“MSCI semi-annual rebalancing will happen in May 2020 at its scheduled date”

“Top 5 stock that will benefit from MSCI rebalancing”

“India’s Weightage is increased to 8.07% in the MSCI Emerging markets index”

You all must have come across these headlines or at least read some short news on the same. For those who know a bit about financial markets and terms, they might have got some understanding of the same. But those of you who din get it, don’t worry, we always got your back! (But to keep improving on your financial knowledge go follow us on Instagram and LinkedIn and if you have already done sit back, relax and continue reading)

MSCI is an acronym for Morgan Stanley Capital International. Hold on guys!… it’s not the dream consultancy firm (Although this one is of similar stature!) that we all wanted to work in but just one of their investments!

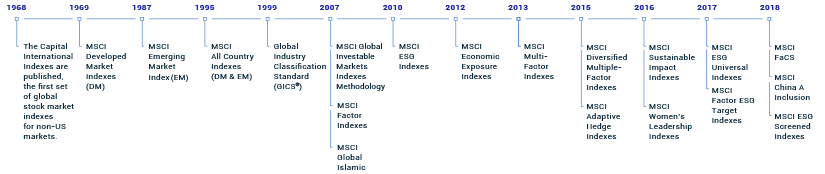

Let’s begin with the history:

In the year 1968, Capital International (CI) published their first ever indexes to mirror the international markets – the first global stock market indexes outside the states. In 1969 Morgan Stanley acquired the licensing rights of publishing the indexes and become the largest shareholder of the MSCI Inc – Morgan Stanley Capital International.

But what do they do?

In the year 1969, MSCI published the Developed Markets Index covering the countries which were considered as developed nations like the USA, Canada, UK etc. Cometh the year 1987, cometh their (currently, one of the most popular and followed indexes) Emerging Markets Index. This Index covers 26 countries as of today and has more than 1400 securities listed under them. India too is part of this Index since 1994.

Currently, apart from its USP of providing Index Services, MSCI also provides multiple business services such as Portfolio Risk and Performance Services Analytics and Governance Tools for hedge funds and other institutional investors.

So, is Morgan Stanley and MSCI one and the same? – NO! Though Morgan Stanley is the largest shareholder of MSCI – I mean majority shareholder, the management is completely different and independent (at least that is what they call it! Do let us know what you feel about this in the comments section below)

Fun Fact 1: MSCI has over the years developed so many tools and indexes. As of today, they have 1,60,000 Indexes and almost a 12,000 of them show real time changes while others are updated post-closing sessions. The latest of all is the ESG or the sustainability Index which includes companies with least carbon emission.

How do these indexes work? How do they weigh the same?

MSCI has about 1,60,000 Indexes and majority of them are Market-Cap Indexes. Now let’s see how these indexes function and work. MSCI has a few blanket indexes like the Emerging Markets Index and the Developed Markets Index which includes many stocks of multiple countries. Apart from this, each country has an Index of its own! Every country has multiple Indexes of MSCI including various stocks, based on their sectorial research.

MSCI gives weights to each of these stocks in their respective Indexes based on their market capitalization at the end of the trading day. Market Capitalization is calculated as:

Market Capitalization = Stock price ꭓ Number of shares outstanding

The stock with highest market capitalization gets the largest weightage. The rationale behind the same is that Large-Cap companies have bigger impact on the economy. It reflects a better picture of the economy than what is visible in Mid-Cap and Small-Cap companies.

So, what is the use of creating these indexes with so much effort?

Before answering this question, we have to understand – ETFs or Passive Funds.

1. Active Funds and Passive Funds:

Active Funds are those funds where the fund manager allocates the fund amongst various assets based on his skills, knowledge and also his gut (on some occasions). (Yes, fund managers take risks on their gut too!) eg – Direct Growth Based Mutual Funds. While Passive funds are those where a fund manager allocates funds based on a certain Index eg – Exchange Traded Funds (ETF).

2. Exchange Traded Fund (ETF):

These funds or ETFs are just like any other funds that have units subscribed by investors, traded on various platforms and have large AUMs with the only difference being that they follow allocation of asset based on an INDEX like S&P 500, BSE Sensex or the one we are studying currently, the MSCI Indexes.

Now the answer to your question – All these Indexes that MSCI publish are used by large ETFs all around the globe to invest in various economies, countries and stocks. These ETFS allocate their fund to a particular country or a sector or a stock based on the weights given by MSCI in their Indexes.

MSCI Indexes that are most popular and followed:

- MSCI Emerging Markets Index:

This index was published in the year 1987 and currently covers 26 countries, the likes of it being India, China, Thailand, Brazil, Russia, South Africa.

- MSCI Frontier Markets Index:

This Index includes 28 countries that have higher risk and volatility which includes countries from middle east Like Kuwait and other countries including Bahrain, Bangladesh, Jordan, Kenya.

- MSCI EAFE Index:

This index includes all major developed countries except for the states and Canada. It Include Europe, Australia and the Far East

- MSCI ACWI Index:

It is the All Country World Index which includes 23 Developed markets and 26 Emerging markets with more than 3000 stocks.

Fun Fact 2: Globally more than 1300 Equity ETFS are based on MSCI Indexes with total $13.1 Trillion in assets under management benchmarked to MSCI Indexes. (Source: MSCI website)

3. Rebalancing: Rebalancing is a process of realigning the weights of assets or stocks in a portfolio or an Index. Rebalancing can be based on pre-determined weights (as in case of portfolio management) or can be to present a true picture of the economy or the markets (as in case of Indexes)

So now, we know that MSCI has multiple Indexes that weigh different economies, group of economies and also individual countries. Hence it is important for them to review their indexes on regular basis (every Quarter) and rebalance the same (twice in a year) to present a true picture of the underlying economy in the Index.

This activity is important as globally large ETFs have their portfolio based on these indexes. Apart from these ETFs many large fund houses and pension funds also track such indexes because of their accuracy and expertise as a global research firm. To keep up this reputation, MSCI reviews all its Indexes Quarterly and rebalancing is done twice on a semi-annual basis.

What is the Impact of Rebalancing of Indexes?

When the MSCI rebalances their indexes, all ETFs that are based on such indexes need to rebalance their portfolio according to the latest rebalanced index of the MSCI. In the process there is a passive inflow and outflow of foreign capital across various countries. MSCI provides a time period of 14 days to the ETFs to rebalance their portfolios. Apart from the flow of passive capital, as many active funds also follow MSCI’s indexes to certain extent, active capital is also flown across countries.

The weights of stocks in the indexes are based on the market capitalization formulae. Hence in case if upward rebalancing (without any new addition or deletion of existing securities) is done with regard to sectorial weights or for a country, Large-Cap stocks with higher market capitalization have to face outflows and ones with growing market capitalization will have inflows. This based on the principle of relative rebalancing (In simple terms it’s like the sibling relation we have at dinner table. If no new food is available and your younger brother is hungry (in terms of stock – its growing) the elder one has to sacrifice from his plate!)

In case where due to rebalancing there is addition or deletion of securities, huge impact on foreign capital flow is observed. Securities added to index will receive foreign funds and those deleted will see outflow of foreign funds. The security being added also attracts active funds and domestic players which leads to upward movement in their price while those getting removed from the index/ reduced (with respect to their weights) tank down.

In the current situation of Covid 19….

Just like our friend at the MSCI reviews and rebalances indexes, other such publisher like the FTSE also rebalance their indexes. But, due to the current situation, majority of the research houses and index published have delayed the rebalancing. Though, the MSCI continued with their scheduled date (for rebalancing) of May 12th, 2020. In a press note made by the MSCI, they have stated that it’s important to rebalance the indexes taking the current market scenarios to present the actual picture of markets through indexes.

Global Impact:

The rebalances across all major global indexes took place on the 12th of May and the same had to be closed by all major ETFs by the 29th of May. In this rebalance:

The MSCI ACWI index saw an addition of 137 securities while 181 securities were removed from the index. The MSCI world Index saw 62 additions and 93 deletions. The Global Small Cap Index had 442 additions while 544 securities were removed from the index. The MSCI frontier market index wasn’t rebalanced much as lot of countries were kept away from the process i.e. Just 1 addition and 5 deletions. (Source: MSCI Press release)

The biggest sector to have impact was the travel and airline sector. Majority of the stocks deleted across the indexes were in this sector. Also, many of them saw a move from inclusion in the global standard indexes to Small-Cap Indexes. Sectors that were added to the indexes belonged to Education (mostly EdTech), internet & broadcasting and financial services. The largest addition being Zoom video comm A in the world index and offcn education A in the Emerging market index.

Indian Impact:

MSCI Emerging Markets Index:

India is one of the 26 countries in the Emerging Markets Index of MSCI. Until the rebalancing that happened recently, India’s weight in the index was 7.56 % which increased by almost 51 basis points to 8.07% (In USD terms). This increase in weight is expected to bring in a net foreign capital of about US$ 1 Billion in passive funds and US$ 5 Billion in active funds (as per a report by Morgan Stanley). Stocks like L&T, Divis Labs, Asian Paints can benefit from increase in weight.

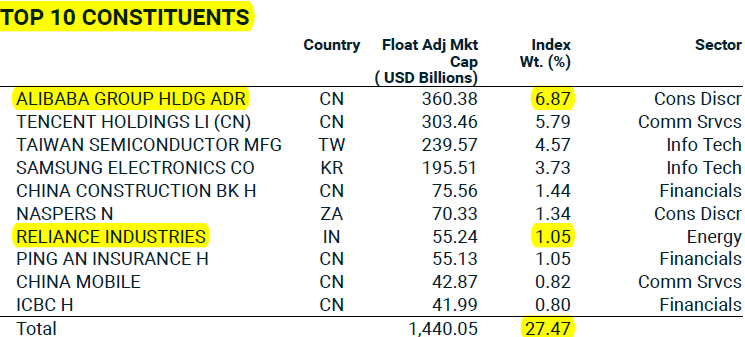

The index consists of 1403 securities from 26 countries. The top 10 stocks itself have a combined weightage of 27.47% with Alibaba sitting on top (6.87%) and Reliance Industries at number 7 (1.05%).

This gives rise to an important question. While the whole world has reduced their weights on India’s growth, why is MSCI increasing weights?

The answer has 2 parts to it. One that amongst the emerging markets, India’s pace of development still seems to be ahead of other countries in the index. Secondly, with effect from April 1st 2020, we entered a new era of foreign capital where foreign portfolio investment limits were made sectorial rather than a stock specific.

5 Indian stock have been added to the index: Biocon, IGL, Tata Consumer Products, Jubilant FoodWorks, Torrent Pharma.

4 Indian stocks deleted: Ashok Leyland, Tata Power, Shriram Transport and M&M Financials.

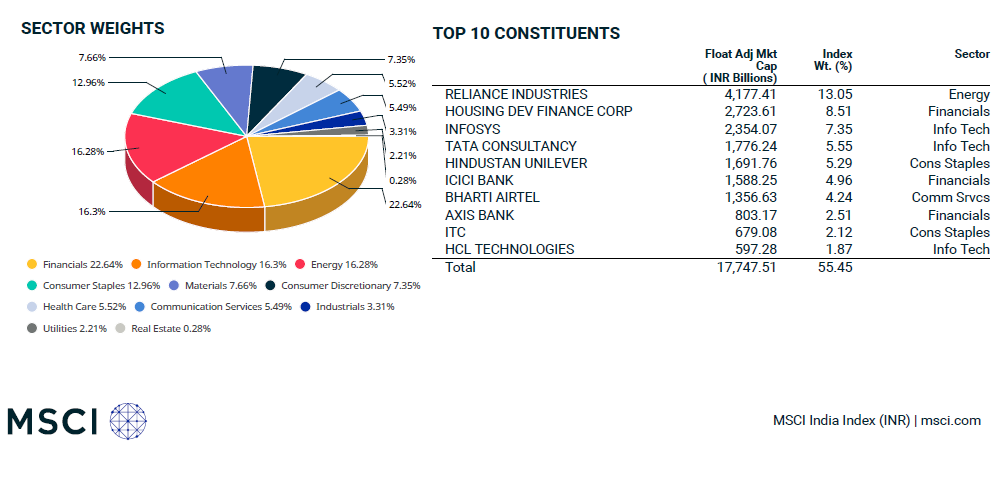

MSCI India Domestic Index:

In earlier paragraphs, I mentioned that MSCI also has standalone country wise indexes which represent the economy of that particular country. In simple terms, it is their own Sensex or a Nifty. The MSCI India Index consists of 84 stocks majorly from the large cap category across various sectors.

As all indexes went through a review and rebalancing, the MSCI India index also saw some changes in its constituents. The Index saw 6 stocks being added and 5 being removed.

Additions: Abbott India, IPCA Laboratories, Jubilant FoodWorks, PFC, Tata Consumer Products and Torrent Pharmaceuticals.

Deletions: Ashok Leyland, Tata Power, BOB, Cummins India Kirloskar and M&M Financials.

Along with this, the MSCI Small-Cap India Index also saw addition of 13 stocks (5 from the superior index) and few others like Emami, Future Retail and others. While 52 stocks were removed from the index. (Source: MSCI Press release)

The impact of these changes is directly related to the inflow and outflow of investments made by the Foreign Institutional Investors (FIIs) and Foreign Portfolio Investors (FPIs). A report by Emkay predicted a net flow of US$ 143 million into passive benchmarked fund due to above-mentioned rebalancing in the domestic index. India’s foreign capital policies, as discussed earlier, has been relaxed. The investment limits have been raised to sectorial limits from company specific limits. This has led to increase of foreign capital inflow in the country.

To Conclude and summarize:

MSCI reviews all its global and domestic indexes on quarterly bases and rebalancing happens twice in a year. Stocks are added or removed from an index by analysts within MSCI to ensure that the index still acts as an effective equity benchmark for the market it represents. ETFs adjust their holding accordingly which leads to flow of capital across countries. Unfortunately, the rebalancing scheduled for the current year coincides with these uncertain times but MSCI unlike other research companies, did not postpone the same so as to reflect the current market scenario.

The rebalance took place on 12th May and adjustments by the benchmarked funds were expected to be closed by 29th May. As per NSDL data, India saw a net outflow of INR 6,884 Crores in April, 2020 but in the month of May we had a net inflow of INR 14,569 Crores of foreign capital in equity. As on 10th June, 2020 net inflow of foreign capital was INR 22,353 Crores.

MSCI has increased India’s weight along with liberal foreign policy. So, this monsoon we might not only have rain pouring on the country but may have showers of foreign fund too!

Liked the Article you just read? Show us your support by clicking that like button and sharing it with your friends. Also don’t forget to leave your thoughts about the article in the comment section below.

You can become a part of our mailing list by clicking here

Excellent article on MSCI Rebalancing by Parth Shah! Enjoyed reading.