The recent valuation debacle of ‘We Company’ raised a lot of questions around how do VCs actually assign so exorbitant valuations to start-ups? Does it depend on their bottom-line? Is start-up’s market share the most important driver? Is it solely based on future growth? or is it just a product of the inherent bias of the VCs to capture as much value of a company as possible pre-IPO? The reason I mention the last question is because of two data-points, as per a report from Upfront VC:

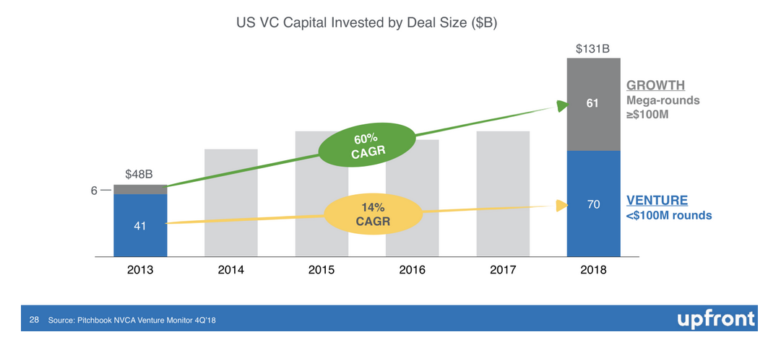

- In US, the Mega-rounds, i.e. where the investment size >$100M, have increased at a CAGR of 60% for 2013-18, meaning more money is being pumped in the late-growth stage start-ups, i.e. Pre-IPO stage.

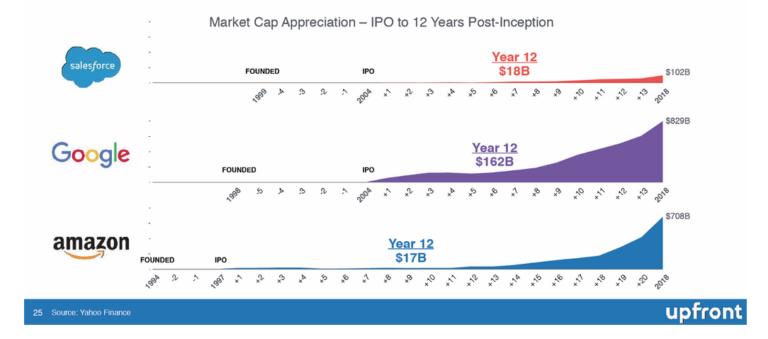

- The traditional time to IPO since inception, has been increased. If you see the image below you’ll realize that earlier start-ups used to IPO in about 6-7 years after their inception. However now this timeline has been stretched out to about 10-12 years. This is because historically, the market-cap (valuation) of companies like Google have sky rocketed post 5-7 years of IPO. Therefore VCs have extended their timeline to IPO in order to capture that value, so that the start-ups have a stellar IPO debut and this in-turn benefit the VCs.

However this is where the problem lies, in theory this approach of waiting a few more years to IPO may seem sound but in practice not all has been hunky-dory. I say this keeping in mind the IPOs of company like Uber, Lyft, Spotify etc. These stocks in no way have been the big money makers they were expected to be post their IPOs. Moreover their share price is down post their respective IPOs.

What all of this points towards is, that there is a significant problem in how these companies are being valuated.

The reason I say this lies in the events that followed the We Company’s debacle. Softbank came to We Work’s rescue bringing its valuation down to less than $8Bn, firing employees, reducing costs etc. (As of last week, Softbank has backed out of the rescue plan). Softbank did not go on reducing cost on just We Work, rather it nudged its other start-ups to focus more on their bottom-line as well.

In Indian context, these start-ups would include the likes of Paytm and Oyo. Oyo has been focusing on reducing its cost significantly and has been laying off employees in a staggered manner. Softbank is also looking to reap the benefits from investments especially in Paytm in the coming five years and have therefore asked Paytm to cut back on losses and concentrate more on the bottom-line. As per recent reports, with no clear way of monetizing its user base, Paytm is looking to cut back on a few cost and turn profitable in the next 2 years.

The Valuation Bubble, Pre-IPO

The scepticism around the valuations of Unicorns is not new and neither are the underperforming IPOs of such unicorns. Then why do investors agree to put their money in overvalued start-ups at a late-growth stage? The reason is because most of these deals benefit both the investor and the entrepreneur. The investors of these rounds are offered guaranteed returns on IPOs and/or greater control over the management of the start-up. In case the IPO does not go through as per expectation, the investors have preferential rights and are issued more equity to compensate for the loss. The entrepreneurs on the other hand benefit as the value of their shareholding goes up as a result of overvaluation and it a great ego massage and signal of success that helps in marketing and attracting great talent from the market.

The Changing Landscape

Now you see a lot of entrepreneur turned VC entering the field of investment and backing a lot of new and disrupting technology. The advantage they have over the traditional VCs is that they’ve had their start-ups, they’ve seen their ups and downs and they understand the game in a much better way. They are not just there to offer money to an entrepreneur, they invest in a start-up to offer their expertise and in most cases help build a team as well.

Moreover the era of chasing wild growth is slowly coming to its end. Availability of cheap capital against growing market share, increasing customer base (without a way of monetizing them) and a tendency to go for growth at any cost is on the decline. The focus is shifting towards profitability, especially after the start-up has established itself, their product and services are known. (Typically post Series-A)

Up until Series-A, the focus of a start-up and rightly so is to roll out their product or service, market it and try and built a name for themselves. It requires a great deal of marketing expense and the Cost of customer acquisition is also high. However, post Series-A, it becomes important to focus on monetizing the customer base and reducing the cost of acquisition. Without this there is no path to profitability and the endless chase for growth begins.