There are six main components to the Dow theory.

1. The Market Discounts Everything

The Dow theory works on the efficient markets hypothesis (EMH), which claims that asset prices reflect all available information, something similar to our Bhav Bhagvaan Che. It claims that factors like Earnings growth, competitive moat, competent management and other such factors are priced into the market, even if not every individual knows all or any of these details. In more strict readings of this theory, even future events are discounted in the form of risk.

2. There Are Three Kinds of Market Trends (Primary, Secondary & Minor)

Markets experience primary trends which last a year or more, such as a bull or bear market. Within these broader trends, they experience secondary trends, often working against the primary trend, such as a pullback within a bull market or a rally within a bear market; these secondary trends last from three weeks to three months. Finally, there are minor trends lasting less than three weeks, which are largely noise.

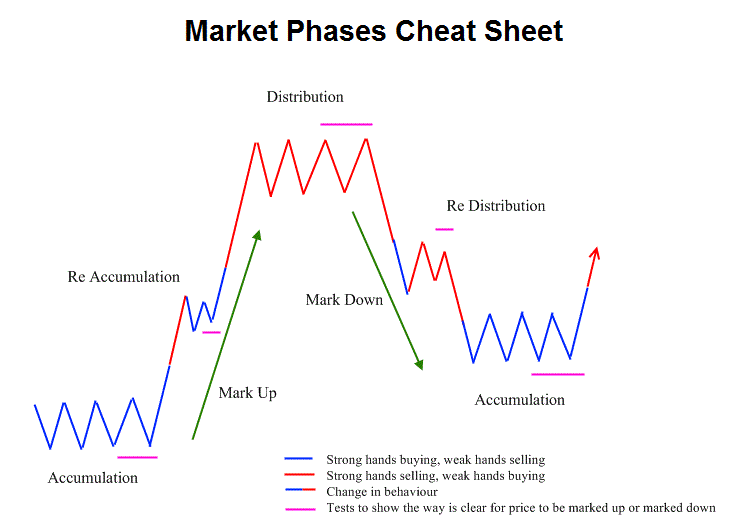

3. Primary Trends Have Three Phases

A primary trend will pass through three phases, according to the Dow theory. In a bull market, these are the accumulation phase, the public participation (or big move) phase, and the excess phase. In a bear market, they are called the distribution phase, the public participation phase, and the panic (or despair) phase. The below image explains the same with a few added details.

A primary trend will pass through three phases, according to the Dow theory. In a bull market, these are the accumulation phase, the public participation (or big move) phase, and the excess phase. In a bear market, they are called the distribution phase, the public participation phase, and the panic (or despair) phase. The below image explains the same with a few added details.

4. Indices Must Confirm Each Other

Dow stated that in order for a clear trend to be seen, both the indices (back then he used the Dow Jones Industrial Average and the Dow Jones Transportation Average) should confirm each other’s moves. If one is rising and the other is not, traders must not hop on to the uptrend as it would likely not be sustainable.

5. Volume Must Confirm the Trend

Volume should increase if the price is moving in the direction of the primary trend and decrease if it is moving against it. Low volume signals a weakness in the trend. For example, in a bull market, the volume should increase as the price is rising, and fall during secondary pullbacks. If in this example the volume picks up during a pullback, it could be a sign that the trend is reversing as more market participants turn bearish.

6. Trends is valid until proven otherwise

Reversals in primary trends can be confused with secondary trends. It is difficult to determine whether an upswing in a bear market is a reversal or a short-lived rally to be followed by still lower lows, and the Dow theory advocates caution, insisting that a possible reversal be confirmed.

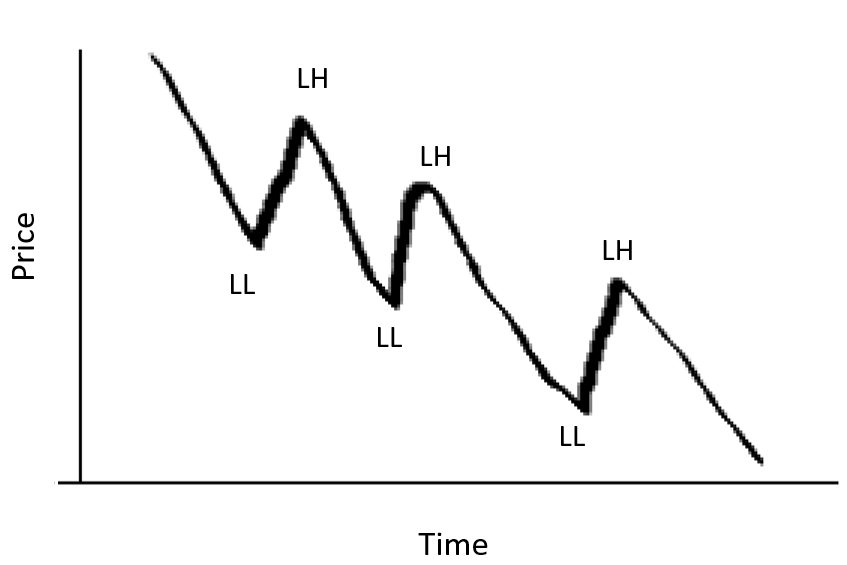

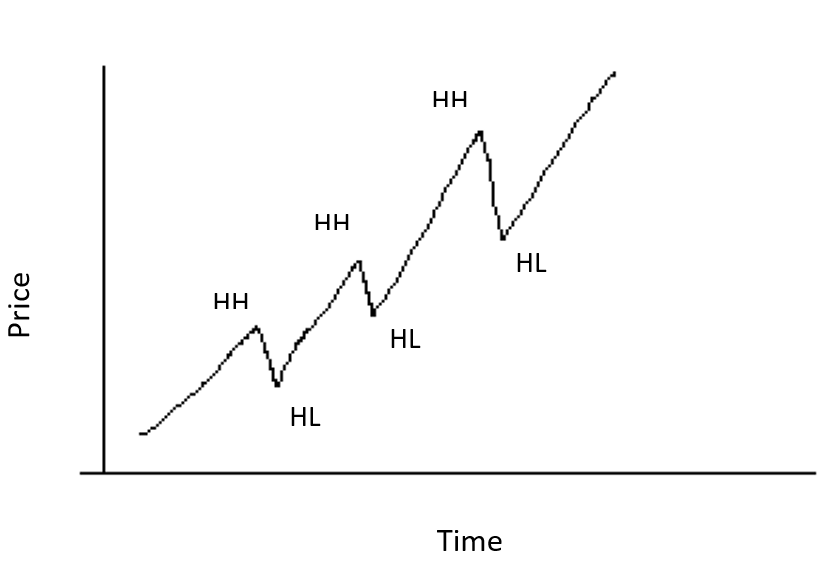

To summarize, if the price is making higher highs and higher lows, with large traded volume on the rise and low traded volume on the pullbacks, it can be said to be in UPTREND. If the price is making lower highs and lower lows with large traded volume on the declines and low traded volumes on the pullbacks, it can be said to be in DOWNTREND.

An uptrend looks like this:

A downtrend looks like this: