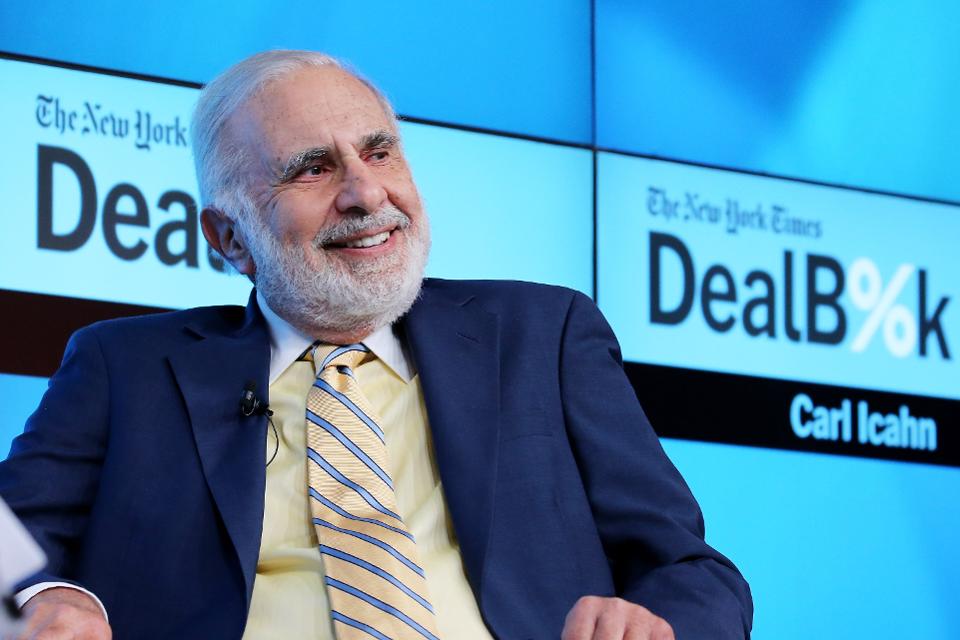

Carl Celian Icahn, being born on 16th February in 1936, to Michael and Bella Icahn in Queens, New York in a Jewish household. Icahn graduated from Princeton University in Philosophy and later joined a medical school but dropped and went to join Army reserves.

Icahn started his financial career as a stock broker in 1961 and later in ’68, he used some of his personal capital as well as a relative’s to start a firm called ‘Icahn & Co’. He also managed to secure a seat at New York Stock Exchange. The firm mainly dealt in arbitrage and options trading.

Later, he started buying controlling stakes in companies and got famous a corporate raider, after his successful takeover of Trans World Airlines in 1985. What he usually used to do is unlock hidden value from such companies who appear weak. In 1988, he sold the assets individually of Trans and repaid the borrowers who lent him the money for the take over. Then he took the Airline private and made around $470 million profit personally. A strategy now commonly known as Leveraged Buyout.

This was his modus operandi. They try to look at companies which have been growing less than their peers so they are undervalued, and they try to unlock the value by make profits for themselves and other investors (a debatable point) and increased debt on the balance sheet of the target company.

Some of his other investments include Netflix (10% position), Lyft (a $100 million investment), The Hertz Corporation, Gannet Co. Inc, also held Apple shares but sold them citing difficult relationship b/w the company and China.

He controls what is now Icahn Enterprises, a conglomerate which invests in variety of diverse businesses. He is highly critical of passive investing and Index funds and believe that they have led to bubble in the price of US stocks.