The advancement of technology in the 21st century has revolutionized the world. We’ve made such great strides in technology that our ancestors wouldn’t have envisaged.

Siri, Alexa and many of the similar robots/AIs have become a part of our daily lives now. Artificial Intelligence (AI) is slowly replacing humans in areas such as e-commerce, retail, healthcare, banking, etc.

You may ask what are AIs? They are softwares they helps computer perform some tasks that require basic human level intelligence

Now imagine a robot taking care of your investments. Sounds crazy, but such a technology does exist!

Robo advisors are digital platforms that provide financial planning services and invest your money based on algorithms, with little to no human intervention. They became popular after the 2008 Global Financial Crisis. Although Robo advisors originated in the form of fintech startups, they’ve gained more popularity in recent years, particularly with large global financial institutions like Black Rock, Wells Fargo and Bank of America bringing their Robo advisory services to the market.

So how exactly do they work?

The strategies and portfolios offered by these advisors are based on the Modern Portfolio Theory and the Efficient Market Hypothesis. They ask various questions such as your age, income level, number of people at home, financial goals, investment timeline, risk tolerance, etc. Based on these answers, the advisor provides a collection of various investments and the proportion of each in your portfolio, which match your preferences.

Once your account has been funded, the Robo advisor continuously monitors your portfolio. As the value of the assets rises or fall in the market, the Robo advisor will look for opportunities to buy or sell investments to keep everything in proportion, thereby attaining your investment goals.

Okay..so why should I opt for a robo-advisor?

First, it’s the ease of use and accessibility. We are living in an era where smartphones are controlling our lives. Robo advisors are conveniently accessible through apps and mobile phones – you can check your portfolio performance, track your goals, make changes to your risk profile, etc. They are available 24×7 as long as you have an internet connection. Thus, it offers much-needed flexibility to investors.

Second, the cost factor. You don’t need to spend a chunk of your money now to hire a human financial advisor. The minimum amount required to obtain Robo advisory services is lower than the traditional advisors. The average Robo advisor charges around 0.25% to 0.30% of the total assets under management(AUM), while the rate for a human advisor is around 1% of AUM.

Another benefit is the automatic tax-loss harvesting and portfolio rebalancing. At the end of the year, your investments in red (in losses) are sold off and these losses are set off against the gains, resulting in lower tax obligation for the year.

Portfolio balancing can even be done on a daily or monthly basis which ensures that your asset allocation (amount of capital in certain assets) remains consistent and risk tolerance is maintained (how much risk you are willing and able to take)

Lastly, if you are a small investor or don’t know much about investing, you can opt for a Robo advisor. Many of these advisors are accessible with zero or low minimum balance. Betterment, the first robo advisor launched in 2008, requires $0 as minimum balance, while Wealthfront requires a minimum of $500.

But, every coin has a flipside...

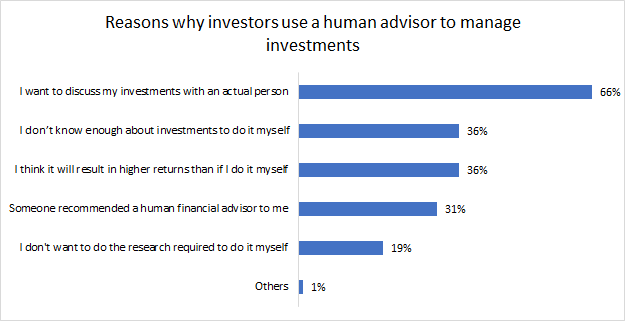

The biggest drawback of Robo advisors is the absence of personal advice. Investing involves a lot of emotional content (taking care of some biases and making clients aware about certain personalized investment choices etc) due to which many investors prefer having a human advisor, with whom they can have face-to-face conversations. However, this is dependent on your investment goals and needs.

A lot of Robo advisors aren’t 100% personalized yet but are finding ways to combine personal and automated services for the investors.

Second, if you have a particular stock or a mutual fund plan where you want to invest in, you won’t be able to tell your Robo advisor about it. This might create discomfort among the investors since the investment options offered to them are extremely general.

Robo advisors are not financial planners. They are solely focused on your investment portfolio based on a questionnaire and aren’t designed to help you get out of debts or increase your total income.

Robo advisors - the scenario in India

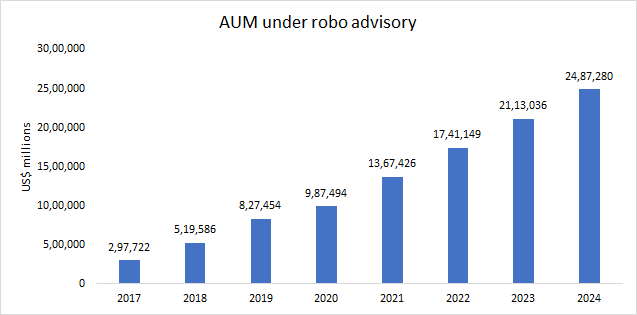

Robo advisory in India is at a very nascent stage today. However, it is rapidly gaining momentum with ~39 companies in India that have started operations in this space. As of 2019, the total AUM in this segment in India amounts to US$42 million, and is expected to grow at a compounded annual growth rate (CAGR) of 36% over 2019-2023. With lots of investments being made in fintech and the number of smartphone users in India expected to rise, it looks like this space could thrive in the future.

Conclusion

Adoption of such technology would take time. The current global market scenario due to the ongoing Covid-19 pandemic may demand a higher level of communication between the investor and the advisor. In the future, those companies which would be able to leverage Robo advisory with a personal touch of a human advisor will prove to be successful. However, with the rapid pace of artificial intelligence replacing human intelligence, don’t be surprised if there is zero human touch involved in it too.

Follow Us @

Yes Technolgy is taking over in all feilds of life

21 century many decisions will be taken by AI

All over world