Where does the US-China Trade Deal – Phase 1 stand post Covid-19? 1 step forward, 2 steps back.

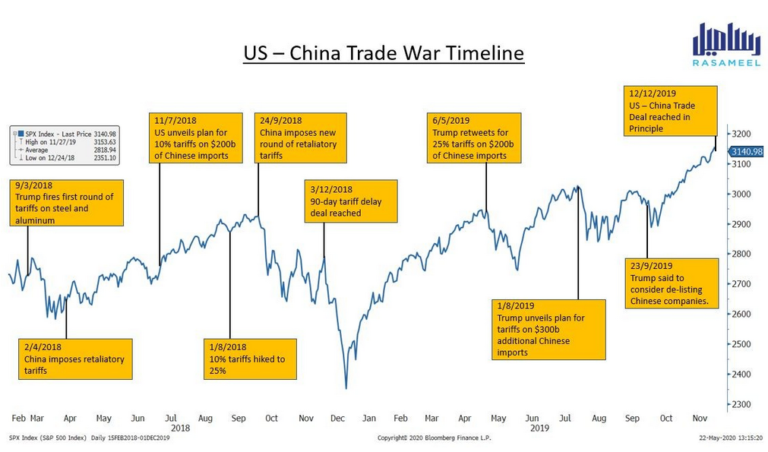

The Phase 1 trade deal was already a tough ask from China since Day 1. But it should now be clear with the US unwilling to re-negotiate that the commitments will not be met given the scale of demand destruction and China’s trade agreements with other countries, like Brazil for soybeans, to meet its needs in a coordinated fashion. Although China has effectively restored supply chains, the adverse effects on demand will be hard to overcome in the near term.

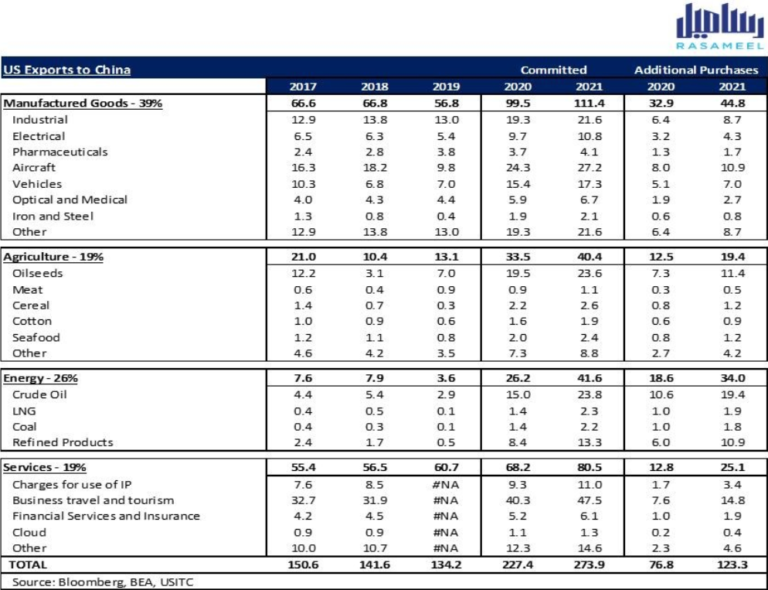

Breaking down the four major categories covered under the pledge:

- Manufactured goods (39%) – Aircraft and vehicles were expected to be the biggest chunk of purchases. However, given the negative outlook for global air travel demand and falling vehicle sales, China is unlikely to go through with these commitments. Bloomberg estimates suggest about 300 additional aircraft purchases over 2020-21 to meet commitments, 30-40% over its existing backlog of orders. Boeing’s ongoing production issues may also limit China’s ability to push state-owned firms to buy.

- Agriculture (19%) – Soybeans constitute the majority of the committed agricultural purchases. Over 50% of China’s hog population was impacted by African swine flu. With the hog population still recovering from the impact, the purchases of soybeans (hog feed) will also likely fall short of estimates even after tariff reductions on US imports. China also has agreements in place to purchase Brazilian oil seeds and will thus have to narrow down on suppliers.

- Energy (26%) – Demand for oil might not be able to rise fast enough to absorb the incremental purchases. With Oil prices down roughly 60% YTD, it is difficult to fulfill the gross purchases. Adding to an already adequate stockpile would stoke storage concerns.

- Services (19%) – The ongoing U.S. trade ban on Huawei means neither sides can count on rising technology patent royalties to meet their goals.

If the ‘Phase 1’ deal fails, it won’t just be China that loses, the U.S. also stands to lose by increasing tariffs during a time of economic crisis, effectively punishing U.S. companies, manufacturers, and farmers that are already struggling to survive. Why not incentivize American companies via Tax breaks and subsidies to move manufacturing out of China, to other low-cost manufacturing countries like India, Indonesia and Vietnam?

Should the markets brace for another round of turbulence before the November elections?

Liked the Article you just read? Show us your support by clicking that like button and sharing it with your friends! Also don’t forget to leave your thoughts about the article in the comment section below.

You can become a part of our mailing list by clicking here