all suckers for hope. The tulip mania in the Netherlands or the South Sea Bubble in Britain or more recently the DotCom Bubble — they all tell the same story:

Step 1: Intrigue

X represents an opportunity never seen before. X has the power to change the world. Anyone who doesn’t hold X is an idiot. Its a guaranteed millionaire maker.

Step 2: Euphoria

Then? The price of X skyrockets — 100%, 200%….5000% who knows? And just when a feeling of immortality creeps in… BANG — 0. Everybody loses their shirts (often their houses too).

Step 3: Hindsight

” Whoever invested in X was a fool ”, said the fool.

The same script has repeated all too often — kind of like Michael Bay movies.

Usually, when a bubble bursts however, it’s horrible — people lose a lot of money, The Asset dies, and life goes on. However, it ever so often something magical happens. The crash shakes out the non-believers, the speculators, and other unsavory participants and we’re left with the good apples. That’s exactly what happened with the DotCom bubble too right? It was only the most resilient companies that survived. And now those companies are some of the most valuable corporations in the world.

Bitcoin might have a similar tale to tell.

Bitcoin 101

So let’s start with a quick refresher course, shall we? Bitcoin was the first cryptocurrency. A peer-to-peer digital cash system running on a magical new validation system that filled a very big hole that existed in the internet community — Trust.

Pre-bubble, Bubble, and post-bubble in 30 seconds:

We all know December 2017 all too well. Bitcoin was the next big thing. It was almost ‘a sure thing’(Codeword for ‘a bubble’). All hail the new global reserve currency. Everybody was trying to get in on the ground floor. The price shot up from $1,000 -$20,000 in 6 months. It created instant millionaires. Until of course, like any bubble, it crashed from $20,000 to $3,000 (as of Dec’19) and was resigned to the dustbin of internet has-beens.

But then, the price stabilized (stable in crypto terms is ‘did not go to Zero’) and even started rising again, and has been between $5k-$10K ever since. Till the storm hit that is.

2020 — The perfect storm:

I call this the perfect storm because it is the culmination of 3 different events that set conditions for Bitcoin’s Jordan-esque comeback.

- Coronavirus and the global economic sh*tshow:

Black Swan? Maybe. Bitcoin’s golden goose? Quite likely.

The COVID19 crisis and the subsequent market collapse saw bitcoin being tested in its original use case — a hedge against the financial system. And boy did it fail spectacularly. March 12th saw $BTC prices plunge by more than 50% almost perfectly correlated with the market — the very thing it was to hedge.

However, defying all expectations, it climbed again. and again. and again. until it crossed it earlier top and is now trading at around $9,000 a pop (an 18% increase over the same time last year).

Just $BTC things.

- The Fed and the money printer:

When the US Stock market collapsed, it was practically a game of limbo -’How low can you go?’ That’s when the Fed (a.k.a the Federal Reserve) and the US Govt. stepped in and said wait a minute, why don’t we just stop it from falling? and they did just that — a $3 trillion stimulus package and unlimited Quantitative Easing (I’ll get to this in a second) from the Fed has held up the stock market, for now.

What is Quantitative Easing (QE)? Let the Telegraph Explain:

Basically, the Fed printed and will continue to print more money to keep businesses afloat making the money you already hold less valuable.

How does Bitcoin come into the picture? Well, Bitcoin is meant to act as a store of value (of last resort, but first access) when markets go haywire (case in point — Venezuela). And with this unlimited QE ‘propping up’ Currencies, Equities, and Debt markets — a lot of people feel that systemic economic shocks are coming, and are warming up to the potential of $BTC as an alternative exit route. Simply because it’s disconnected from the financial system.

Now time for the biggest reason behind Bitcoin’s resurgence.

- The Halving:

What is a halving? A Bitcoin halving event is when the reward for mining Bitcoin transactions is cut in half, which means for each block created the miner’s reward will fall from 12.5 BTC to 6.25 BTC immediately.

This will reduce the number of new bitcoin created per block cutting Bitcoin’s inflation rate theoretically in half. Just imagine it as if, when the demand for gold is skyrocketing, 50% of gold miners just shut down their mines. Crazy isn’t it?

It is a Quantitative Tightening to the world’s Quantitative Easing.

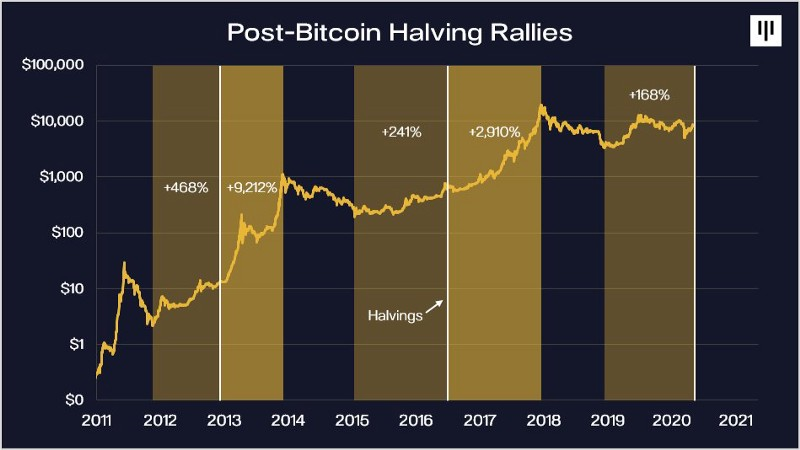

What is interesting though is not the Halving event itself, but what has happened after the past 2 halving events:

A dude under the pseudonym PlanB published a model on twitter in 2019. It was called the BTC Stock to Flow or S2F Model.

This model created waves across the crypto-verse. For context, because of its volatility, at the time very few valuation models really fit the historical price data of bitcoin. Then comes along an anonymous dude and publishes this game-changer.

Long story short (very very short) it values bitcoin based on its scarcity.

I highly recommend you read through the model (by clicking here) to get a deeper understanding.

For a more casual talk on the halving:

But yeah, the most important and mind-boggling part — the S2F model (or its Revised S2FX cousin) values bitcoin in the next halving cycle (2020–2024) anywhere between $55,000-$288,000.

Whether Bitcoin will really test those limits remains to be seen. But it seems that the stage is set. Let’s sit tight, and wait for the curtains to open.

Caveat Emptor

From all that we’ve seen, bitcoin seems like a no-brainer right? Maybe, maybe not. Remember that Cryptocurrency has 2 routes — it can be the motor car of our generation or it can be the Hindenberg. Nobody knows.

Crypto is Binary — its either 0 or 🚀.

Back it if you believe in the long term project.

You trade, you gamble — remember the house always wins.

I also haven’t dived into the rabbit hole that is Alt Coins. But more coming soon…

The article first appeared in PerCapita.in: To Bitcoin or not to Bitcoin

Liked the Article you just read? Show us your support by clicking that like button and sharing it with your friends! Also don’t forget to leave your thoughts about the article in the comment section below.

You can become a part of our mailing list by clicking here