For generations among the Indian households, Asian Paints has maintained the reputation of being the best paints brand. Given the market share it currently holds, there is a high likelihood that the wall around you is painted with a product of Asian Paints. With over 75 years of existence and over 50 years of market leadership in India, it continues to attract customers and dealers.

Started in 1942, Asian Paints became the largest paint company in India in 1967, which it continues to maintain today. It is also the 3rd largest in Asia and 9th largest in the world. The company currently has operations in 19 countries and is servicing customers in over 65 countries.

Over the years, it has managed to generate stupendous wealth to its investors. As it turns out, Asian Paints is the only business in the history that has grown its revenues at 20% CAGR for over 6 decades. For FY 20, the company generated revenues to the tune of USD$ 2.8 billion.

The remarkable consistency in revenue growth, earnings growth and disciplined capital deployment stands testimony to its calibre. This was achieved with unwavering customer focus and relentless zest for innovation.

You must be wondering-

a) How did Asian Paints reach this dominant position in the competitive Indian market?

b) How did it manage to consistently grow revenues, earnings and shareholder wealth?

c) What is the secret sauce that gives Asian Paints a sustainable competitive edge?

Let’s find out!

Inception of Asian Paints

In the context of Indian Paints industry, the foundation was laid in the year 1902 with the setting up of Shalimar Paints in Calcutta. It was only during the World War II that large paint manufacturing units were being set up in India.

The year 1942 was a tumultuous one. World War II was on and Gandhiji launched the Quit India movement at Gowalia Tank, Mumbai. In those volatile days, the paints industry in India comprised a few foreign companies and Indian players like Shalimar Paints. A temporary ban on paint imports during World War II resulted in an opportunity for domestic production. Spotting this opportunity, a 26-year-old entrepreneur, Champaklal Choksey and three of his friends—Chimanlal Choksi, Suryakant Dani, and Arvind Vakil—set up Asian Paints in a garage in Mumbai.

The founders named the company “The Asian Oil & Paint Company”, a name picked randomly from a telephone directory.

Establishment of Asian Paints Brand in India

Champaklal Choksey, the co-founder, was extremely good at analysing the customer needs and devising strategies around them. This way he would make strategies by identifying consumption trends and patterns. Once devised, he would test these strategies, choose the winning approach and focus consistently on improving processes.

Back in the 1940s, Choksey chose the decorative retail segment instead of industrial paints. He saw that the industrial paints business was price-driven and the company with the lowest price won the business for that year. However, decorative retail was inherently different. It had the potential of building sustainable strengths around relationships with dealers/ distributors and also had strong brand recall. Choksey bet his fortune on building a strong presence within this consumer-facing segment of paints.

The challenge faced by Choksey was to establish the Asian Paints brand in a business where a handful of distributors controlled the supply of paint across India. After being ignored by these distributors in big cities like Mumbai and Pune, Choksey and his partners took to the villages to sell directly to the shopkeepers. This is where Choksey’s plan started working wonders. Asian Paints received its first dealership in Sangli, a small town near Satara, in south Maharashtra. The dealers felt a sense of great pride while dealing directly with the company, rather than dealing with distributors. They were also getting the product at a better price.

One example to show how brilliantly they devised strategies around consumption patterns of consumers is the identification of a unique demand during Pongal and Pola festivals, when the villagers worshipped their bulls and the horns were painted. Choksey saw the opportunity for a paint was required in bright colours and in small quantities for painting the horns. They were successful in breaking this market.

As demand for their products rose, dealers in small towns and cities started stocking them. As a result of this, the larger distributors in bigger cities who previously did not want to sell their products started partnering with the company. This approach of building the business from rural to urban India, and delivering on untapped consumer demand helped the company reach an annual turnover of INR 23 crore in 1952 (equivalent to USD$ 48 million at that time!), a decade after it was founded.

Choksey kept analysing consumer demand and identifying opportunities to create a product. In the cities, for example, he saw the difference between basic distemper and the more expensive plastic emulsion paint (which was launched by Jenson and Nicholson under the brand name Robbialac). While dry distemper was cheap, it had a tendency to peel off walls, stick to clothes, and stink badly. On the other hand, plastic emulsion was free from these problems but was five times costlier than dry distemper, and hence unaffordable. Thus, during the 1950s, Asian Paints launched a new innovative product—the washable distemper, placed between dry distemper and plastic emulsions. This was supported by a highly successful advertising campaign which said, ‘Don’t lose your temper, use Tractor Distemper.’

Effective advertising remains a cornerstone of the company’s marketing strategy. In 1954, the company introduced its mascot— Gattu, The Mischievous kid (created by R.K. Laxman).

The creation of this mascot was innovative and it appealed to India’s middle-class households. Once again, it was a daring experiment by Choksey and it paid off.

During the 1950s and ’60s, most of its competitors had foreign ownerships and focused mainly on industrial paints, marine paints, and large distributors or institutional orders for decorative paints. In 1967, 25 years after commencing operations, Asian Paints became India’s largest paints company by revenue.

Professional Management and Strategic Investments- Competitive Moat

After the company became the largest paint company in India in 1967, the promoters realized that they were not well equipped to tackle the evolving world and continue scaling up the organization. Particularly, they required to develop abilities to handle the complexities of an expanding direct-to-dealer distribution network and streamlining of systems and processes across various functions. Hence, they started hiring fresh graduates from IIMs and offered them complete authority and responsibility. The strategy worked and people like Biji Kurien and P.M. Murty joined Asian Paints in the late 1960s and early 1970s. Anand, an IIT- Bombay and IIM- Calcutta alumnus, was hired from the campus in 1970. While Kurien left to lead Berger Paints in the 1970s, Murty, an IIM- Calcutta graduate, went on to become Asian Paints’s head of decorative business, and was elevated to MD and CEO in 2009. Anand took over as MD and CEO in 2011. Both Anand and Murty have been with Asian Paints since the 1970s, a testimony to the loyalty that the promoters have enjoyed with their best hires.

Through the 1970s, the company focused on upgrading its facilities. In 1974, a major modernization programme was undertaken to streamline the paint production facilities by improving the layout of machines and replacing old machinery. During the period 1967–87, the internals of the organization were made super strong. This included computerization of various functions, improvement of supply chain efficiencies and manufacturing plants’ productivity, and expansion of capacities. All the other companies couldn’t react adequately to what was happening inside Asian Paints, thus taking the company beyond the reach of competition.

In 1984, Choksey was succeeded by his son, Atul Choksey, as the managing director of Asian Paints. He focused on IT automation and expansion of the company’s manufacturing facilities beyond the west (Maharashtra and Gujarat), into the south (Andhra Pradesh in 1985, backward integration in Tamil Nadu in 1987) and north (Uttar Pradesh in 1990). These plants would go on to have their capacities expanded in the late 1990s. In 1982, two years before Atul became the MD, Asian Paints had done its IPO on stock exchanges to raise capital which partly funded this expansion of manufacturing units.

Asian Paints has been at the forefront when it comes to IT investments. They strived to use the best possible resources in improving their systems and processes to achieve productivity and operational efficiencies. At a very early stage, they started making significant investments in IT and automation for strengthening their infrastructure and streamlining processes. This has been the single largest driver of competitive advantage for Asian Paints to date!

On 31 July 1997, Choksey passed away at the age of 81. At that time, media reports (India Today) indicated dissent between Choksey’s son Atul and the remaining three promoter families. Eventually, Atul sold his 9 per cent stake in Asian Paints to its competitor ICI India, a subsidiary of ICI UK. Atul exited the company in 1997 and went on to head Apcotex Industries Ltd, one of the leading producers of performance emulsion polymers in India, and a division of Asian Paints until 1991.

After this, Asian Paints hired management consultants Booz Allen Hamilton to guide them on the way forward. The key benefits of this exercise were:

1. the best practices of all the manufacturing plants were brought together to improve operating efficiencies;

2. working capital cycles were brought down by rationalization of both raw material and finished goods’ inventory management processes

3. freeing up of bandwidth of managers which allowed them to focus more on the core business rather than spend time managing inefficient manual processes

4. improved organizational structure across three business units—domestic decorative, international and industrial paints.

Some of the key IT infrastructure investments made by Asian Paints over the years include-

1. Purchasing the 1st mainframe computer in early 1970s. Choksey led the purchase of 1st supercomputer ever used in India for INR 8 crores. This was 10 years before ISRO and IIT- Bombay had used a supercomputer, and 21 years before any other company in India used it. This was not used for payroll or admin processes, but for demand forecasting and improving service levels across the country. Since then, Asian Paints has nurtured the use of Data Analytics to forecast demand and consistently improve its supply chain efficiencies.

2. Importing colour computer in 1979. The company imported colour computer in 1979, which helped reduce tinting time from 5-6 days down to 4 hours.

3. Procuring software for supply chain management in 1999. In 1999, the company procured software for supply chain management from i2 Technologies (a US-based company), which centralized and automated a large part of the process of demand forecasting, production planning and raw material procurement. Earlier, there was manual demand forecasting with manual interpretation of data, whereas here, there was a demand planner with analysts, who were trained to look at demand patterns in a more systematic manner.

4. ERP Implementation in 2000 and Phased upgradation to S/4 HANA in 2018. In July 2000, the company set up its first ERP software across India. They made the following upgrades over the years to tackle the ever-changing business environment and stay ahead of competition-

- In December 2011, they started using SAP HANA whereby they implemented a side-car approach for billing data to be pushed to HANA from SAP ECC for real-time analysis, thus providing insights for their sales team to manage trade promotions.

- As the organisation diversified into home improvement and institutional sales, Asian Paints relooked at their methods of doing profitability analysis across product categories and channels. SAP Simple Finance 2.0 provided the flexibility of COPA allocations & analyses and with the concept of a universal ledger, the reconciliation between FI and CO got eliminated. In 2015, they implemented Simple Finance on Suite on HANA and implemented the new COPA, being the pilot customer for the NZDT tool for Simple Finance Conversation.

- After the GST implementation in 2017, the overall direction of the company was to have a strong digital core for the entire Asian Paints group, including the international business operations which were running local instances of a different ERP system. This led them to fully adopt S/4 HANA (Simple Finance & Simple Logistics) in 2018. This was one of the first implementations of S/4 HANA in India’s manufacturing industry and was an on-premise implementation. This platform helped Asian Paints achieve a 60% reduction in database requirements, and set the foundation for future innovations by allowing IT to rapidly integrate the core transactional platform as newer business models emerged for the company. This was essential as we were increasing the services offered to end consumers and entering into the décor space.

5. Automatic storage and retrieval system in 2008. As a company with a passion to push the future, Asian Paints stepped up its efforts on the digital front when the word had not even entered the corporate lexicon. Asian Paints adopted automated storage and retrieval systems in 2008. This was the time when robotic warehousing was unheard of in the Indian manufacturing industry. Stirred by the courage of its conviction, Asian Paints adopted robotic warehousing and integrated it with ERP to solve the problems of a bloated inventory, increased opex, supply chain efficiency and factory level losses, in one stroke.

6. GPS implementation between 2010 and 2015. The company started using GPS (Global Positioning System) between 2010 and 2015 for tracking movement of trucks carrying finished goods in the channel.

7. Other investments in emerging technologies (just a few among the many!)

- Investments in the data mining platform are being leveraged to gain insights into a wide variety of business problems in logistics, people analytics, and material sourcing.

- Asian Paints has harnessed the cloud model to facilitate its business operations. The company shifted quite a few critical enterprise processes like the entire employee lifecycle processes, frontline sales engagement processes and customer visualization processes to the cloud.

- Asian Paints’ IT team has successfully conducted PoCs in emerging technologies like IoT, Artificial Intelligence, Conversational chat bots, Natural language translation and 3-D visualization of home décor.

Asian Paints is leveraging digital to engage customers, dealers, and influencers. The company’s well thought out business strategy is welded into its technology roadmap. At Asian Paints, reinvention is the key to unlock the next phase of growth and customer centric innovation. This attribute has helped the company go from strength to strength, and gives it a competitive advantage that is almost indomitable.

Experienced Promoters and Top Management

The promoter group of Asian Paints (families of Chimanlal Choksi, Suryakant Dani, and Arvind Vakil) hold the majority shareholding in the company at 52.79% of outstanding shares.

Asian Paints has always been at the forefront when it comes to hiring and retaining highly qualified professionals for managing the business. The current leadership team of Asian Paints includes the following-

Name & Position | On Board Since | Background |

|---|---|---|

K. B. S. Anand Managing Director & CEO | Retired on 31st March 2020 | · IIT-Bombay and IIM-Calcutta alumnus, hired from the campus in 1970. · Took over as MD and CEO of Asian Paints in 2011. · Under his able leadership, the Company moved from being a product-centric to a consumer and service-oriented brand, forayed into Home Improvement, made international acquisitions and established world-class manufacturing plants. |

Amit Syngle Managing Director & CEO | 1st April 2020 | · Holds a BE– Mechanical degree from Punjab Engineering College and has done MBA from CBM Panjab University. · Has been working with Asian Paints for the last 30 years in various capacities across Sales, Marketing, Supply Chain & Research and Technology. |

R J Jeyamurugan CFO & Company Secretary | 27th Nov 2019 | · Chartered Accountant (ICAI) · Company Secretary (ICSI). · Joined the company in the year 1991, holding positions as Assistant CS, heading Finance, Accounts and Shared Service Centre, Tax, Legal, Secretarial & Investor relations functions. · Was earlier VP- Finance and also Compliance Officer since May 2018 |

International operations and Business expansion

Starting from Fiji in 1978, Asian Paints now has a presence in the Caribbean, the Middle East, South East Asia, the South Pacific and Africa. The strategy underlying these international expansion initiatives has been:

1. leveraging on the company’s skills and capabilities in India to capitalize on growth opportunities in other emerging countries;

2. gaining exposure to the rest of the world as the firm prepares for its long-term future; and

3. sticking to the paints industry as much as possible since that is what the firm knows best.

In 2002, the company acquired Berger International (Singapore) and SCIB (Egypt). Regarding the acquisition, Jalaj Dani, then head of international operations of Asian Paints and newly appointed chairman of Berger International said, “The emerging markets have 50% of the world’s population and this is where we see the potential upside as we seek to draw more efficiencies out of the acquisitions we have just completed. Further, the company will implement cost structures in Berger’s operations worldwide for increased plant efficiencies and increased asset productivity. It will focus on improving working capital management through various initiatives and introduce IT in areas of operations where essential.”

Asian Paints operates in the industrial coatings segment through two 50:50 JVs with PPG Industries Inc. USA – PPG Asian Paints Pvt Ltd. (PPG-AP) and Asian Paints PPG Pvt Ltd. (AP-PPG). Of the total industrial paint demand, about two-thirds come from the automotive sector. PPG-AP is the first 50:50 JV of the Company with PPG Industries Inc., USA. It manufactures automotive Original Equipment Manufacturer (OEM), refinish, marine, packaging and certain industrial coatings and is the 2nd largest supplier in India.

Further, vertical integration has seen Asian Paints diversify into chemical products such as Phthalic Anhydride and Pentaerythritol, which are used in the paint manufacturing process. However, the company has discontinued production of Phthalic Anhydride from end of July 2017.

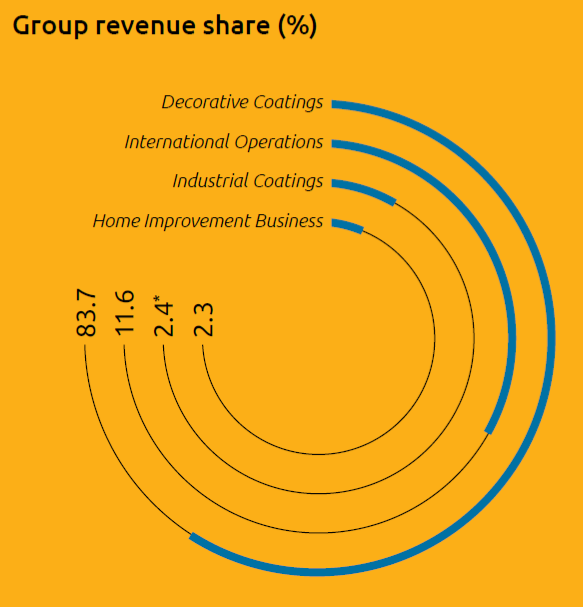

Business Divisions

Currently, Asian Paints has operations within the following business divisions-

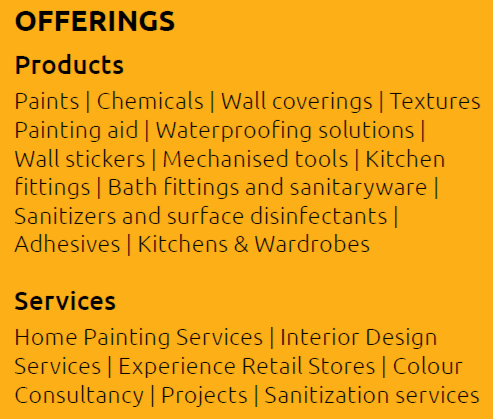

- Decorative coatings

The company has 8 decorative paint manufacturing plants across the country, supporting an extensive distribution platform. Their products cater to varied price points and requirements, consisting primarily of 4 segments – interior walls, exterior walls, wood finishes and metal finishes. Recently, the company introduced new categories such as water proofing, wall coverings, painting tools and implements, alongside adhesives and sanitizers.

- International operations

The company operates in 4 regions across Asia, the Middle East, South Pacific and Africa through the seven corporate brands viz. Asian Paints, Apco Coatings, Asian Paints Berger, Causeway Paints, SCIB Paints, Taubmans and Kadisco Asian Paints. Their presence in the Middle East and South Asia is significant, and are expanding with key focus on Africa and Indonesia.

- Industrial coatings

Asian Paints caters to the Indian industrial coatings market through 2 strategic joint ventures with PPG Inc. of USA, a global leader in coatings, offering the entire spectrum of industrial coatings products such as automotive coatings, refinishes, protective coatings, floor coatings and powder coatings, among others. It is the market leader in the auto refinish segment and the 2nd largest player in the automobile OEM segment. Their industrial coatings manufacturing capacity is being steadily enhanced to address the growing OEM demand.

- Home improvements

In 2013, Asian Paints acquired the Sleek Group which caters to the organized modern kitchen space. In FY 2015, it acquired the front-end business of Ess Ess, a high-quality player in the bathroom fittings segment. Hence, under home improvements it has 2 operating divisions-

i. Kitchens and Wardrobes

ii. Bath Fittings and Sanitaryware

Development of Futuristic Products and Services

Asian Paints with its intent to enter the Home Improvement and Décor space in India had acquired 51% stake in Sleek group, a kitchen solutions provider in August 2013. Sleek is a major player in the organized modern kitchen space and is engaged in the business of manufacturing, selling and distribution of modular kitchens as well as kitchen components including wire baskets, cabinets, appliances, accessories etc. Recently, the company has launched ‘Smart Kitchen’ range for easy installation and design under the Sleek brand. Sleek has also introduced wardrobes in its portfolio since FY17. In December 2017, Asian Paints acquired the balance 49% in Sleek from its erstwhile promoters. Sleek is now a wholly owned subsidiary of the company.

In June 2014, Asian Paints acquired the entire front and sales business including Brands, Network and Sales Infrastructure of Ess Ess Bathroom products Pvt Ltd. Ess Ess is a prominent player in the bath segment in India and has high quality products in this segment. Recently, the company introduced ‘Royale’ – premium range of bath fittings as well as ‘Bathsense’ – sanitary ware range of products for the evolving consumer.

Both, the Kitchen and Bath business have been co-branded with Asian Paints.

The acquisitions of Sleek Group and Ess Ess come across as a deviation from the strategy to remain focused on paints. However, the rationale behind these acquisitions is to protect the distribution channel of mom-and-pop stores in the paints industry from disruptive evolution of the industry. This disruption could emerge as the paints industry evolves either into a service-oriented model or a DIY (do-it-yourself) model, thereby enabling large global MNCs to open large-format stores with value addition to customers, which could dilute the importance of the traditional mom-and-pop store network.

To understand this in numbers: The cost of labour involved in painting a home has increased to approximately 65% of the project cost for a household from around 10% in 1980. This is because labour costs have grown at 9–10% CAGR over the years versus a mere 3% CAGR in paint prices. With this trend likely to continue, there is a high likelihood that 15-20 years from now, labour costs will be around 90% of the overall paint project cost. Thus, in the future, it might make more sense to buy paint from a store and paint a home yourself rather than employ painters and labourers. Indeed, this is the practice in developed economies. Once this happens, two consumption patterns are likely to emerge. First, customers will be willing to pay for labour involvement if there is a service-oriented value addition attached to it. This could include decor consultancy services either on the shop floor or at your doorstep, or faster/ cleaner/ highly organized ways of executing the paint project.

To this end, Asian Paints has tried several service-oriented models over the past decade like:

i. opening of experience stores in Mumbai, Delhi and Kolkata;

ii. Colour Ideas stores (430+ currently) which provide colour consultancy in the mom-and-pop stores;

iii. Home Solutions painting service, which currently executes 20,000–25,000 projects each year;

iv. introduction of Royale play, high-end textured paints; and

v. colour consultancy services at home

New Categories/Offerings

1. Recently launched ‘Viroprotek’ range of hand, Surface and space sanitizers and disinfectants. It is also offering ‘San Assure’ a sanitization service and ‘Safe Painting’ service for its customers.

2. Recently launched range of Furniture, Furnishings and Lighting Products under three brands – Nilaya, Royale and Ador, thus offering wide spectrum of offerings in the ‘Home Décor’ category.

3. Launched ‘Beautiful Homes Service’ – an exclusive end-to-end solution that provides consumers a personalized interior design service with professional execution to create their dream homes.

Wealth creation to Investors

Ever since 1942, the company has been growing rapidly in terms of revenue generation. Over the years, it has achieved the following revenue milestones thereafter-

- INR 100 crore revenue in 1985

- INR 1,000 crore revenue in 2000

- INR 10,000 crore revenue in 2012

- INR 20,000 crore revenue in 2020

The company’s size, measured by market capitalization, has grown at an astounding 27% CAGR over the last 22 years (since 1999). On the other hand, Sensex has grown at just 12.84% CAGR over the same period. To give you a perspective, INR 1 lakh invested in 1999 would amount to a whopping INR 2.08 crore (208 times) today!

During FY 20, Asian Paints group has generated revenues of USD$ 2.8 billion (INR 20k crore) and PAT of USD$ 200k (INR 2,800 crore). It has also delivered an EBITDA margin of 24.5% and ROCE of 38.4% during the year.

The last 5-year financial performance is as follows (until FY 20)-

- Revenue growth of 9.5% CAGR

- EBITDA growth of 13.9% CAGR

- PAT growth of 14.9% CAGR

- Market capital growth of 15.5% CAGR

Today, the promoters of Asian Paints are worth INR 1.27 lakh crores (USD$ 17 billion)!

Awards and recognition

Among the multitude of awards and accolades that Asian Paints received over the years, the following is the list of some of the recent ones-

- KBS Anand, ex-MD & CEO of the Company wins Ernst & Young (EY) ‘Entrepreneurial CEO of the Year’ Award, Feb 2020

- Included in the Forbes List of World’s ‘Best Regarded Companies’ (September 2019). It was the second consecutive appearance for Asian Paints in the coveted list.

- Ranked 3rd among Top 25 Paint Manufacturers in Asia Pacific (Asia Pacific Coatings Journal) – June 2019

- Ranked 9th among the world’s leading paint companies by Coatings World – Top Companies Report (July 2020 issue).

- Stood among ‘Top 10 Valuable Indian Brands’ – Brandz Most Valuable Indian Brands

- Included in Forbes Asia’s list of ‘Best over a Billion’ companies in Asia Pacific – September 2019

- Stood among ‘Most Trusted Brands’ in the Household Care category (Brand Equity – Most Trusted Brands) – March 2020.

The Legacy of Asian Paints- In a nutshell

From the small beginnings in 1942, Asian Paints has managed to retain stakeholder loyalty and remains one of the most trusted and valuable companies in India.

The visionary promoters of the company created a business empire that continues to deliver remarkable results, with the help of product innovation and technology investments which make it near impossible for any other paint company in India to compete at the level it operates. Some of the key drivers of Asian Paints’ success include-

1. Focus on its core business

Asian Paints has become synonymous to the paints industry. Although recently the company started venturing into newer service offerings to prepare for the future (like home improvements and sanitizers), the main focus has always remained on its core business- paints.

2. Prudent capital allocation

Right from the beginning, the company has been prudent when it comes to allocation of capital to investments like setting up new manufacturing plants, expansion to new geographies and technology improvements. All the investments were sufficiently funded from cash flows generated from operations and some from its IPO in 1982.

3. Deepening of its competitive moats through-

- Innovation- Achieved through unique product development based on demand forecasting and effective supply chain management.

- Brand loyalty- Achieved through relentless focus on building customer and dealer relationships; and effective marketing strategy addressing the target audience (common-man)

- Architecture- Building a culture of excellence and rewarding top talent; and strategic investments in IT to stay miles away from any other company (let alone its competitors)

- Strategic assets- Wide geographical spread of its supply chain network of manufacturing plants and depots; and deep-rooted relationships with dealers built through non-transactional initiatives.

Asian Paints’ resilient business existence summed up in numbers-

- #1 Paints company in India

- #3 Paints company in Asia

- #9 Paints company in the world

- 75+ years of existence and innovation

- 50+ years of market leadership (since 1967)

- 60+ markets served globally

- 26 manufacturing facilities

- 70,000+ dealer network in India

- 7,500+ employees worldwide

- 200+ scientists supporting Research & Technology (R&T) facility for technology adoption and product development

- 430+ Colour Idea Stores in India

Biblography

- Company’s website

- Company’s annual reports

- The book “The Unusual Billionaires” written by Saurabh Mukherjea

- Press articles (Economic Times, Business Standard, India Today)

Follow Us @