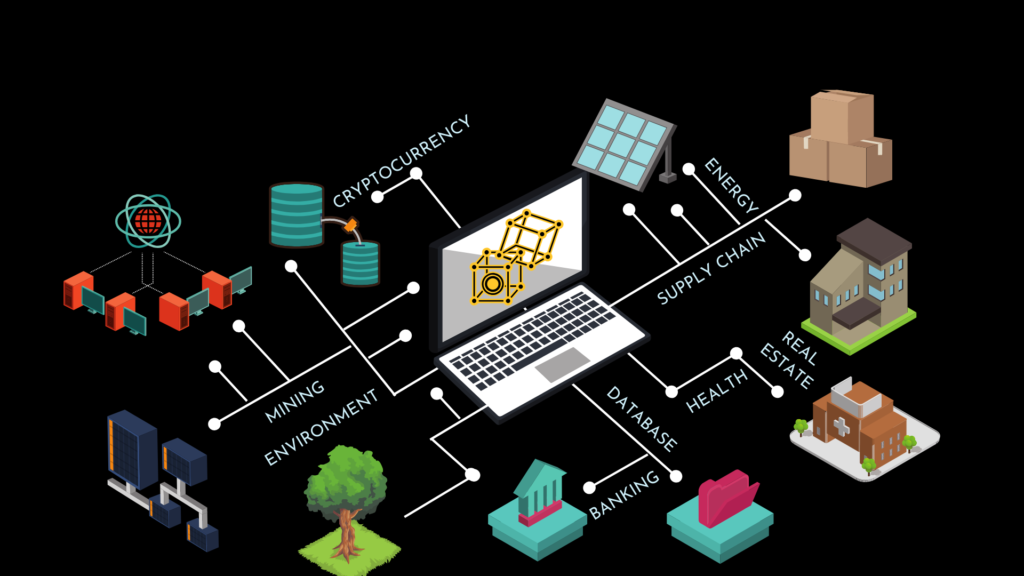

Previously, we talked about the need for a trust protocol. This time, we’ll talk about how blockchain meets that need. Big banks and some governments are using blockchains to revolutionise how they store information and conduct transactions. There are many reasons to do this, some of which include faster speed, lower costs, greater security, and fewer errors. A blockchain also eliminates central points of attack and failure. None of these reasons requires cryptocurrency per se. However, many important blockchains are based on Satoshi Nakamoto’s Bitcoin model; and here’s how they work.

The Working

Bitcoin or any other digital currency isn’t saved in a file somewhere. Instead, it’s represented by transactions recorded on a blockchain. Think of it as a global spreadsheet or ledger. Each Bitcoin transaction entered on it is verified by a large peer-to-peer network. Each blockchain is distributed. That means it runs on computers provided by volunteers around the world. It also means there’s no central database to hack. However, it doesn’t mean all distributed ledgers are blockchains.

A distributed ledger is a database existing in many places with many people using it. Not all distributed ledgers have the encryption and verification standards of a blockchain.

A blockchain is a specific type of distributed ledger, just as a square is a specific type of rectangle. The blockchain is public; it’s open-source code; it’s a protocol, not a product. Anyone can view it at any time because it’s located on the network, not inside a single institution. The blockchain has heavy-duty encryption, using public and private keys. Think of it as the two-key system to access a safety deposit box. Unlike Walmart or Tesco, there are no weak firewalls to attack; and unlike at Morgan Stanley or Federal Governments, there are no untrustworthy staffers to steal secrets. Every 10 minutes, like the heartbeat of the Internet, all transactions conducted on the Bitcoin network are verified, cleared, and stored in a block. The block is linked to the preceding block and the block before it, creating a chain of blocks. Each block must refer to the preceding block to be valid. The structure permanently timestamps, stores exchanges of value, and it prevents anyone from altering the ledger. This validation process makes theft impossible by any practical measure. If you wanted to steal a bitcoin, you’d have to rewrite the coins’ entire history on the blockchain. What’s more, you’d have to do it without being detected by millions of other people working on it. And that’s practically impossible. Some scholars say capitalism was able to thrive because of the invention of double-entry bookkeeping. It’s a system where a credit in one account always matches a debit in another. In this case, blockchain- a worldwide ledger of value- goes much further.

We can program a blockchain to record virtually anything and everything of value and importance, not only payments and profits but birth and death certificates, marriage licenses, deeds, titles of ownership, educational degrees, etc. Beyond financial accounts, it can also track votes, medical procedures, insurance claims, and even the origins of every ingredient in our meal. It can track anything that we can express in code. Furthermore, it verifies these records in near real-time. Soon, billions of smart things in the physical world will be communicating with each other. They’ll be sensing and responding to conditions through sensors; but they’ll also be able to do transactions. They’ll be buying electricity and sharing important data, doing everything from protecting the environment to managing health. So, this Internet of Everything needs a trustworthy ledger for everything.

Derivation of value of cryptocurrencies

To understand the derivation of value of any cryptocurrency, it is pertinent to be clear about fiat currencies. Historically, the purpose of ‘money´ has been two-fold, simplistically speaking: medium of exchange and a store of value. Economists might say we missed unit of account, but that’s not relevant here. In modern history, currencies relied on the fact that they are “representative”, meaning that each unit can be directly exchanged for a specified amount of a commodity. When most of the countries left the gold standard, almost all global currencies (even today) are classified as fiat. Fiat currency is issued by a government and not backed by any commodity, but rather by the faith (an IOU) that the counter parties to a transaction will accept that currency. Central banks control the supply of currency to control interest and inflation rates.

Now, consider trading of these fiat currencies. Transactions worth $5 trillion per day are executed in the forex market. This is the largest trading market in the world, by a tall margin. Segue to online currency, as explained above, blockchain tech makes cryptocurrencies more secure against risks than commonly misunderstood. In it’s own way, cryptocurrencies serve almost all purposes to be qualified as money, except the backing of a government and central banks, which means the value cannot be controlled by institutions (exception: Ripple Inc.). Also, most cryptocurrencies have a fixed supply and, therefore, the devaluation of cryptocurrencies through inflation is virtually nonexistent.

It is rather obvious to state that the biggest determinant of value of the cryptocurrencies, is the demand and supply, which is the most basic economic principle. If a cryptocurrency has a high token supply with little demand from traders and users, then the cryptocurrency’s value will drop. Conversely, if the supply of a particular cryptocurrency is limited and the demand is high, then the value of the coin will increase. Fiat currencies are of course, also governed by demand and supply, but it is far from the most important factor. Major shifters for fiats range from controlled printing of units of currencies, to geopolitical disturbances, to changes in oil reserves of a country, etc. Whilst most cryptocurrencies are relatively immune to these events, they are not immune to other, more specific disruptions. Since the cryptocurrency market is in a nascent stage (developed less than 12 years ago), public sentiment has a really big influence on its price. As a result, we see massive fluctuations in the prices of cryptocurrencies.

Even more so, limited liquidity exists within the market if you compare it to more established markets like traditional economies, including the foreign exchange market. To put it into perspective, the total value of all the money in the world is more than $90 trillion, while the total cryptocurrency market cap is hovering around $250 billion — a 36,000 percent difference. (source: cointelegraph.com). However, price manipulation as a result of over dependence on demand and supply economics, can be rife in crypto markets. The effect of manipulation is compounded if you throw in thousands of new market participants every day who can be easily taken advantage of. In addition, price manipulations can be hard to prove and control in unregulated markets.

All in all, cryptocurrencies are sound monies that is secure from political influence. Money promises to preserve and increase its value over time. Cryptocurrencies are also a fast and comfortable means of payment with a worldwide scope. This also gave birth to an incredibly dynamic, fast-growing market for investors and speculators, trying to reap as much value from this new market as they can.

Trading systems

/This is where the article gets a little technical. Brace yourselves./

Trading Infrastructure Systems, following the development of computer science and cryptocurrency trading, many cryptocurrency trading systems and bots have been developed. Some of them are listed here:

1. Capfolio is a proprietary payable cryptocurrency trading system which is a professional analysis platform and has a advanced backtesting engine

2. 3 Commas is a proprietary payable cryptocurrency trading system platform which can take profit and stop loss orders at the same time

3. CCXT is a cryptocurrency trading system with a unified API out of the box and optional normalized data, and supports many Bitcoin / Ether / Altcoin exchange markets and merchant APIs. Any trader or developer can create a trading strategy based on this data and access public transactions through the APIs

Types of trading systems:

Real-time Cryptocurrency Trading Systems: A real-time cryptocurrency trading system is composed of clients, server and database. Traders use a web-application to login the server to buy/sell crypto assets. The server collects cryptocurrency market data by creating a script which uses the Coinmarket API. Finally, the database collects balances, trades and order book information from server. Data in database is the copy of master data.

Turtle trading system in Cryptocurrency market: The original Turtle Trading system is a trend following trading system developed in the 1970’s. The idea is to generate buy and sell signals on a stock for short-term and longterm breakouts and its cut-loss condition which is measured by Average true range (ATR). The trading system will adjust the size of assets based on their volatility. Essentially, if a turtle accumulates a position in a highly volatile market, it will be offset by a low volatility position. Extended Turtle Trading system is improved with smaller time interval spans and introduces a new rule by using exponential moving average (EMA).

Arbitrage Trading Systems for Cryptocurrencies: Arbitrage trading aims to spot the differences in price that can occur when there are discrepancies in the levels of supply and demand across multiple exchanges. As a result, a trader could realise a quick and low-risk profit by buying from one exchange and selling at a higher price on a different exchange.

So, if you wish to dive into the market of cryptocurrencies, we hope the due diligence conducted and your risk appetite is up to the mark, in order to guarantee your money’s security from loss of value and possibly generate some profits as well.

Follow Us @