There is a constant debate amongst investors on whether one should focus on (i) buying quality businesses which, most of the time are available at extreme valuations or (ii) focus on buying businesses at cheap/fair valuations instead.

We all know many great businesses like Nestle, HDFC Bank, etc. that have passed the test of time but never seem to be available at cheap valuations. As a result, the majority of the Indian investors never invest in such businesses and in turn lose the opportunity to earn well above-market returns while investing.

Businesses like the ones mentioned above have consistently hovered around the high-end range of P/E which most would find over-valued, but this doesn’t mean that an investor has to outright ignore them for their valuations. Such businesses require a different approach which should be less to do with numbers and more to do with understanding the business.

Case In Favour of Valuations

Before starting, let’s consider this first – Actually, the valuation process forms an important element of the investment process because buying at the right valuation protects you from the speculative component (current market valuation), the one which you can’t control. It lets you focus on the business component (businesses with quality earnings growth) which is in your control as you can choose whether to invest in the business or not.

In other words, how the share price performs over the next 10 years is not under anybody’s control. Rather what we can do is to invest in businesses trading near fair value range whose performance will dominate the share price movement, leaving the P/E component alone.

Buying at different valuations can have a great impact on shareholder returns. Let’s take the example of Infosys

An investor who bought INFY at the top of the Internet Bubble in March 2000 would have effectively ended up with no return till December 2008. This is more than 8 years without any price return on the investment, actually negative returns if you consider inflation even when the PAT grew from 285 CR in 2000 to 4470 cr in 2008! The P/E for Infosys in March 2000 was around 312 which got deflated to 16 in December 2008!

Therefore, to explain our previous statement on the importance of valuation, if one would have bought Infosys at a fair value of say 30 P/E (FY02 & 03), he would have still ended up with excellent returns even after the share prices halved in FY09 i.e. the returns would have been largely in line with the business performance and not influenced by market sentiment.

This is just one example, the point we are trying to make here is that valuations do matter for ALL the businesses. It’s just that it depends on the nature and factors associated with different businesses that some require more attention to valuations and others require more attention to qualitative factors. More emphasis must be put on valuations if investing for short term or in a low growth / risky business.

Businesses with P/E as low as 10 could prove to be expensive while others with P/E as high as 80 could prove to be fair if not cheap. Let’s see how these P/E 80 businesses can be valued…

(We got inspired to use the below method of evaluating richly valued companies by watching various interviews given by Saurabh Mukherjea and Rakshit Ranjan online)

A Different Approach...

Now, we know that there are some businesses like Nestle, HUL, Asian Paints, etc. that continue to trade at extreme P/E ratios year after year. These stocks when looked over multiple years continue to hold their P/E ratings for a long time now. But what is unique in them that markets are valuing them at such high prices? Let’s find out the reasons for this by using the below approach –

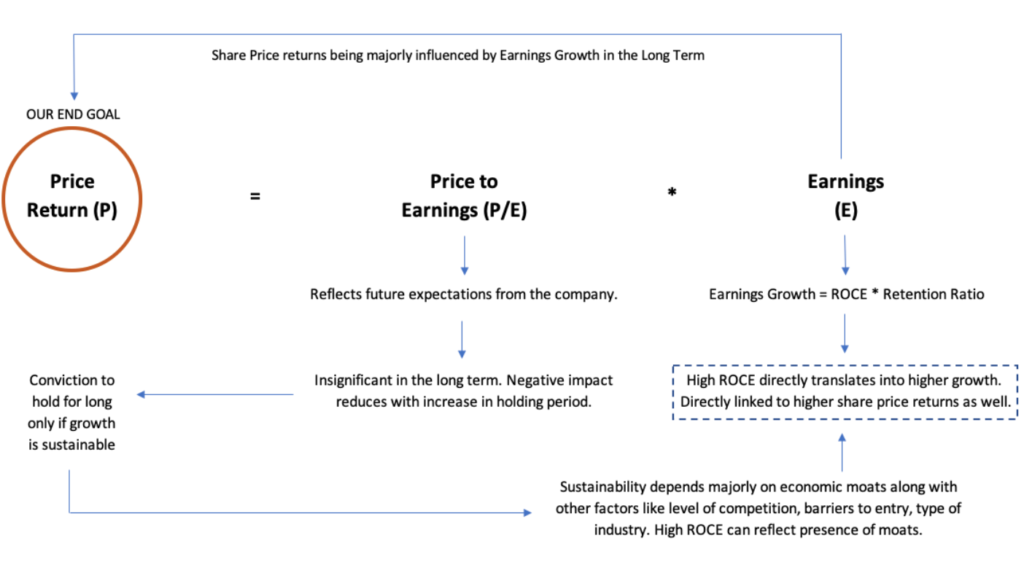

Starting with the most basic factor, what generally is the main goal of every investor – making money from stock market investing. Correct? Therefore, let’s consider the price return for our study. Take a look at the following formula –

Price per share (P) = Price to Earnings Ratio (P/E) * Earnings per share (E)

Looking at it mathematically, it’s pretty straightforward, P = P/E * E as the E component cancels out each other leaving us with P i.e. price per share. Let’s divide this into two parts, (i) earnings component and (ii) P/E component, and try to decode it by logic.

1. The Earnings Component

Part 1 - Now, the above formula can also be written as -

Price Return = Return from Earnings Growth + Return from change in P/E ratio

Take a look at the following case –

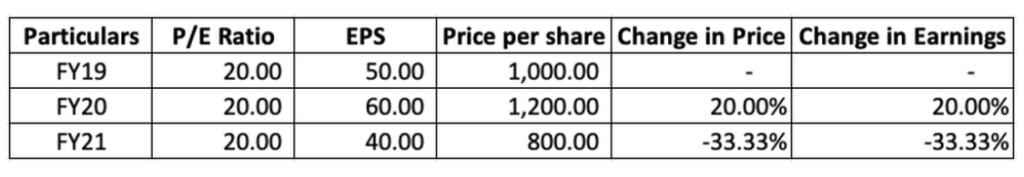

– Company X is trading at a P/E of 20 and reports an EPS of Rs. 50 for FY20. As a result, price per share comes out to be 20 * 50 = 1,000 for FY20. Now, for FY21, P/E remains unchanged at 20 and EPS grows to Rs. 60. Similarly, for FY21, P/E remains stable at 20 and EPS declines to 40. Here is how the price got affected:

This directly shows that earnings change or Growth is a DIRECT factor that influences the price of the stock (straight mathematics). Further to establish if earnings growth is a direct factor of price, let’s compare NIFTY share price return and compare it directly with its EPS:

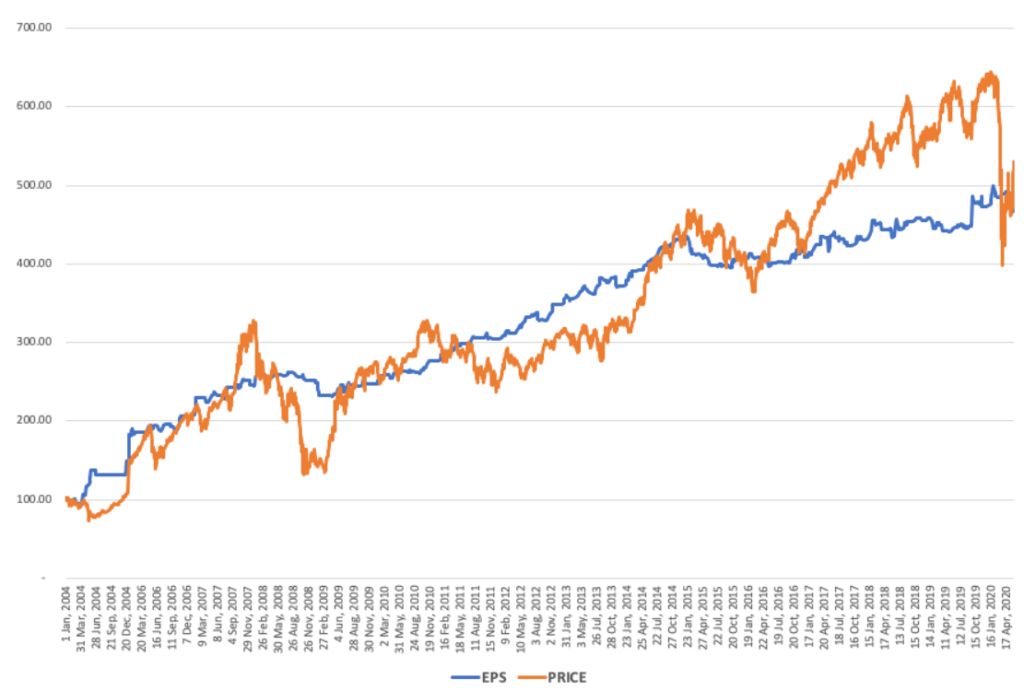

We took the data from Jan 2004 up to date (June 2020) and rebased the numbers to 100 to make them comparable. As a result, both the components gave a CAGR of 10.99% and 10.12% respectively when the data was run for 16 years. The small difference in returns is mainly attributable to PE expansion in NIFTY from 21.09 in Jan 2004 to 23.91 in June 2020.

We ran a test between Nifty Price and its EPS and found out a correlation score of 94.31% for the years 2004-2020. This is indicative of the fact that earnings growth is indeed a major driver of stock price returns in the LONG RUN. Emphasis has been highlighted in the long run because, in the short run, the returns are at the mercy of the public where their sentiments and emotions can heavily impact the stock price through P/E expansion or contraction.

- For example, if we were to look at price vs EPS performance in the above chart during GFC, one would notice that EPS didn’t decline the way prices did, and neither it climbed the way prices did.

Part 1 - Now, the above formula can also be written as -

Earnings Growth (E) = Return on Capital Employed (ROCE) * Retention Ratio (R)

This is pretty much straightforward. If a company needs to grow, it needs to re-invest (retained earnings) what it earned (which comes in the form of ROCE) in the previous years. Therefore, companies need to create new assets to increase their production capacity in order to grow and in order to create new assets, the company needs cash to re-invest back into the company. If the company gives out all its profits in the form of dividends (retention ratio being zero), it won’t be left with cash to re-invest, which would make it nearly impossible for the company to grow.

- ASSUMPTIONS TO THIS APPROACH

(i) Doesn’t apply to the services sector – these can grow disproportionately to the amount the re-invest back as their assets are mainly employees. (Infosys, TCS, CRISIL)

(ii) The company is assumed to be running near full capacity. A company running at 50% can still double the output without any re-investment.

(iii) Can be disproportionate in companies with pricing power or improving operational efficiencies. However, the major driver still remains re-investment in the long run as one cannot constantly improve margins over the years.

- CORRELATION BETWEEN HIGH ROCE COMPANIES WITH THEIR PAST PERFORMANCE

Now, we have established that share price returns have a direct relationship with earnings growth which is in turn directly linked with high ROCE. This isn’t just theory, but a proven fact:

1. In a book called Coffee Can Investing, Saurabh Mukherjea constructs a portfolio that focuses solely on ROCE and growth using the below two filters:

The business should have ROCE > 15% every year AND

The business should have Sales Growth > 10% every year for 10 consecutive years.

He buys these stocks without any qualitative inputs and here are the results ->

This portfolio has proved to beat the market index every time (alpha of 5-7%~ compared to Sensex) when held for 10 years.

2. Another investor, Anoop Vijaykumar tested the relationship between high ROCE companies and stock returns. The conclusion was below:

In good times, all except the worst ROCE companies do just fine.

In bad times, all except the best ROCE companies struggle.

The highest ROC decile outperforms all others by a wide margin. Almost all ROC deciles outperform lower deciles.

We highly recommend to check out his article here. With this, let’s discuss the other component that would impact our returns…

2. The P/E Component

This is the second (and less important) component that would impact our returns and needs to be studied carefully. Now that we are talking about high P/E stocks here, first let’s address the issue of how we can actually ascertain the risk of a stock getting de-rated in the future. After all, a P/E de-rate would mean negative returns in this component! There are 2 things that can be done to address this issue here –

- IMPACT OF HOLDING PERIOD ON RETURNS

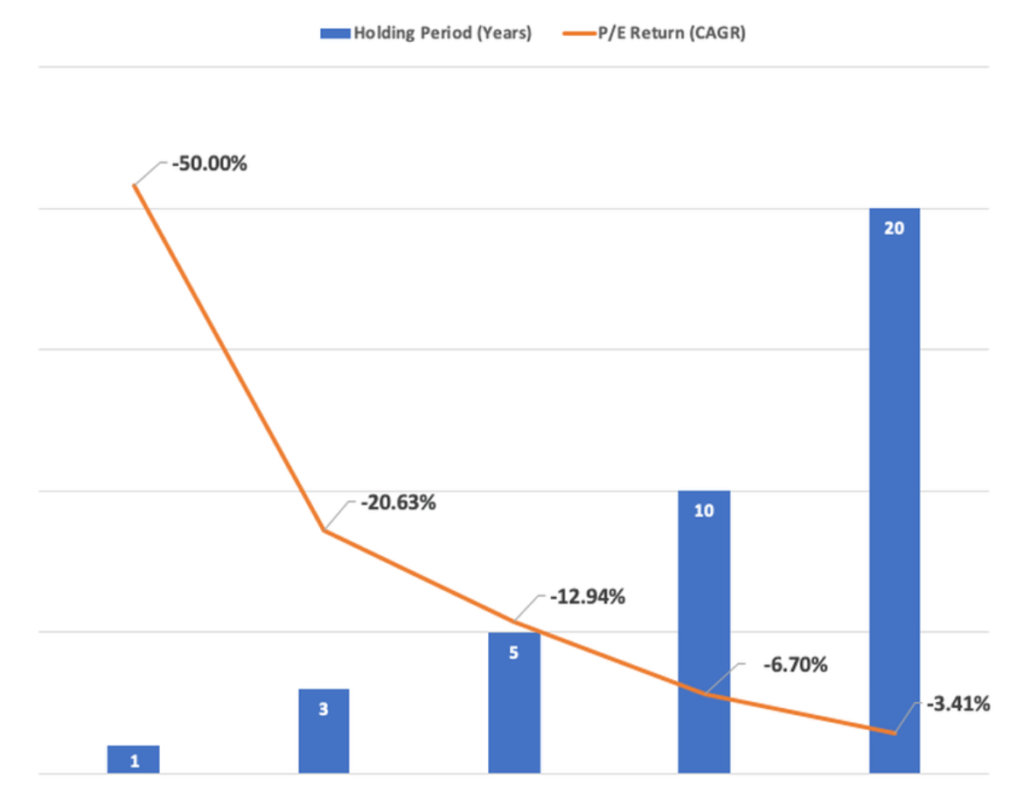

First, this can be addressed up to a great extent by simply holding the stock for a longer period of time. The impact of negative returns of a P/E de-rating is reduced as we increase our holding period –

This is the power of holding! As we increase our holding period, our CAGR negative return arising due to P/E de-rate declines dramatically. A stock which even halves (P/E from 80 to 40) after you invest in it, would bring a negative return of 50% if held for one year or 6.7% CAGR if held for 10 years!

- IS THE BUSINESS WORTHY OF HOLDING FOR LONG TERM?

Secondly, the other and more important thing to keep in mind is if we increase our holding period to say, 10 years which is quite a long time, then we should accordingly pick only those businesses whose products appear to remain in demand even after 10 years and have good economic moats to sustain their growth. There is a reason to pick such businesses –

Consider this, an FMCG business with strong customer loyalty has a much higher probability of surviving in the future than an auto business as the auto industry is more susceptible to innovation and competition along with overcapacity and demand-supply economics of their product out of their favor. You would think multiple times before making a Rs. 10 lakh car purchase compared to Rs. 150 hair oil.

The point we are trying to make is that if we are addressing the risk of P/E downgrade by increasing our holding period, we should select our investments accordingly which will actually sustain the test of time. What good is the investment in this case if it is not able to sustain earnings growth only!

This is one of the reasons why companies that are expected to survive for long trade at expensive valuations. Here, it is very important to understand that a high P/E does not necessarily imply over-valuations but might be reflecting survivability, longevity of growth coupled with other factors like high barriers to entry, customer loyalty, lower risk of the industry going out of favor, etc.

- LINKING LONGEVITY WITH ROCE

Actually, the survivability and longevity of growth can be linked to our earlier discussion of picking businesses that have reported consistent, high ROCE over the past 7-10 years. A high ROCE over the long period indicates the presence of some kind of economic moat present in the company that cannot be easily overridden. The strength of the moat depends upon how easily the competition can come and start eating away profits until the point ROCE is not attractive. As a result, it’s very important to judge what all strengths and moats the company possesses and actually how durable are those moats.

Therefore, companies with high growth and ROCE, brilliant moats, sustainability for the long term are poised to outperform the other stocks by a wide margin and as a result trade at higher P/Es which we consider as over-valued.

Let’s take a hypothetical case to see if this works –

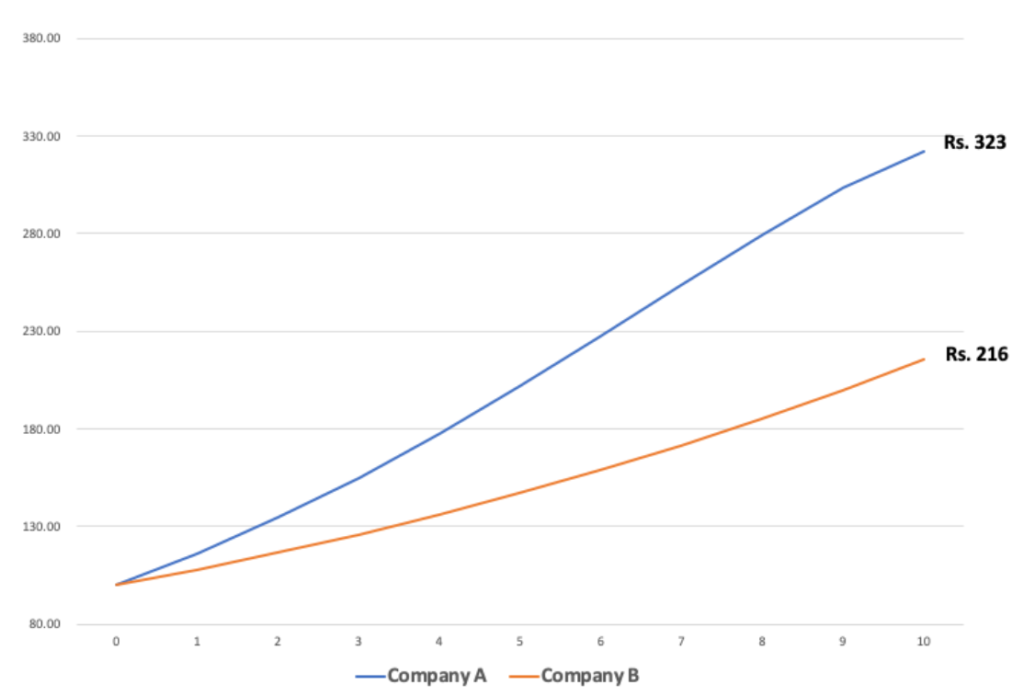

Company A is a food chain company with ROCE of 30% and a Dividend Payout of 20%. The company retains 80% of the profits and reinvest back into the business. As a result, it is able to grow at 24% and is trading at P/E of 80 in FY20. This company gets re-rated from a P/E of 80 to 30 in 10 years even when the growth looks sustainable.

At the same time, Company B is a chemical company with a ROCE of 8% and no dividend payout. The company, as a result, grows at 8% annually. An investor bought the company at P/E of 9 remains at the same level after 10 years. (Sustainability of chemical company is generally low as chemicals is a highly competitive space with no pricing power). Let’s compare the share price of the two:

Company A still outperforms Company B by 50%~ (or 4% CAGR) even as the PE ratio of former gets cut by 62.5%! That’s what high ROCE, growth and holding period do to the returns.

Combining It All Together

We discussed that our total returns come from a combination of (i) earnings growth and (ii) P/E change. Since the approach is applied only to richly valued companies here, we know that there is a probability of a P/E downgrade over the years which is addressed by increasing our holding period.

Holding period for only those businesses can be increased which have strong economic moats that will help the business sustain its earnings growth despite attractive looking ROCE to competitors. To summarise, in order to apply this approach to extremely valued businesses, we need to focus on businesses with high earnings growth combined with economic moats that shield us from the possibility of a P/E downgrade. Take a look at the below image which summarises our view –

Therefore, apart from some basic things to look for like accounting & management checks, free cash flow checks, etc while evaluating such businesses, one has to consider the below –

How much earnings growth is expected in the future?

What is the probability of earnings sustaining in the future?

What is the probability of facing a P/E downgrade in the future and to what extent?

Are the total expected returns (after incorporating negative returns from P/E) attractive enough considering the risk, and other opportunities available in the market?

If an investor’s research says Nestle earnings won’t grow more than 10% for the next 10 years, then one might conclude its not worthy of investment because there exists better opportunities in the market as well as a good probability of negative returns from P/E downgrade for Nestle, leaving a minuscule return for the investor for the next 10 years!

In the end, we want to say that this approach looks simple, but in reality rather difficult to execute. This is because –

It requires extensive research in the first place to find out businesses with ‘sustainable’ high growth and return on capital employed.

It requires understanding the unique characteristics (i.e. moats) of the business that will protect itself from the competition takes heavy research for months.

It also requires determination and patience to hold the business for long term to diminish the impact of P/E downgrade on returns in case the risk materializes.

To keep the article as short as possible, case studies citing examples of Nestle, HUL, ITC, HDFC Bank, etc will be discussed later.

Happy Investing!

Disclaimer:

THE OPINION EXPRESSED IN THIS ARTICLE IS FOR INFORMATIONAL & EDUCATIONAL PURPOSES ONLY AND IS NOT INTENDED AS ADVICE TO BUY / SELL SECURITIES. ANYTHING WE WRITE OR SHARE IS OUR OWN OPINION AND IS NOT TO BE CONSIDERED AS AN ADVICE.

Follow Us @

An excellent piece!!

My two cents: I think it is ambiguously stated that earnings growth (E) is correlated to ROCE (Return on Capital Employed). You see, the CE portion of ROCE reflects the total capital provided by debt and equity holders whereas earnings growth is the returns distributable only to equity holders. Therefore, in order to make an apple to apple comparison, one should use earnings growth (read Net Income growth) in conjunction with ROE (Return on Equity) and EBITDA/EBIT growth (read Operating Earnings growth) with ROCE to understand the dependance of growth on the Return metric (ROCE or ROE).